Here’s A Quick Way To Solve A Info About Accrual Basis Financial Statements Understanding A Statement

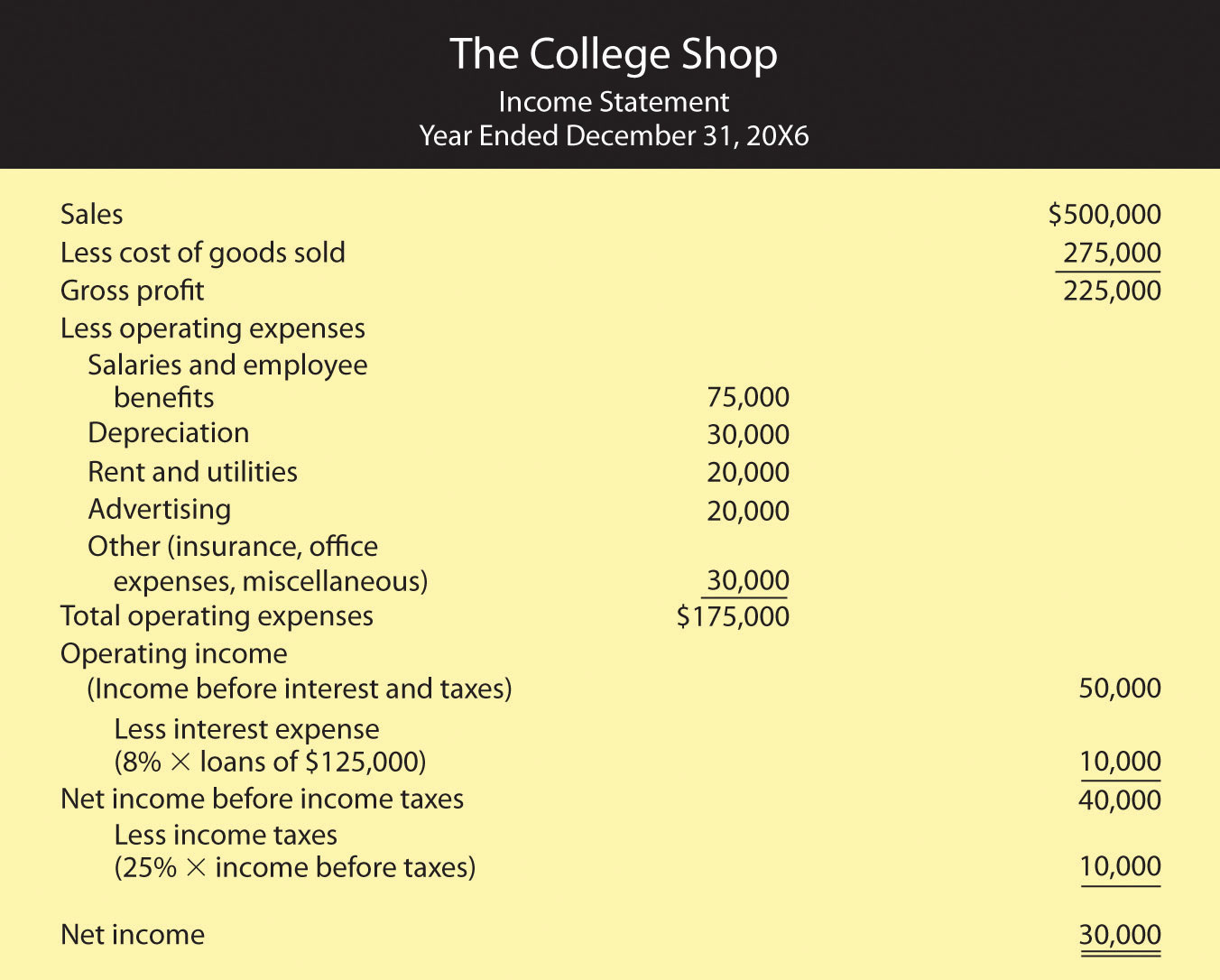

In the realm of accounting, the accrual basis method plays an eminent role in generating and interpreting a company's financial statements.

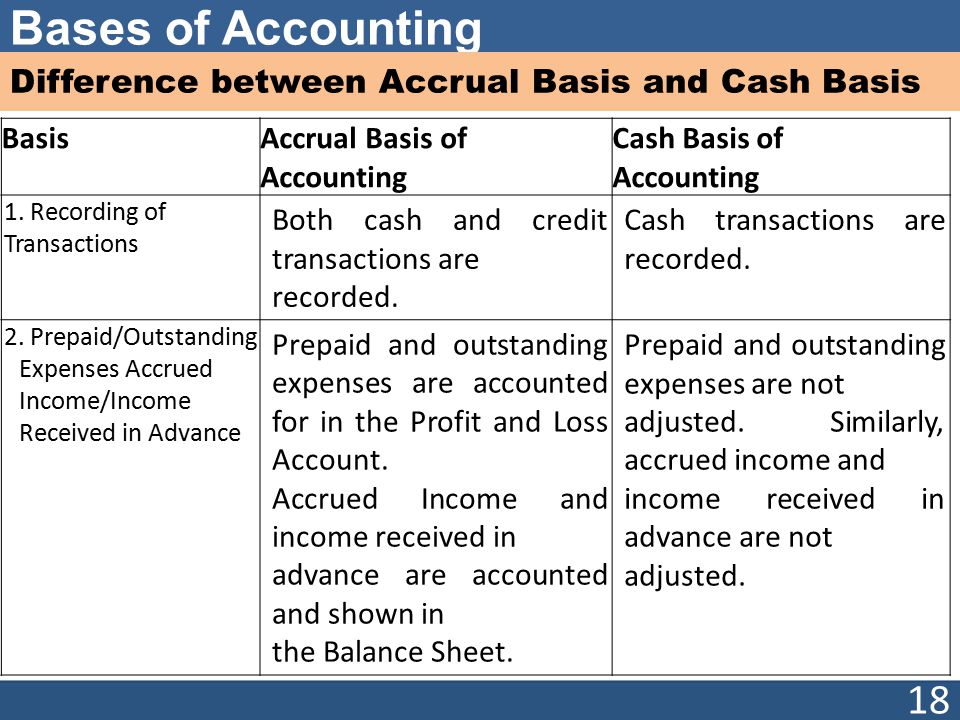

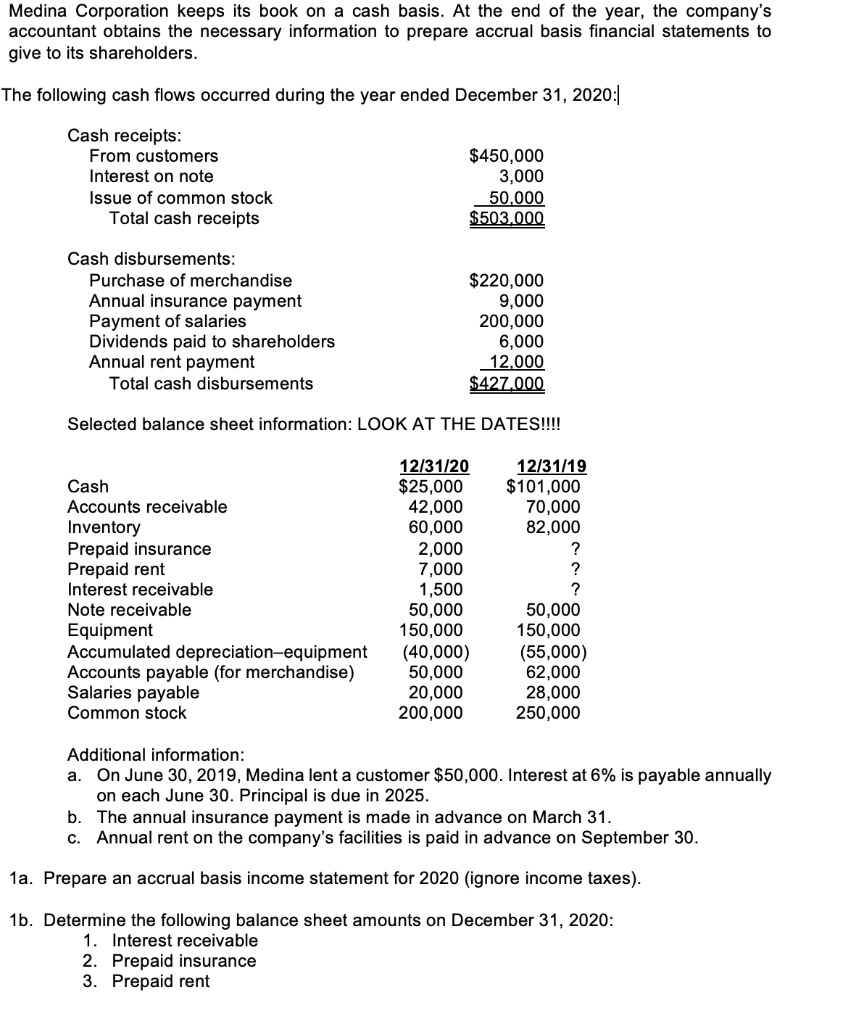

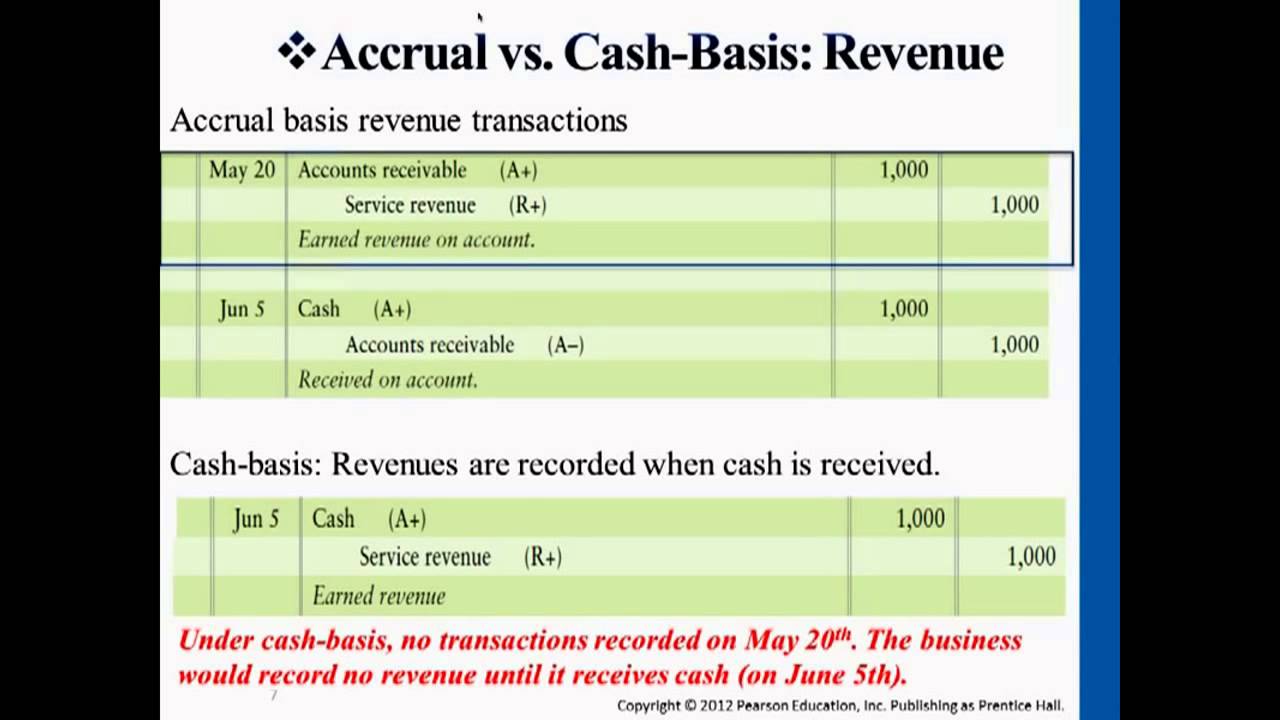

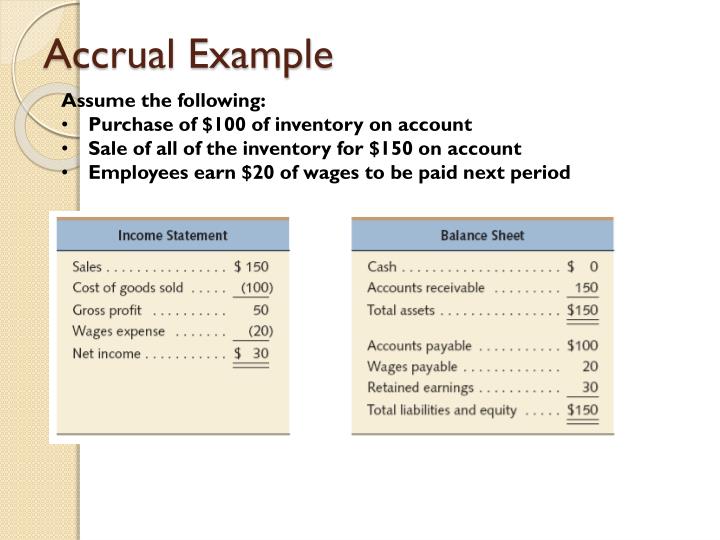

