Build A Tips About Balance Sheet In Entrepreneurship P&l Leader

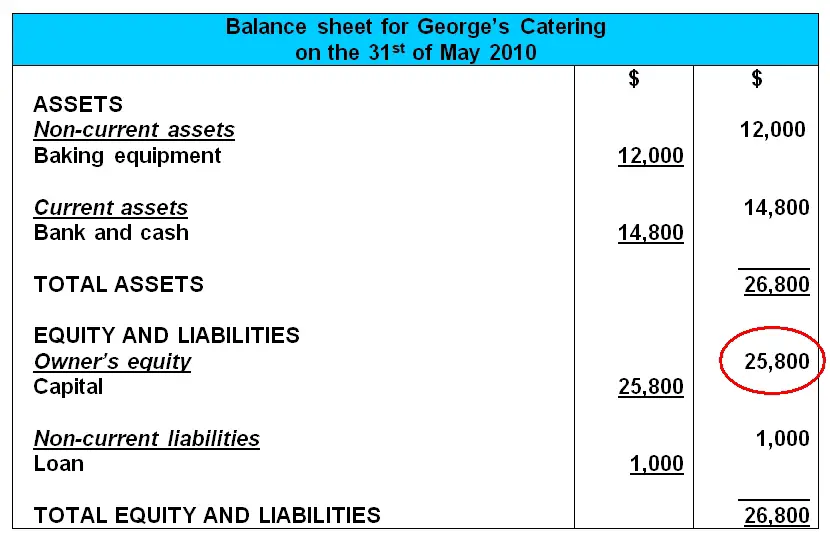

It follows the accounting equation:

