Here’s A Quick Way To Solve A Info About Interim Dividend In Cash Flow Statement P&l Revenue

The same amount is deducted as tax paid as the last item to calculate cash flow from operating activities.

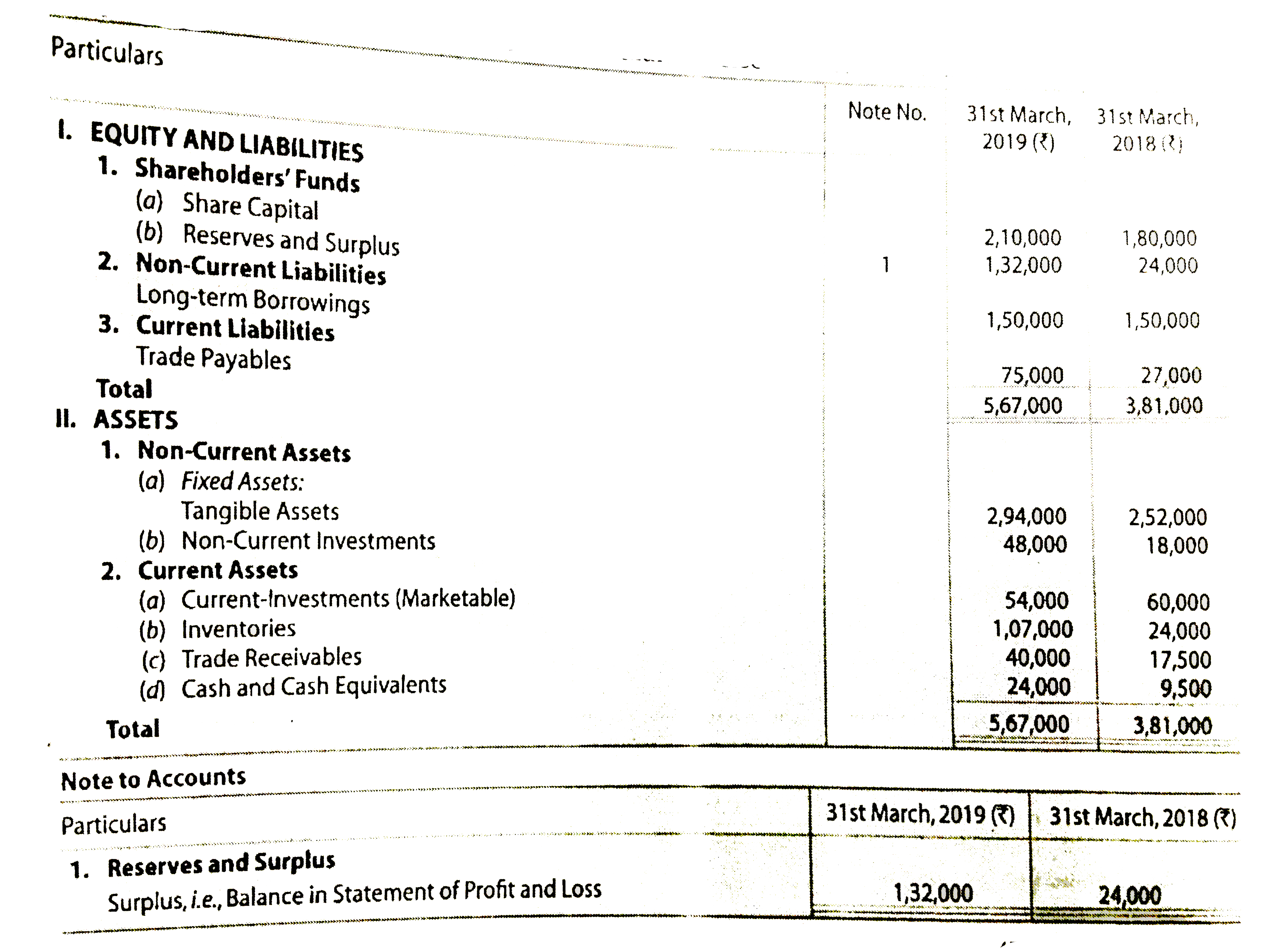

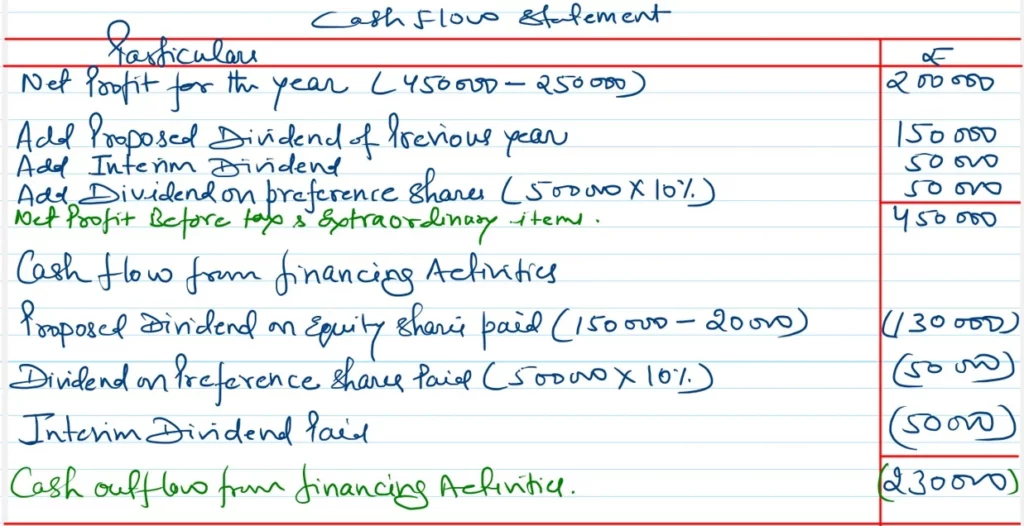

Interim dividend in cash flow statement. In this video i have explained the treatment of proposed dividend, interim dividend & final dividend in cash flow. It is the decision of the board of directors and is done with the shareholders' approval. (a) requires entities to classify each type of cash flow (dividends paid, dividends received, interest paid and interest received) in a single section of the statement of cash flows;

Dividend may be proposed or final but it should be. And (b) results in a classification in the statement of cash flows that is generally consistent with the classification of the related income or expense in the What is an interim dividend?

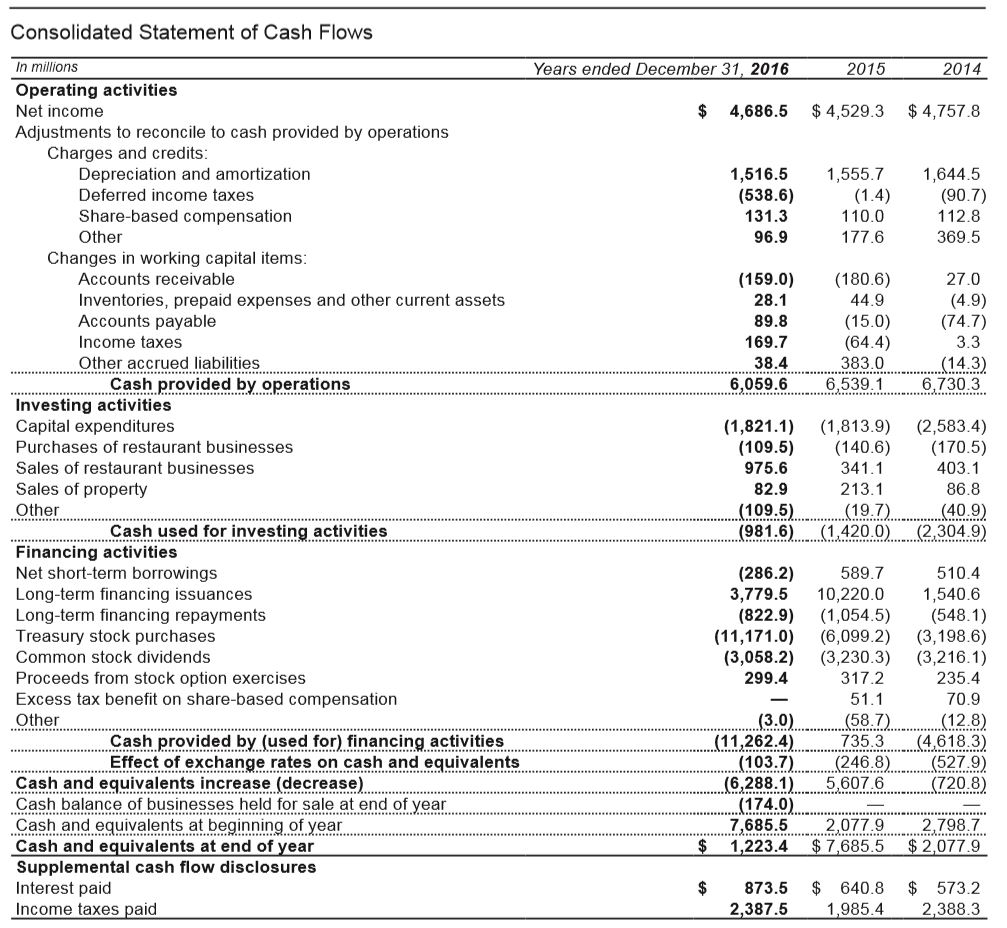

Condensed consolidated statement of cash flows 11. It is a partial distribution of profits, usually declared in the middle of the fiscal year. 2 segment information 15 3 profit and loss information 17 4 dividends 18 5 property, plant and equipment 18 6 intangible assets 19 7 current provisions 21 8 borrowings 21 9 equity securities issues.

An interim dividend is a payment made by a company to its shareholders before the annual financial statements are finalized. The board pays this dividend from the retained earnings or. An interim dividend is the distribution of earnings to shareholders before the end of the fiscal year.

Dividend payments in the year will normally be contained in the statement of changes in equity. Interim dividend is paid in the same year, it is declared. This dividend is declared between two annual general meetings.

An interim dividend is a dividend declared by the company (board of directors) between two annual general meetings and before the release of final financial results. Ias 34 applies when an entity prepares an interim financial report, without mandating when an entity should prepare such a report. How do dividends impact cash flow?

Dividends paid during the year are reported on the (3) cash flow statement. This declared dividend usually accompanies the. Companies pay dividends to incentivize equity investors that are looking for income together with share price appreciation.

Dividends are paid in either cash or stock, given out of a company's profits as a reward or incentive. These are not required to be paid. It’s listed in the “cash flow from financing activities” section.

So, are dividends in the cash flow statement? These condensed interim financial statements were approved for issue on 29 august 2020. Cash flow (many of the links in this article redirect to a specific reviewed product.

Dividends in the statement of cash flows. The drug manufacturer paid a final dividend totaling to.