Recommendation Info About Comprehensive Income Calculation Uses Of Trading Profit And Loss Account

Us financial statement presentation guide 4.5.

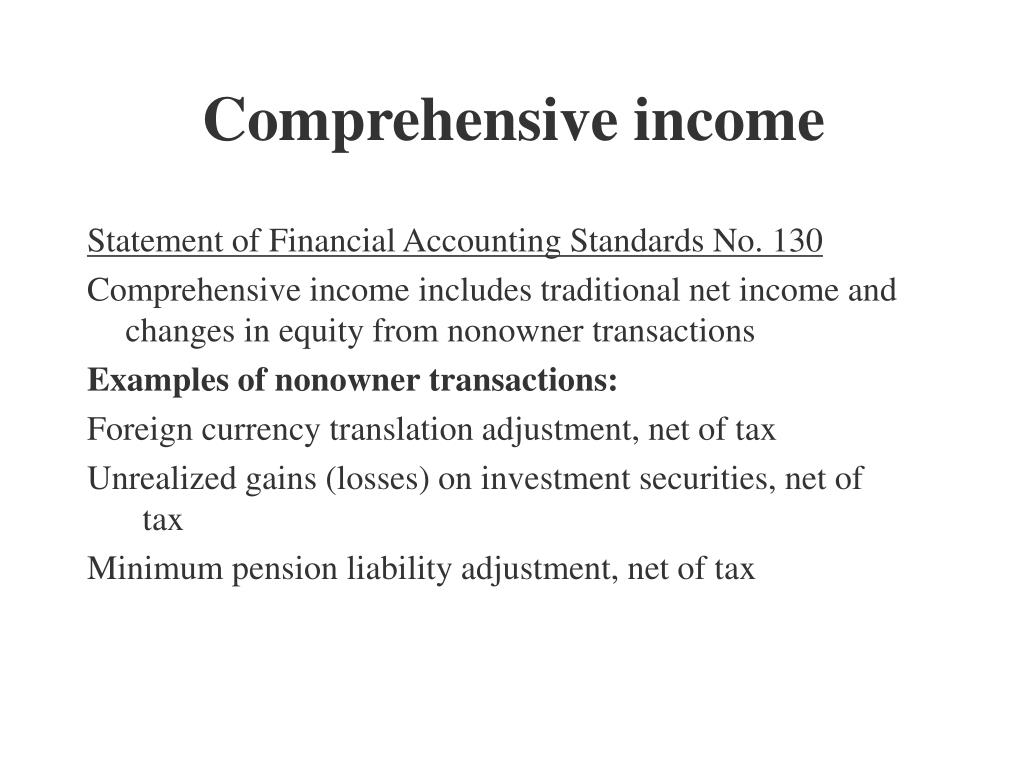

Comprehensive income calculation. A firm's pension obligations or a bond portfolio. Other comprehensive income (oci) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized. The formula for comprehensive income is:

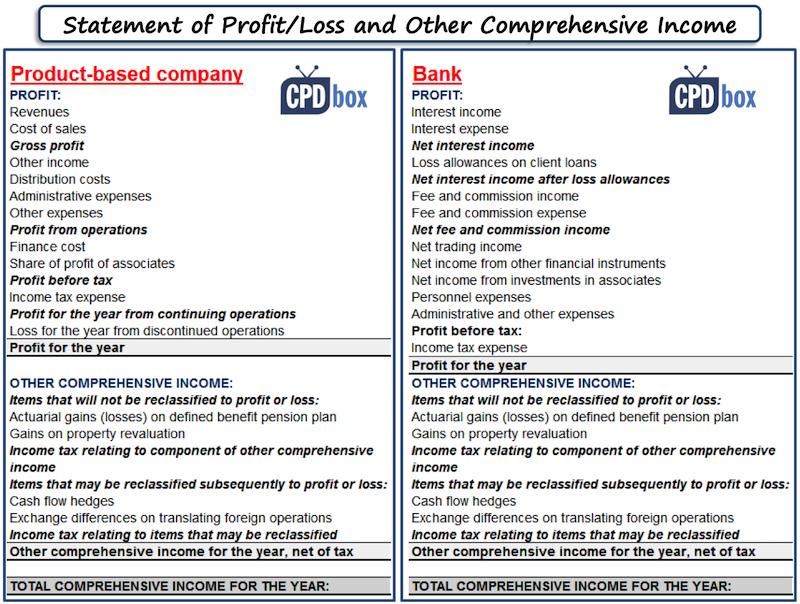

Statement of other comprehensive income. Updated july 13, 2023 reviewed by melody bell fact checked by marcus reeves what is comprehensive income? In business accounting, other comprehensive income (oci).

Start free written by cfi team what is other comprehensive income? Recall that net income is ultimately closed to retained earnings.

Andrew bloomenthal updated april 29, 2023 reviewed by charlene rhinehart fact checked by jiwon ma what is other comprehensive income? There is a formula to calculate comprehensive income. Profit or loss as a key performance measurement;

Comprehensive income = net income + other comprehensive income. The correct answer is b. This video explains how to use financial information to complete a statement of comprehensive income.

Think of it as the missing piece of the puzzle. Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of. These items, such as a company’s unrealized gains on its investments, are not recognized on the income statement and do not impact net income.

Comprehensive income is the variation in the value of a company's net assets from. Total comprehensive income reflects the change in net assets of the business (which would exclude owners equity). Why should we care about oci in financial reporting?

Calculating oci involves summing up these components, which are initially bypassed in the net income calculation. Study methodology is based on critical analysis of literature and the empirical researches regarding comprehensive income and its consequences on financial reporting. 4.5 accumulated other comprehensive income and reclassification adjustments.

This is a task you may need to complete in your exam. Role of other comprehensive income in financial reporting.

Other comprehensive income includes items such as unrealised gains or losses on investments, foreign currency gains or losses, and pension plan modifications. Total comprehensive income is calculated by adding net income (loss) and other comprehensive income (loss).