Fantastic Tips About Income Tax Paid In Advance Cash Flow Projected Monthly Statement

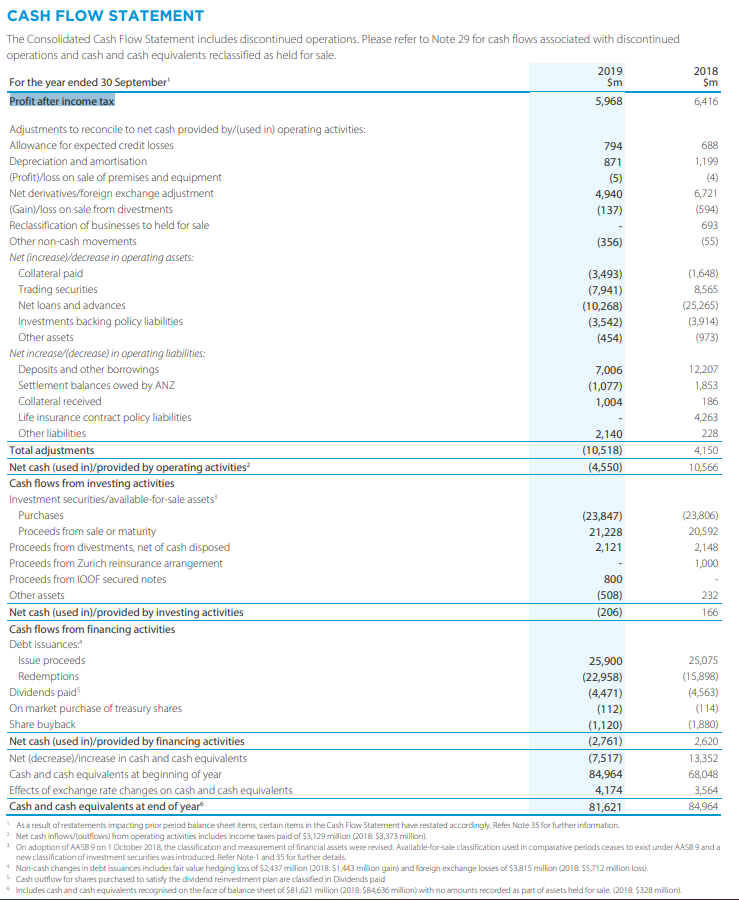

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

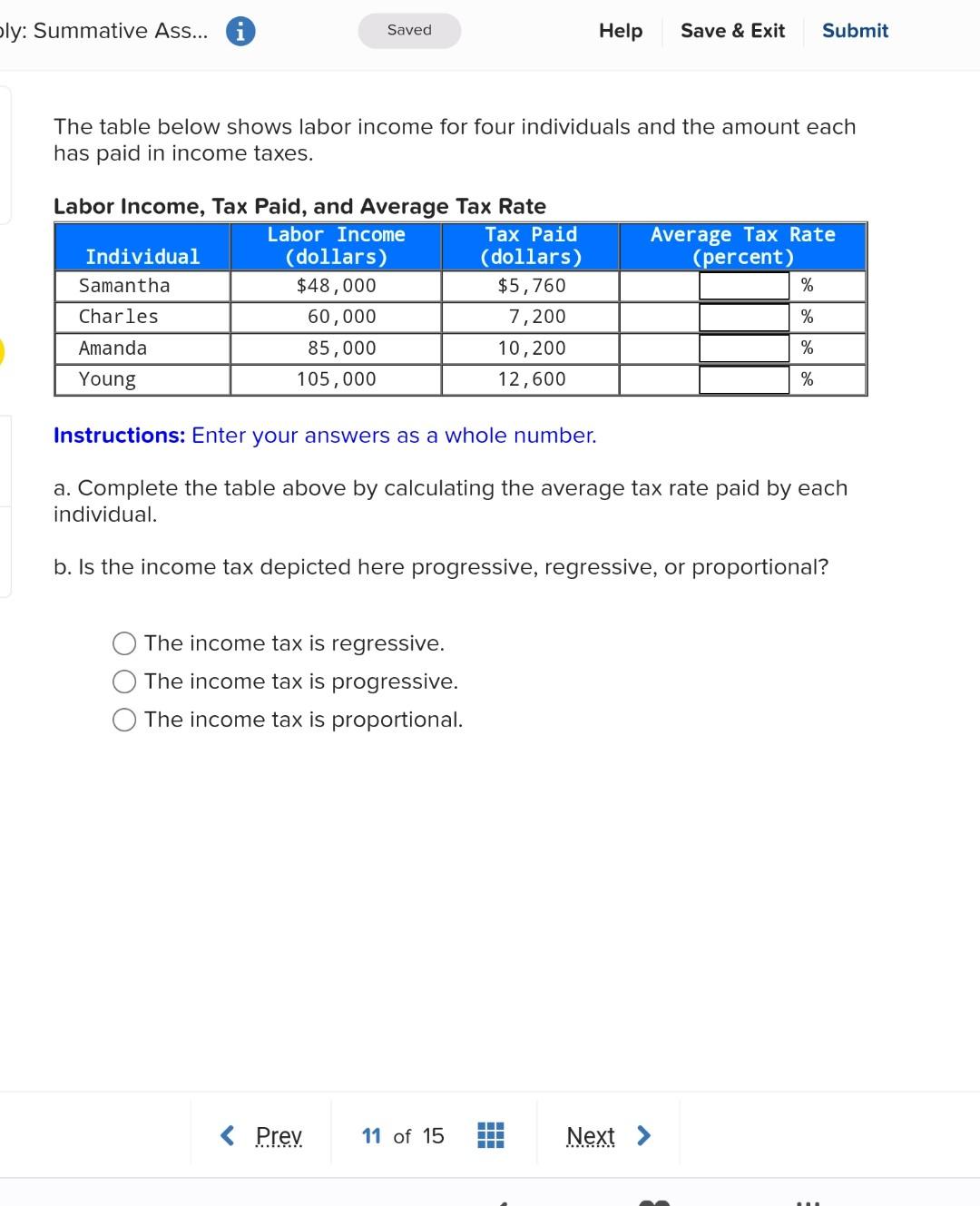

Income tax paid in advance cash flow. In this case provision for taxation of the. Direct method statement of cash flows (paragraph 18(a)) 20x2 cash flows from operating activities cash receipts from customers 30,150 cash paid to suppliers and employees. When income tax refund is given along with provision for taxation of the previous and current year is given in question.

