Sensational Info About Gaap Cash Flow Statement Trading Account Format In Excel

A cash flow statement tells you how much cash is entering and leaving your business in a given period.

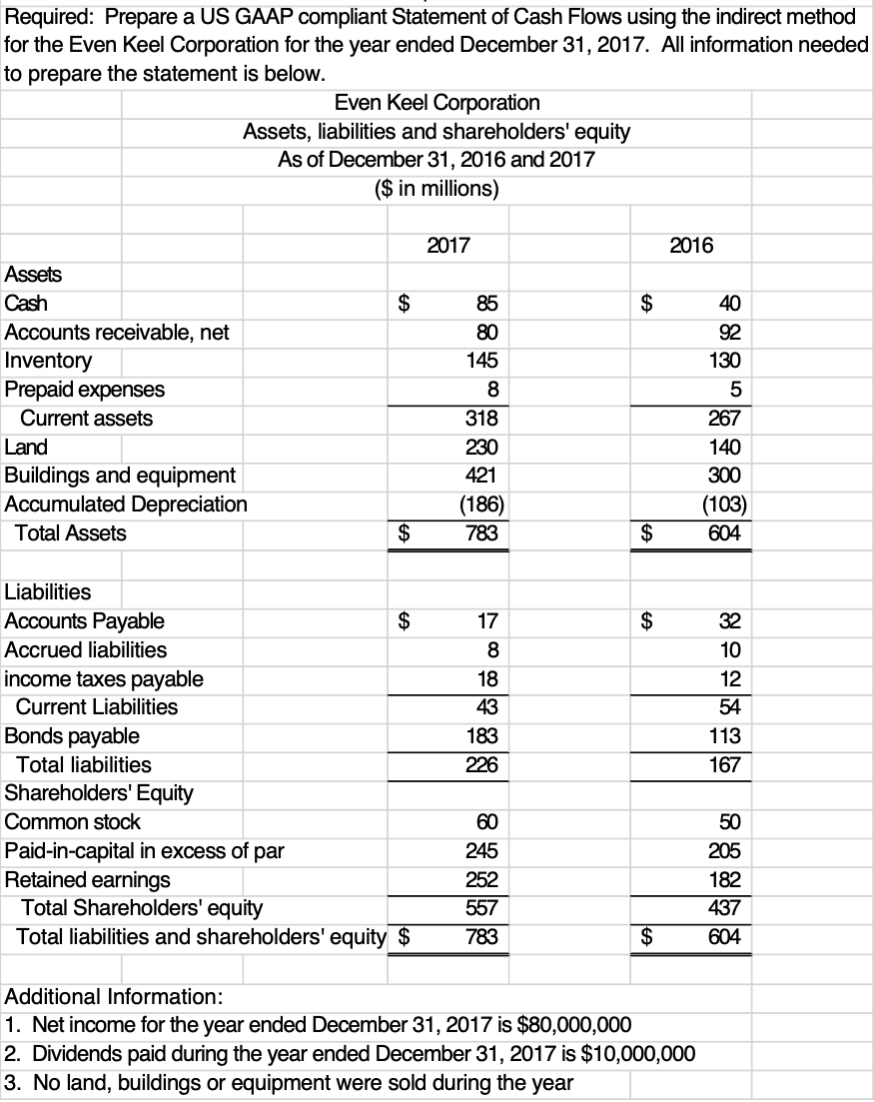

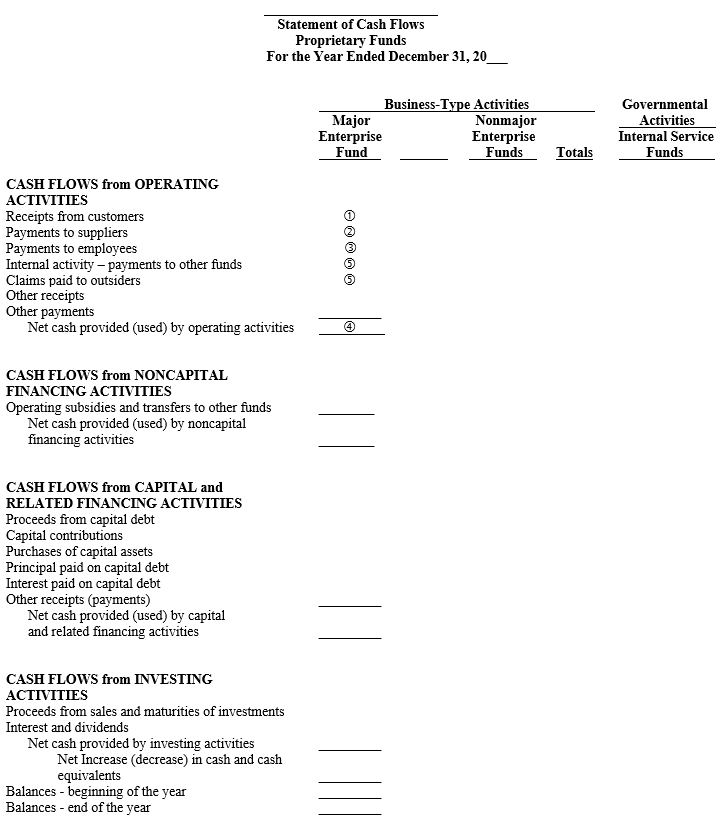

Gaap cash flow statement. Here we summarize our selection of top 10 gaap differences related to the statement of cash flows. A complete set of financial statements consists of five financial statements and the notes to the financial statements: The cash flows of a business are reported on the statement of cash flows.

Returned over $600 million to shareholders through dividends and repurchases in the first quarter ; There is currently no explicit guidance in us gaap on the accounting for digital assets, including how an entity classifies its receipts of and payments for such assets in the statement of cash flows. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

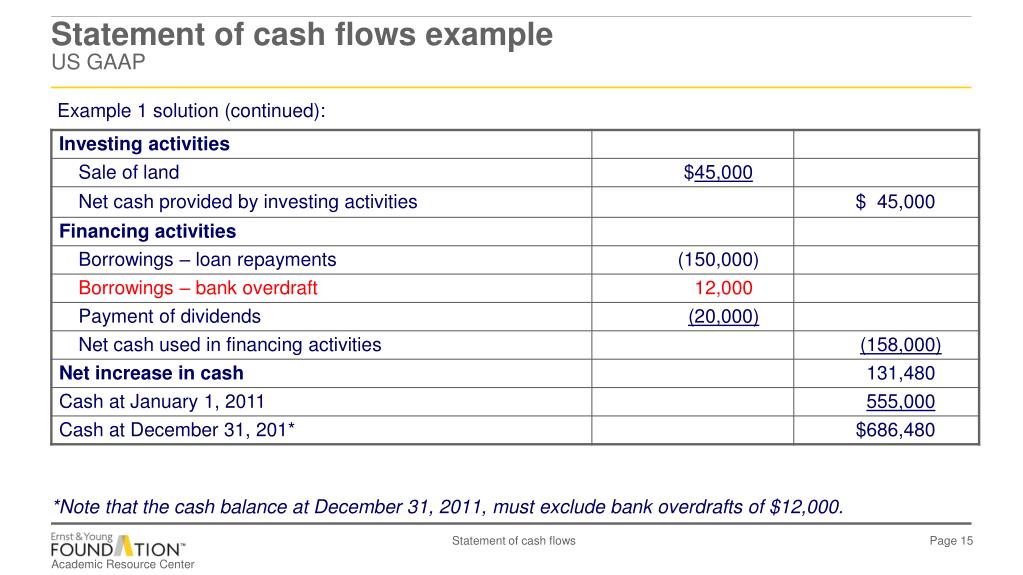

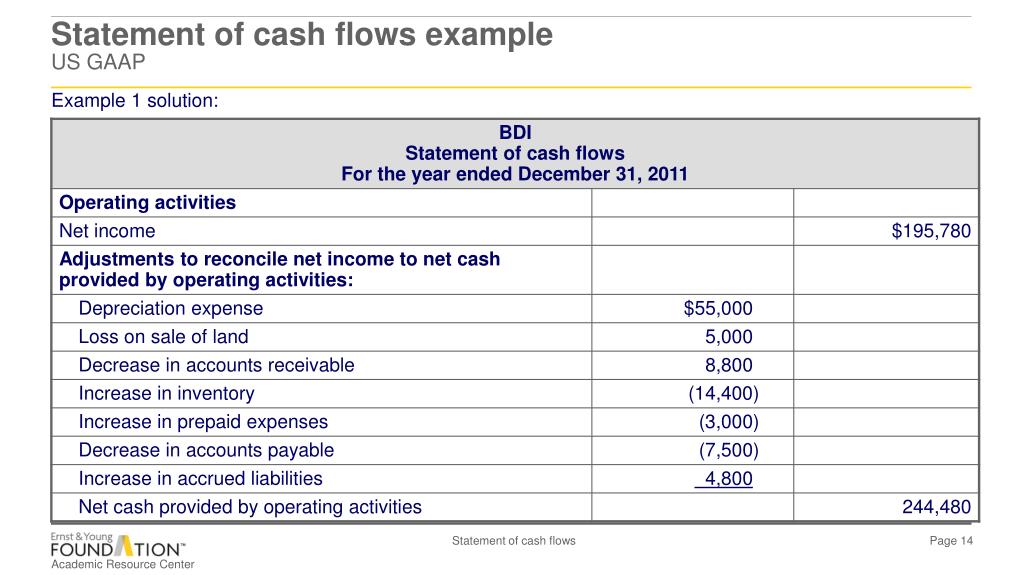

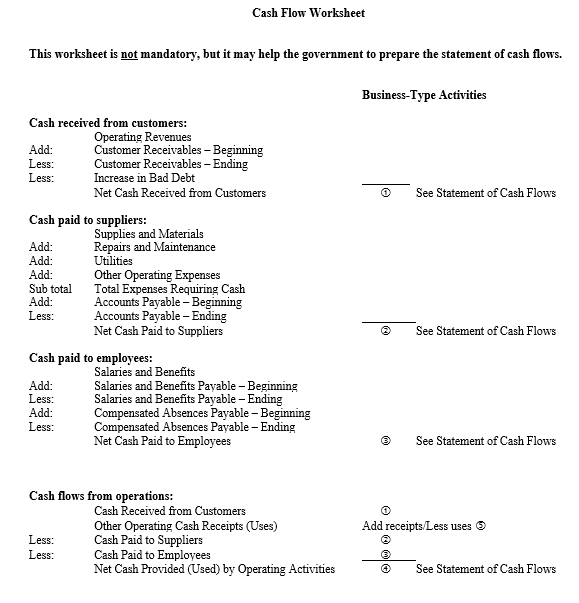

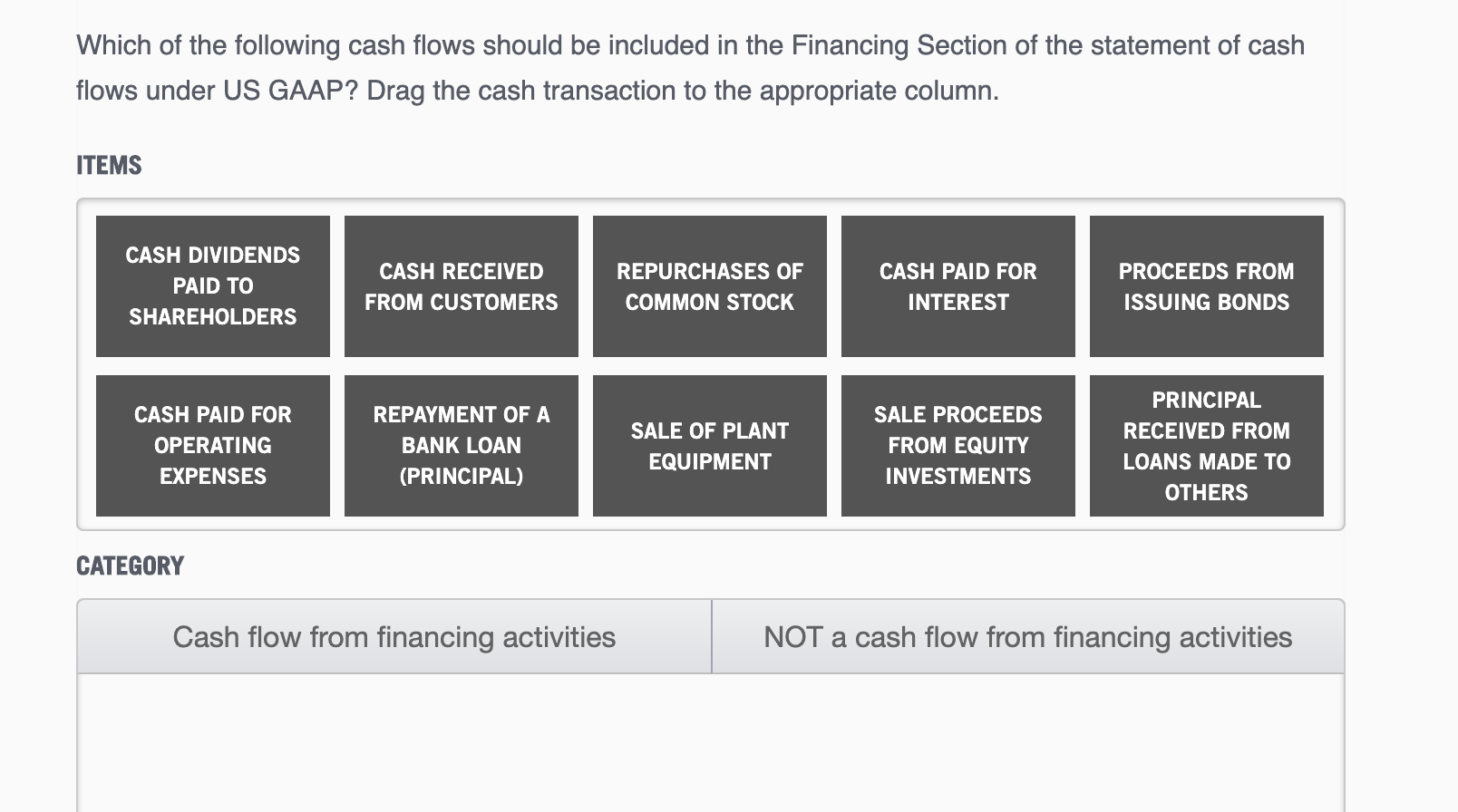

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a gross basis.

This value can be found on the income statement of the same accounting period. The cfs measures how well a.

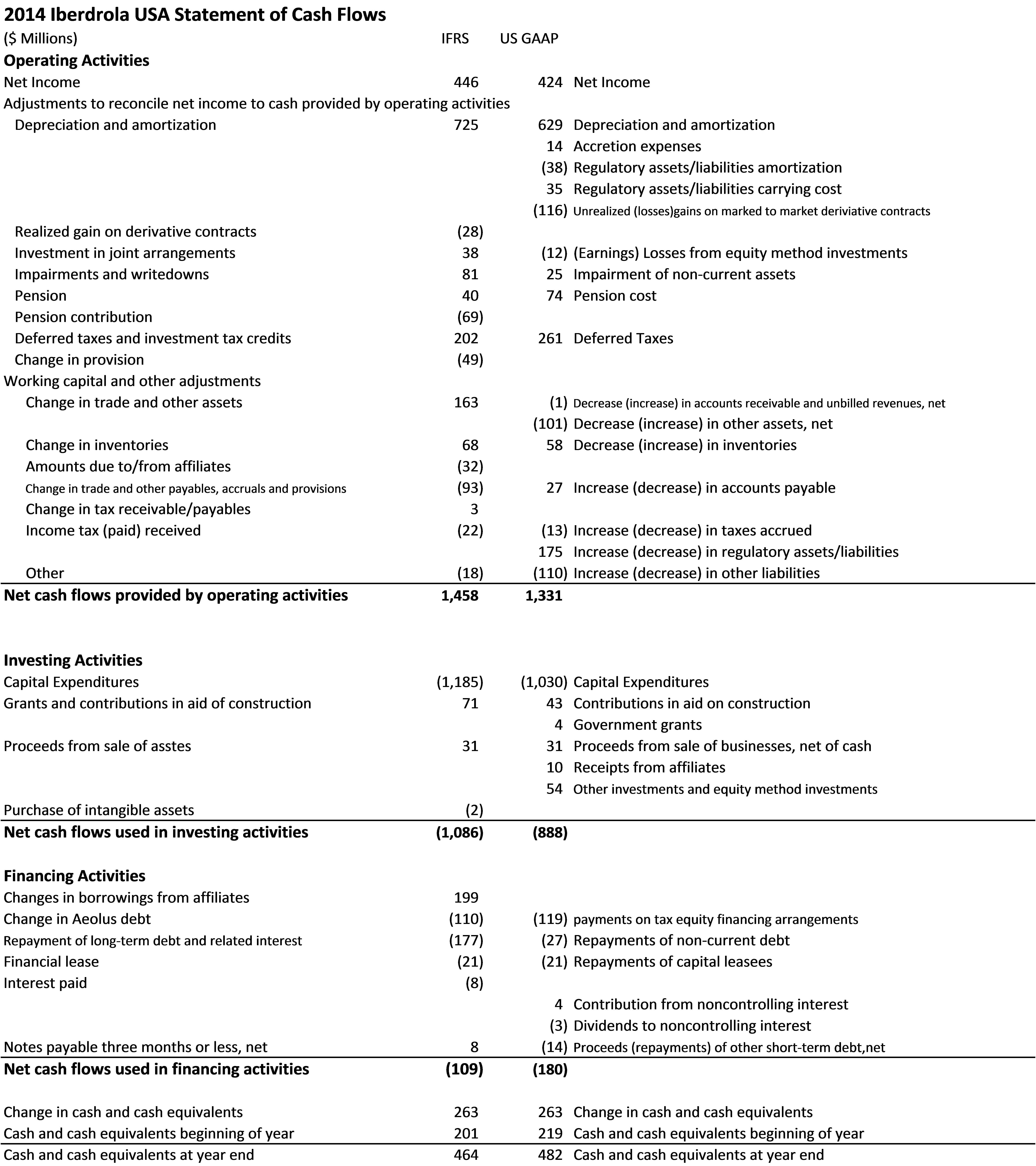

Several differences exist between how the cash flow statement is prepared under ifrs and us gaap. One objective of financial reporting is to provide information that is helpful in assessing the amounts, timing, and uncertainty of an organization’s cash inflows and outflows. Raised quarterly dividend by 7%, marking the twentieth.

A statement of cash flows provides. This required financial statement is appropriately named the statement of cash flows. The essentials—cash flow statements.

In ifrs, the guidance related to the statement of cash flows is included in international accounting standard (ias) 7, statement of cash flows. Total cash, cash equivalents and restricted cash shown in the statement of cash flows $ 513,314 $ 533,096 $ 513,314 $ 533,096. Remaining performance obligation grew 22% year over year to $10.8 billion;

Gaap is included in the financial accounting standards board’s accounting standards codification (asc) topic 230, statement of cash flows. Cash flow statement under us gaap and ifrs. The statement of cash flows shows the change during the period in total cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents.

The income statement, the balance sheet, and the cash flow statement. The cash flow statement looks at the inflow and outflow of cash within a company. Compared to current uk gaap (frs 1), frs 102 extends the scope of the statement of cash flows by requiring the inclusion not only of inflows and outflows of cash, defined as cash in hand and demand deposits, and of bank overdrafts repayable on demand, but also of cash equivalents.

As a result, an entity must apply judgment when classifying cash flows associated with transactions involving such assets. Cash equivalents include investments with a maturity of three. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under accrual accounting.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)