Breathtaking Tips About Income Statement Under Marginal Costing Net On Cash Flow

:max_bytes(150000):strip_icc()/Absorptioncosting-1a583ac14f1e40dda214632af50ec4fd.jpg)

The essential characteristic and mechanism of marginal costing technique may be summed up as follows:

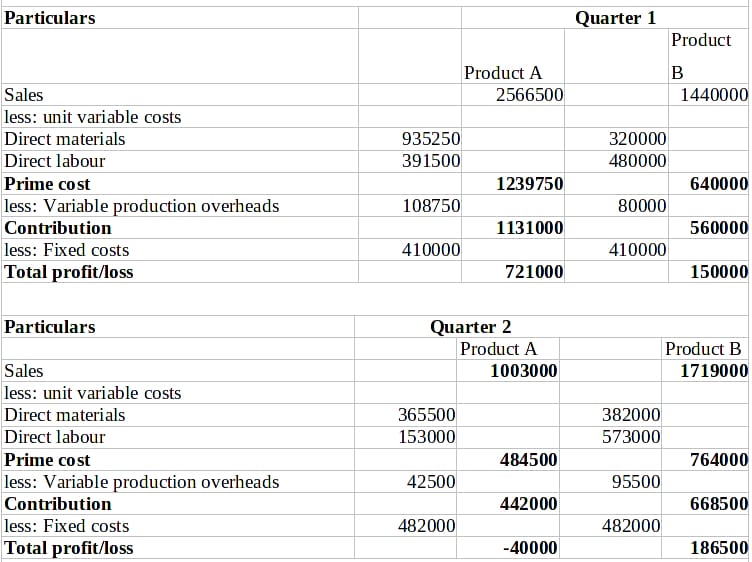

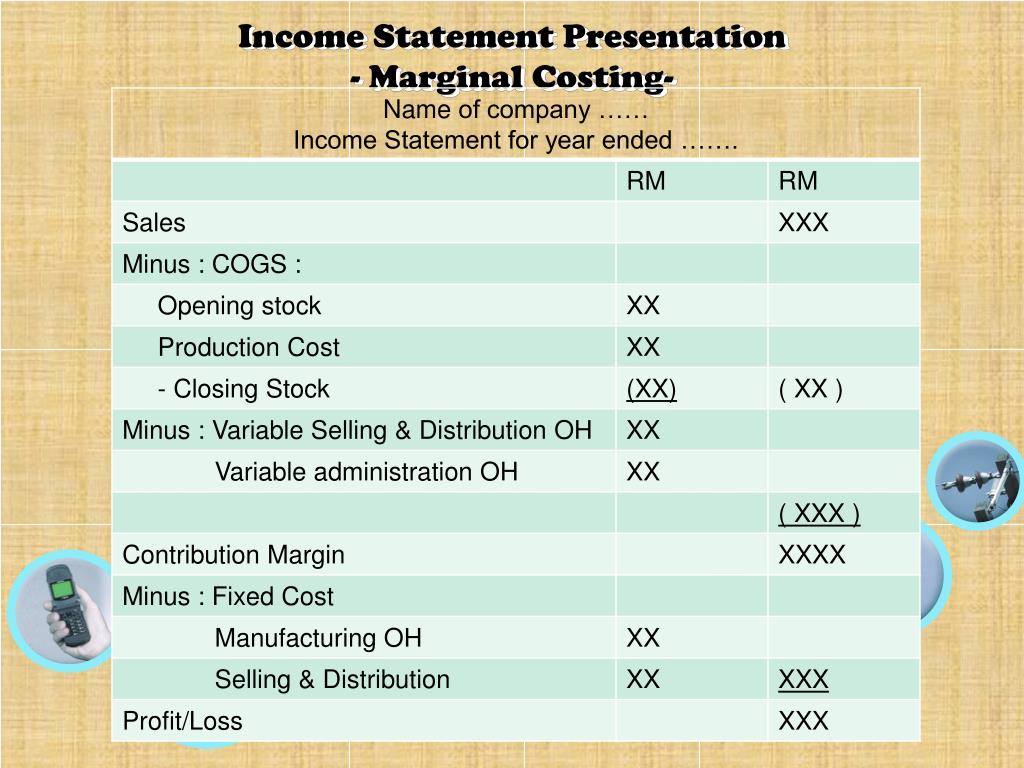

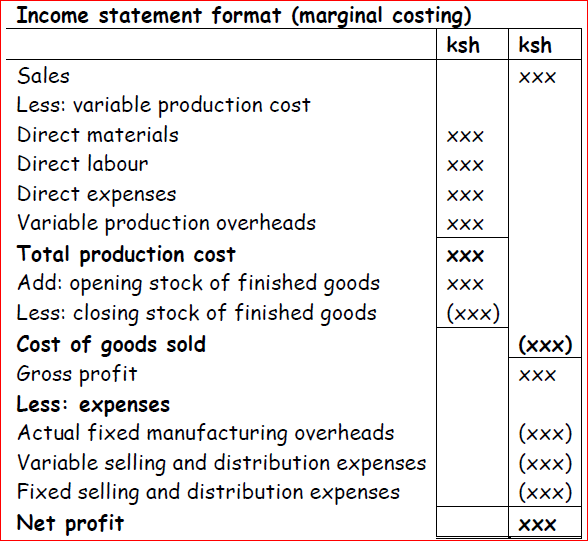

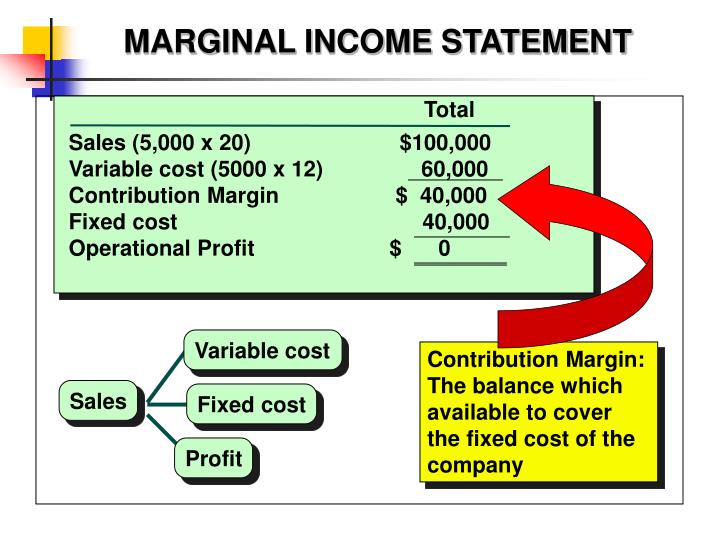

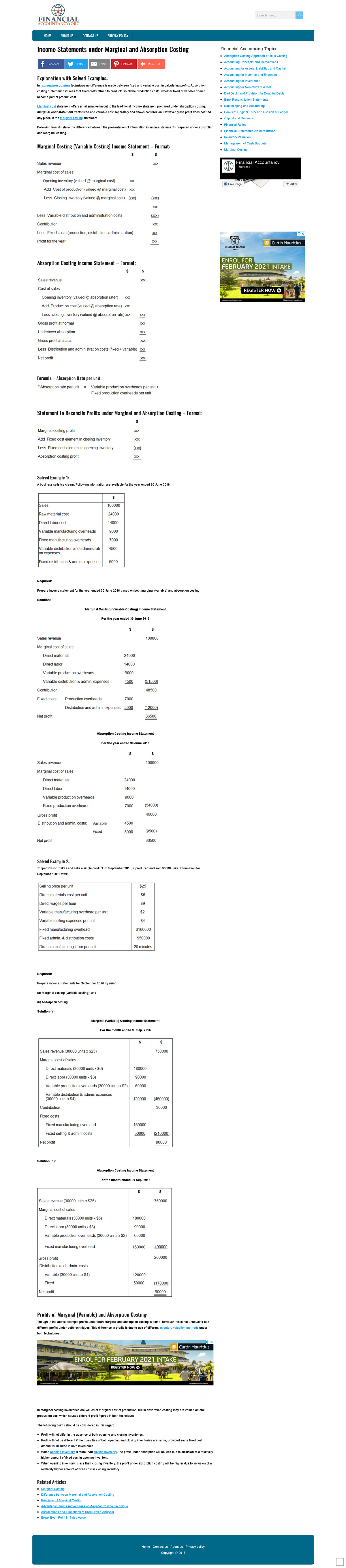

