Recommendation Tips About Reporting Comprehensive Income Panera Bread Financial Statements

We investigate determinants of managers' comprehensive income reporting location choices.

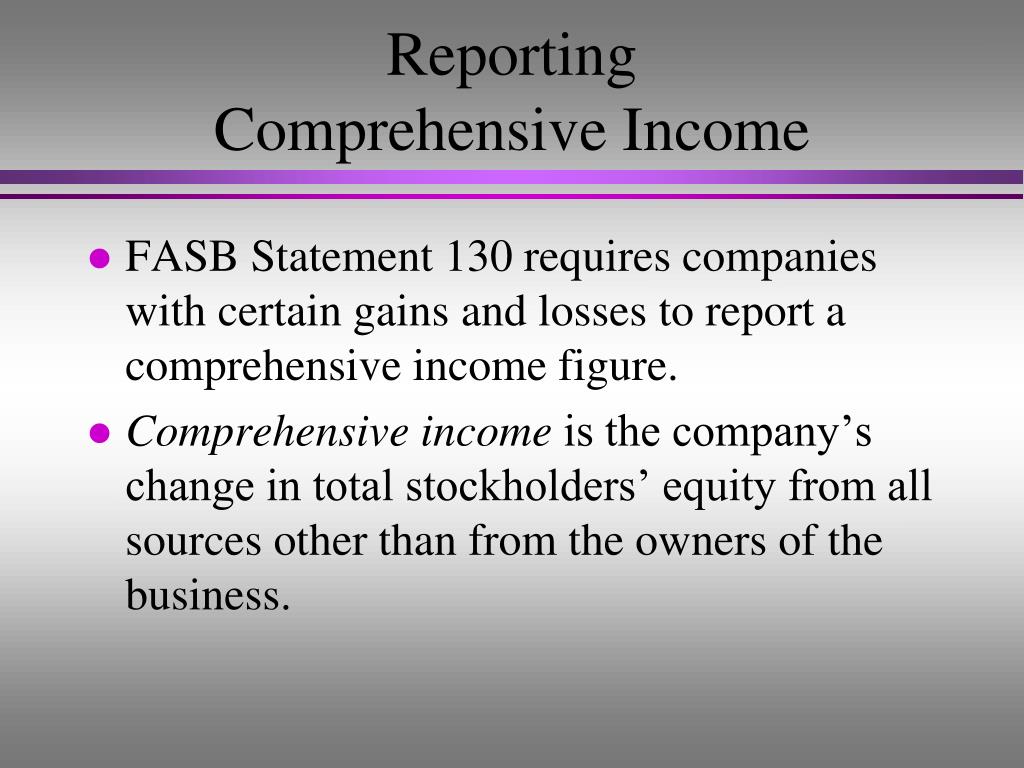

Reporting comprehensive income. They provide evidence that insurers who report comprehensive income in a statement of equity are more likely to smooth earnings by Pensions and other employee benefits.

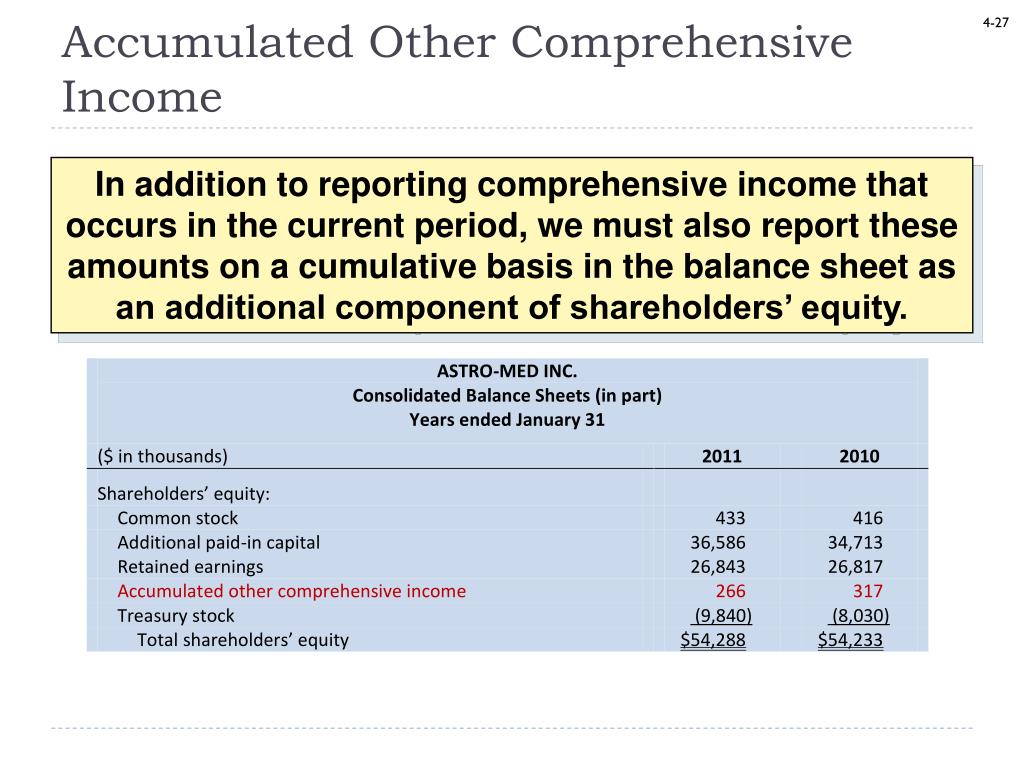

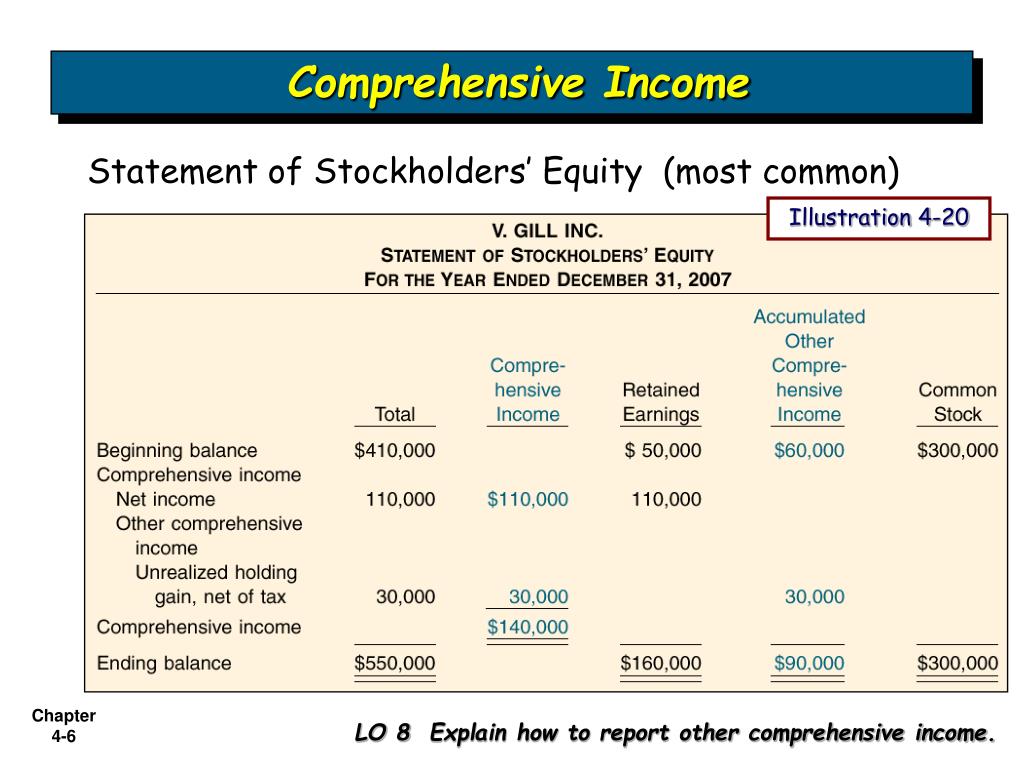

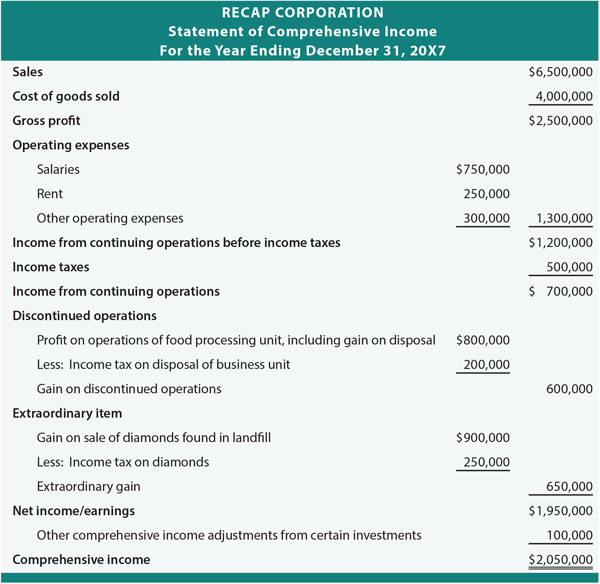

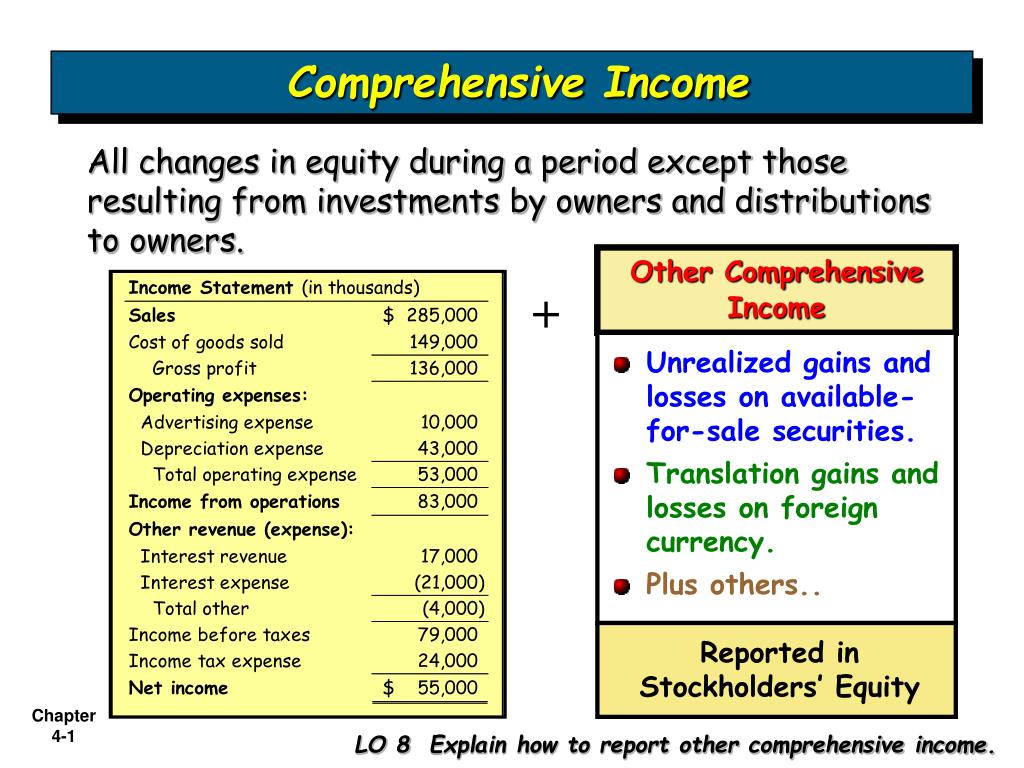

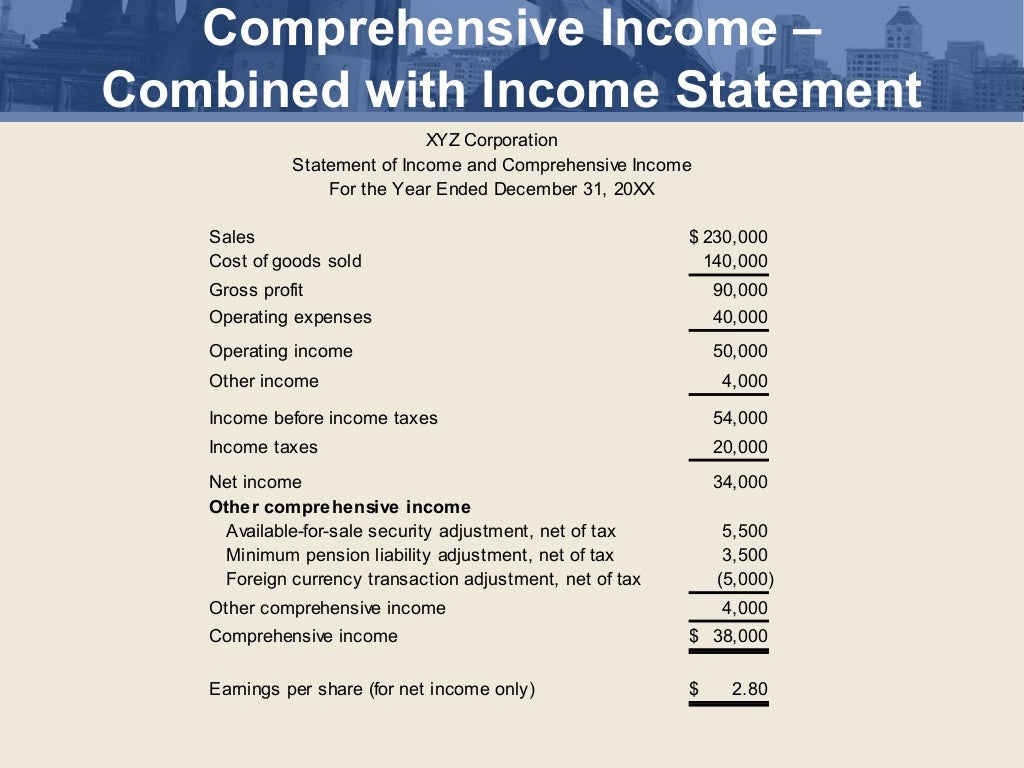

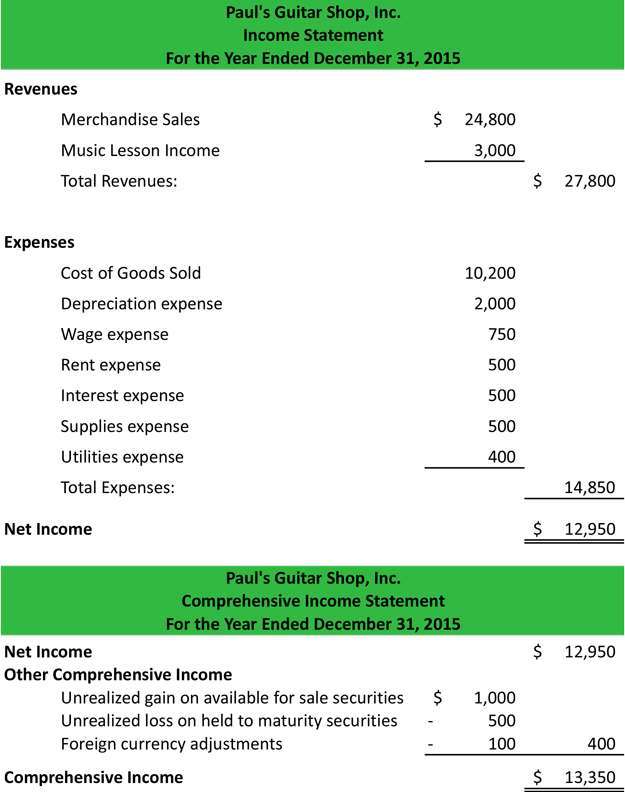

Start the statement of comprehensive income with net income. The amendments in this update affect any entity that is required to apply the provisions of topic 220, income statement—reporting comprehensive income, and has items of other comprehensive income for which the related tax effects are presented in other comprehensive income as required by gaap. The statement of comprehensive income reports the change in net equity of a business enterprise over a given period.

Report the components of comprehensive income in one or two statements of financial performance (method 1 or method 2); Children fly a kite at a makeshift tent camp for displaced palestinians in rafah, southern gaza strip, on sunday. In financial reporting, performance is primarily measured by net income and its components, which are.

The iasb discussion paper, preliminary views on financial statement presentation (iasb 2008), asks whether income should be aggregated and reported as a single comprehensive income figure, and how. February 14, 2024 at 7:46 p.m. A change in fiscal year requires transition period financial statements.

Net income, and other comprehensive income, which incorporates the items excluded from the income statement. The chapter also provides presentation and disclosure requirements for business interruption insurance.

The different risk levels will mean more or less regulation. Report other comprehensive income and comprehensive income in a second separate, but consecutive, financial statement. In april 2021, the european commission proposed the first eu regulatory framework for ai.

Or any other financial statement with the same prominence as the financial statements that constitute a full set of financial statement (method 4). This chapter provides guidance on the reporting, presentation, and disclosure of comprehensive income. A firm's pension obligations or a bond portfolio.

Traditional theories of contracting incentives cannot explain this reporting location choice that only affects where comprehensive income data appear, because the contractible values of. The only empirical evidence on this choice is the lee et al. The statement should be classified and aggregated in a manner that makes it understandable and comparable.

1120 unaudited interim period financial statements. Asc 220 income statement — reporting comprehensive income.

It addresses the classification, presentation, and disclosure of unusual or infrequently occurring items. This chapter provides guidance on the reporting, presentation, and disclosure of comprehensive income.