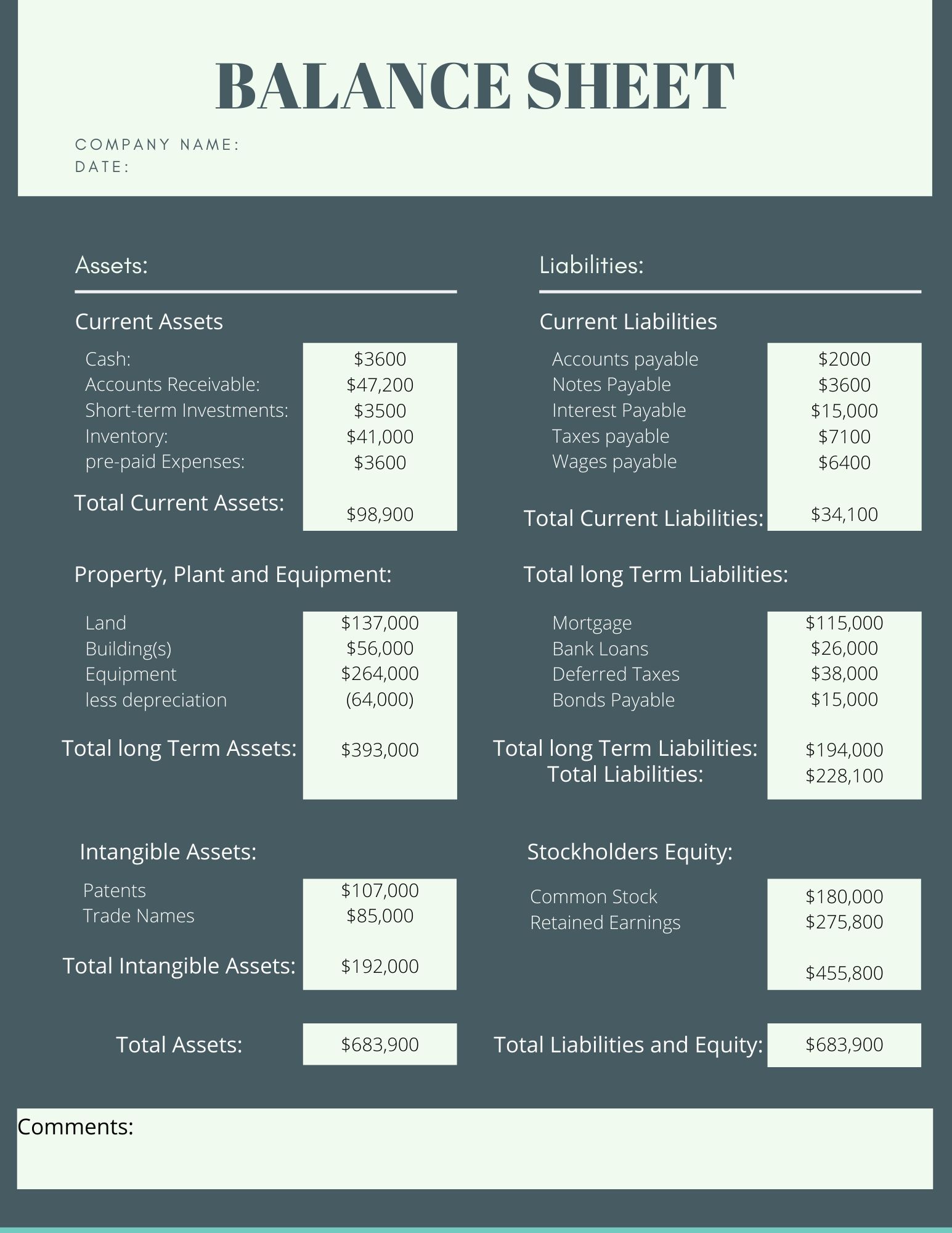

Balance sheet in entrepreneurship. Reporting the assets, liabilities, and equity held at a given point in time (or at different time intervals) can help you better understand… As i am writing this first post for our new cfib blog, a lot of canadian business owners find themselves at a crossroads. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

