Breathtaking Info About The Adjusted Trial Balance Is Prepared Sheet Detailed Format Cash Flow Statement Exercises

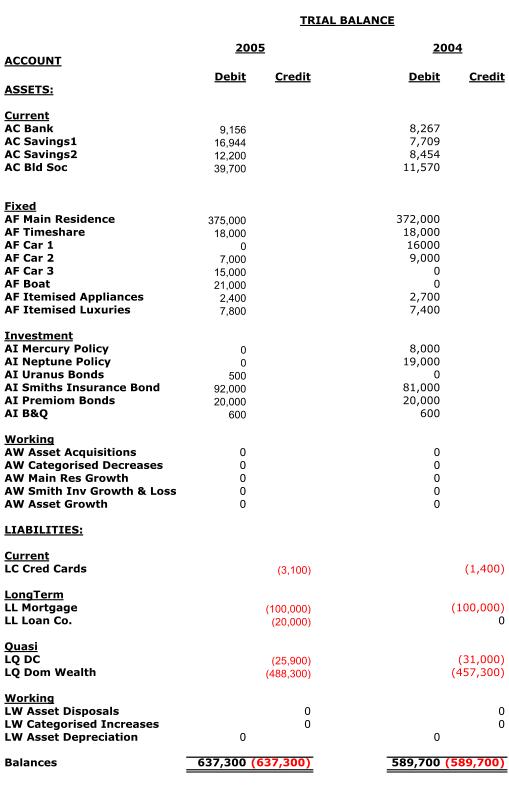

This statement comprises two columns:

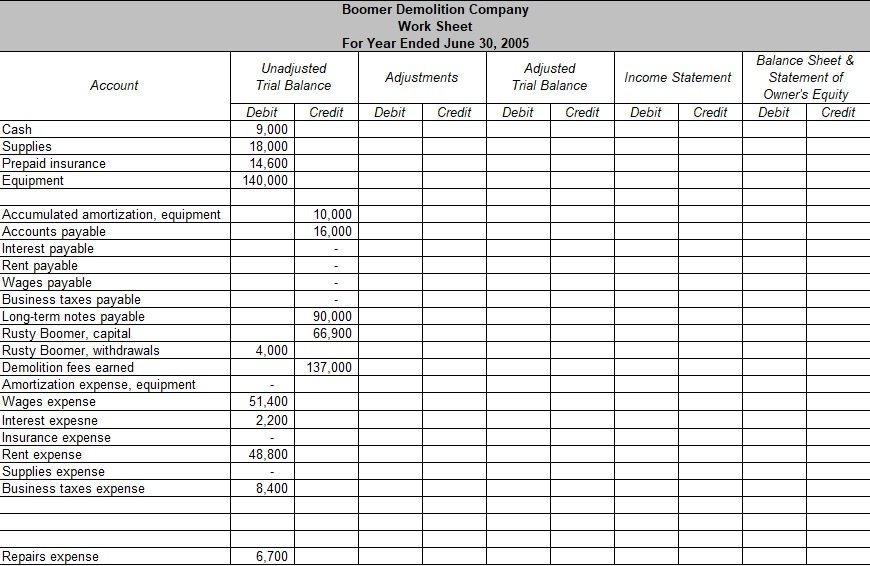

The adjusted trial balance is prepared balance sheet detailed format. Adjusted trial balance is a list of all the accounts of a business with their adjusted balances. The adjusted trial balance is used to prepare the income statement and the balance sheet. An adjusted trial balance is formatted exactly like an unadjusted trial balance.

An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. Adjusting entries typically affect one income statement (revenue or expense) and one balance sheet (asset.

Three columns are used to display the account names, debits, and credits with the debit balances listed in the left column and the credit balances are listed on the right. Before preparing the financial statements, an adjusted trial balance is prepared to make sure total debits still equal total credits. As you see in step 6 of the accounting cycle, we create another trial balance that is adjusted (see the adjustment process).

Adjusted trial balance contains both the elements of balance sheet and income statement. Unadjusted trial balance to illustrate how it works, here is a sample unadjusted trial balance: Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

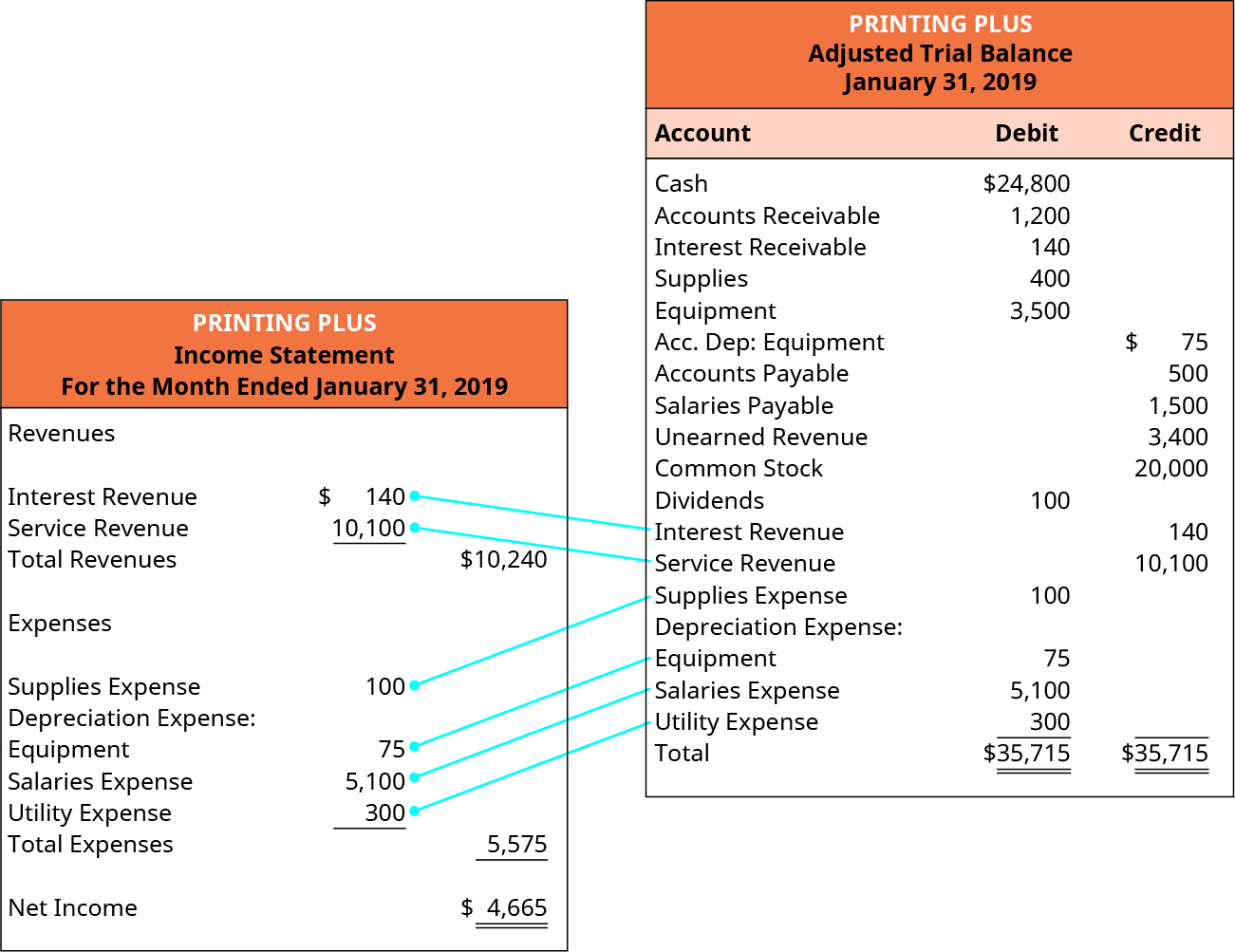

The trial balance information for printing plus is shown previously. In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works. When constructing a trial balance, we must consider a few formatting rules, akin to those requirements for financial statements:

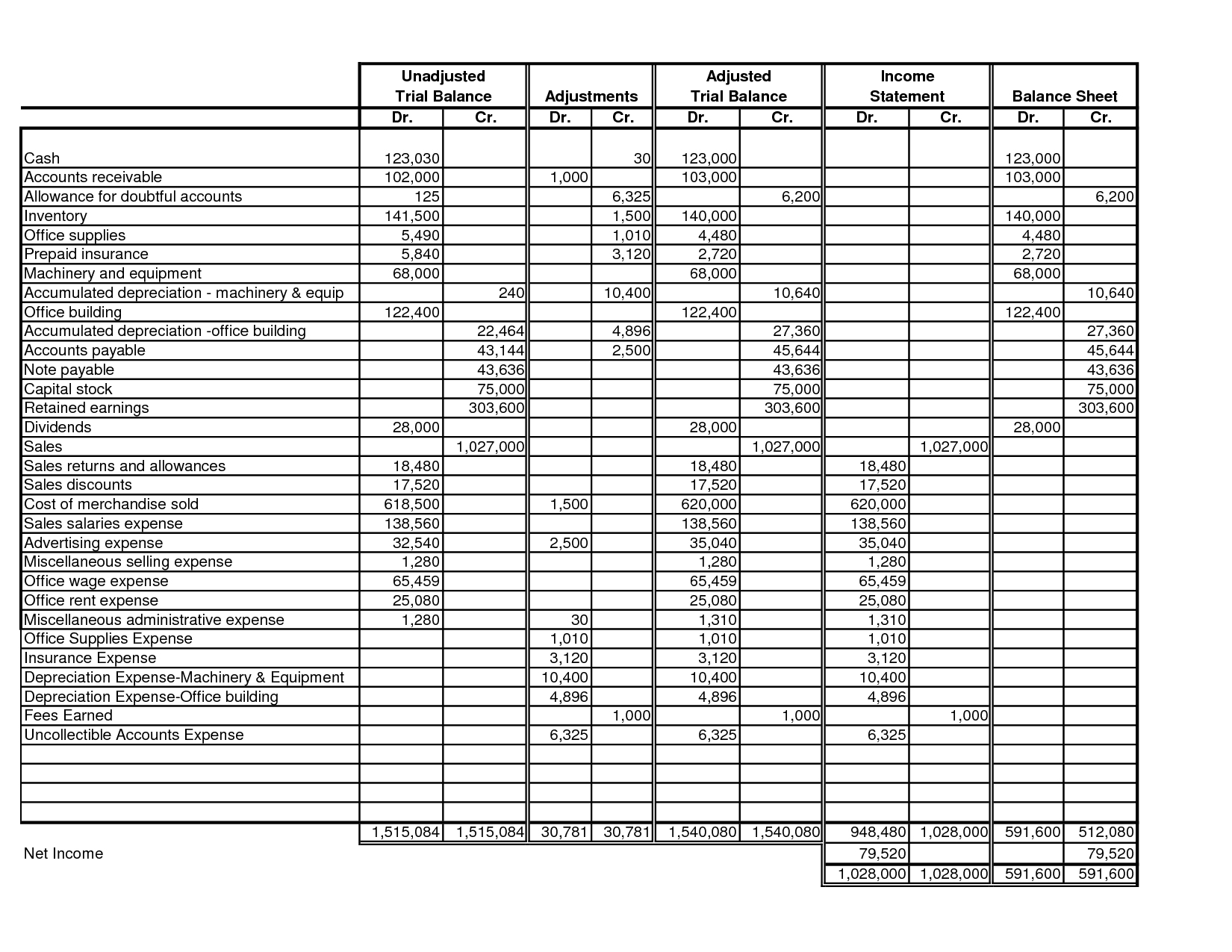

The preparation of the adjusted trial balance is the sixth step of the accounting cycle. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. For instance, it carries a heading that includes the name of the firm, report title and date.

Generally, the trial balance format has three columns. Adjusted trial balance contains balances of revenues and expenses along with those of assets, liabilities and equities. The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity.

From this information, the company will begin constructing each of the statements, beginning with the income statement. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. First columns or particulars describe the ledger account describe the ledger accountledger in accounting records and processes a firm’s financial data, taken from journal entries.

Income statement s will include all revenue and expense accounts. This becomes an important financial record for future reference. An adjusted trial balance represents a listing of all the account balances after posting of all the necessary adjusting entries in ledger accounts.¹ the purpose of preparing an adjusted trial balance is to correct any errors and to make the entity’s financial statements compatible with the requirements of an applicable accounting.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. To prepare the financial statements, a company will look at the adjusted trial balance for account information. It is used for creating financial statements.