Exemplary Tips About Change In Stockholders Equity Trustee Financial Statements

Three major factors influence stockholder equity:

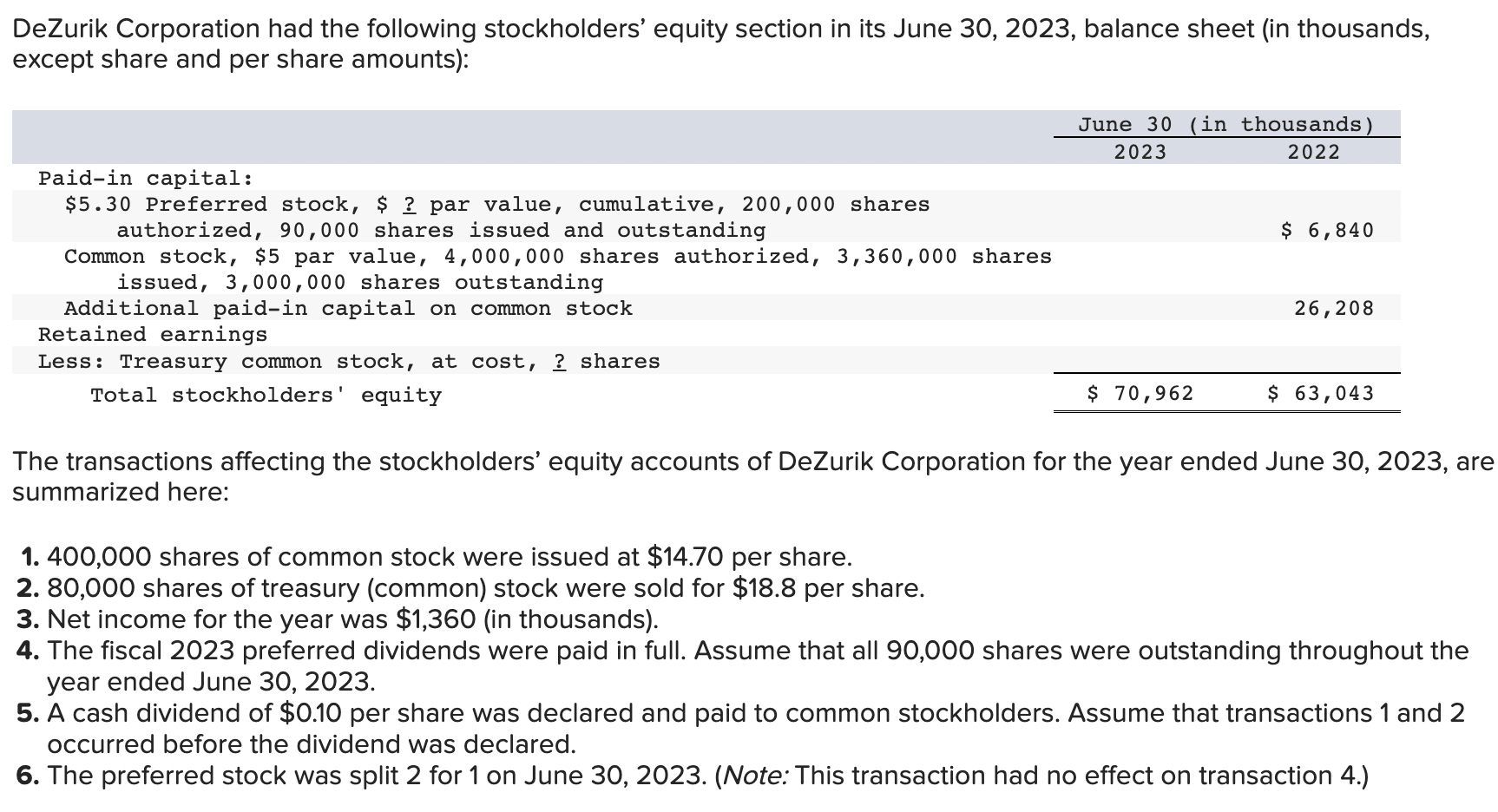

