Simple Info About Interest Payable Income Statement Restricted Cash In Balance Sheet

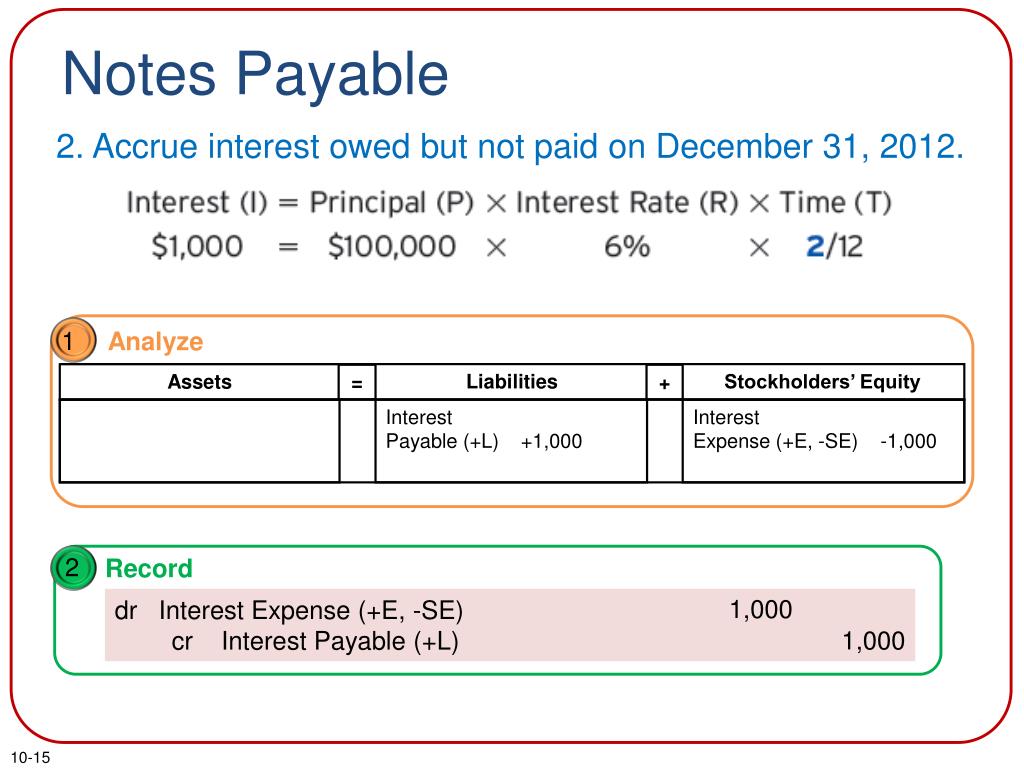

It’s recorded as an expense in the income statement.