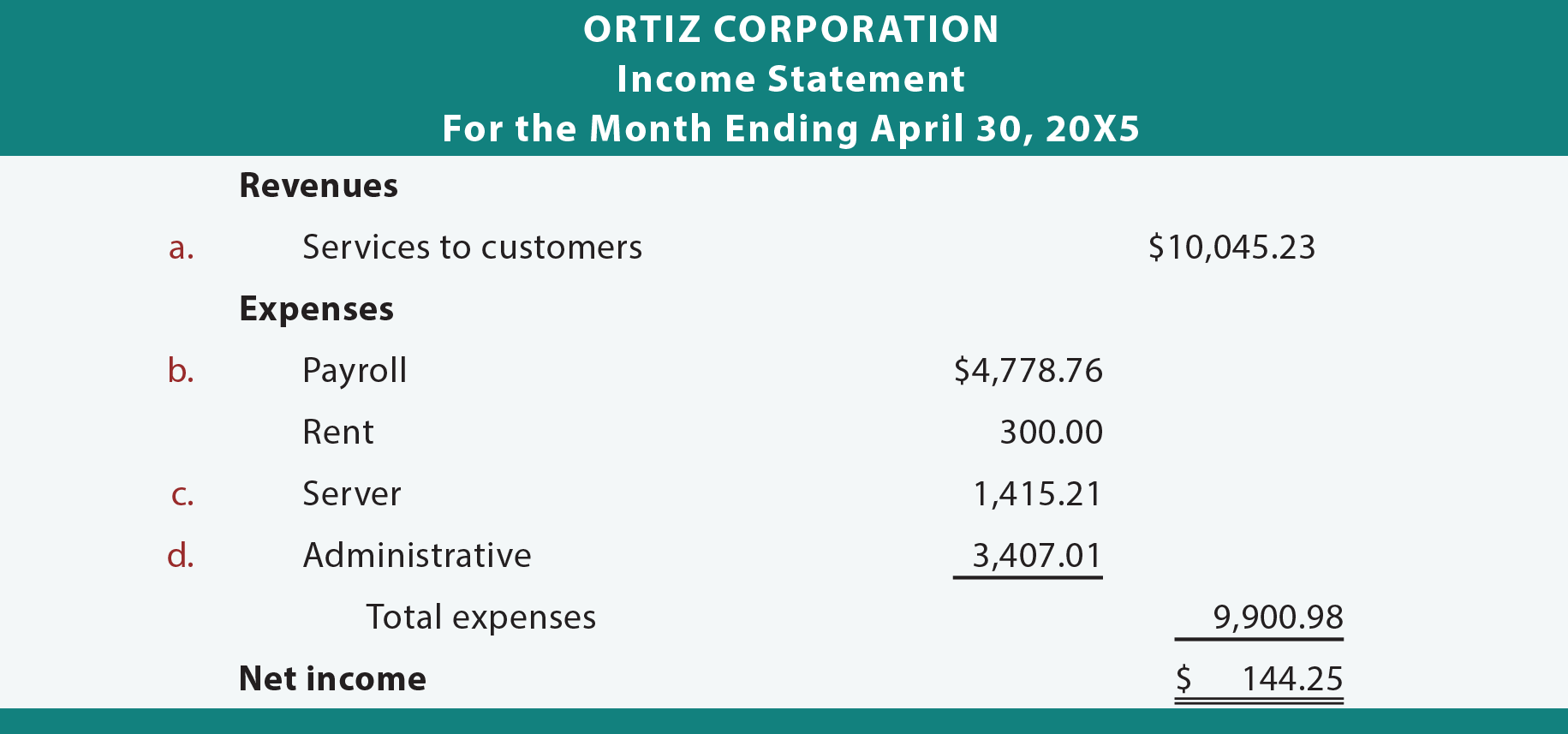

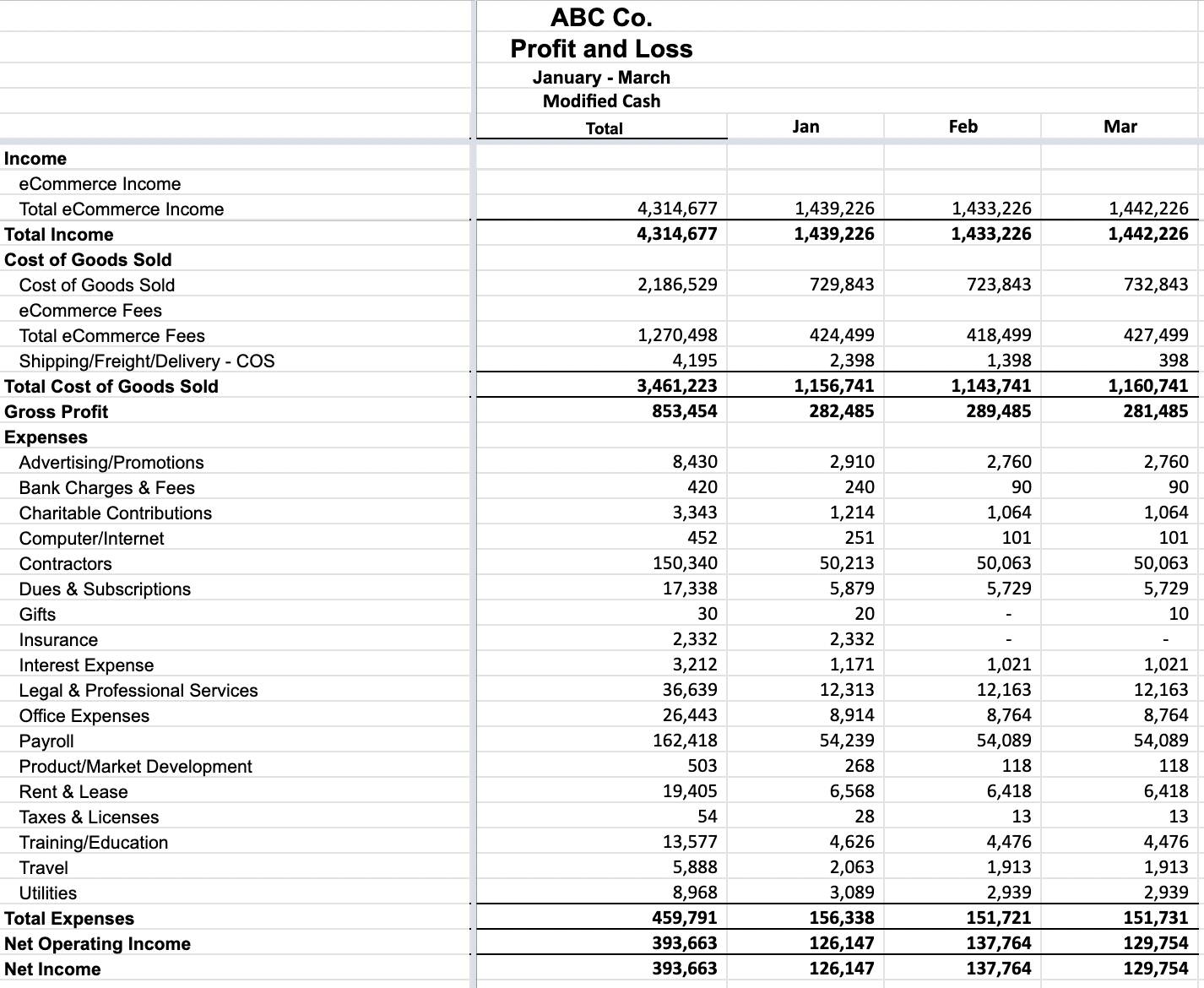

Accrual basis financial statements. And the whole idea with accrual accounting is to match your revenues and expenses to when you actually perform the service. Definition of accrual basis of accounting. Most companies use the accrual basis of accounting.

