Wonderful Info About Investing Operating And Financing Activities Balance Sheet Simple Format

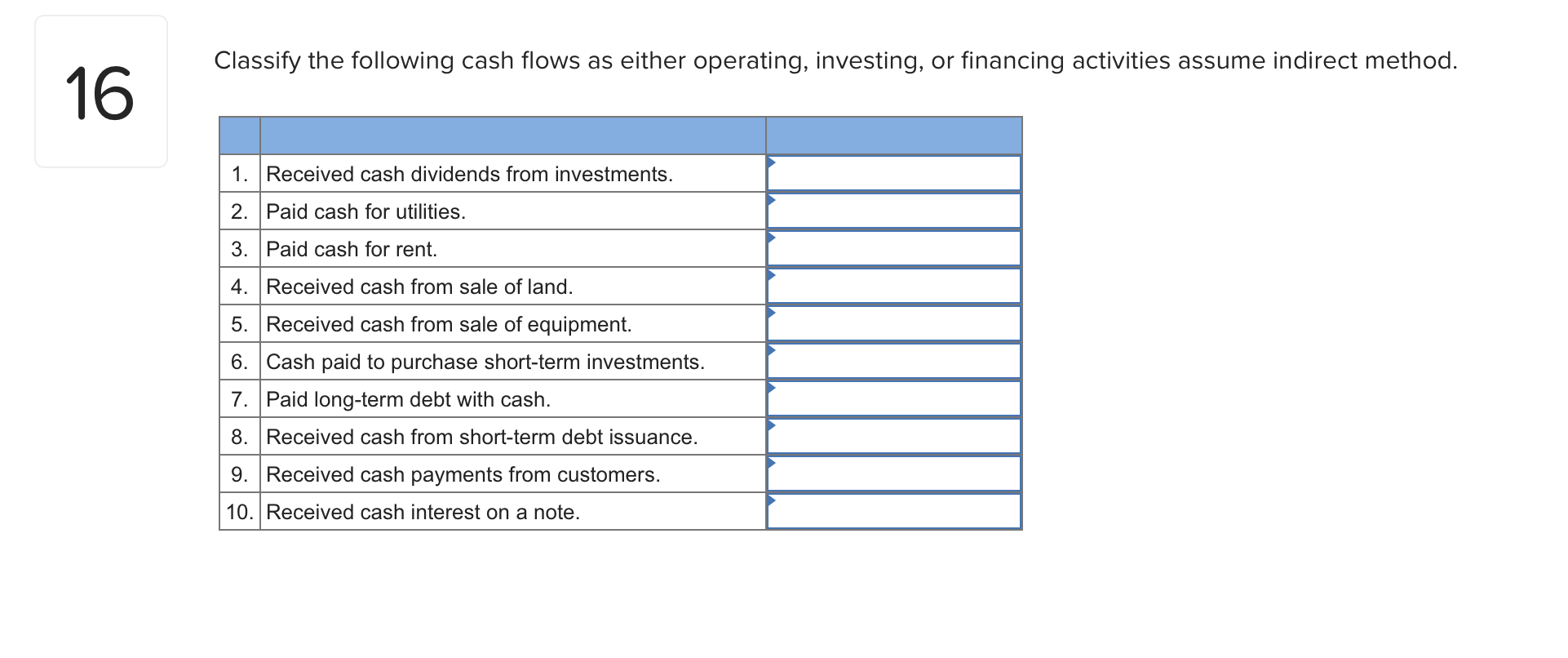

The two methods of calculating cash flow are the direct.

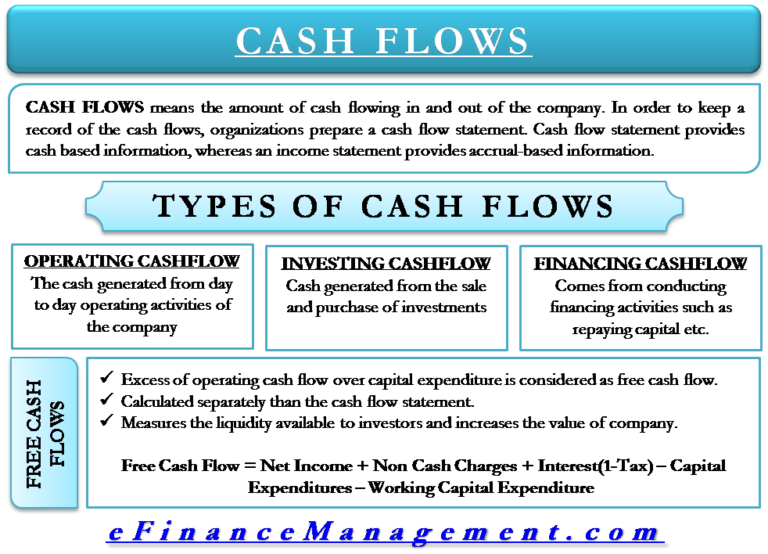

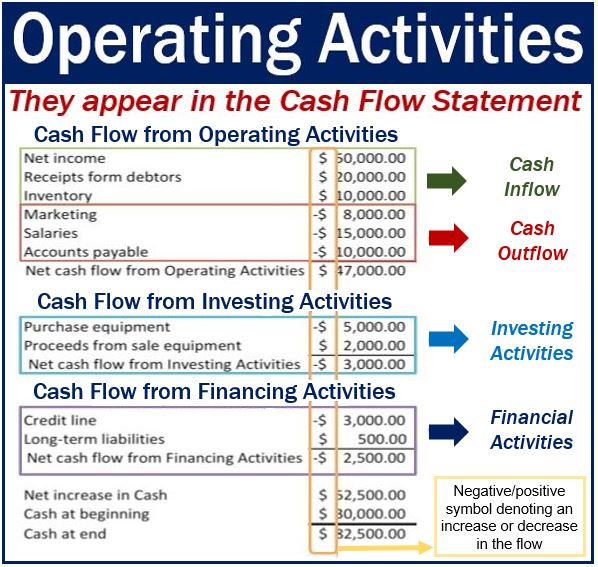

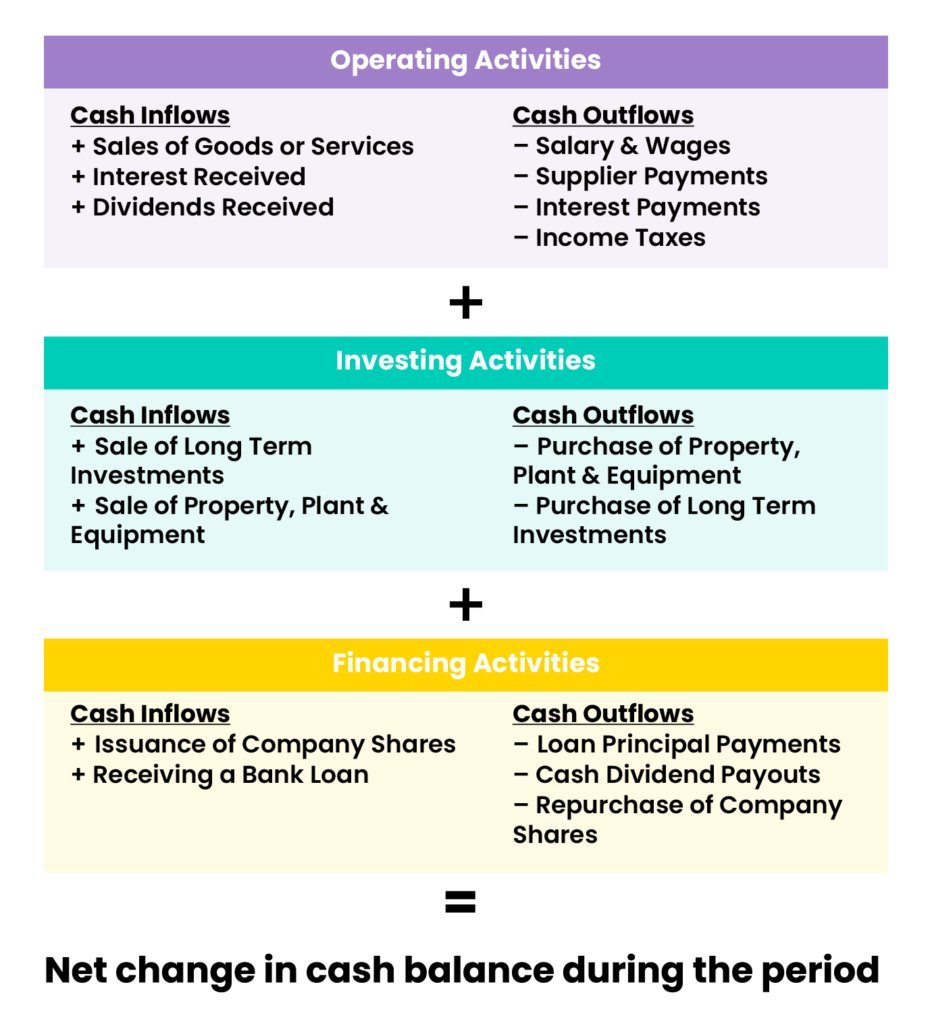

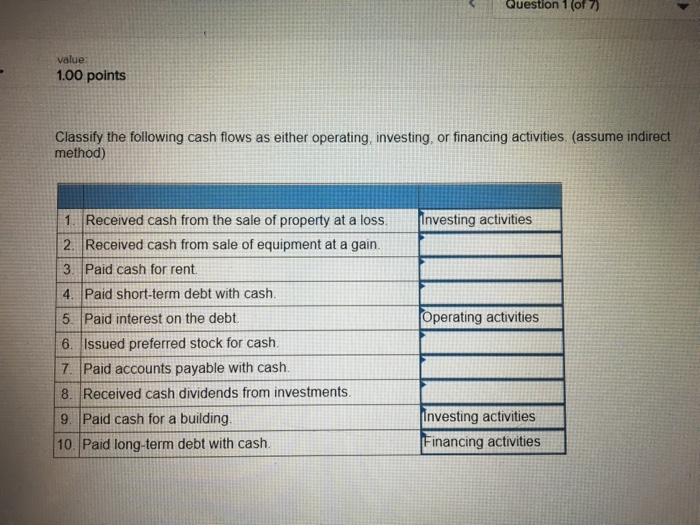

Investing operating and financing activities. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. On a statement of cash flows, this transaction is listed within the financing activities as a $400,000 cash inflow. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

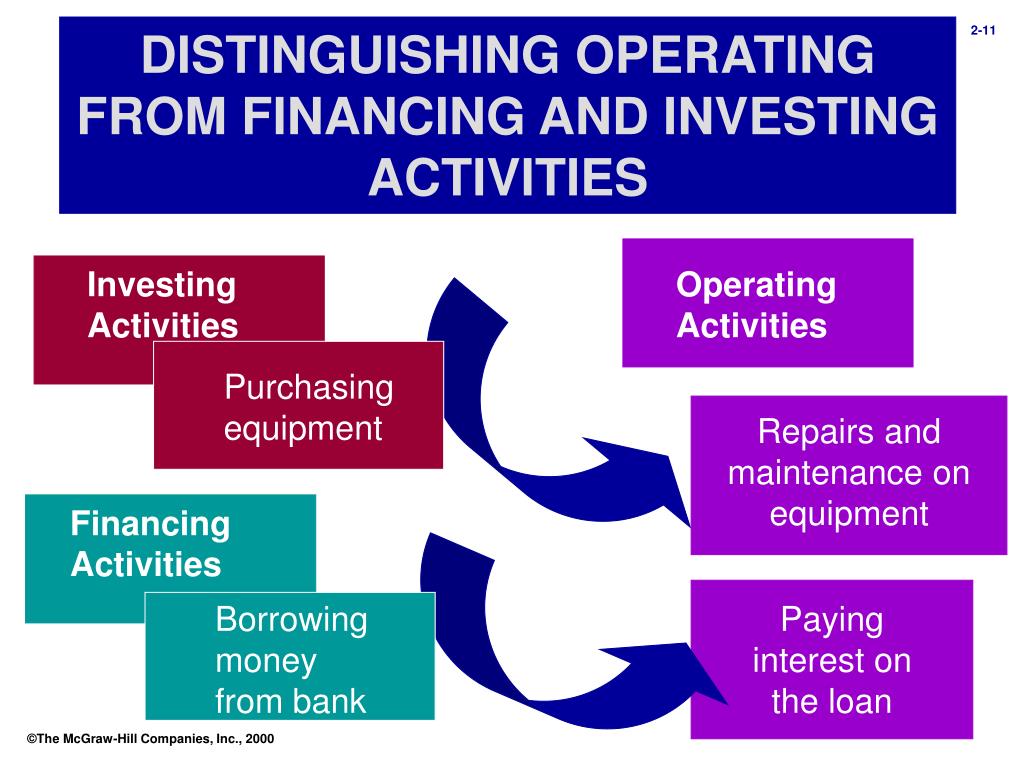

A complete list of airports receiving funding can be found online. Differentiate between operating, investing, and financing activities mitchell franklin; A is incorrect because proceeds from the issuance of bonds relate to a financing activity.

349 (674) cash flows (for) from investing activities: Research understanding operating, investing, and financing activities for financial success explore the importance of cash flow and the different activities that impact it. Cash flows from financing activities;

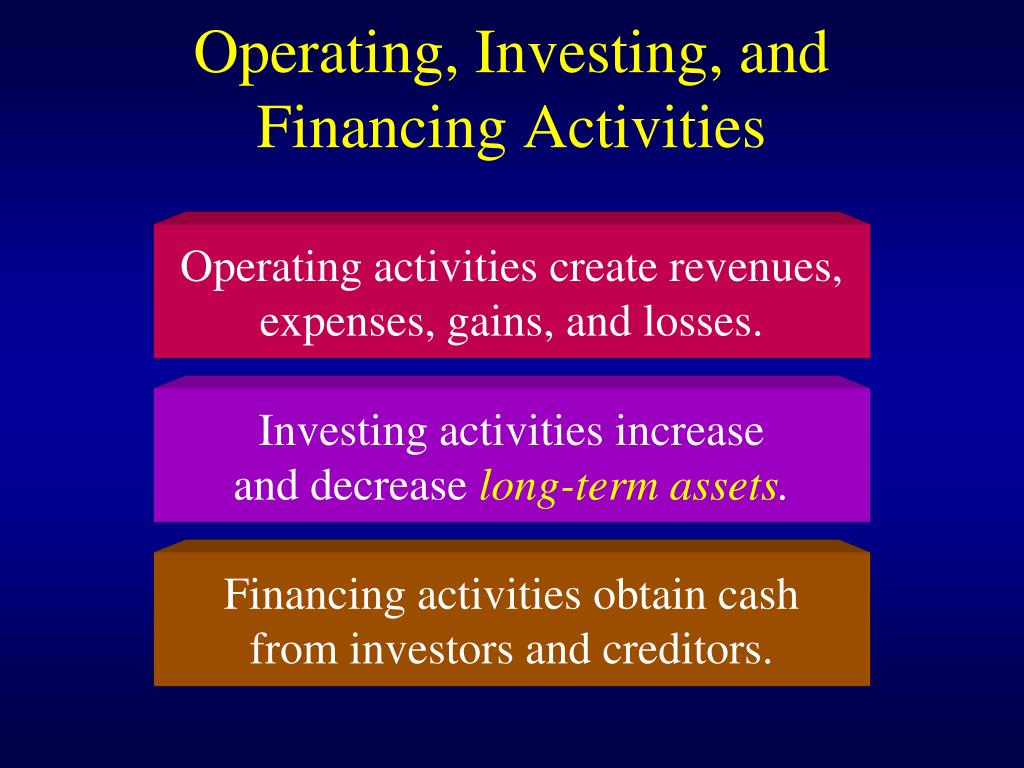

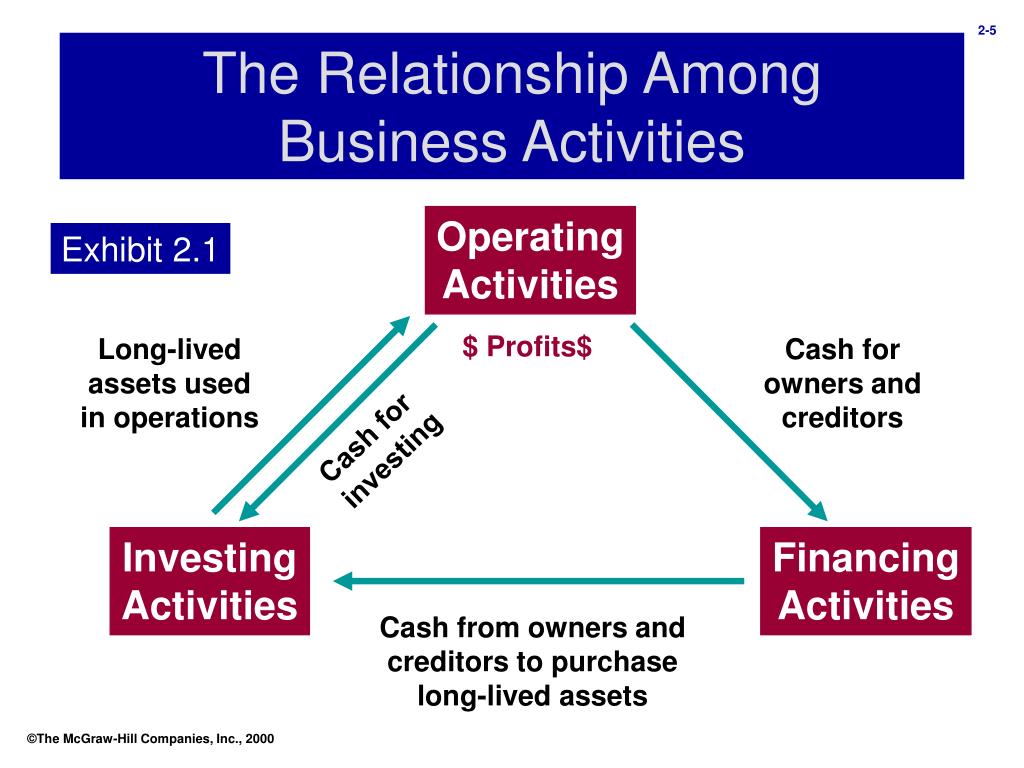

Operating activities, investing activities, and financing activities. The statement of cash flows classifies cash receipts and cash payments. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets.

The law provides $1 billion annually for five years. Purchase of property and equipment (148) (186) site and software development costs (203) (272) other. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000.

Each of these three classifications is defined as follows. Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. The statement of cash flows presents sources and uses of cash in three distinct categories:

The largest line items in the cash flow from. C is incorrect because the sale of inventory is an operating activity. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by. Investing decisions can impact both operating and financing decisions because they affect future cash flows. Operating activities are distinguished from investing or financing activities, which are functions of a company not directly related to the provision of goods and services.

Your cash flow comes from three activities: Lo 14.2 differentiate between operating, investing, and financing activities mitchell franklin the statement of cash flows presents sources and uses of cash in three distinct categories: Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

Cash flows from investing activities; Today’s funding is from the airport terminal program, one of three aviation programs created by the bipartisan infrastructure law and comes on the heels of more than $240 million in funding for airport infrastructure grants. The statement of cash flows presents sources and uses of cash in three distinct categories:

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)