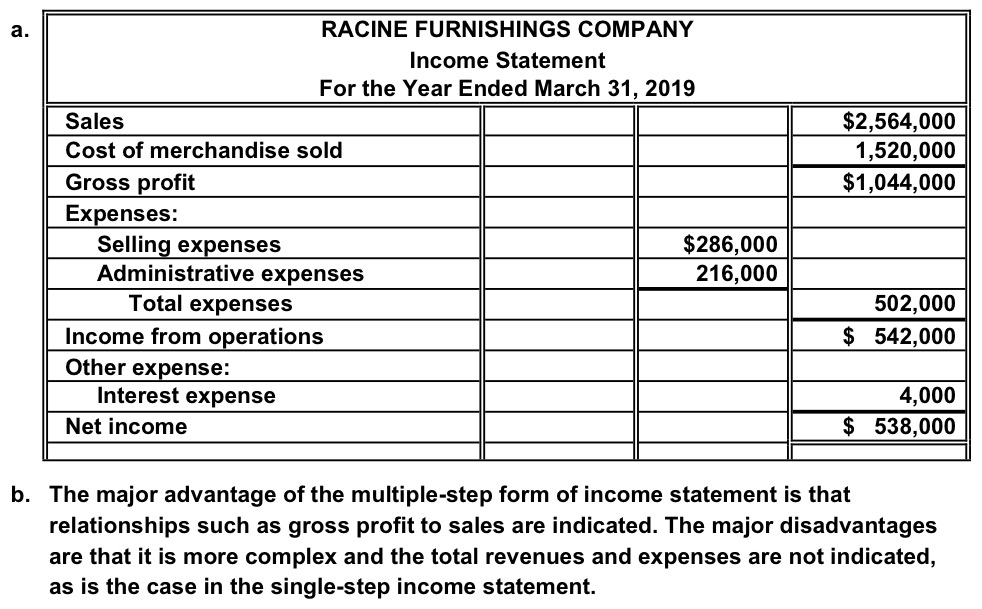

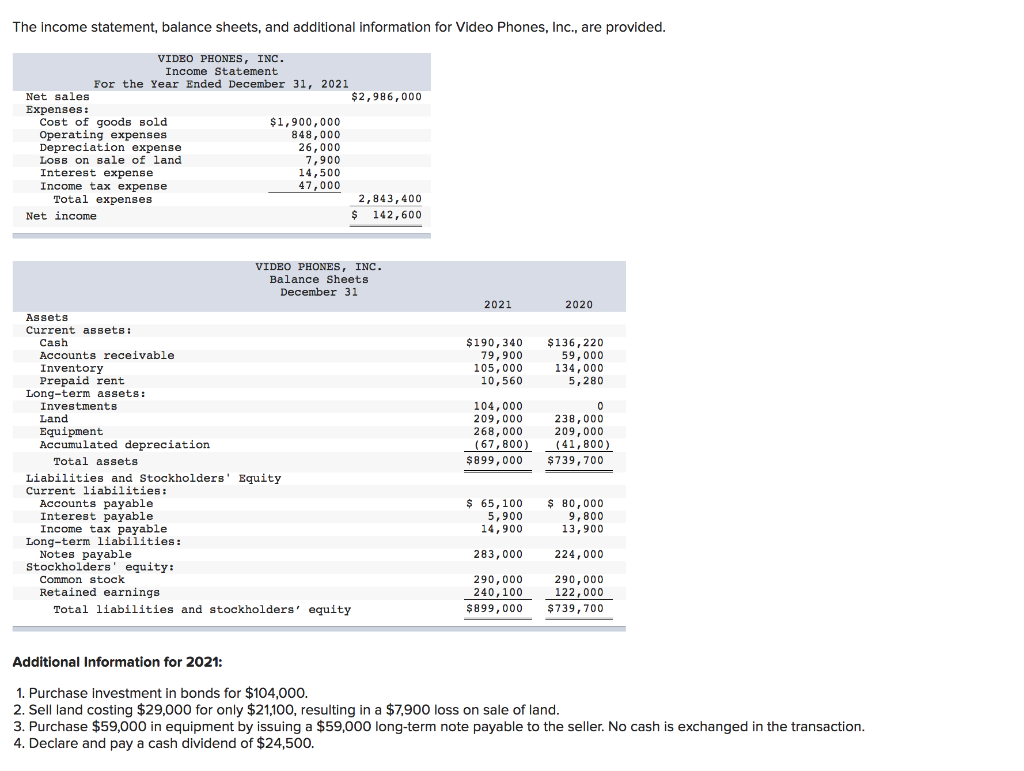

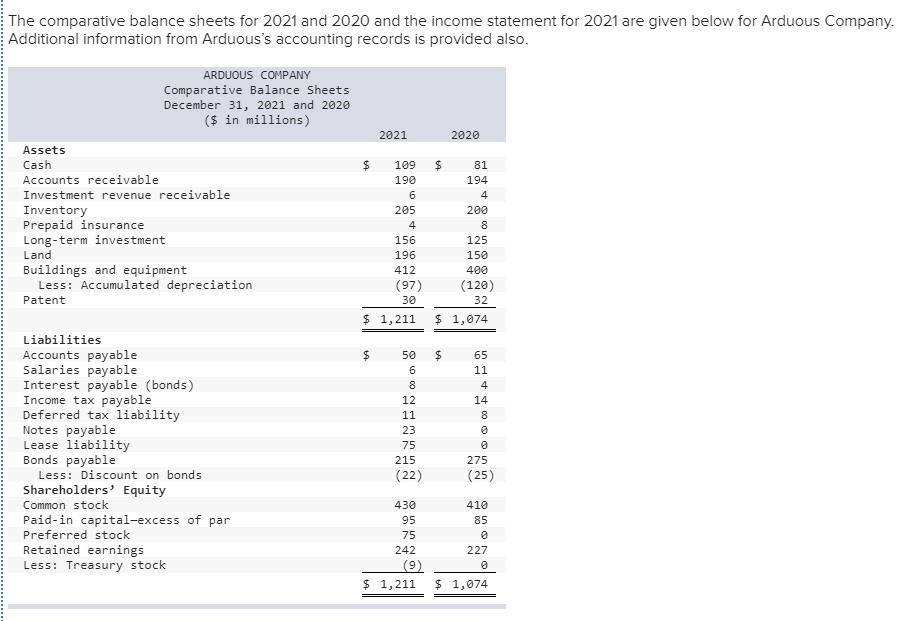

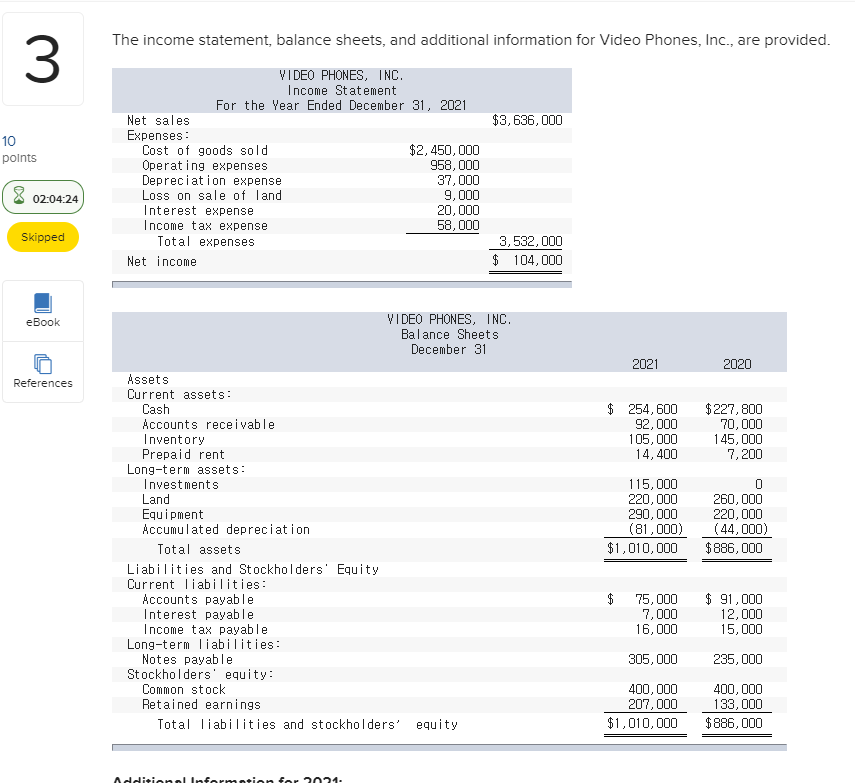

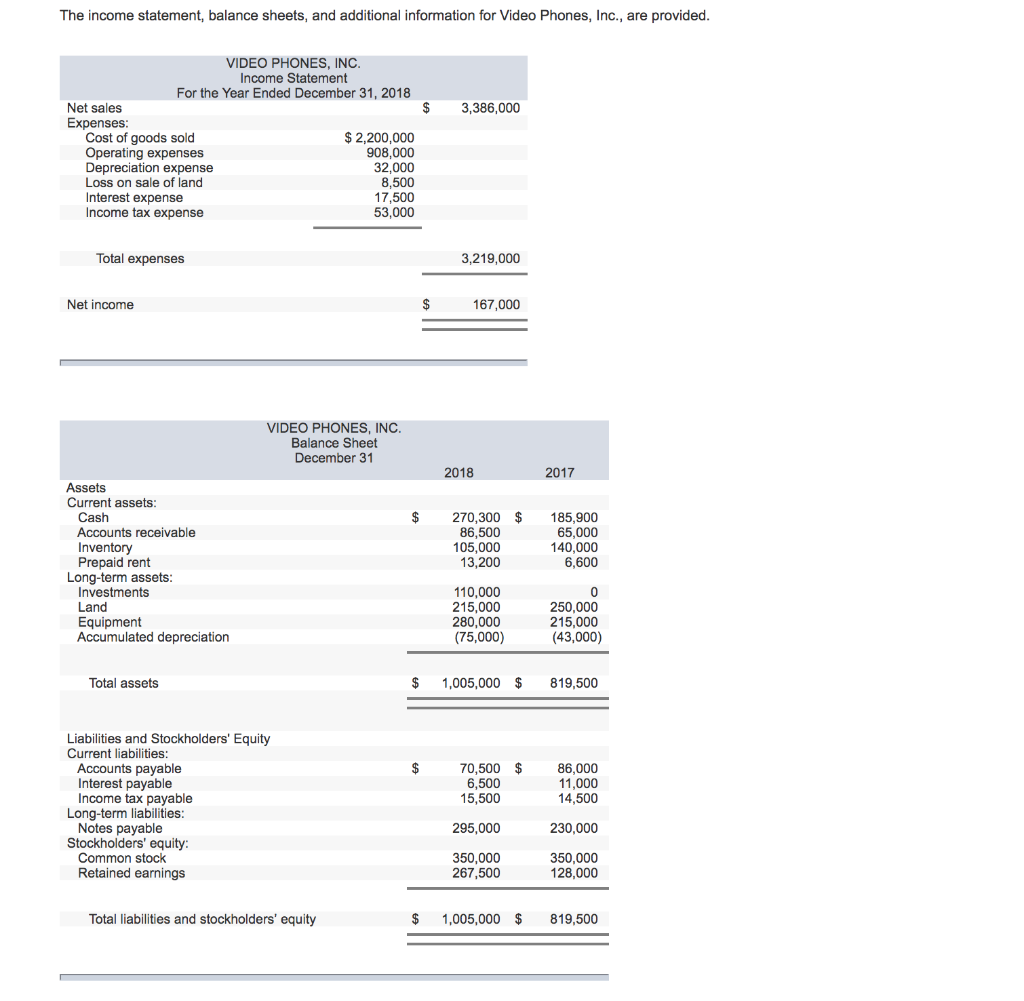

Interest payable income statement. An income statement is a financial statement that reports a company's financial performance over a specific accounting period. Interest payable is the amount an individual or company owes a lender at a particular time but hasn't paid. Simple interest can be computed in very simple steps.

Trump’s civil fraud trial as soon as friday, the former. Trump was penalized $355 million plus interest and banned for three years from. Interest payable is the amount of interest the company has incurred but has not yet paid as of the date of the balance sheet.

Interest payable is a balance sheet item, because it represents the amount of interest outstanding at a particular moment in time. Interest payable is an account on a business’s income statement that show the amount of interest owing but not yet paid on a loan. Regardless of your accounting experience and.

Interest payable, on the other hand, is a current liability for the part of the loan that is currently due but not yet paid. When a new york judge delivers a final ruling in donald j. Definitions and how they differ indeed editorial team updated june 24, 2022 if you're interested in pursuing a career.

The interest expense of $12,500 incurred during 2020 must be charged to the income statement for the year 2020. The income statement, on the other hand,. The corporation has not yet incurred interest for the remaining.

16, 2024 updated 9:59 a.m. Interest payable is the interest expense that has been incurred (has already occurred) but has not been paid as of the date of the balance sheet. Updated september 30, 2022 interest payable is the amount of interest on the debt that a company owes to its lenders.

Let’s look at the process below: In accounting, accrued interest is reported by both borrowers and lenders: The interest owed is booked as a $500 debit to interest expense on company abc’s income statement and a $500 credit to interest payable on its.

The civil fraud ruling on donald trump, annotated. Borrowers list accrued interest as an expense on the income statement and a current. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364.

The yield is 10%, the bond matures on january 1,. Take the annual interest rate and convert the. The $12,500 in interest expense for 2020 must be charged to the income statement for that year.

In other words, if a company paid $20 in interest on its debts and earned $5 in interest from its savings account, the income statement would only show interest. Shannon stapleton/getty images. Interest payable is also the title of the current.