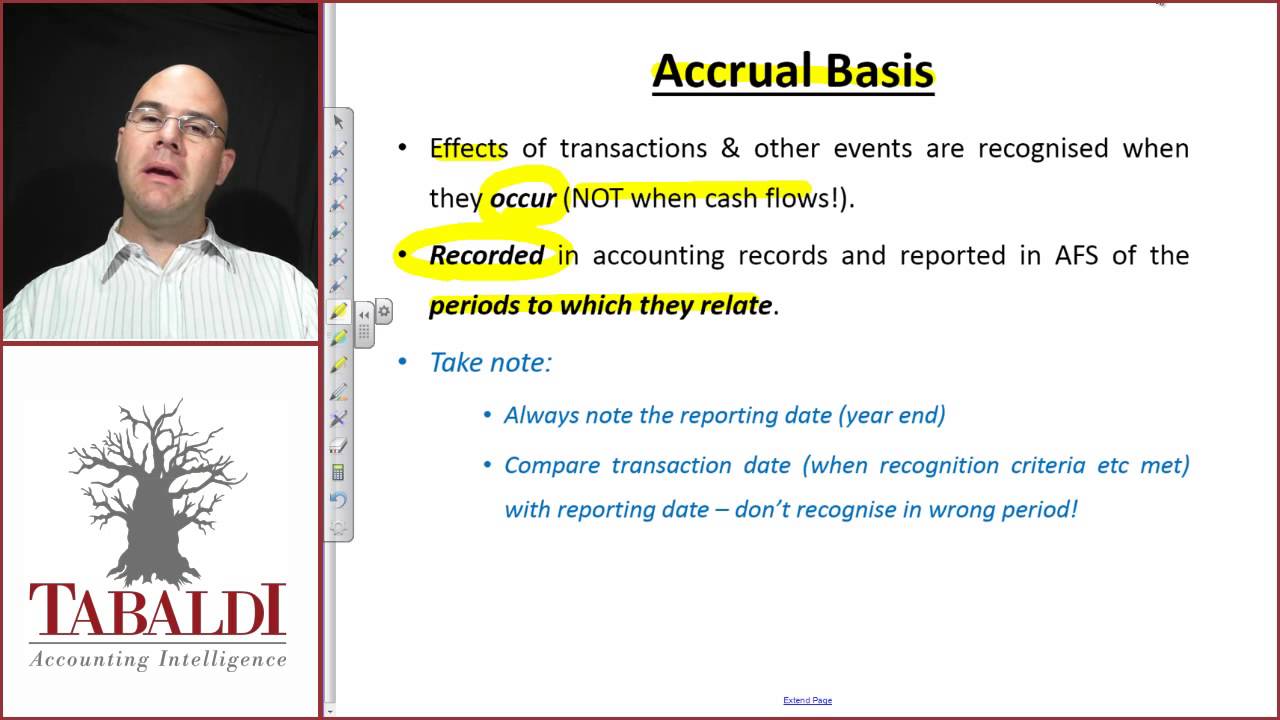

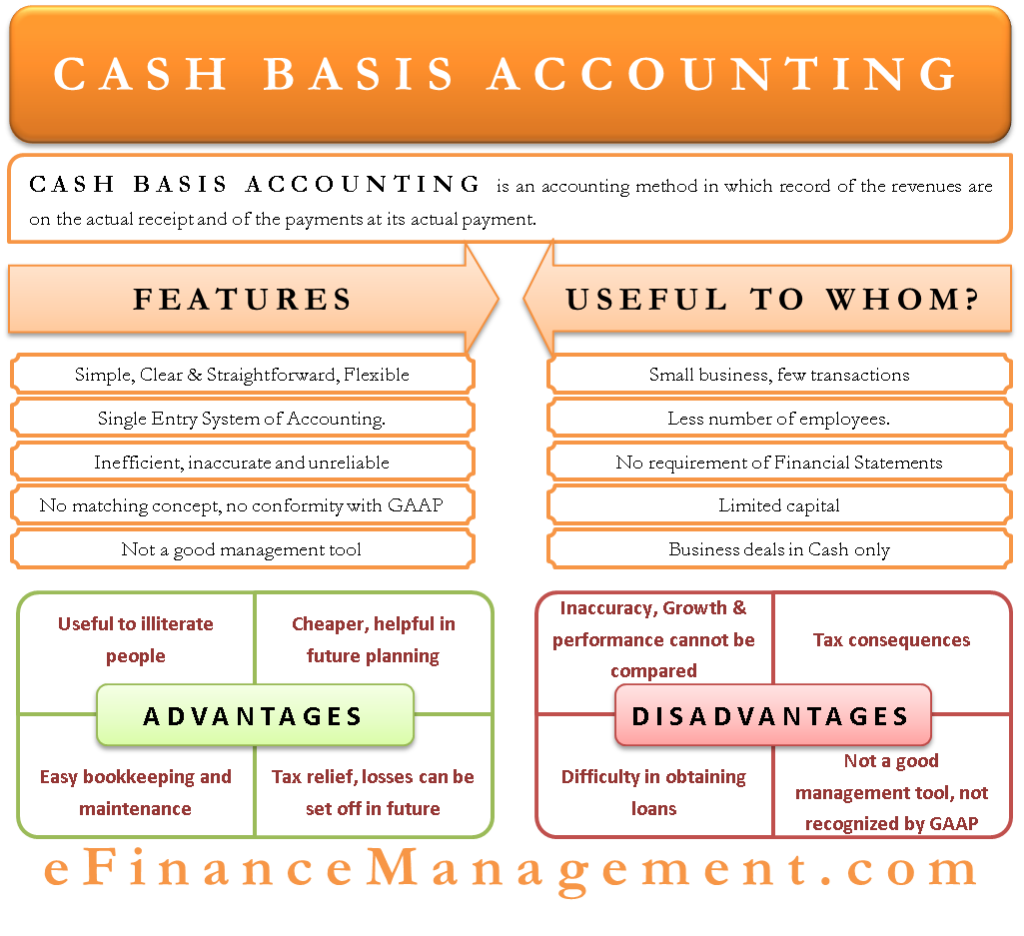

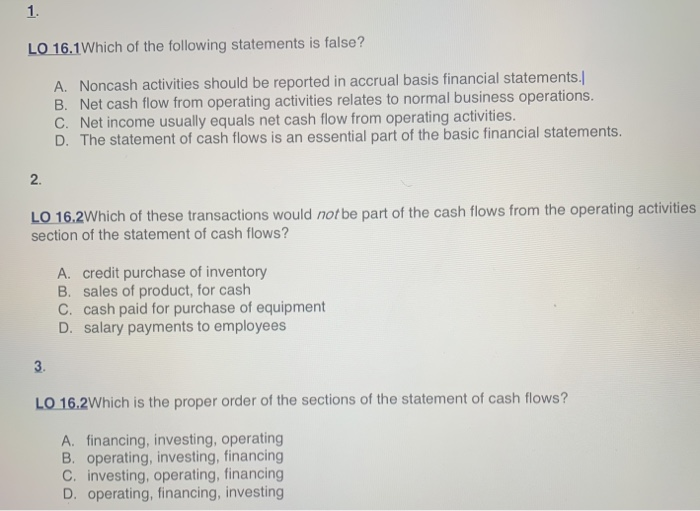

(under the cash basis of accounting, revenues are not. The accrual method typically is required for companies that file audited financial statements and is required under the generally accepted accounting principles (gaap) issued by the. An accrual is a record of revenue or expenses that have been earned or incurred but have not yet been recorded in the company's financial statements.

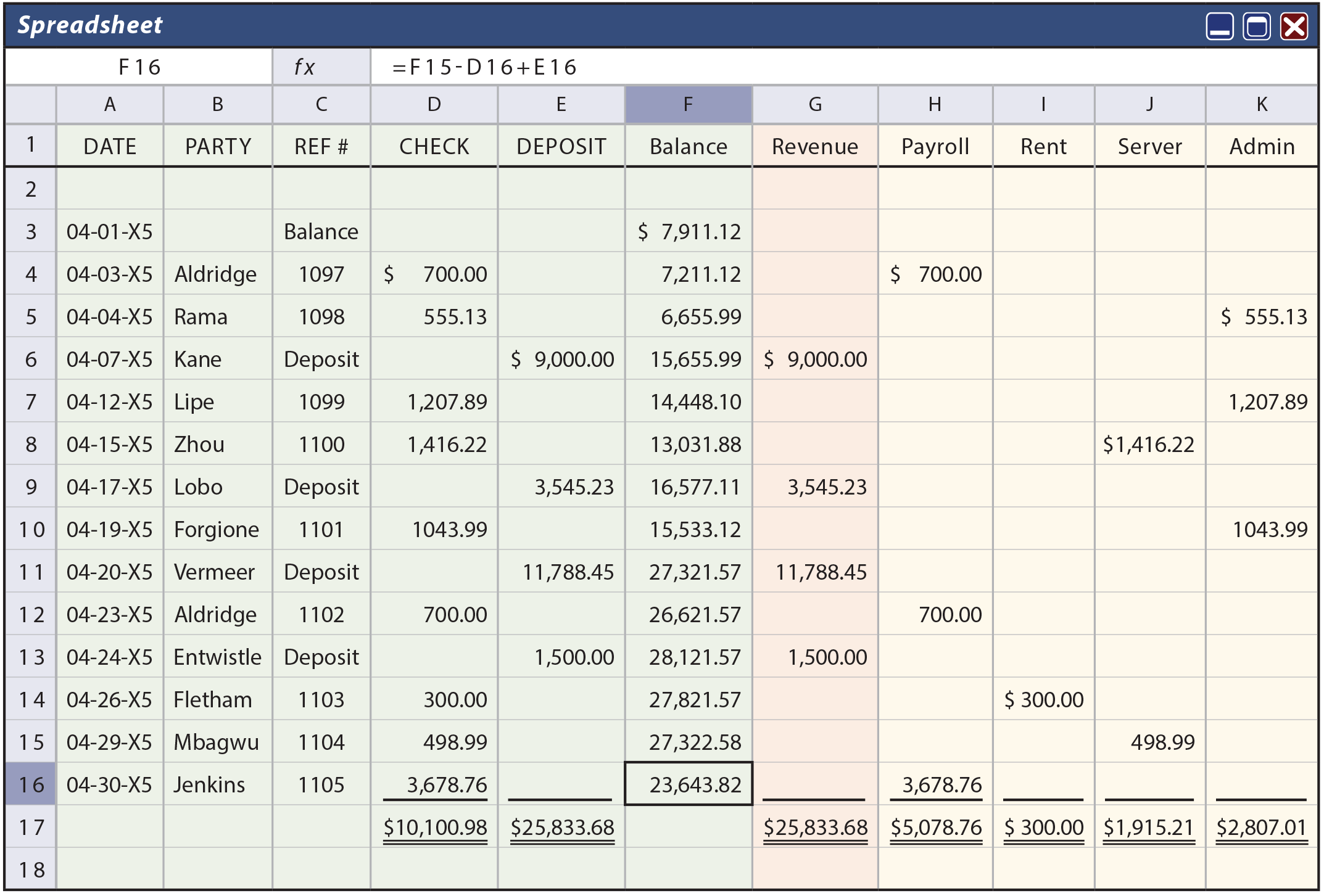

However, statement of cash flows — which is prepared for cash inflows and outflows is prepared on cash basis. Toward accrual (cta) basis, and 1,565 financial statements that using accrual basis. Accrual accounting is an accounting method that records revenue and expenses when you provide or receive a product or service instead of when you make or receive a payment.

Accrual basis accounting is the method that produces the most helpful and accurate financial statements. This can include things like unpaid. Accrual basis accounting recognizes business revenue and matching expenses when they are generated—not when money actually changes hands.

Under the accrual basis, expenses are recognized and recorded in the financial statements at the periods they are incurred rather than at the period they are paid. Under the accrual basis of accounting (or accrual method of accounting), revenues are reported on the income statement when they are earned. The method follows the matching principle, which.

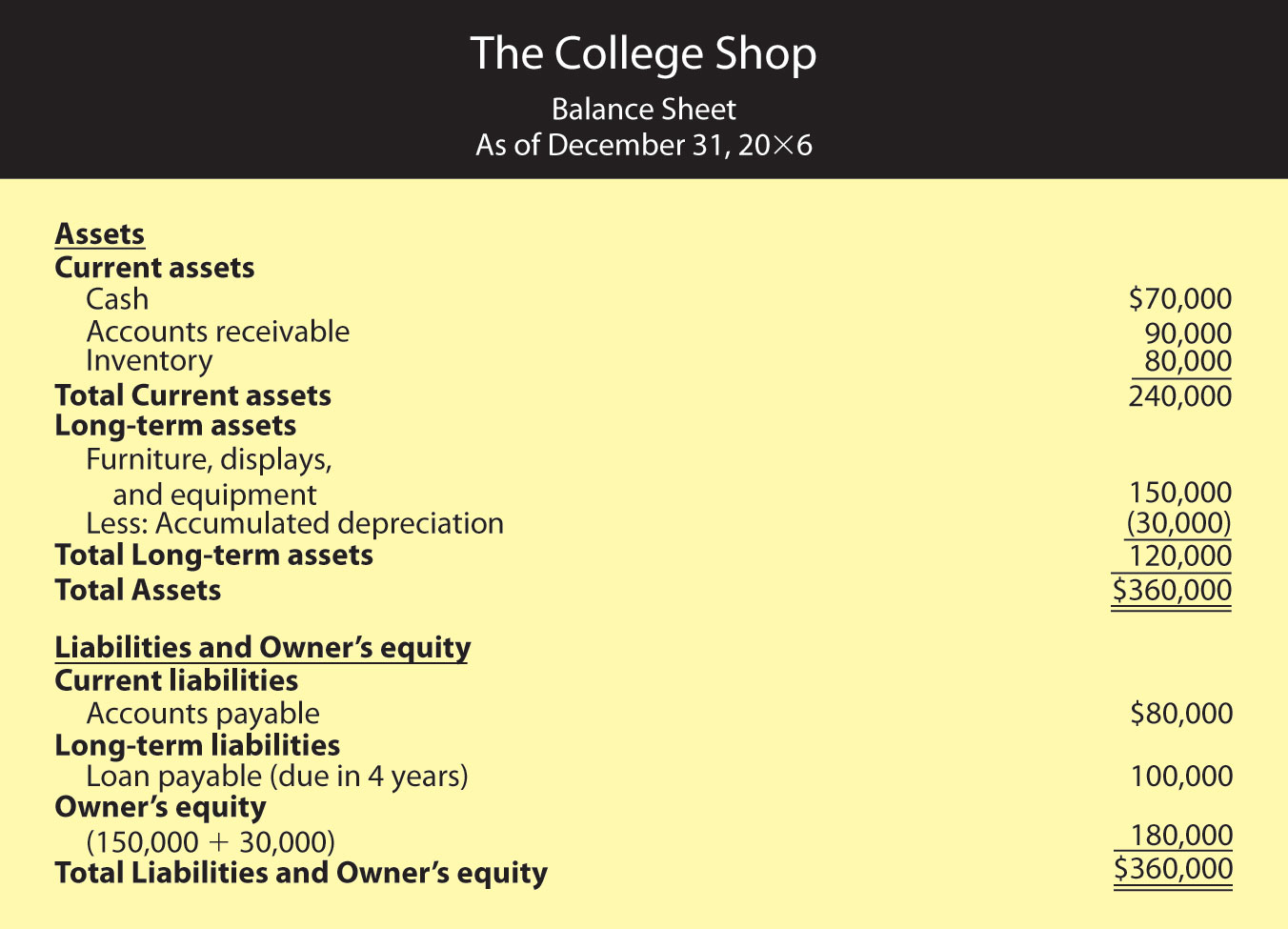

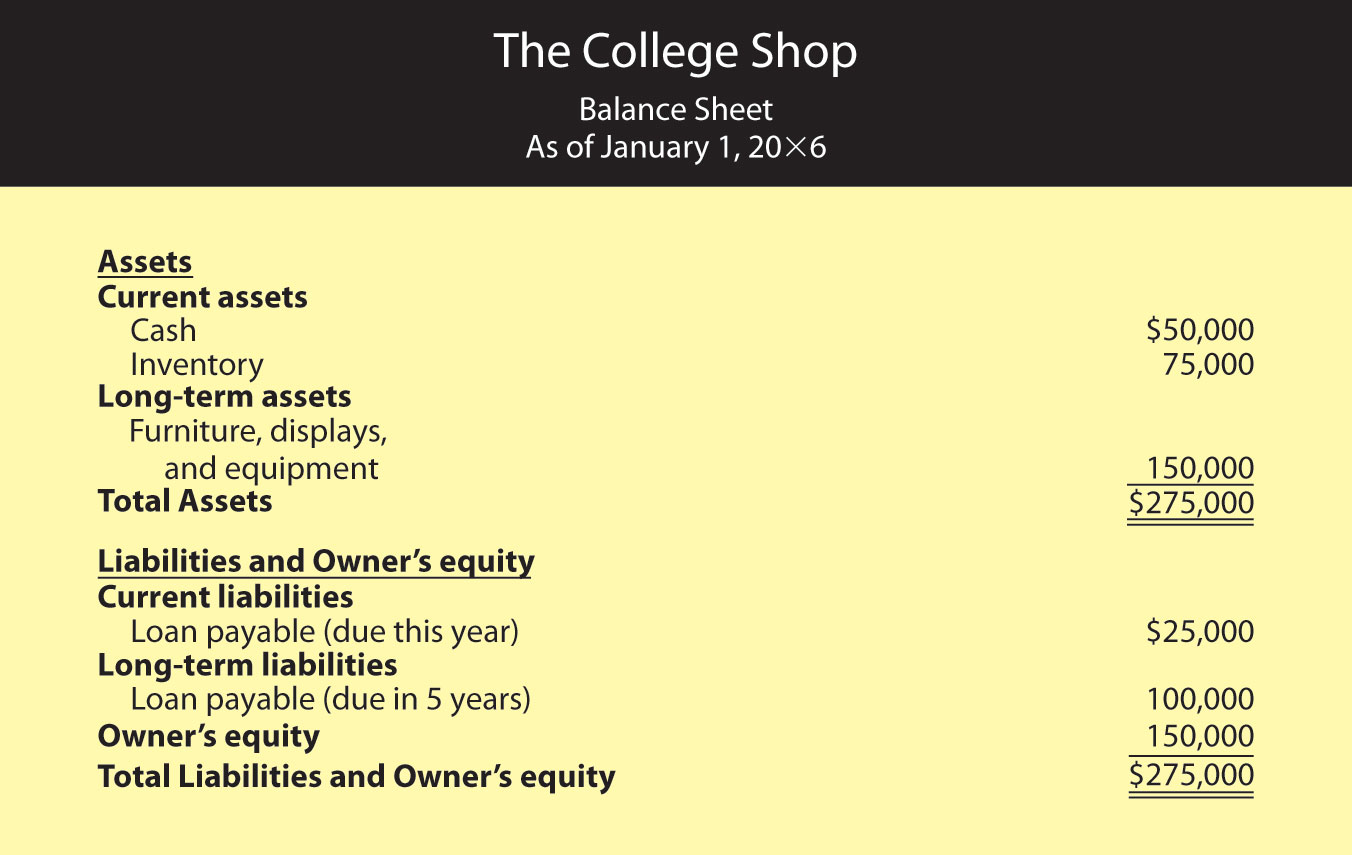

The accrual basis of accounting is the concept of recording revenues when earned and expenses as incurred. Impact on the balance sheet the accrual basis of accounting directly influences the balance sheet by affecting one of its core components: Accrual accounting is an accounting method that recognizes revenue in the period in which it’s earned and realizable, but not necessarily when the cash is actually received.

When the revenues are earned but cash is not received, the asset accounts receivable will be recorded. So it actually captures business activity, as opposed to just capturing when cash changes hands. When payment is received or made.

With accrual basis, a business’s financial position is more realistic because it combines the current and expected future cash inflows and outflows. Presents financial statements following the adoption of accrual basis ipsass, in order to present high quality information: A beginners guide by bridgette austin may 9, 2023 what is accrual accounting?

The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed), regardless of when cash is received. A complete set of financial statements comprises: Statement of financial position statement of financial performance statement of changes in net assets/equity cash flow statement when the entity makes it approved budget publicly available, a comparison of budget and accrual amounts

The use of this approach also impacts the balance sheet, where receivables or payables may be recorded even in the absence of an associated cash receipt or cash payment, respectively. Learn about the goal of financial statements, the definition of the accrual. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs.