Stunning Info About Explain The Income Statement Trial And Balance

A company's income statement provides details on the revenue a company earns and the expenses involved in its operating activities.

Explain the income statement. Revenue realized through primary activities is often referred to as operating revenue. Income statement example sales revenue. In one example, the attorney general's legal team showed that trump's triplex in his eponymously named.

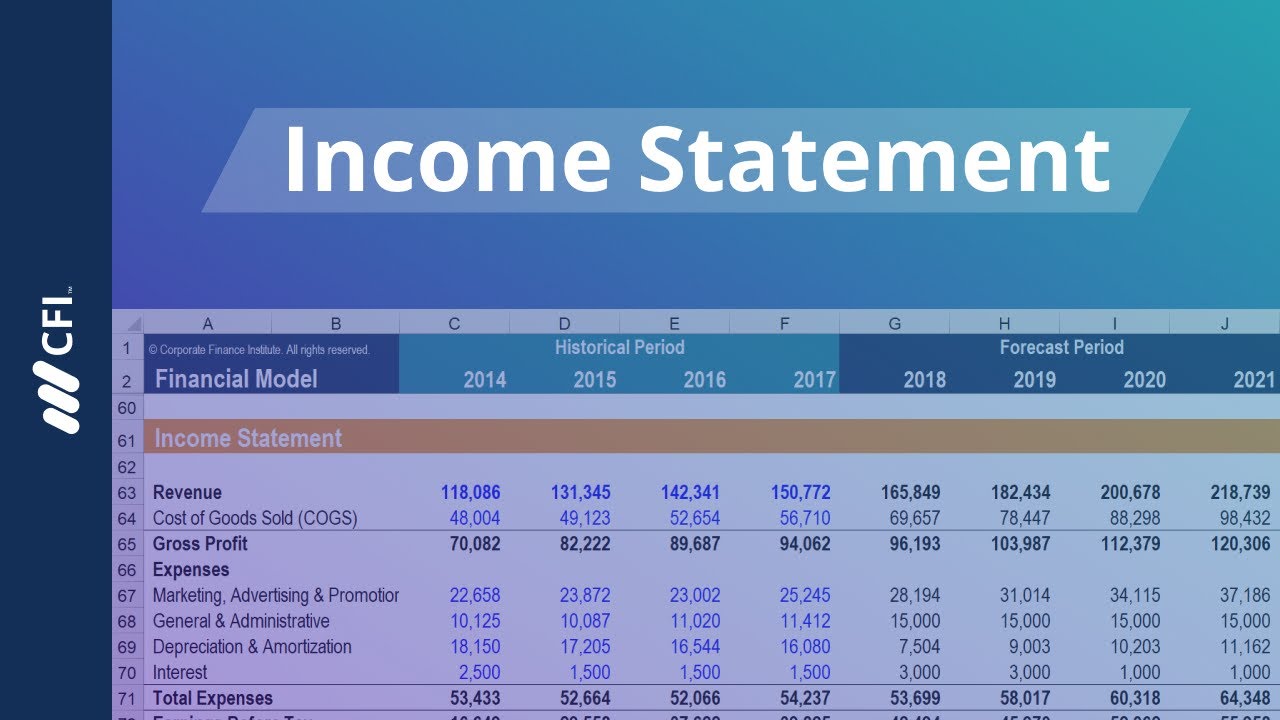

In this guide we’ll use annual reports as examples, but you can prepare income statements quarterly or monthly as well. An income statement (also called a profit and loss statement, or p&l) summarizes your financial transactions, then shows you how much you earned and how much you spent for a specific reporting period. The cash flow statement provides a view of a company’s.

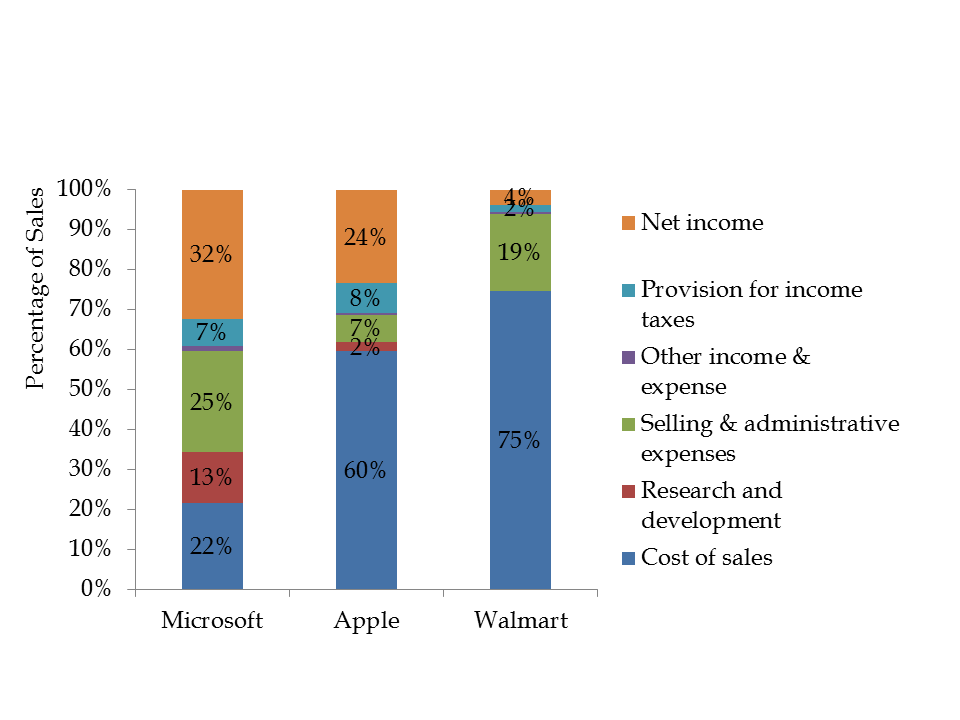

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. Analyzing these three financial statements is one of the key steps when creating a financial model. The cash flow statement is linked to the income statement by net profit or net loss, which is usually the first line item of a cash flow statement, used to calculate cash flow from operations.

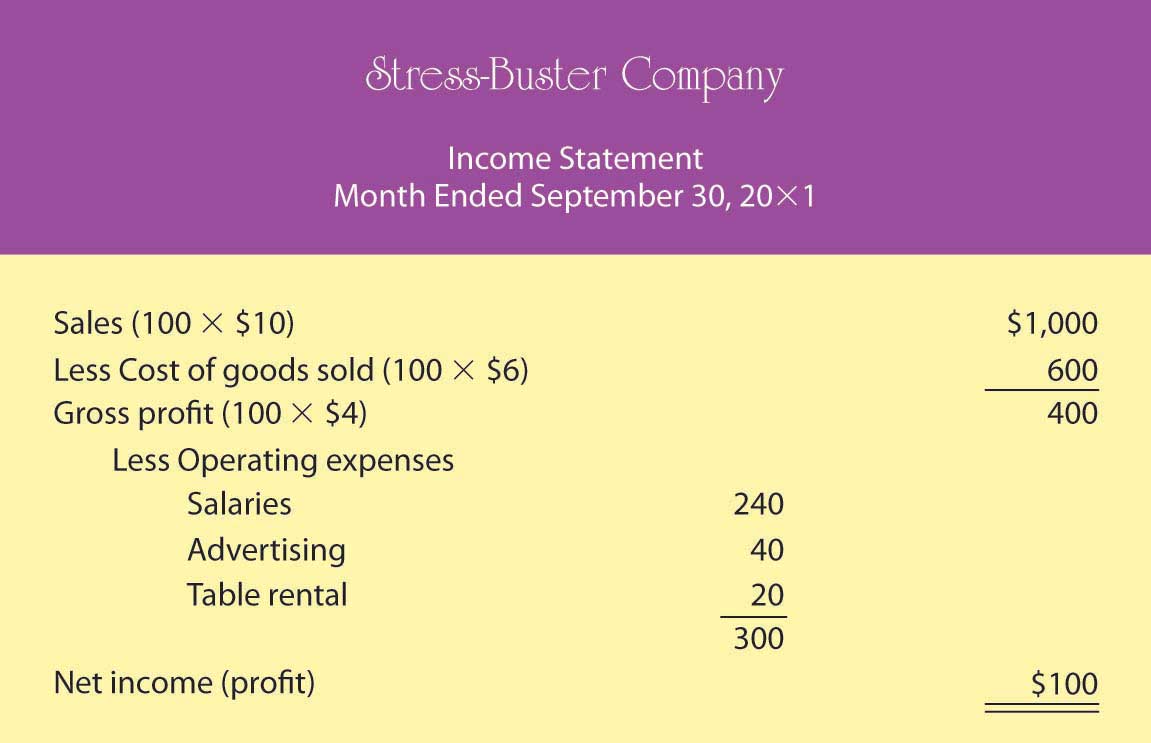

In the income statement, expenses are costs incurred by a business to generate revenue. Income statements are used by managers, investors, lenders, and. The income statement presents the financial results of a business for a stated period of time.

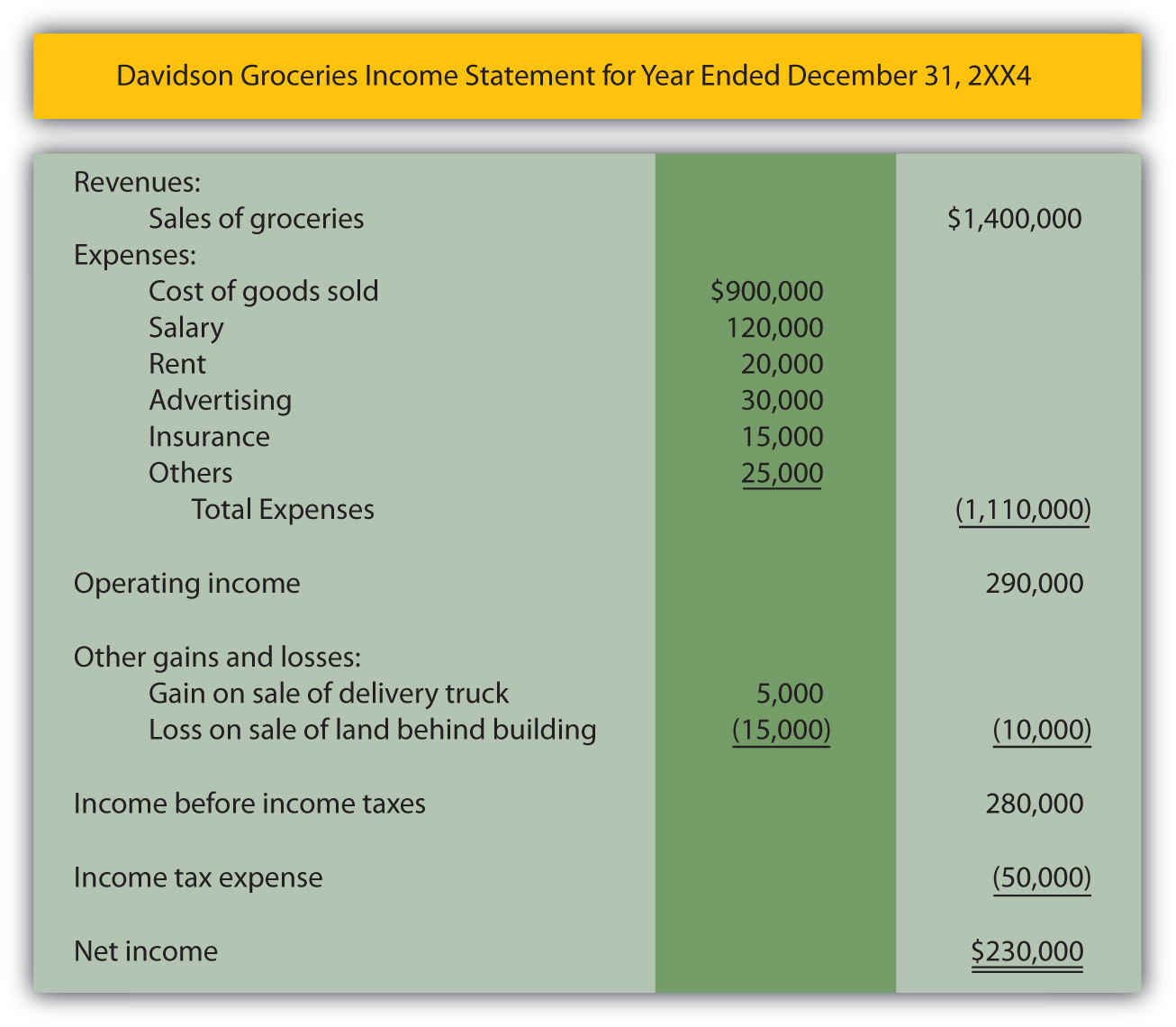

Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. An income statement includes a company’s revenue, expenses, gains, losses and profit for a specific accounting period. This document gauges the financial performance of a business in terms of profits or losses for the accounting period.

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. How you calculate this figure will depend on.

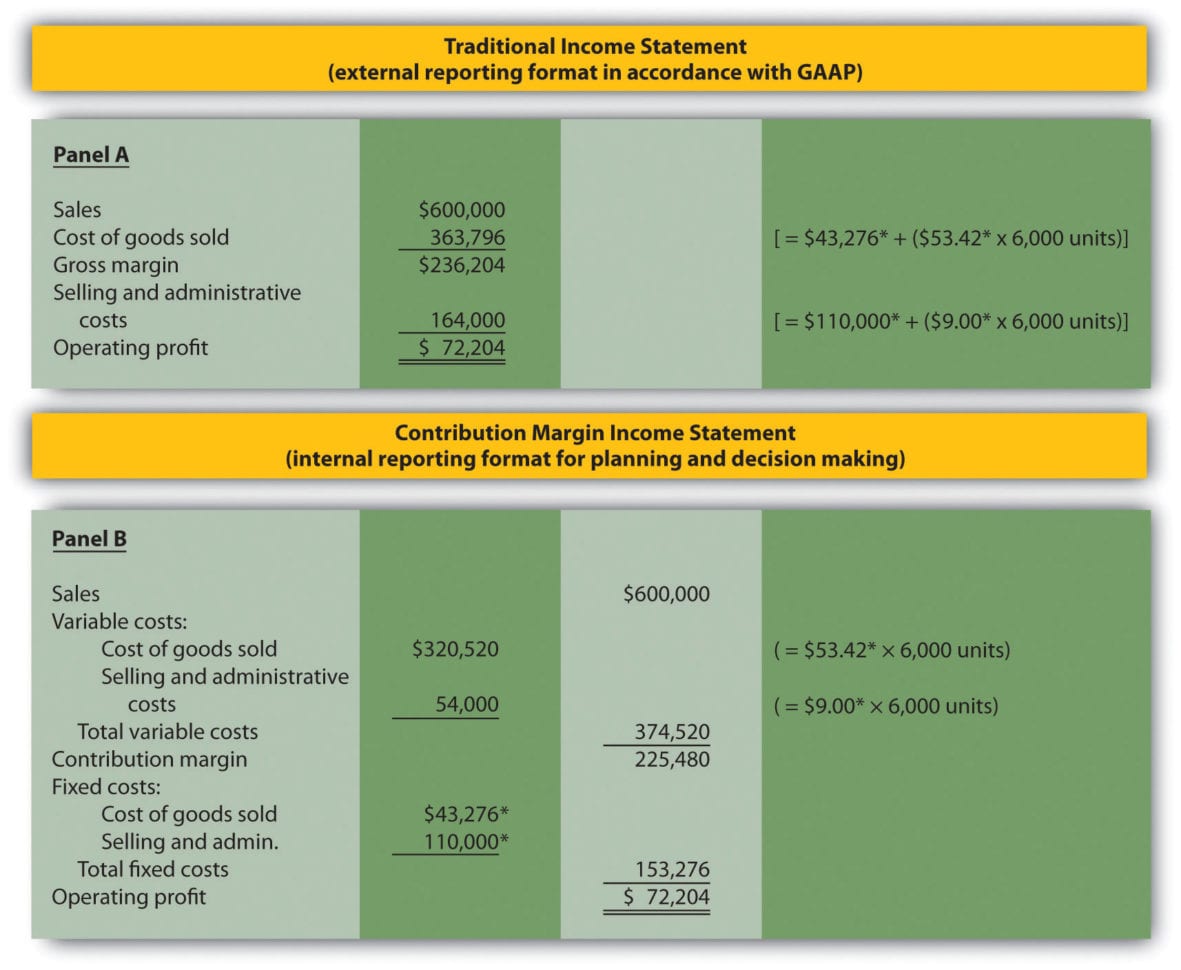

The income statement calculates the net income of a company by subtracting total expenses from total income. What is an income statement? If the expenses are smaller than the sales, the net result is profitability, or net income, rather than a net loss.

Income statements depict a company’s financial performance over a reporting period. These three financial statements are intricately linked to one another. What is the income statement?

It shows whether a company has made a profit or loss during that period. The income statement follows a specific format. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss.

What is an income statement? The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)