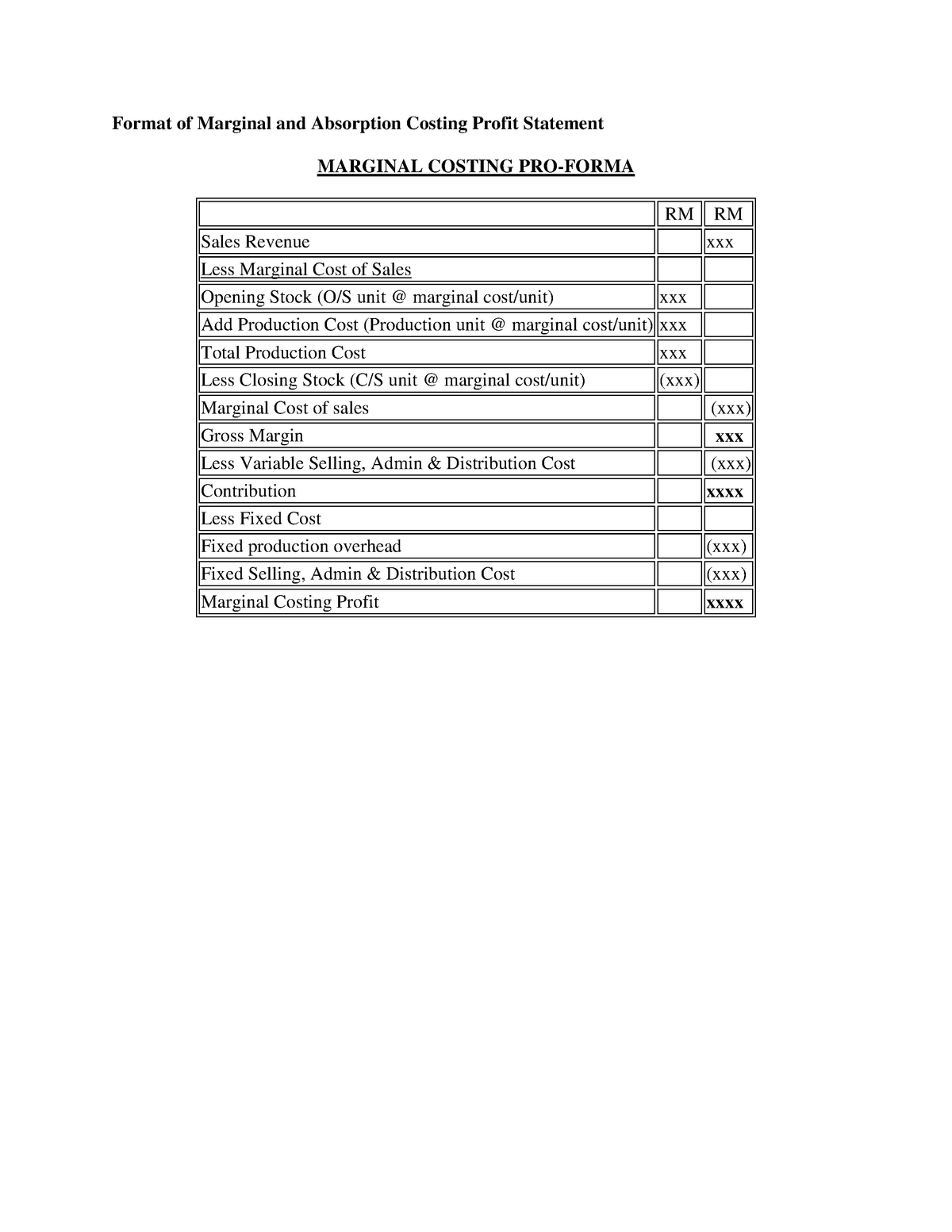

Income statement under marginal costing. Income statement under low accounting it is seen that variable costs are deducted initially from the sales revenue to arrive at that contribution margin. Under marginal costing technique, income statement is presented in the following format: 13.1 introduction the elements of costs can be divided into fixed and variable costs.

Format of income statement under marginal costing examples of marginal costing to understand the