Supreme Info About Operating Cash Flow Depreciation Insurance Income Statement

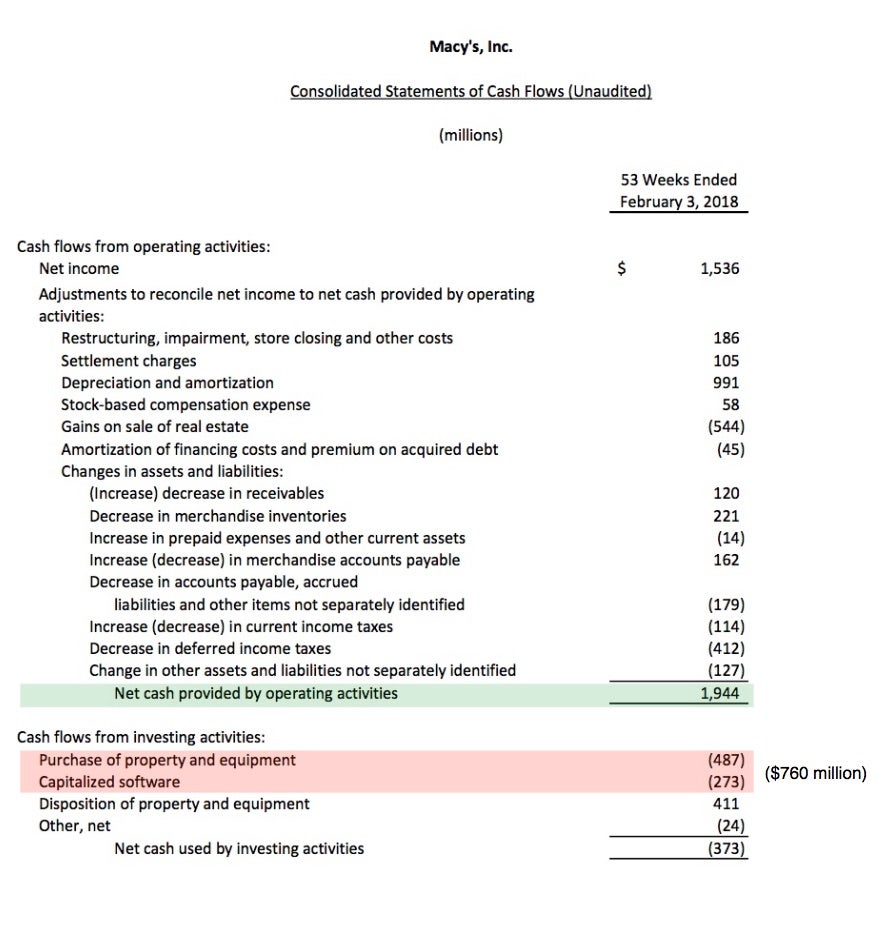

14,293 = net income 10,080 = depreciation & amortization 761 = deferred income tax

Operating cash flow depreciation. It’s calculated as revenue minus operating expenses. Here is another version of the formula for determining operating cash flow: Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method:

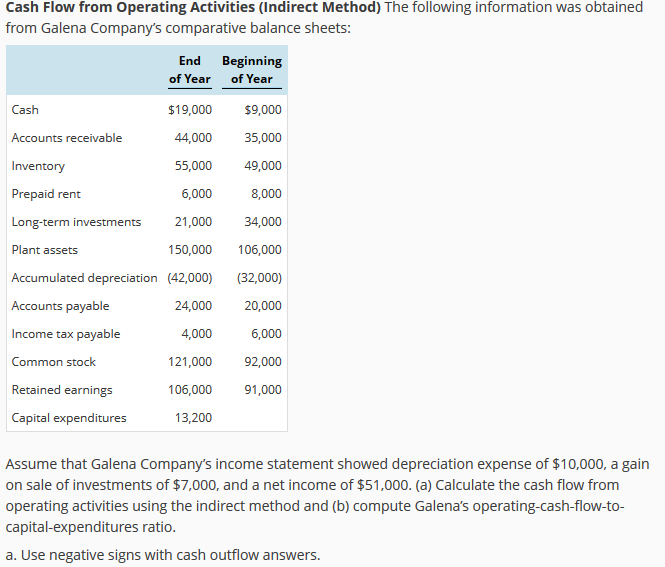

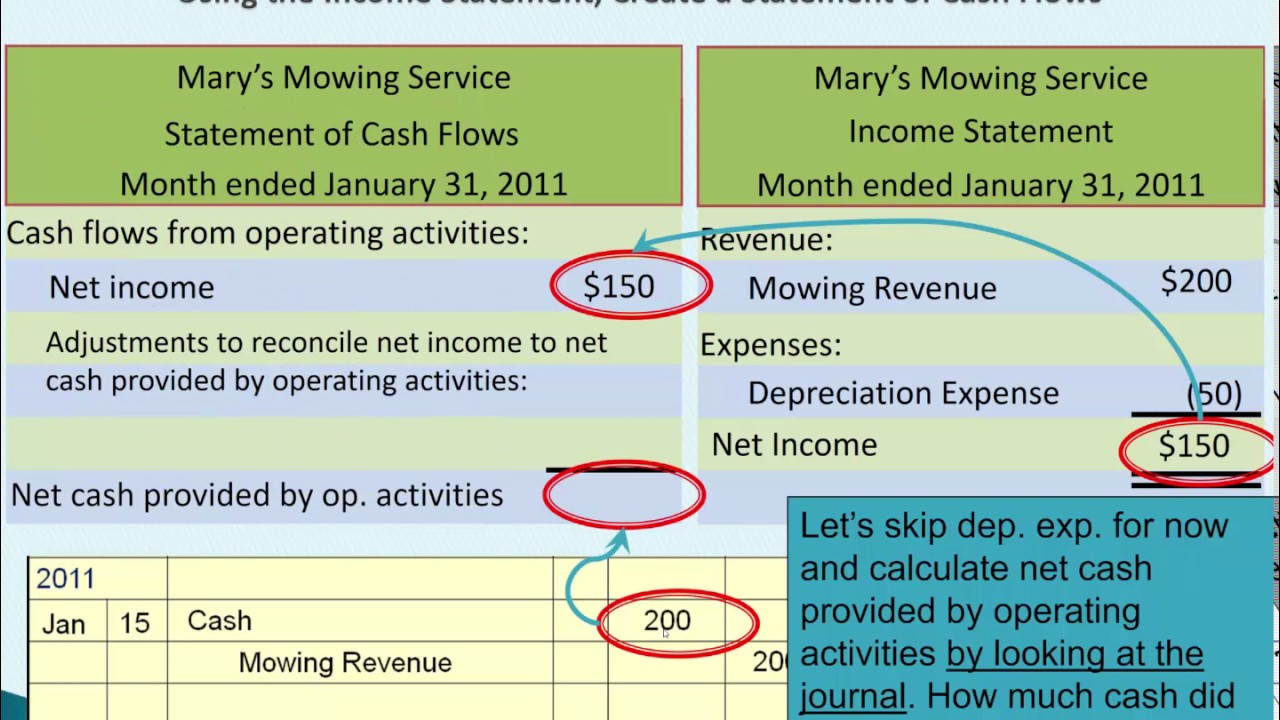

In your video, you subtract the depreciation on the cash flow statement; This is due to no matter how big the depreciation expense is, it will be added back to the cash flow when we make the reconciliation to convert net income to net cash flow under the operating activities section of the cash flow statement. $10,000 change in accounts receivable:

The operating cash flow ratio is a measure of the number of times a company can pay off current debts with cash generated within the same period. However, depreciation is one of the few expenses for which there is no associated outgoing cash flow. Operating cash flow is the part of the cash flow statement that shows how much money a business earns from typical operations.

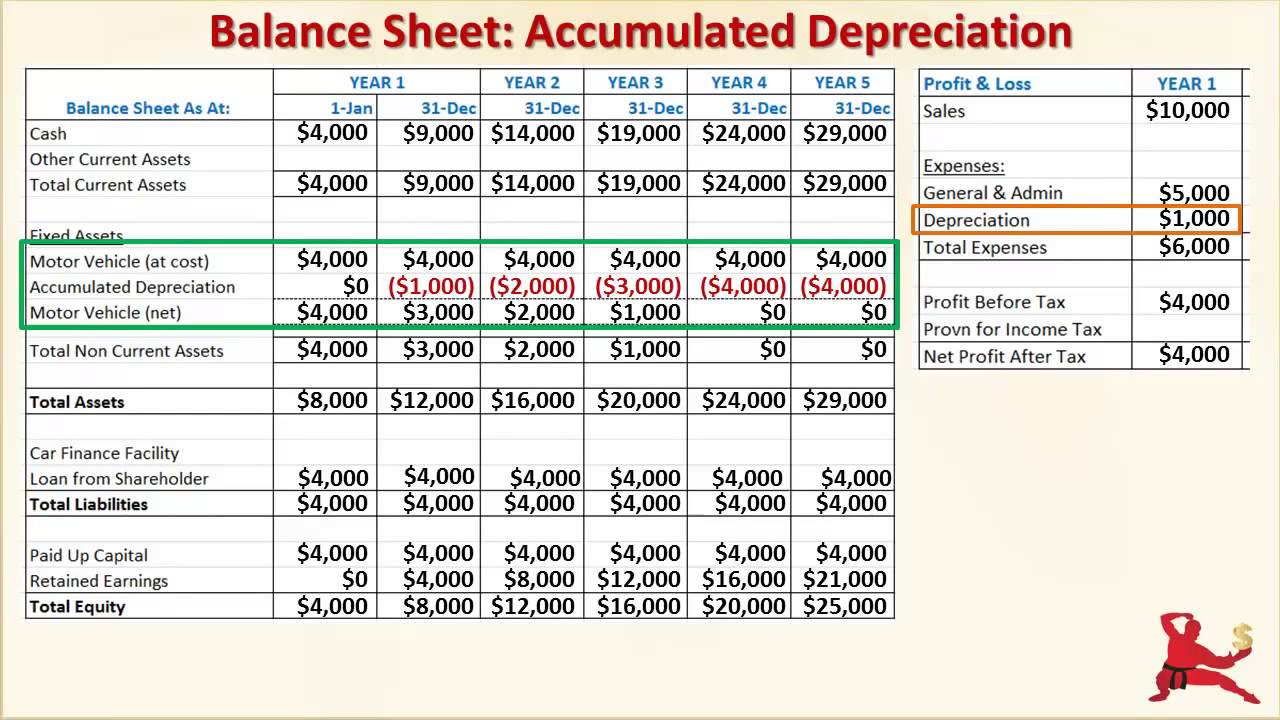

Examples are depreciation, depletion, and amortization expense. Next, we examine how depreciation expense is reported on the good deal co.'s financial statement. Operating cash flow represents a company’s overall ability to turn a profit.

Since the assets being depreciation are part of normal business operations, depreciation is considered an operating expense. A company can face loss or small profit due to large depreciation. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a.

In business, the operating cash flow (ocf) definition is the money a company brings in through their normal operations during a time period. A high number, greater than one, indicates that. The use of a depreciation method allows a company to expense the cost of an asset over time.

In the operating activities section of the cash flow statement, add back expenses that did not require the use of cash. Send feedback june transactions and financial. However, it can have a strong cash flow since depreciation is an accounting expense but not in.

How depreciation affects cash flow depreciation. How depreciation affects cash flow. Market update why should we care about what happens to the fed rate?

Ocf serves as a measure of whether a company can generate sufficient positive cash. However, right now, i am looking at a 2017 cash flow statement from walmart , but depreciation is shown as a positive number. Operating cash flow includes any money.

Net income is the company’s net profit after taxes. Depreciation is a type of expense that when used, decreases the carrying value of an asset. Operating cash flow indicates whether a company can generate sufficient.