Lessons I Learned From Tips About Do Retained Earnings Go On The Balance Sheet Consolidation Forex

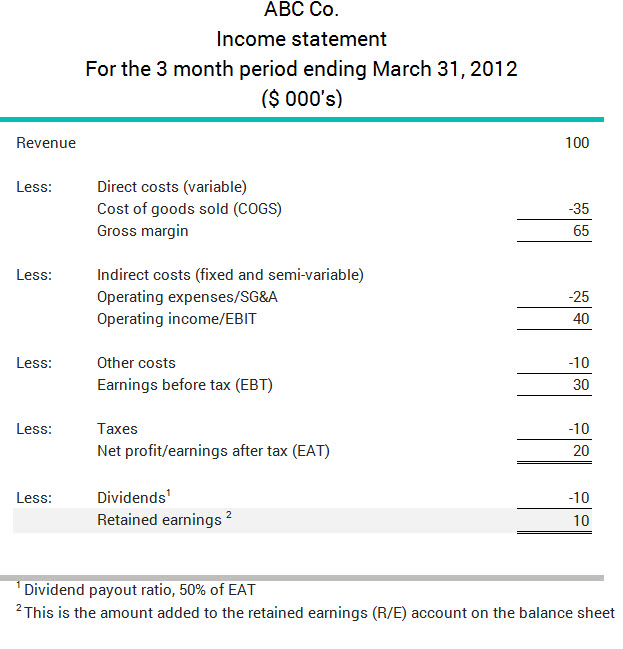

Retained earnings are the cumulative net earnings (profit) of a company after paying dividends;

Do retained earnings go on the balance sheet. If liabilities (debts) stay constant, then an increase in assets will drive up owner’s equity. Although retained earnings are not themselves an asset, they can. Retained earnings don't always appear on the balance sheet.

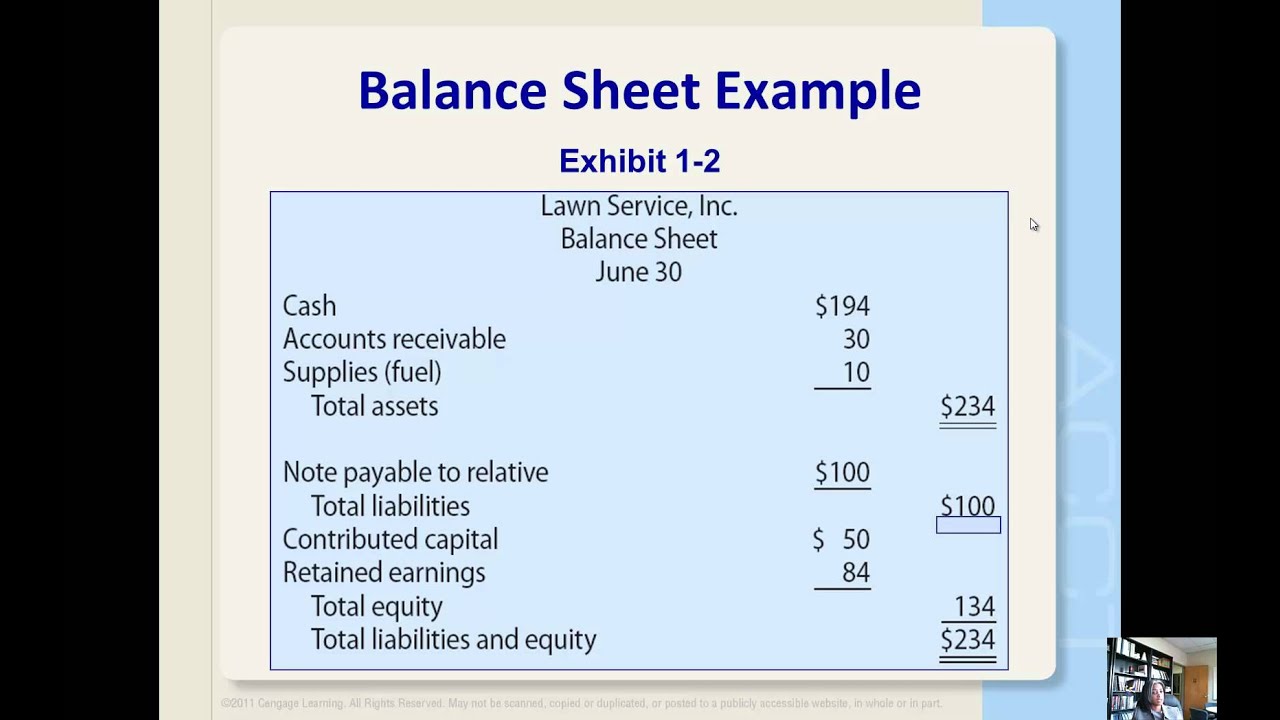

The retained earnings on a balance sheet represent the profits made (or, in the case of a negative balance, the losses) by the company that are not distributed to the shareholders. A balance sheet is a snapshot in time, illustrating the current financial position of the business. Assume you started the quarter with $400,000 in retained earnings.

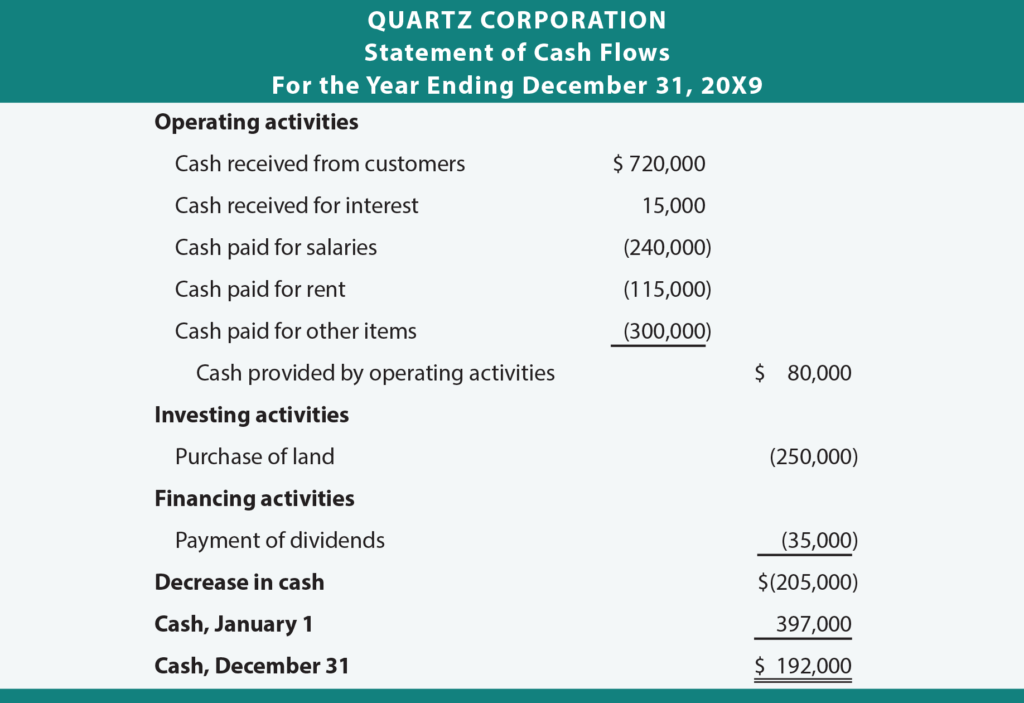

Businesses generate earnings that they reflect on their balance sheet as negative earnings, or losses, and positive earnings, or profits. Even if you don’t have any investors, it’s a valuable tool for understanding your business. The company can reinvest shareholder equity into business development or it can choose to pay shareholders dividends.

Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders. Retained earnings are a type of equity and are therefore reported in the shareholders’ equity section of the balance sheet. In rare cases, companies include retained earnings on.

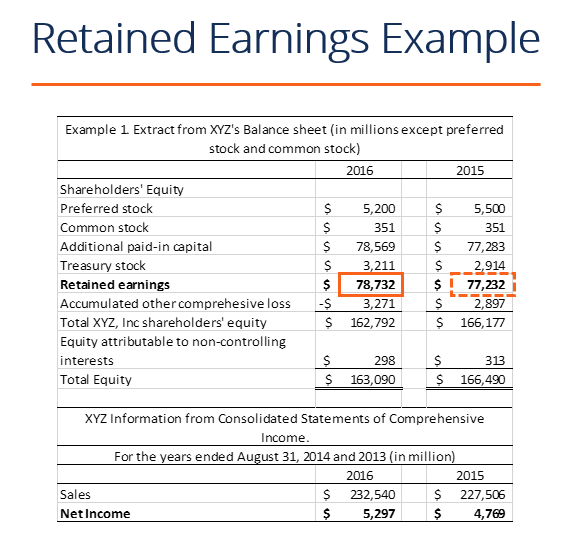

Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To illustrate how to calculate retained earnings on a balance sheet, imagine a firm starting the year with $50 million in retained earnings. How to calculate retained earnings on balance sheet

Why retained earnings are important for a small business That means, the ending retained earnings on the balance sheet at the year’s end is going to be $65,000. Retained earnings are a critical component of a company’s balance sheet as they are part of the shareholder’s equity.

The retained earnings line item can be found in the shareholders’ equity section of the balance sheet. They can be reported on the balance sheet and earnings statement. So, why should you care about retained earnings?

Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder’s equity. They’re in liabilities because net income as shareholder equity is actually a company or corporate debt. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted.

An increase in retained earnings increases the total shareholders’ equity and thereby the total assets (given that total assets = liabilities + shareholders’ equity). Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. Retained earnings are listed under liabilities in the equity section of your balance sheet.

While the statement of retained earnings covers an entire period of time, the balance sheet only. The answer is yes, they do! In more practical terms, retained earnings are the profits your company has earned to date, less any dividends or other distributions paid to investors.