marginal costing, we need to learn what is marginal cost as costing is a method of ascertaining cost. The contribution margin shows how much money is left till cover this fixed expense. The main advantages of marginal costing are as under:

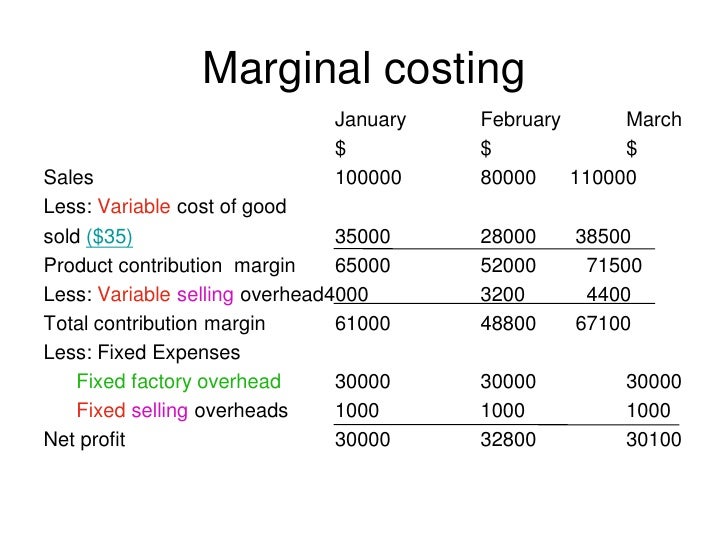

Total sales = 3,600. And to discuss the merits and limitations of marginal costing along with developing a marginal cost equation uses of marginal costing in managerial decisions. Marginal costing income statement.