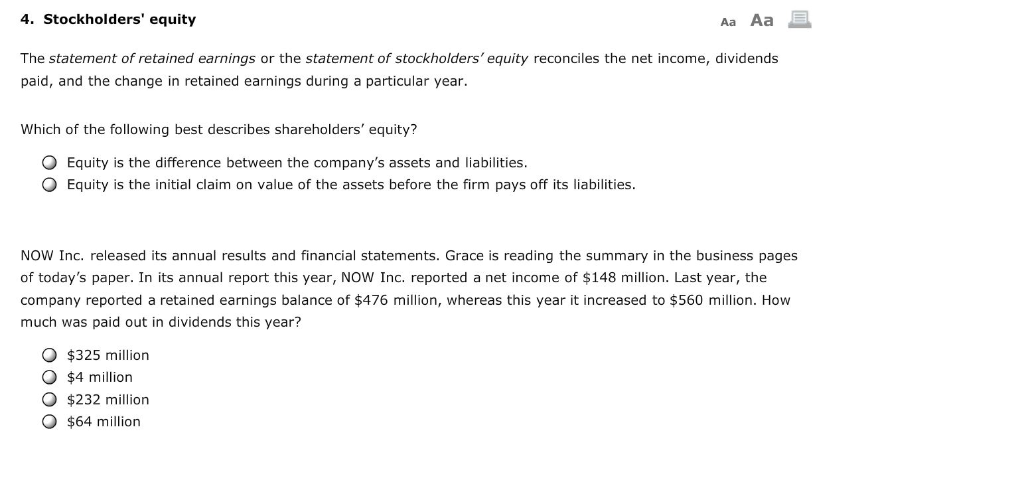

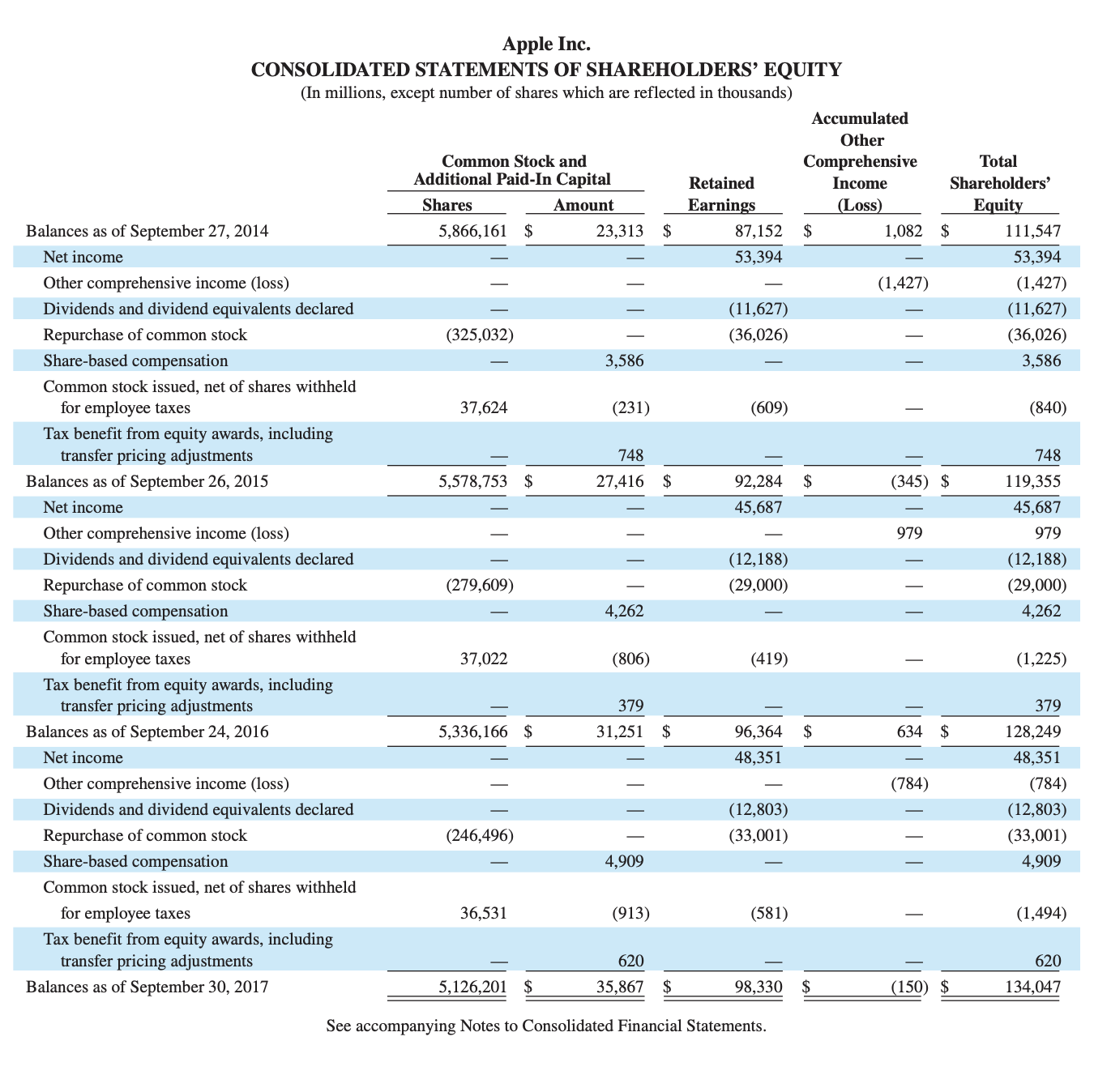

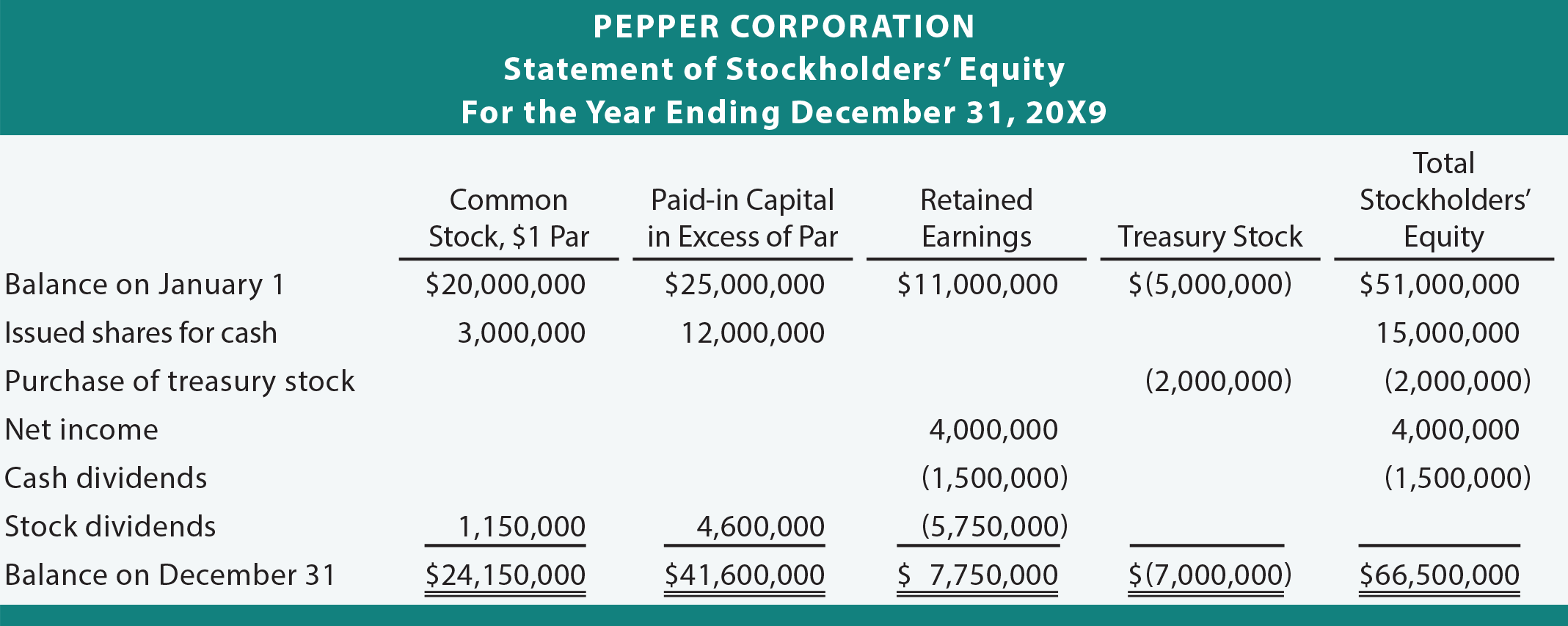

Change in stockholders equity. Read on to learn what it is, how it works, and how to determine a particular company’s stockholders’ equity. Stock is issued and common stock increases, and/or. Contributed capital, retained earnings and other comprehensive income.

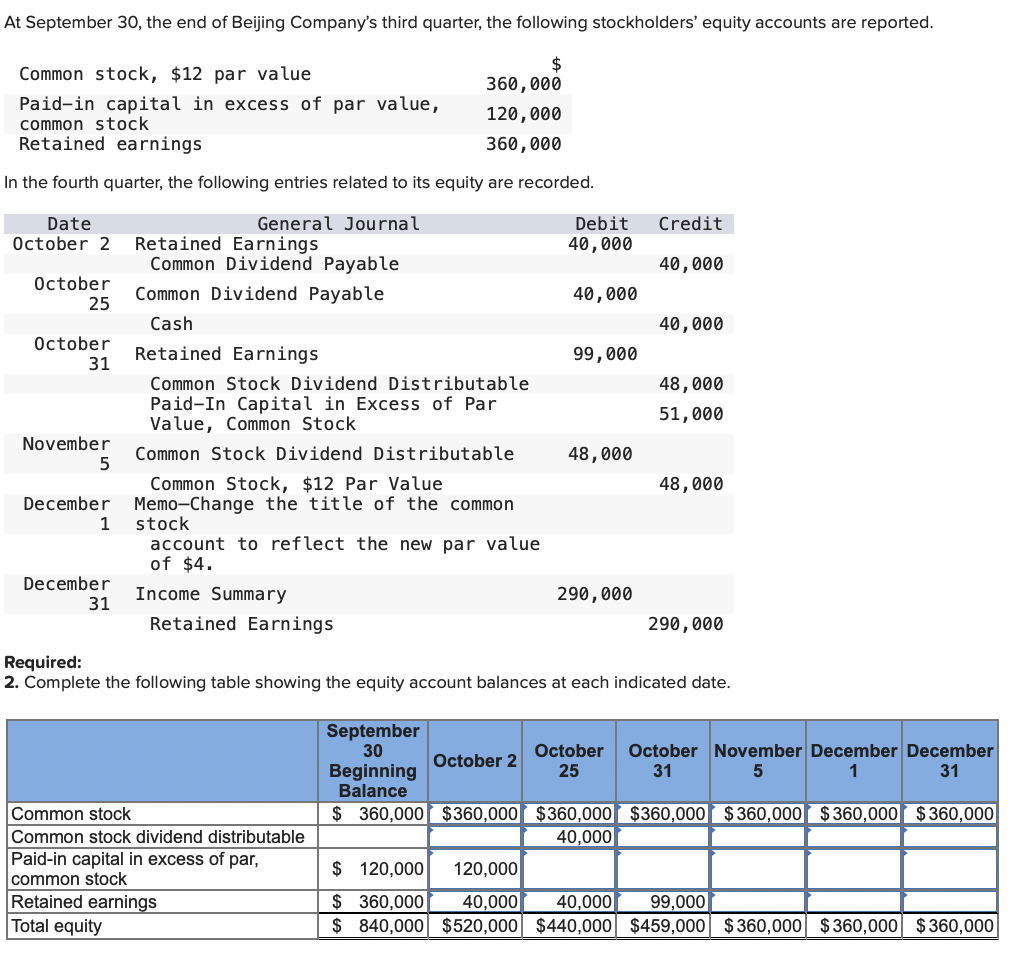

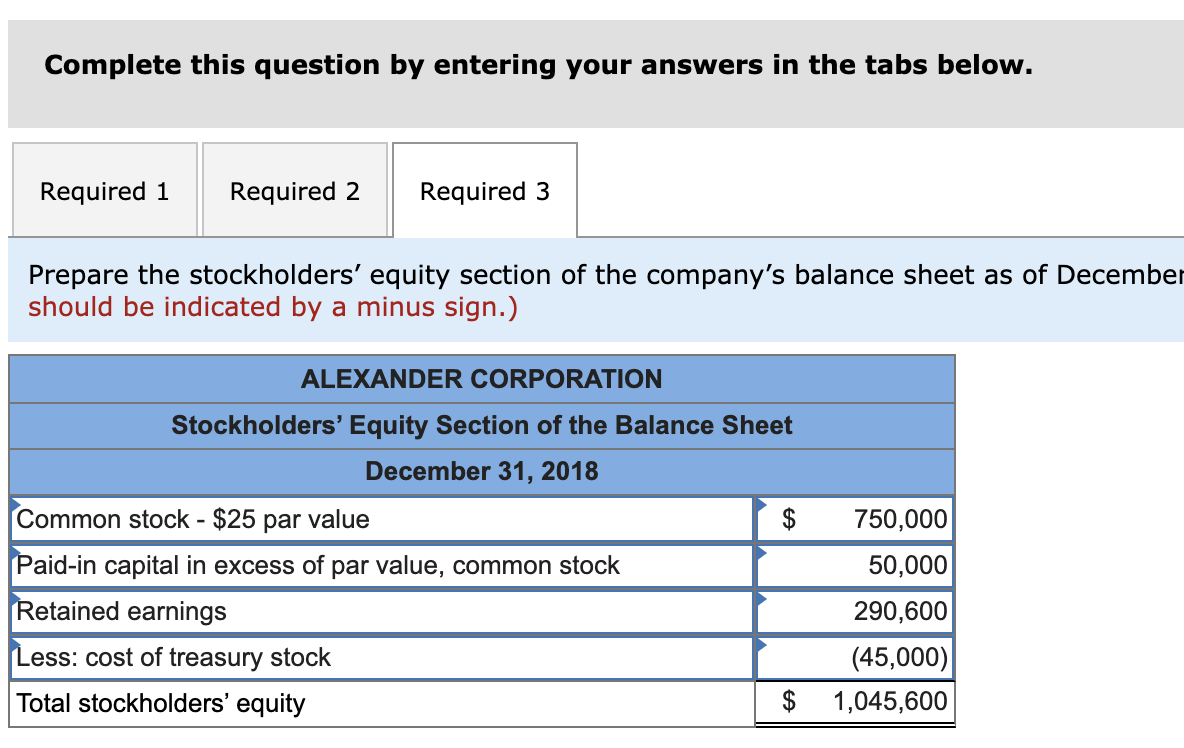

It breaks down changes in the owners' interest in the organization, and in the application of retained profit or surplus from one accounting period to the next. Company granted extension by nasdaq hearings panel to regain compliance with the stockholders’ equity continued listing requirement until march 25, 2024 net revenue for full year 2023 expected. Keep in mind, the shareholders' interest is a residual one:.

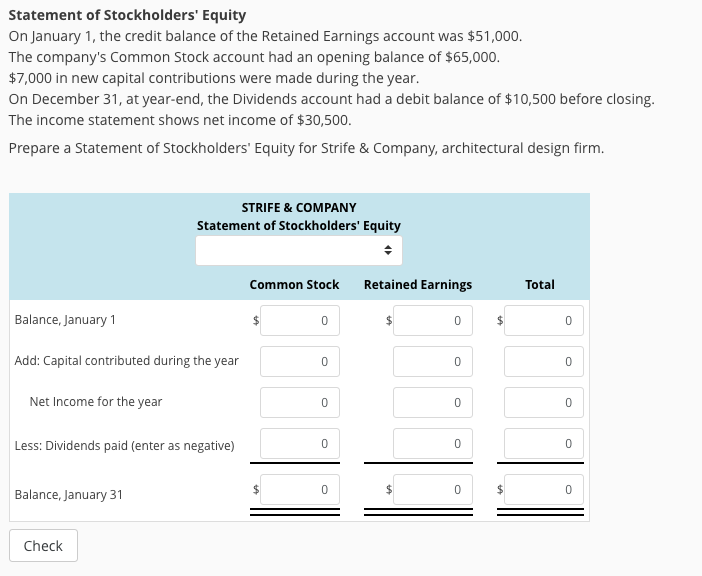

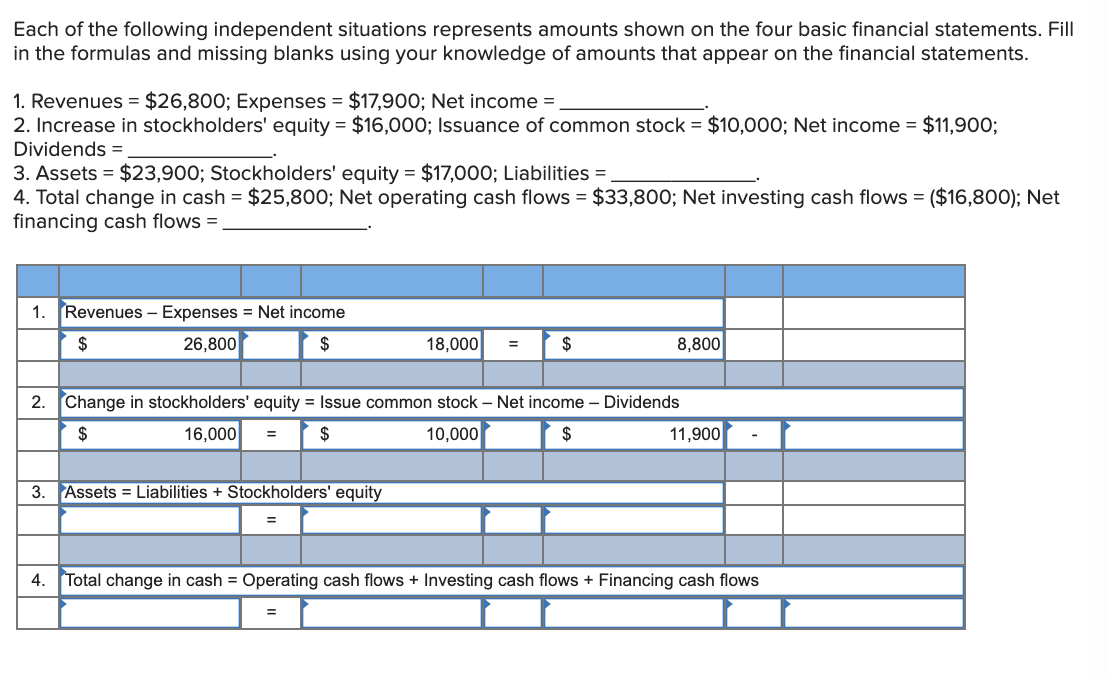

Net income (loss) for the period: Statement of stockholders equity (or statement of changes in equity) is a financial document that a company issues under its balance sheet. Stockholders’ equity can increase in two ways:

Issue of new share capital: One indicator can be stockholders’ equity. Stockholders’ equity can decrease in two ways:

Shares of stock that a corporation issues to its investors results in an increase in shareholder's equity. The equity will be as follows: The face value) of the.

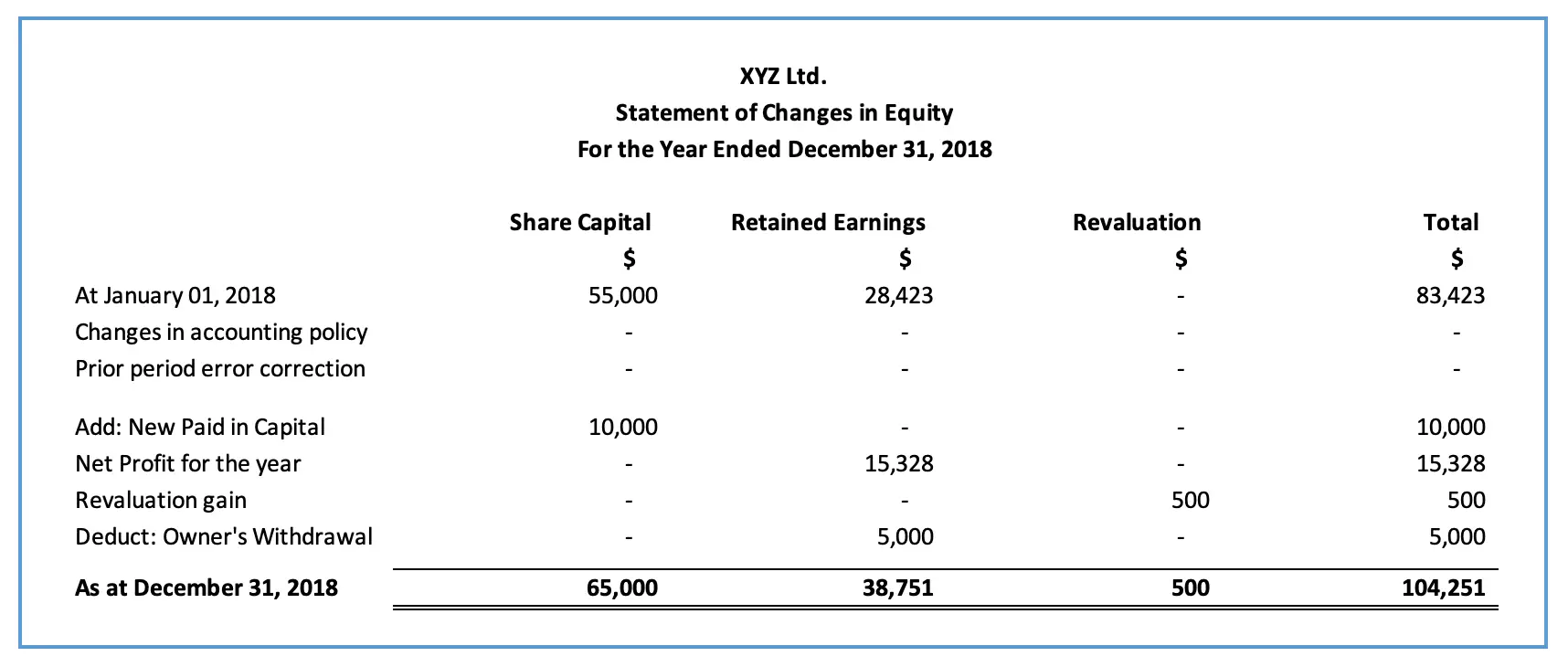

In this article, we’ll cover: It is a required financial statement from a us company whose. The statement explains the changes in a company's share capital, accumulated reserves and retained earnings over the reporting period.

Mar 15, 2022 what is stockholders’ equity? Stockholders' equity is a line item that can be found on a company's balance sheet, and the trend in stockholders' equity can be assessed by looking at past balance sheet reports. Following are the most common changes in shareholders’ equity:

What is the statement of changes in equity? The purpose of this statement is to convey any change (or changes) in the value of shareholder’s equity in a company during a year. This in depth view of equity is best demonstrated in the expanded.

The court found that the defendants—musk, tesla, inc. Otherwise, you could draw the wrong conclusions from changes on a company's. Statement of changes in equity refers to the reconciliation of the opening and closing balances of equity in a company during a particular reporting period.

The rule requires a minimum of $2,500,000 stockholders' equity, $35,000,000 market value of listed securities, or $500,000 net income from continuing operations. Any change in the common stock, retained earnings, or dividends accounts affects total stockholders’ equity, and those changes are shown on the statement of stockholder’s equity. Statement of changes in equity, often referred to as statement of retained earnings in u.s.