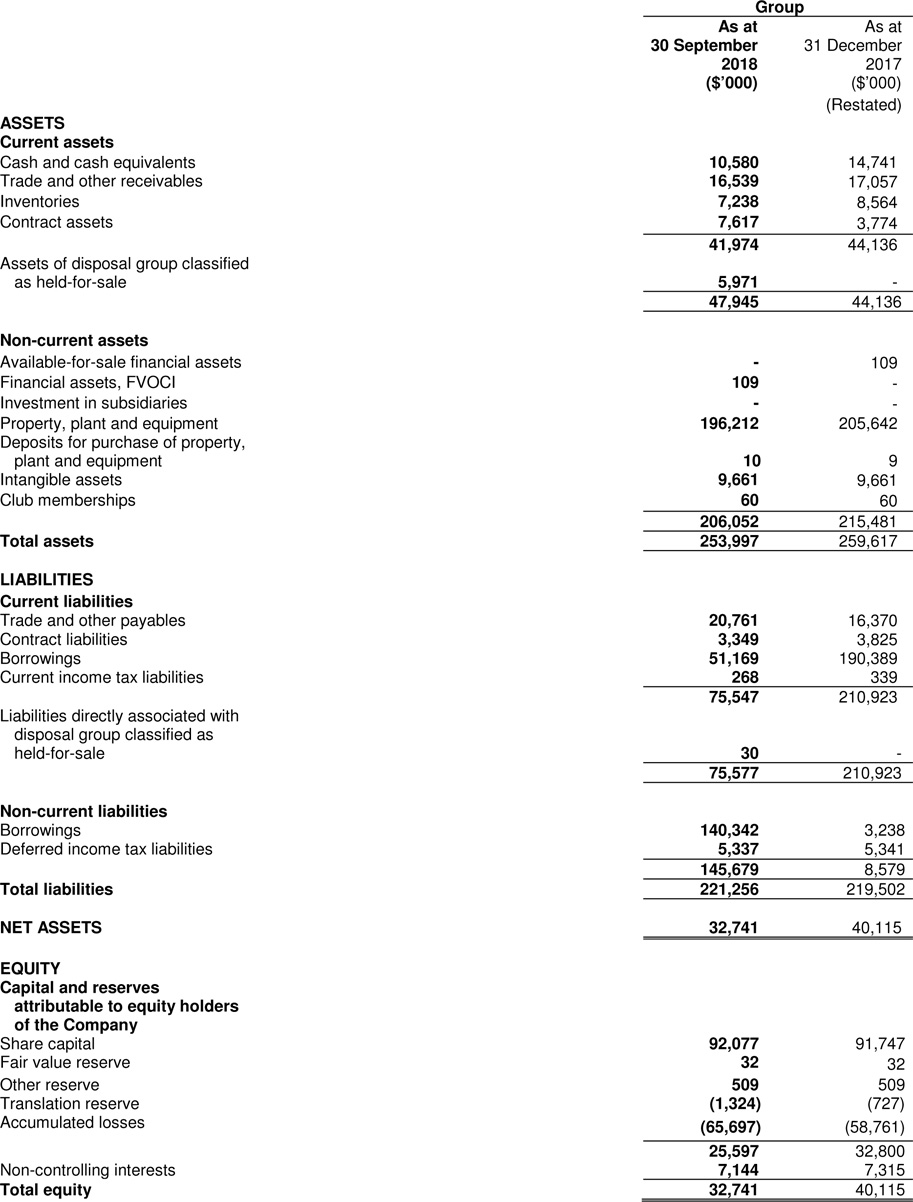

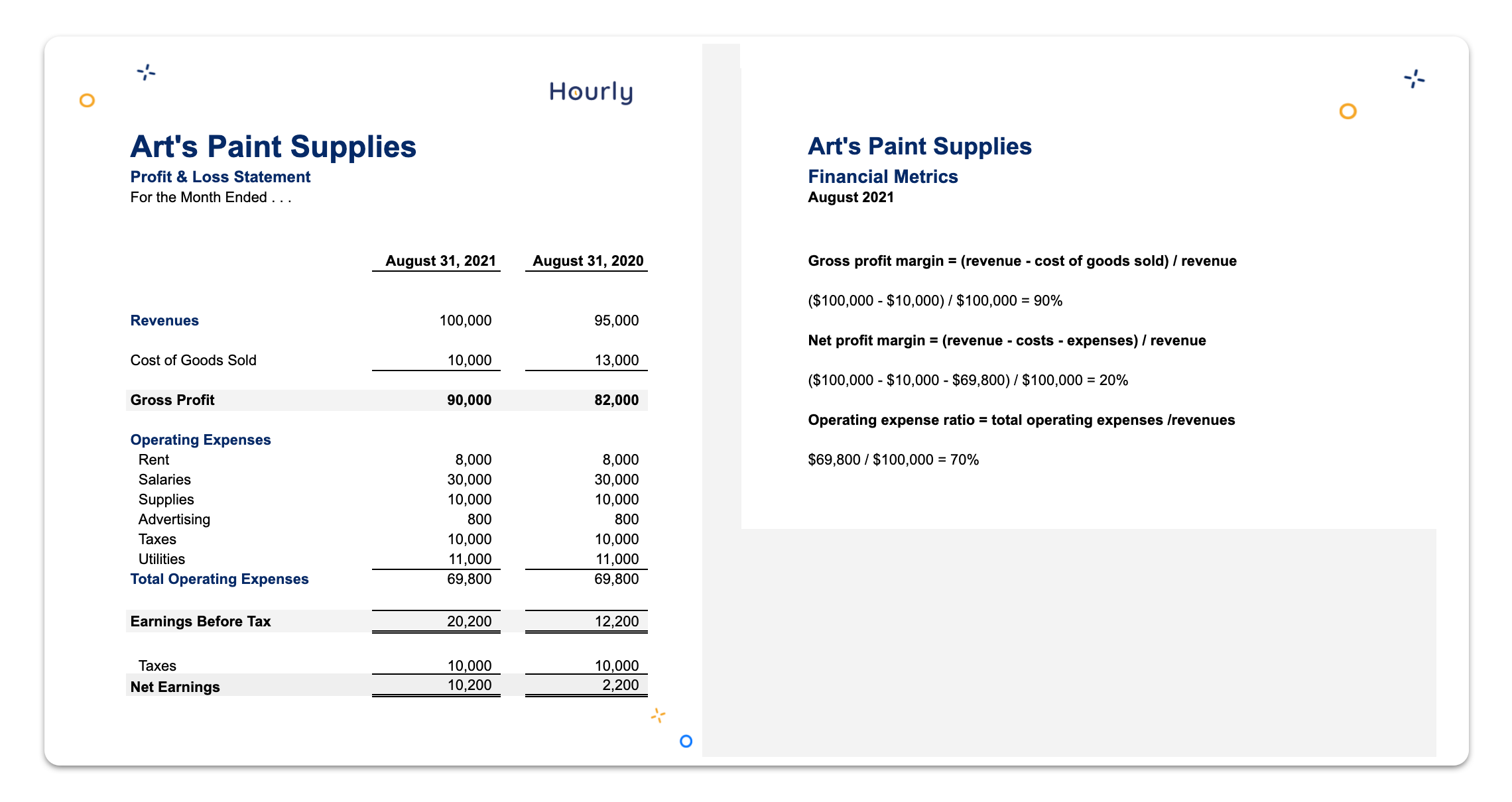

Assets = liabilities + owner's equity. Entrepreneurship is so much more than just a balance sheet. A financial analyst will thoroughly examine a company’s financial statements the income statement, balance sheet, and cash flow statement.

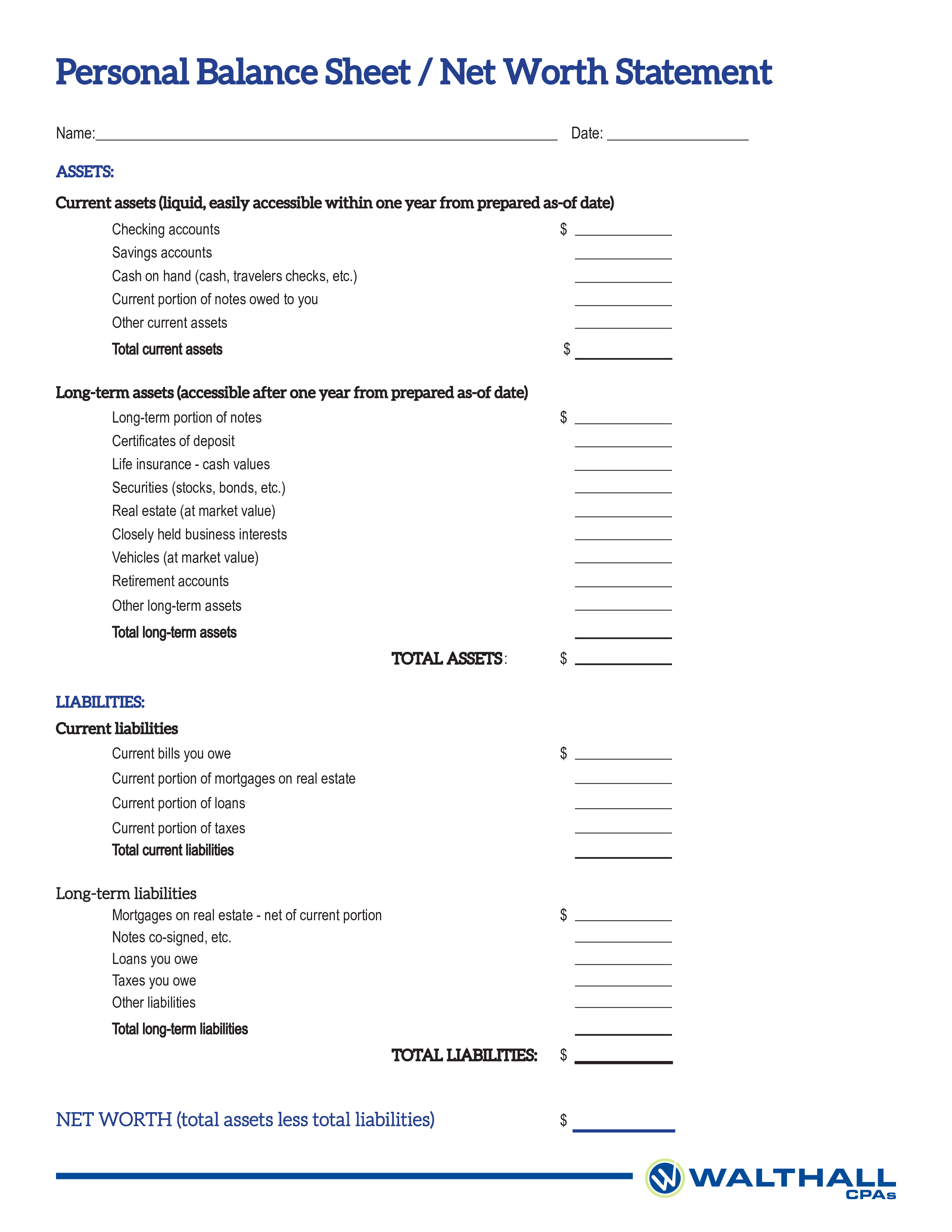

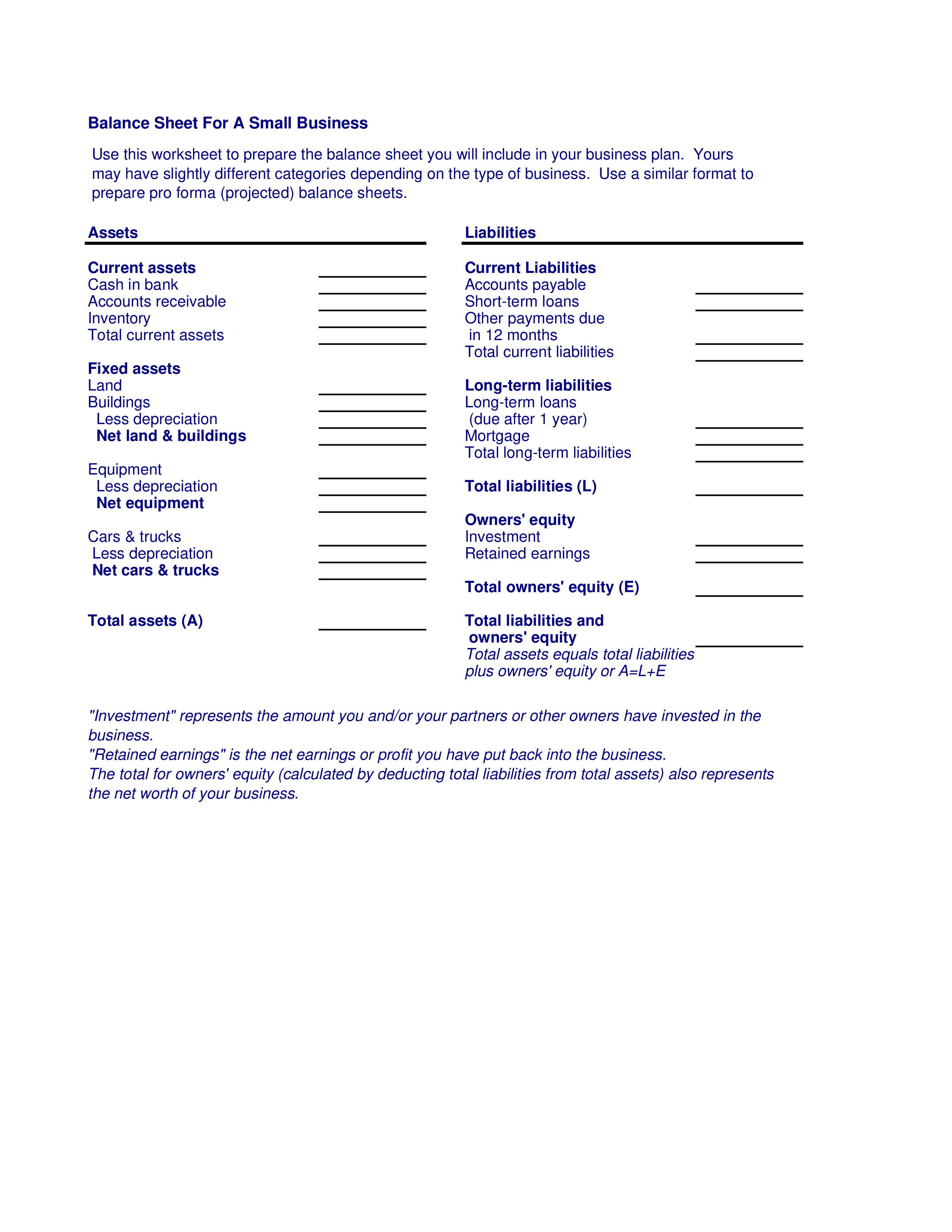

Any entrepreneurial activity before execution requires financial planning to be done. You can download our free, fillable template balance sheet if you need to manually create one. A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owners' equity at a particular point in time.

Free balance sheet template for entrepreneurs. It provides a snapshot of a company's finances (what it owns and owes) as of the date of. For entrepreneurs, a balance sheet is a vital tool for making informed decisions.

Add total liabilities to total shareholders’ equity and compare to assets. In this session, you will learn the basic elements of the balance sheet, and how investors will assess the health of your company by analyzing your balance sheet. A financial statement that lists the assets, liabilities and equity of a company at a specific point in time and is used to calculate the net worth of a business.

Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. Among the essential tools, the balance sheet is a crucial window into your organization's financial standing. Learn more about what a balance sheet is, how it works, if you need one, and also see an example.

In other words, the balance sheet illustrates a business's net worth. A balance sheet is a detailed financial statement that breaks down all of a company's assets, liabilities, and equity at a specific time, such as the end of a month, the end of a quarter or the. To do this, you’ll need to add liabilities and shareholders’ equity together.

A balance sheet includes a summary of a business’s assets, liabilities, and capital. The balance sheet provides a snapshot of the business'sassets, liabilities and owner's equity for a given time. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity).

Amidst all the fun on shark tank, what the show does really well is touch upon some of the most f. It's calculated at specific points in time, such as when your business is in the startup phase then at the end of each month, quarter, year, and at the end of the business. It provides the details of your assets and your liabilities, and it also shows your shareholders equity.

A query of u.s. A balance sheet is a snapshot of a company’s financial health, showing its assets, liabilities, and equity at a specific point in time. Census bureau data reveals that through 2023, americans submitted nearly 62% more applications for new businesses than the same time period in 2019.