Marginal costing is the increase or decrease in the overall cost of production due to changes in the quantity of desired output. This video is about: Closing inventories are valued at marginal production cost.

However, fixed manufacturing above has a product shipping under the absorption costing income statement real a time price on one marginal income statement. Subscribe to our youtube channel to watch more management accounting. The two revenues instruction differ include style and can even erfolg in a different net operative earnings for the period.

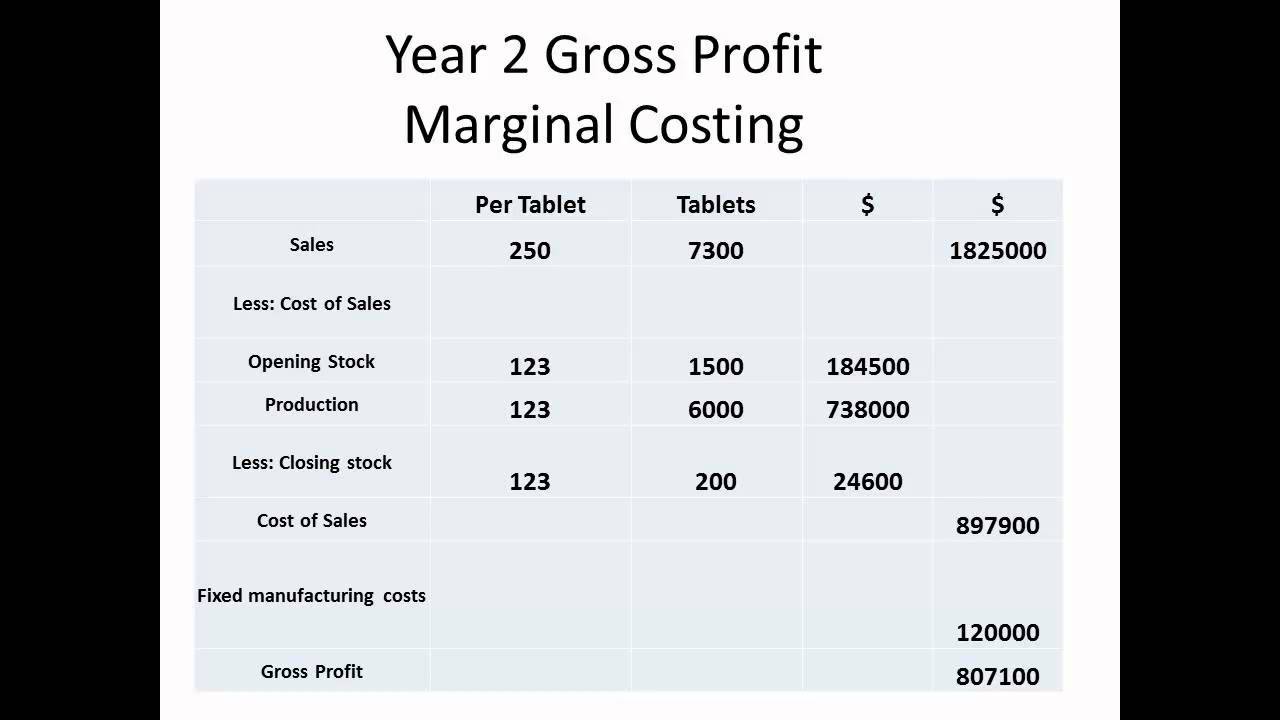

What is the gross profit for product a, using marginal costing? Marginal cost statement treats fixed and variable cost separately and shows contribution. Marginal costing income statement.

Under this case, the income under absorption costing may reflect profit. Cost real profit statement under. Managers can use it to make resource allocation decisions, optimize production, streamline operations, control manufacturing costs, plan budgets and profits, and so on.

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. Let us take a few examples to understand it properly. Income statement impact in absorption costing, fixed manufacturing overhead is allocated to the finished product and becomes part of the cost of inventory.

It is seen that variable costs are deducted first from. In order to be able to prepare income statements under marginal costing, you need to be able to complete the following proforma.

When production is equal to sales 3. Income statement under marginal and absorption costing, management accounting lecture | sabaq.pk |. Contribution may be described as follows: