Matchless Tips About Notes To Accounts In Balance Sheet Most Common Financial Statements

The notes are also referred to as footnote disclosures.

Notes to accounts in balance sheet. Profit and loss statement (income statement) What is a balance sheet? Balance sheet and notes to accounts 1.

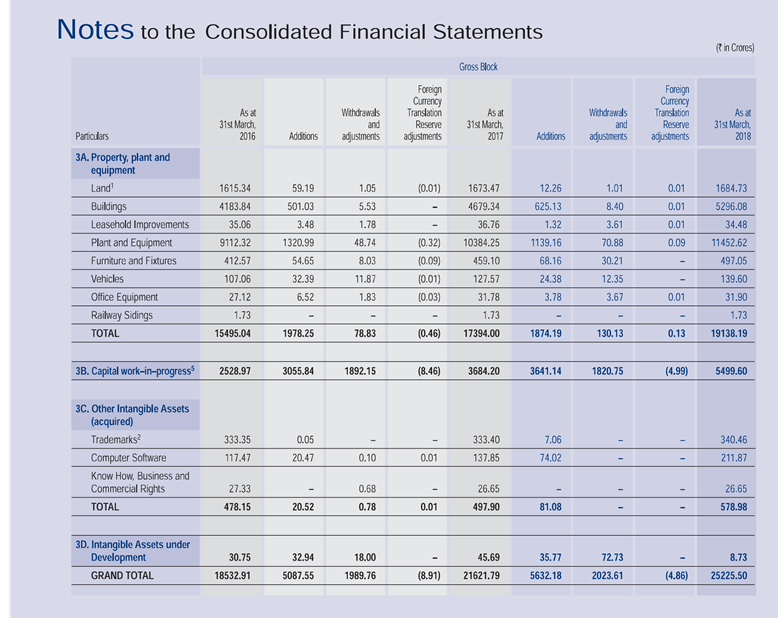

Also known notes to financial statements, footnotes, notes to accounts are supporting information that is usually provided along with a company’s final accounts or financial statements. The notes are used to explain the assumptions used to prepare the numbers in the financial statements as well as the accounting policies adopted by the company. As fixed assets age, they begin to lose their value.

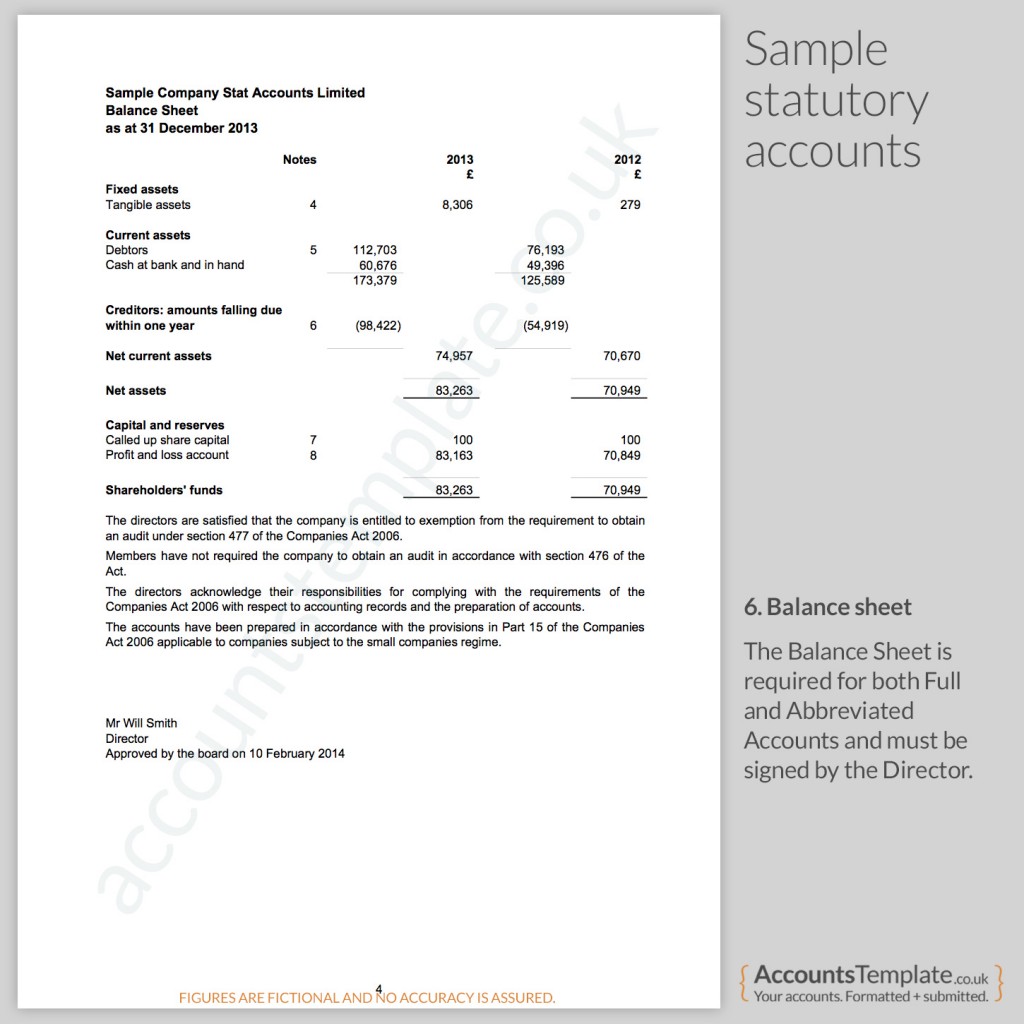

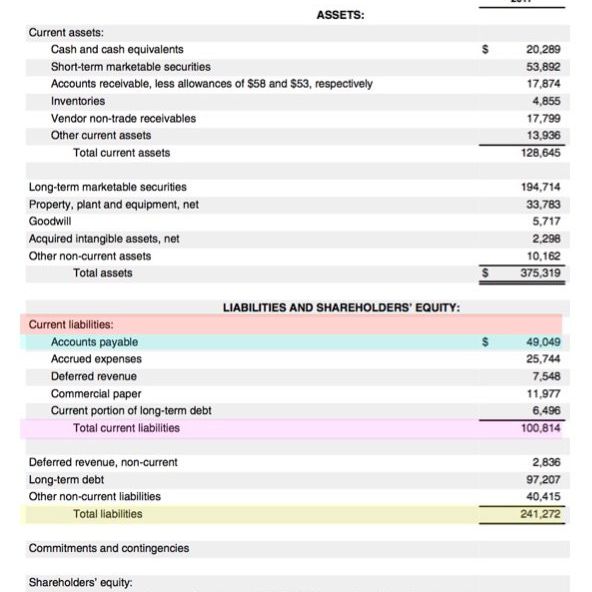

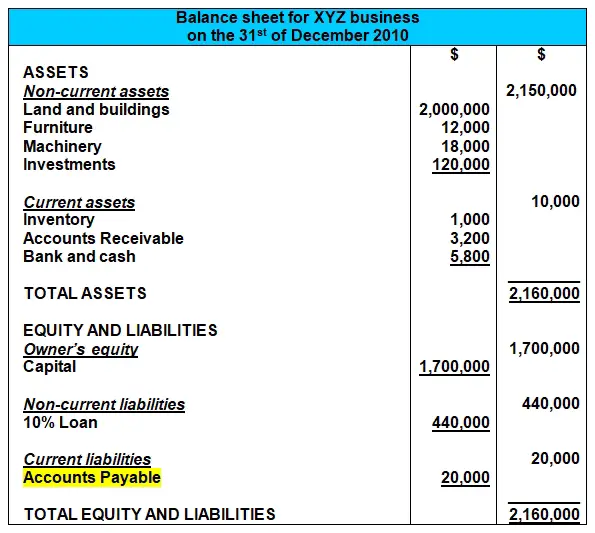

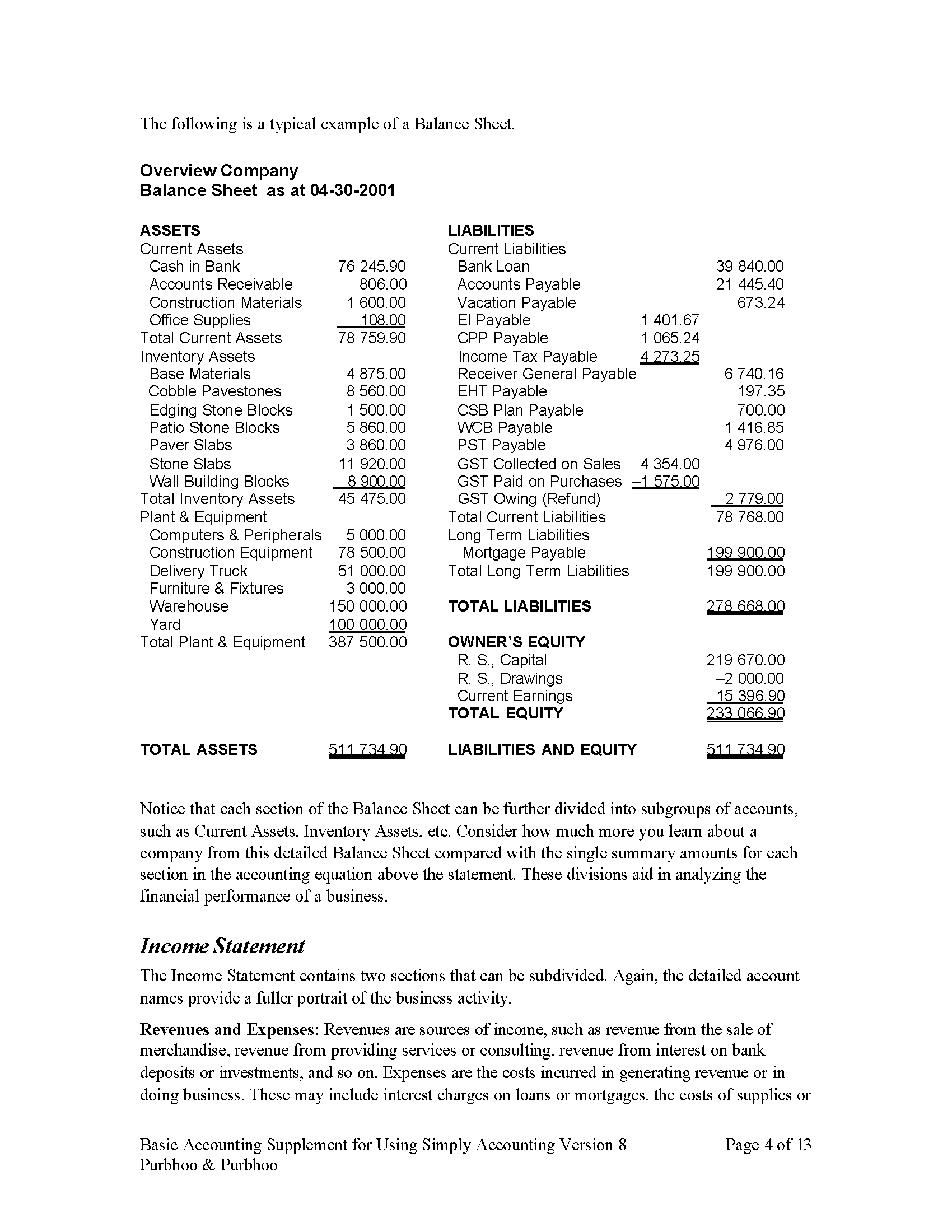

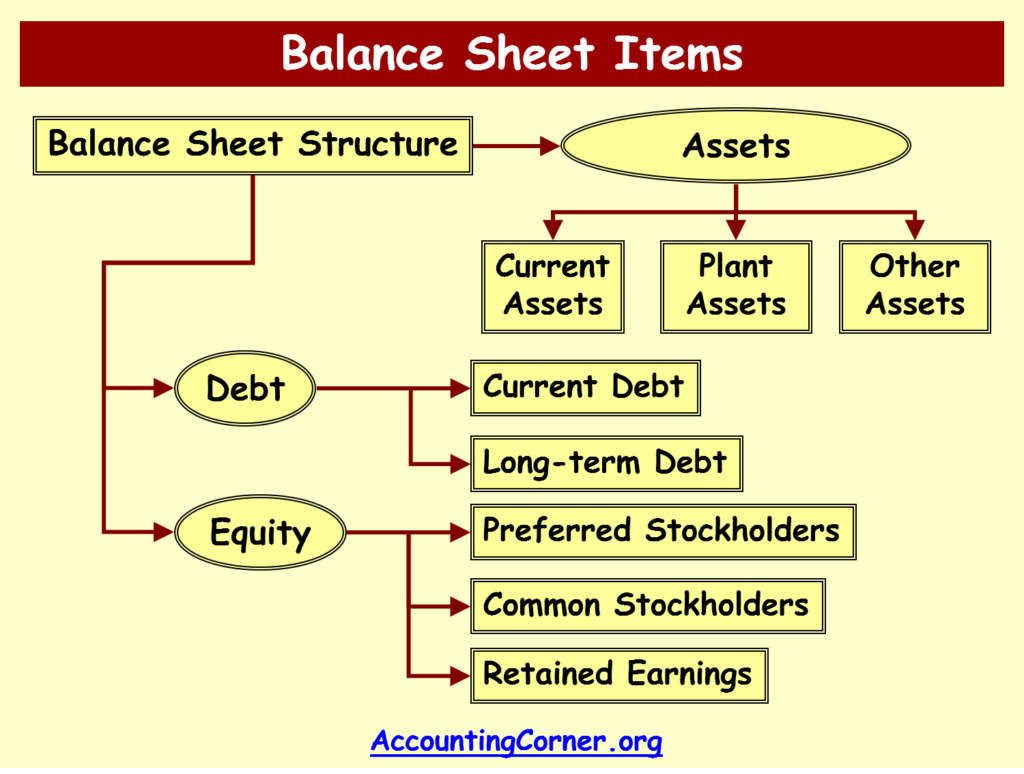

A balance sheet is a financial statement that summarizes the assets, liabilities, and. In these notes, company can include total contingent liabilities, future lawsuit against company's particular asset and other. Each of the first three sections contains the balances of the various accounts under each heading.

A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities). They are required since not all relevant financial information can be communicated through the amounts shown (or not shown) on the face of the financial statements. Excel in accounts executive & internal auditing we provide specialized handwriting notes for the various topics related to.

The notes to the financial statements are a required, integral part of a company's external financial statements. Which comprise the balance sheet as at 31st march, 2017, the statement of profit and loss, the statement of cash flows and the statement of changes in equity for the year ended 31st march, 2017, and a summary of the significant accounting policies and other explanatory information (together hereinafter referred to as “financial statements”. Use this guide to learn more about them and how to analyze it to grow your business.

This financial statement is used both internally and externally to determine the so. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. There are number of templates or sample financial statements available on the internet, so you can get a lot of inspiration from there.

P&l statement, cash flow statement, balance sheet, and more. What is a balance sheet? A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

Additionally, they are classified as current liabilities when the amounts are due within a year. Many such notes are required to be provided by law, including details related to provisions, reserves, depreciation, investments, inventory, share capital. The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity.

In the consolidated financial statements using the equity method of accounting. Balance sheets follow the equation “asset = liability + capital”, and both of its sides are always equal. It is important to note that a balance sheet is just a snapshot of the company's financial position at a single point in time.

Excel in accounts executive & internal auditing we provide specialized handwriting notes for the. study account's with me on instagram: Often, the reporting date will be the final day of the accounting period. A balance sheet consists of all the liabilities and assets of a company.

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)