Outstanding Info About Profit Transfer To Capital Account Entry Pro Forma Modeling With Excel

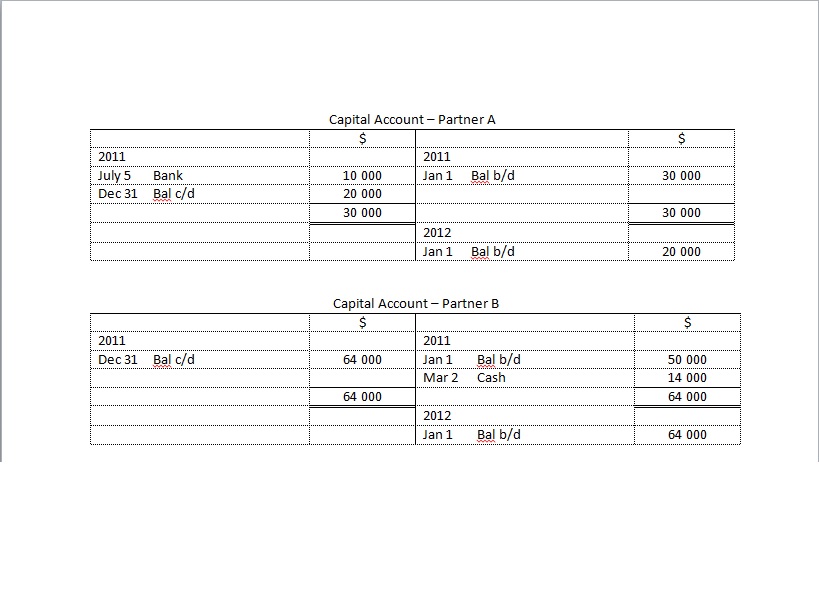

Ashish and aakash are partners sharing profit in the ratio of 3 :

Profit transfer to capital account entry. The partners can take the money. Recorded in the capital account are capital transfers, which are closely related in concept to current transfers, and transactions concerning the acquisition or disposal of non. Transfer to capital a/c.

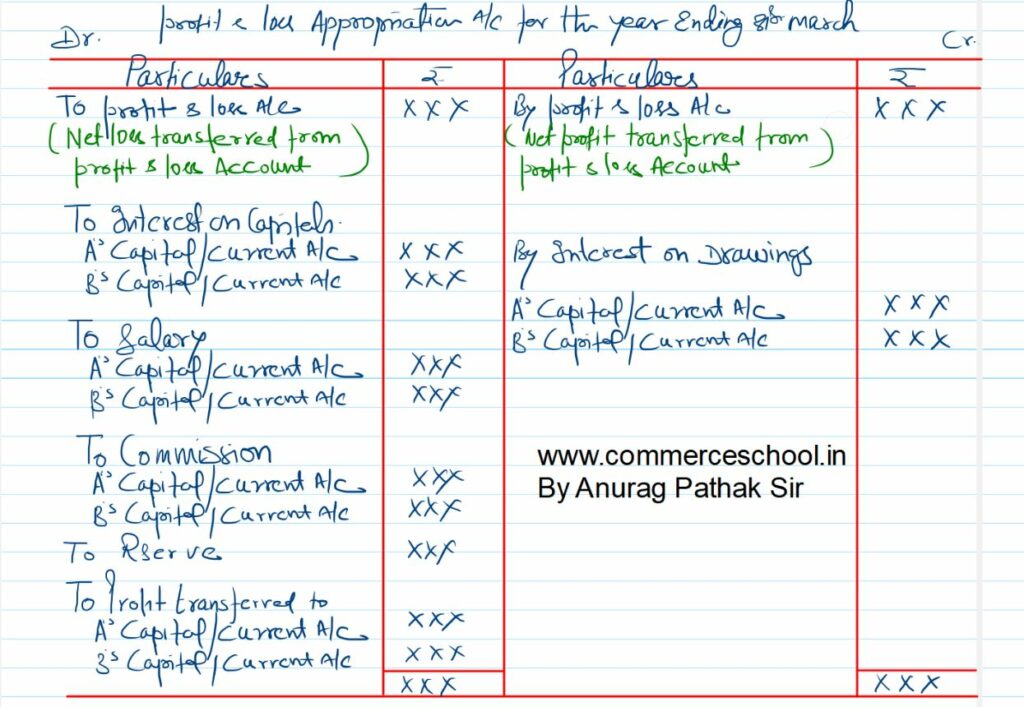

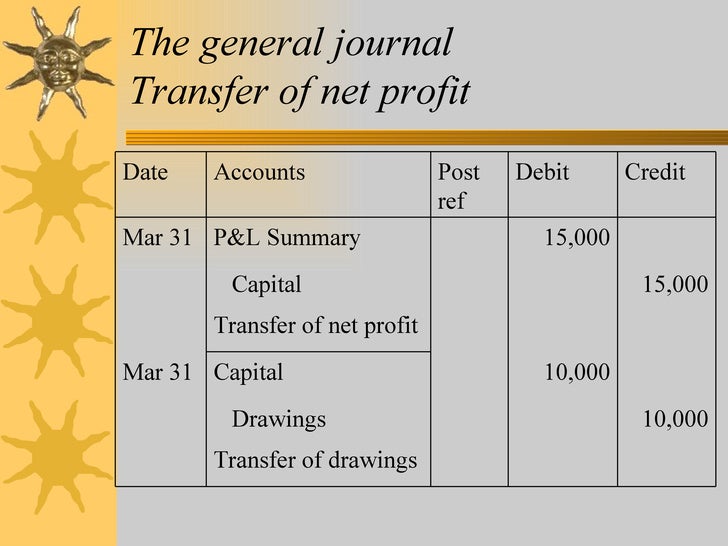

The profit / loss during the financial year should be transferred to the capital a/c of the propreitor on the last day of the financial year (ie. We say that the profit and loss a/c is. Journal entry to allow interest on capitals.

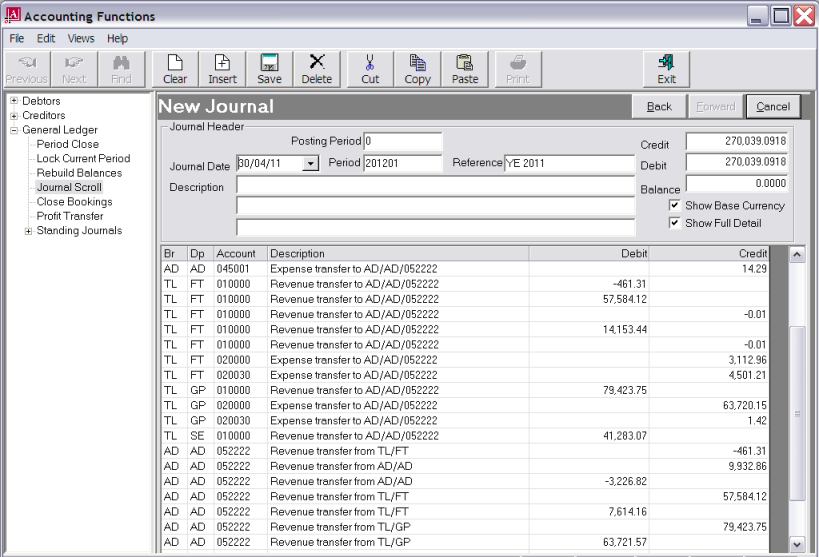

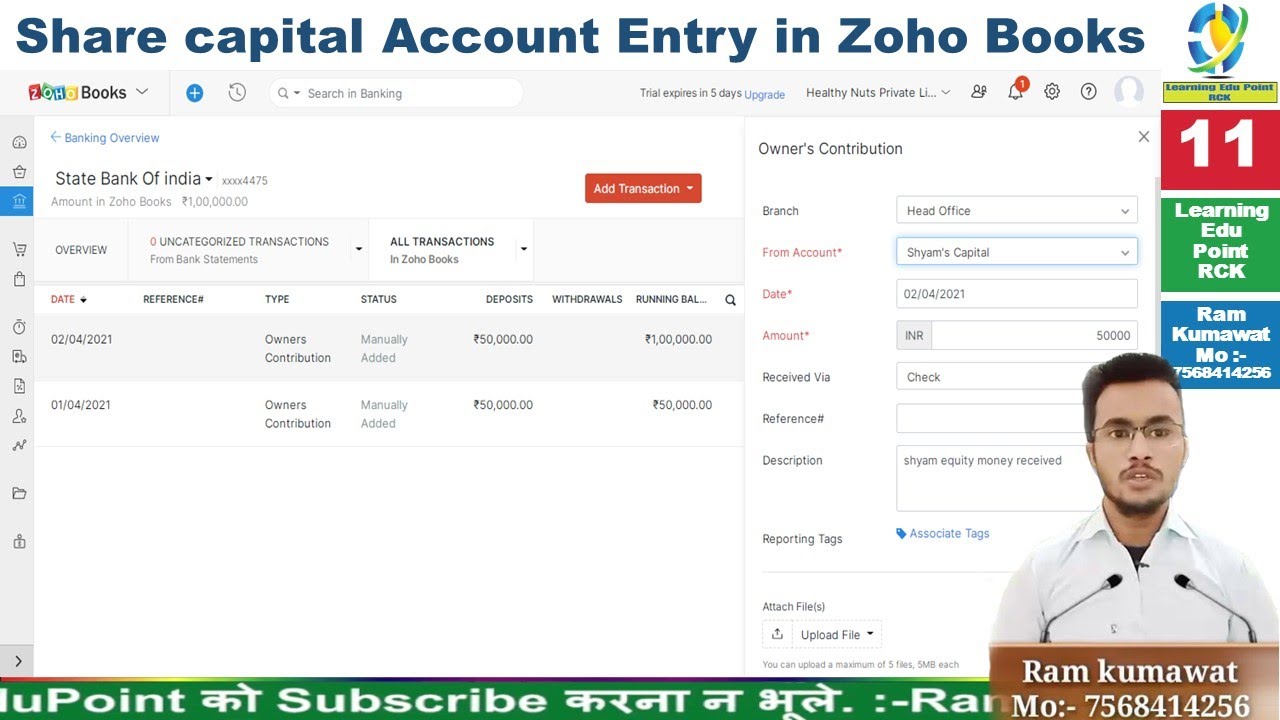

Journal entries relating to profit and loss appropriation account: In this video, we'll see how to transfer profit to capital account. It is done using a single journal entry dated june 30 of your financial year.

Capital contribution is the process that shareholders or business owner invests cash or asset into the company. Their capital accounts showed a credit balance of ₹ 5,00,000 and ₹ 6,00,000 respectively as on 31st march,. Hello dostoin this video i will teach you how to adjustment entry for profit & loss transfer to capital a/c on 31st march for finalize balance sheet in tall.

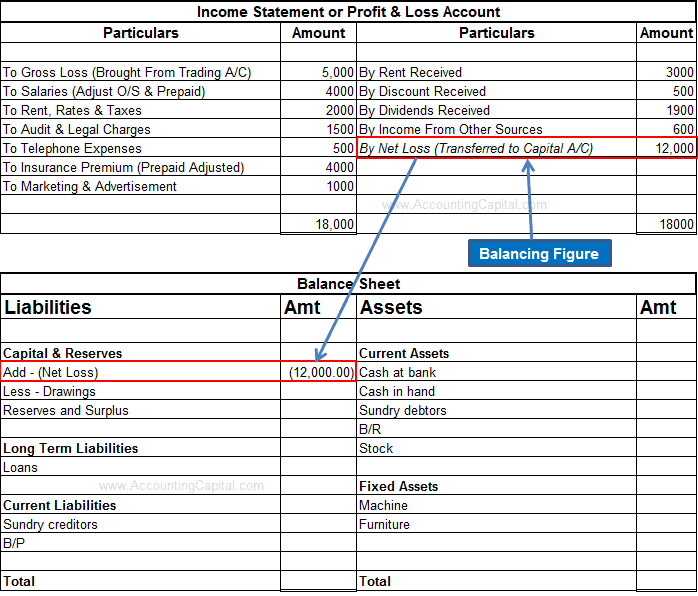

Therefore, the net profits or losses are ultimately transferred to the capital account. Journal entry to transfer the loss from profit and loss account to profit and loss appropriation account. Welcome to our youtube channel @guide.

If it is prepared in the form of a statement, it appears as shown below. No other entry needs to be. The partners agreed to value machinery at rs.1,05,000, patents at rs.65,000 and buildings at rs.1,20,000.

Format of profit and loss account. The net profit from profit and loss a/c is transferred to profit. C retires on the above date.

If they want to withdraw cash, they have to decrease their account balance. Journal entry for general reserve. Process to transfer net profit into capital a/c in marg software.

You need to make journal entry, profit loss account debit to capital account credit.still. Profit is the amount that company. General reserve is the amount of profit that the company keeps away without a specific purpose.

The company needs cash to start the operation as it may not be. It must be performed in the. In a partnership, net profit or net loss.