Fantastic Tips About Cash Flow And Fund Statement Steinhoff Financial Statements

Cash flow and funds flow statements are both essential financial reports serving as a barometer of a company’s performance and efficiency in cash and funds management.

Cash flow and fund flow statement. The cash flow statement is prepared so that the company’s net cash flow can be calculated at the end of a particular period. It identifies the reason for a change in the financial position of a company by comparing two years’ balance sheets. The cash flow statement shows the inflow and outflow of cash, whereas the fund flow.

F inancial planners believe investors can set up systematic withdrawal plans (swp) from their mutual fund scheme to get a monthly cash flow. Both cash flow vs fund flow aid in providing investors and the market with a periodic picture of the. Cash flow refers to the outflow and inflow of cash or cash equivalents in an organization in a specific period.

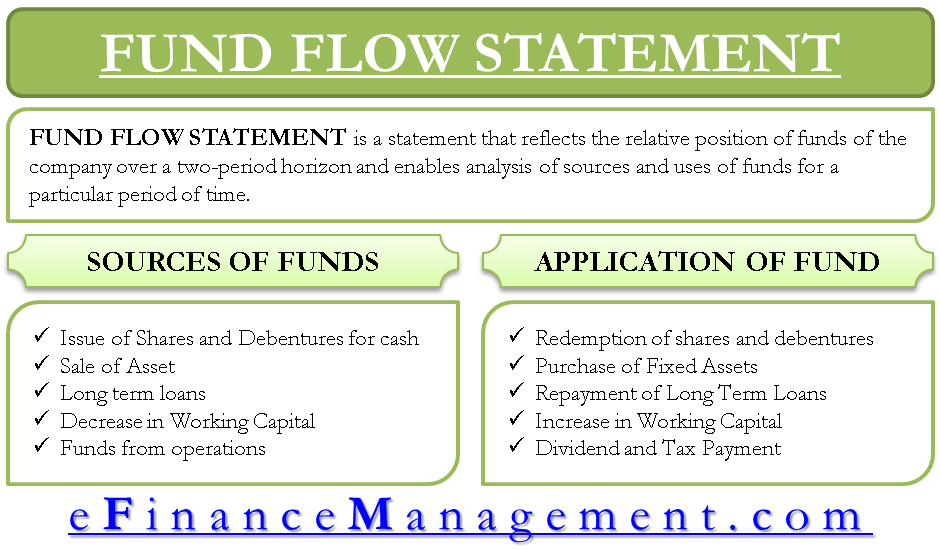

Fund flow is the cash that flows into and out of various financial assets for specific periods of time. Cash flow statement vs fund flow statement: Fund flow statements are used to analyze the changes in a company’s financial position over a specific period.

Difference between cash flow and fund flow statements meaning The former contains a detailed description of cash and cash equivalents of a business, total inflows and outflows accruing to both accounting and investment purposes. Helps in deducing the financial position of a business.

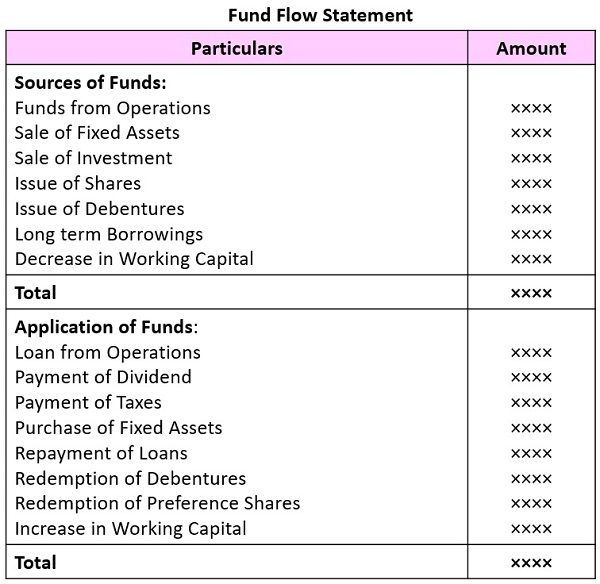

Fund flow statement is a statement that compares the two balance sheets by analyzing the sources of funds (debt and equity capital) and the application of funds (assets) and its reasons for any differences. Definition of cash flow and funds flow statements the cash flow statement, known formally as the statement of cash flows, reports a company's change in cash and cash equivalents from one balance sheet date to another. This statement helps stakeholders understand how funds are generated and whether it has been.

The fund flow statement employs the accrual basis of accounting. The cash flow statement is required for a complete set of financial statements. It can also reveal whether a company is going through transition or in a state of decline.

Investors, financial analysts, and management use these statements to make important investment decisions regarding the company or the stock. A cash flow statement shows the cash flows and cash equivalents of the business during business operations in one time. Statement of changes in the working capital, funds from operations, and fund flow statement are the three parts of the fund flow statement format.

The time interval (period of time) covered in the scf is shown in its heading. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. A company's cash flow and fund flow statements reflect two different variables during a specific period of time.

The cash flow statement emphasizes cash inflows and outflows, whereas the fund flow statement centers on sources and uses of funds. Increases in current assets or decreases in current liabilities impact working capital, while. Using this information, an investor might decide that a company with uneven cash flow is too risky to.

The cfs measures how well a. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. In contrast, fund flow statements do not include opening and closing balances and focus on changes in working capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)