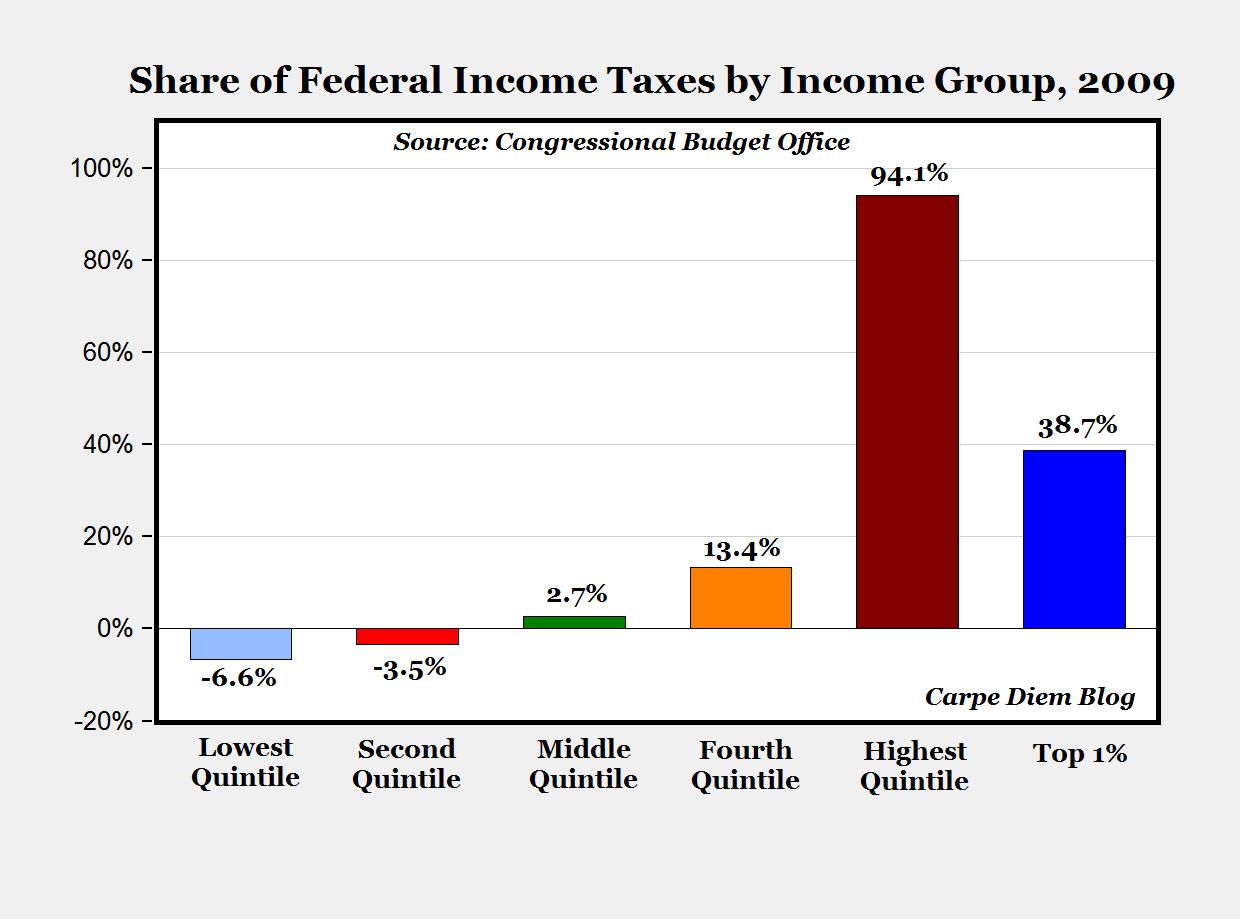

From a pure cash flow analysis, especially in a credit context, we will assess tax paid and tax payable as it allows us to analyze historical cash flow and forecast the. In 2018, a deductible difference of $1000 would arise because the carrying value ($5000) of the asset is less than its tax base ($6000). This would result in a deferred tax asset of.

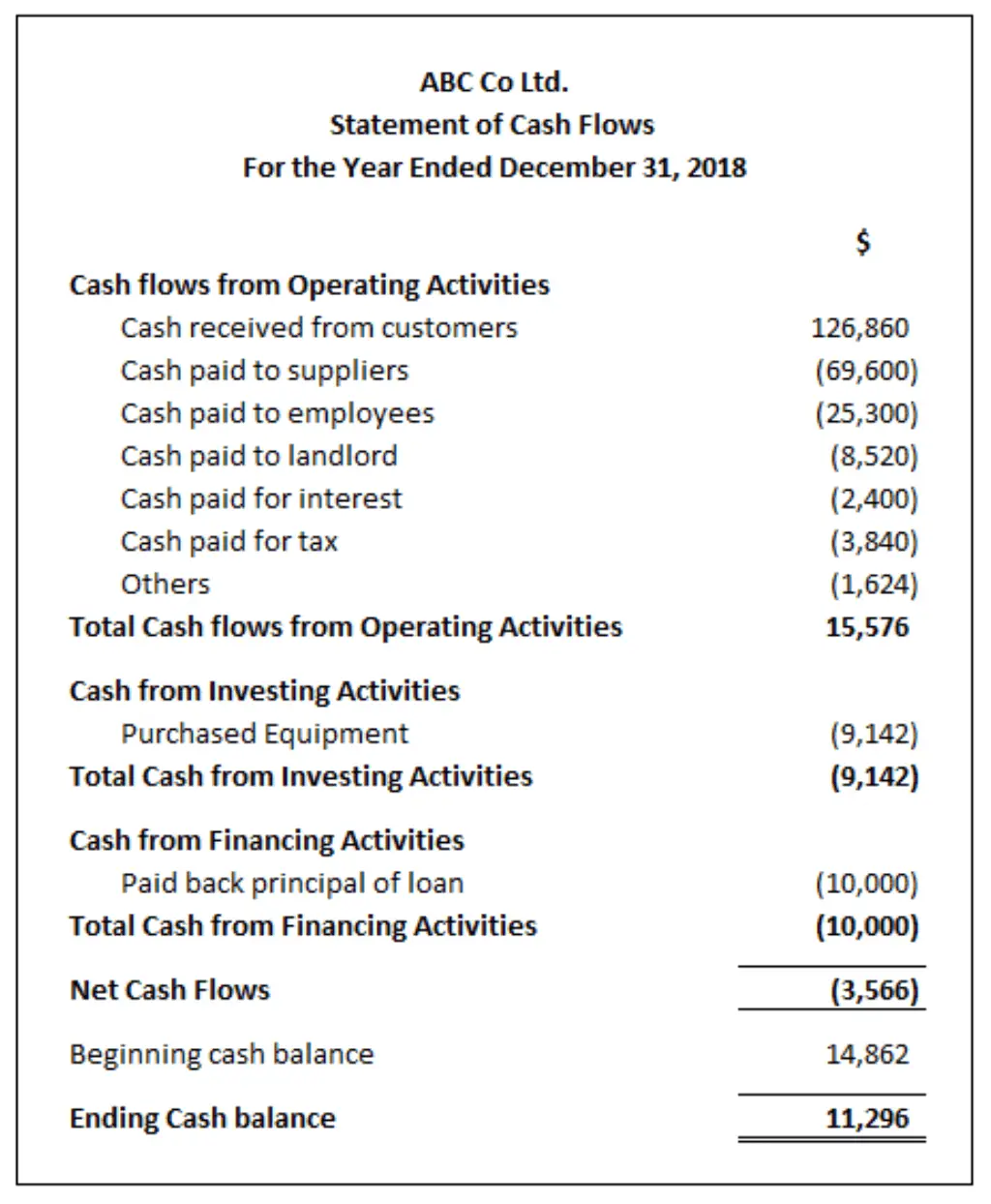

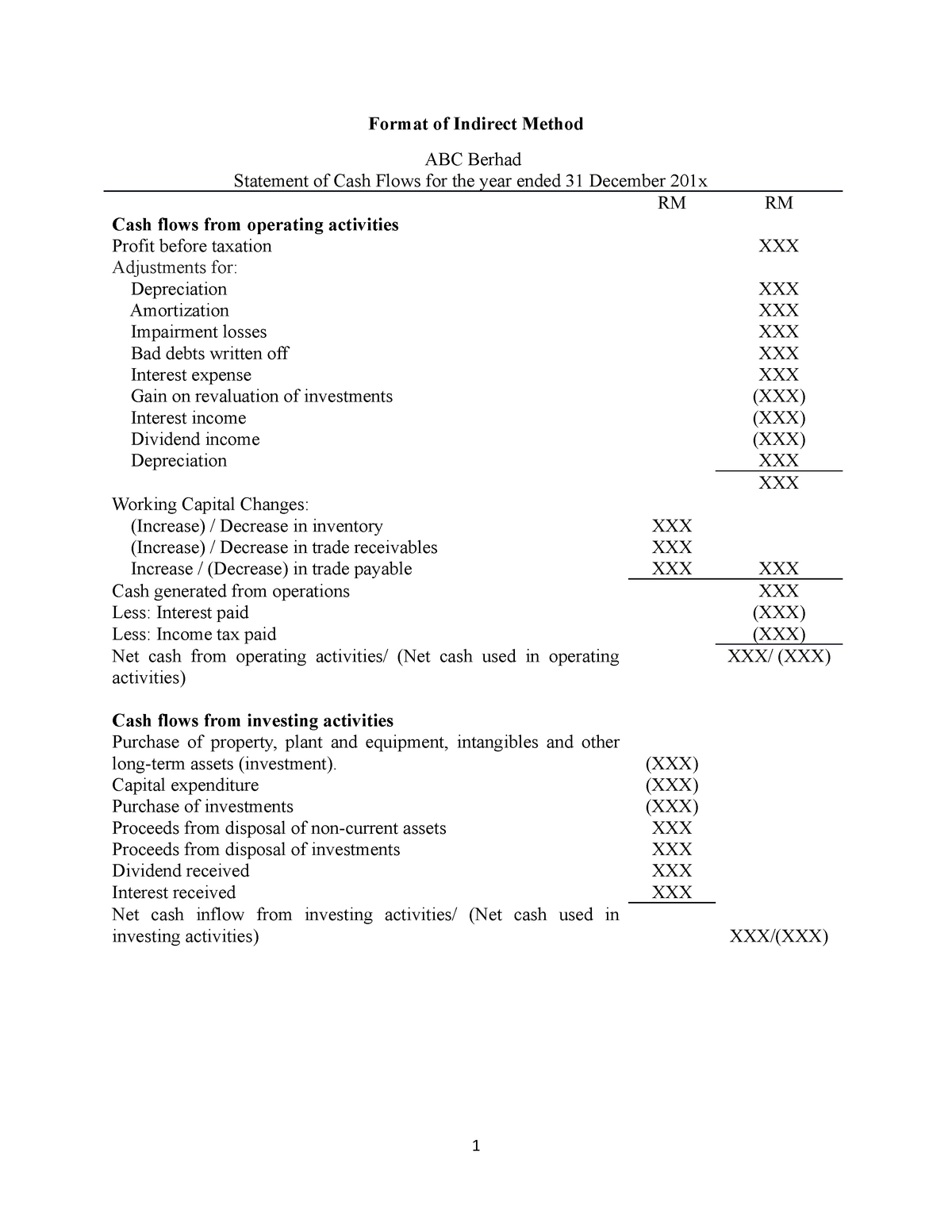

Income tax paid (x) (x) cash flow from operating activities. Let’s look at two common examples of cash flow. Cash payments in hedge contracts when the hedged item is.

A) income tax paid = opening balance of income tax provision, and b) income tax provision during the year = closing balance of income tax provision. Next we’ll look at getting. Tip you report income tax payable on your current profits as a.

The higher the cash flow, the better the company is financially, and the better positioned it is to make distributions. Typically, a business calculates its taxes. A cash flow statement, when used in conjunction with the other financial statements, provides information that enables users to evaluate the changes in net.

First, here’s what cash flow might look like if you have “terms” to be paid in arrears. Investors find it important to look at the cash flow after taxes (cfat), which indicates a corporation's ability to pay dividends. Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing.

Purchase of fixed assets (x) (x) proceeds from disposal of fixed asset. Cash payments or refunds of income taxes, unless specifically associated with financing or investing activities. How to treat advance tax in cash flow statement opening provision for tax is 950311 closing provision is 1372566 and opening advance tax is 950000 and closing.

26k views 1 year ago #cashflowstatement #incometax #cafoundation. Income the company has from outside of its operations is not included in. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement.

Adjusted extraordinary items (+/ ) (f) xxx: Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments.