Spectacular Tips About Concept Of Trial Balance Job Profit

This is prepared as at a particular date which can be financial year end or calendar year.

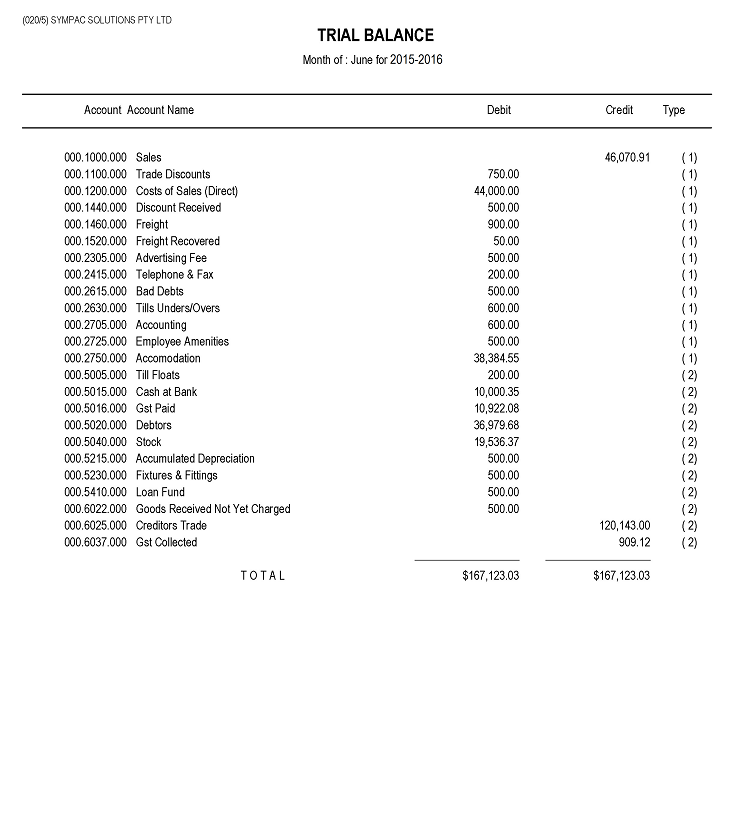

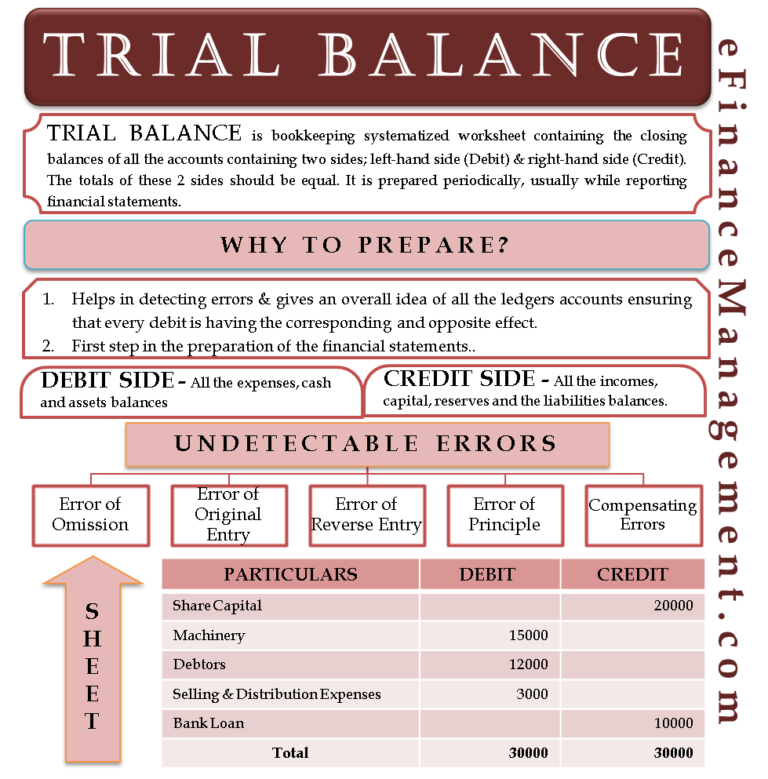

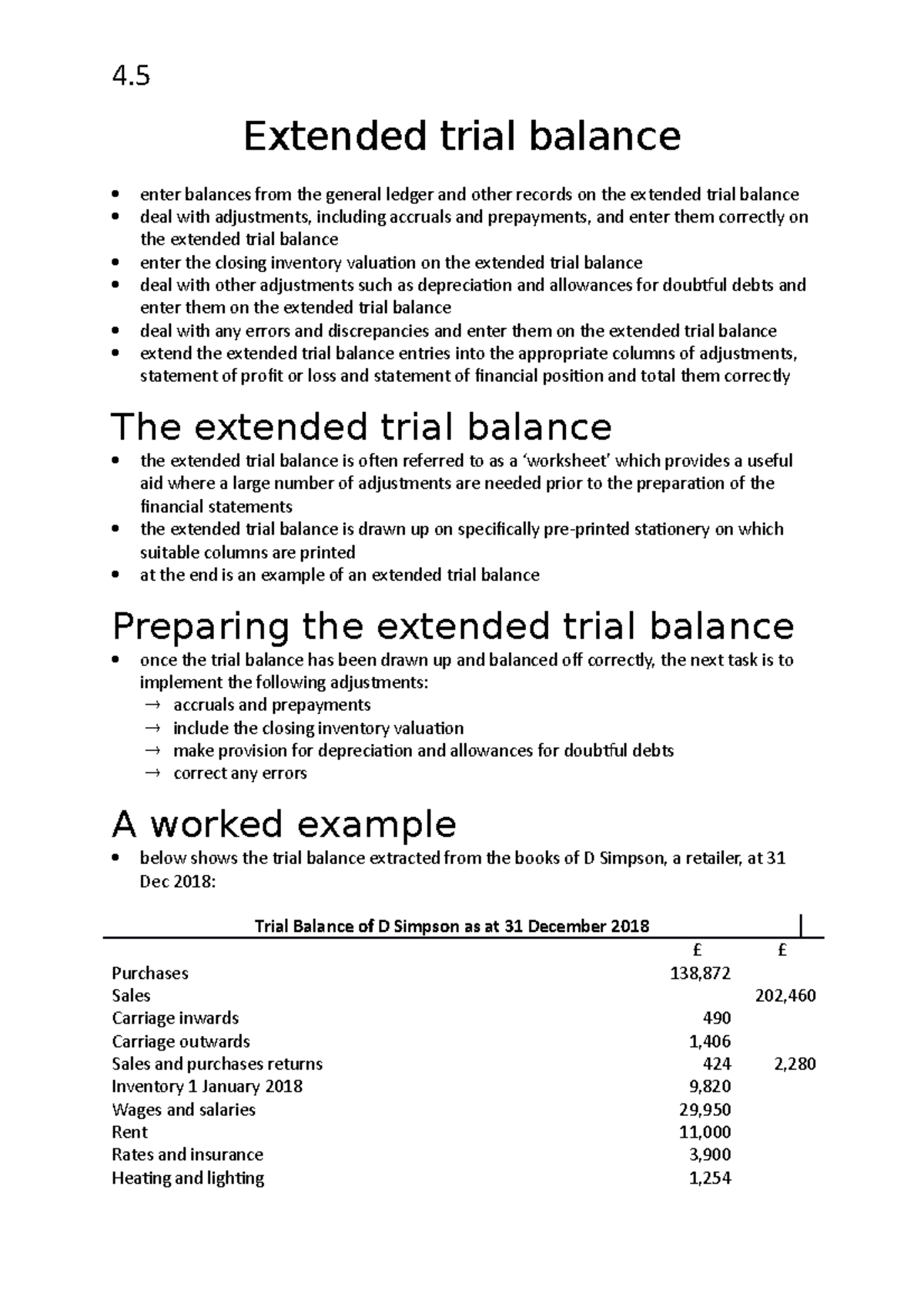

Concept of trial balance. A typical trial balance will have the name of ledger and the balances. Trial balance is a technique for checking the accuracy of the debit and credit amounts recorded in the various ledger accounts. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

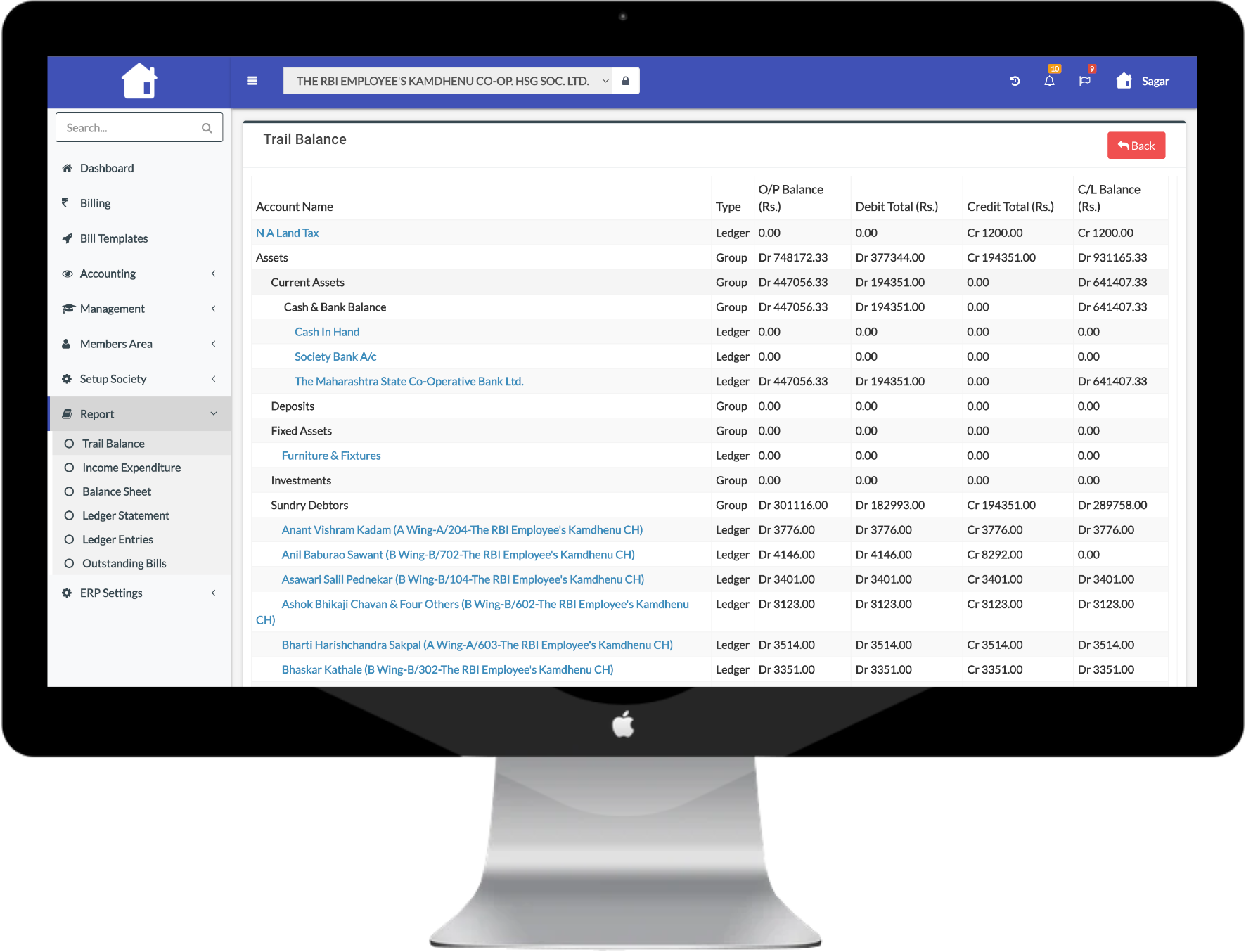

A company prepares a trial balance. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,.

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. A trial balance is a sheet recording all the ledger balances categorized into debit and credit. What is trial balance?

The balances are usually listed to achieve equal. Definition of trial balance in accounting as per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts. It is a statement of debit and credit balances that are extracted on a specific date.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Example of a trial balance document A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

What is a trial balance? It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Note that for this step, we are considering our trial balance to be unadjusted.

![TRIAL BALANCE CONCEPT, FEATURES, ADVANTAGES AND FORMAT [HINDI] YouTube](https://i.ytimg.com/vi/UubgH-6zFB0/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)