Unique Tips About Understanding Financial Statements Uk How To Build A Statement Of Cash Flows

Financial statements are often audited by government agencies and accountants to ensure.

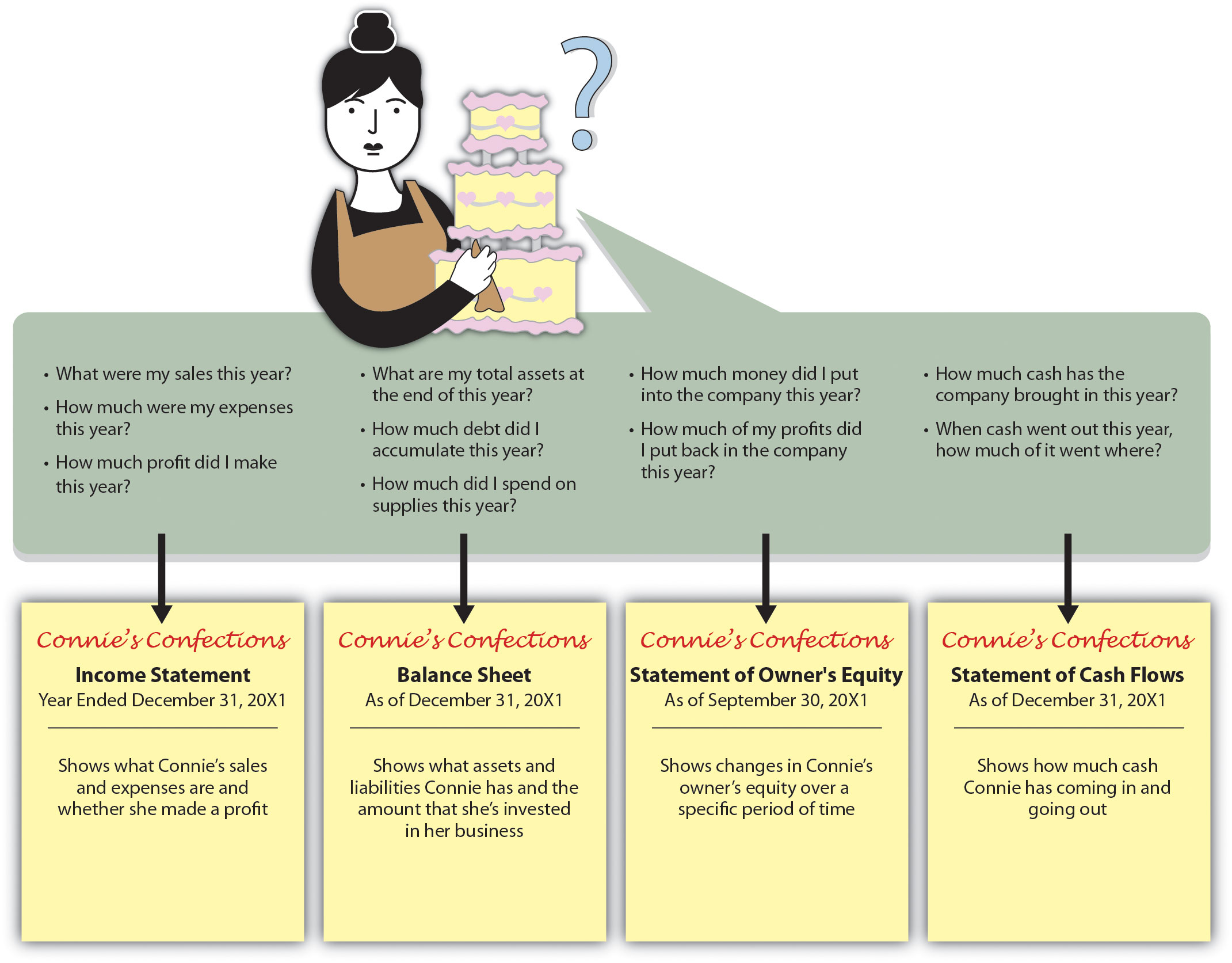

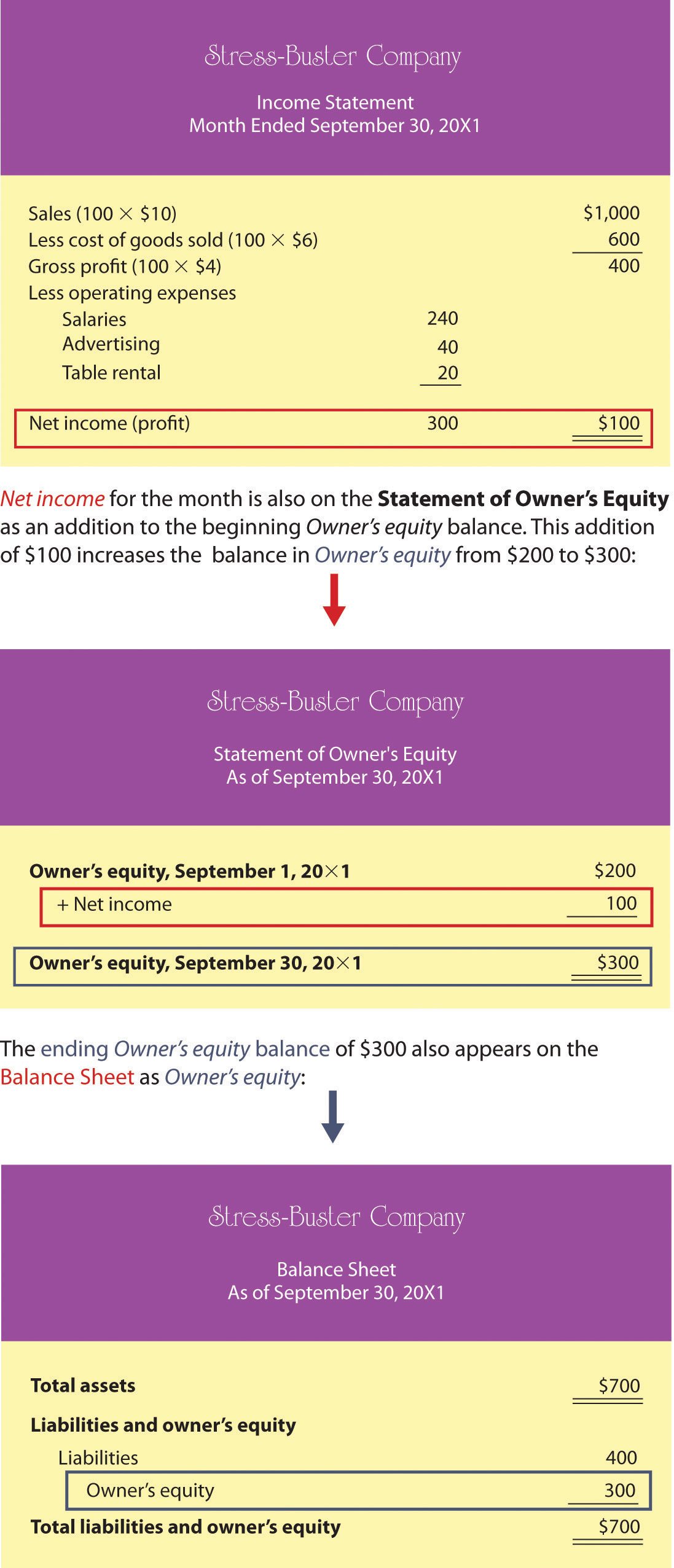

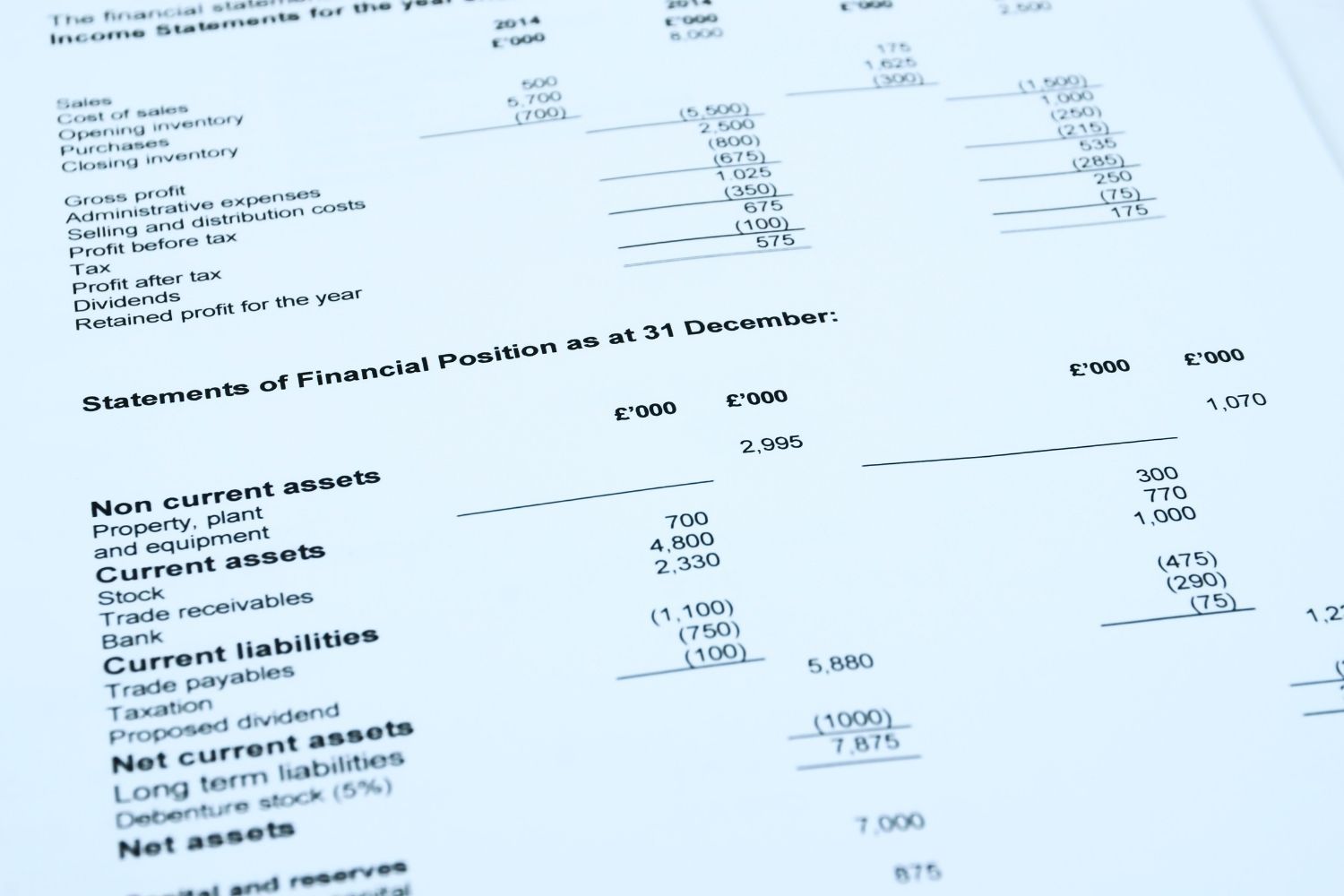

Understanding financial statements uk. Financial statements are written records that convey the financial activities of a company. The three main types of financial statements are the balance sheet, income statement and cash flow statements. You’ll also investigate the different branches of accounting and learn to identify who else in the business uses this accounting information.

The balance sheet shows a company’s. A financial statement is a documented record that shows the financial activities and performance of a business. Financial statements play an important role in helping you to understand the financial position of your business.

Know the difference between a profit and a cash surplus. A beginner’s guide / tips and help / by admin financial statements are a critical tool for businesses of all sizes to understand their financial health and performance. Financial statement analysis:

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: It gives an overview of the financial status of the company. Interpreting financial statements involves comparing data across different periods, industry benchmarks, and competitors.

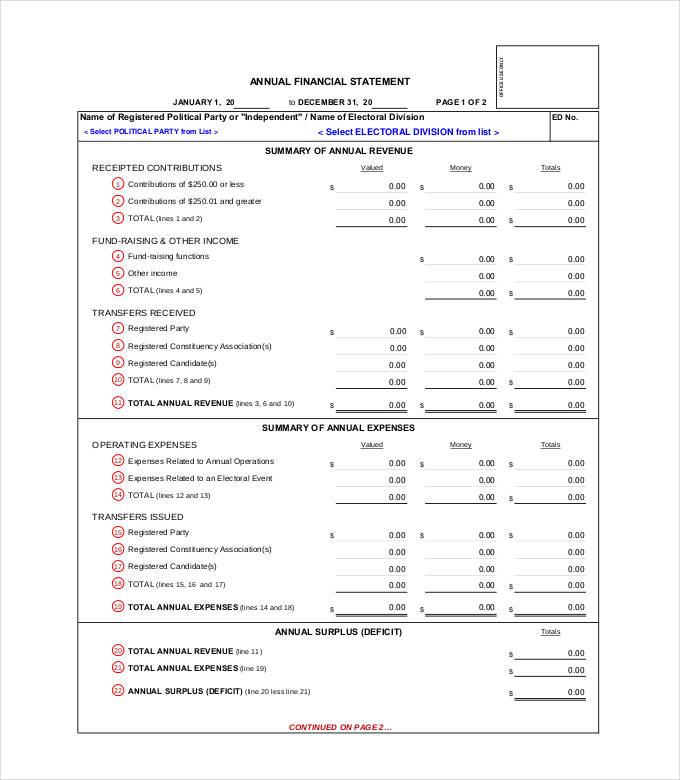

Financial statements are documents containing summarised data that describe an organisation’s financial activities, such as income, expenses, assets, liabilities, net worth, etc. Explain the terms assets, liabilities, revenue, expenses and equity. In this article, we explain what a financial statement is, how to read financial statements, types of financial statements and provide a guide to understanding an organisation's financial documents.

How to understand the difference between a balance sheet, a profit & loss statement and statement of cashflows? Explain how the three financial statements fit together and provide management information. It tells you how liquid you are, your overall financial well being.

Key to note is its only a snapshot of that day in time. The financial statements. The balance sheet is one of the three financial statements businesses use to measure their financial performance.

How to read a balance. Financial statements are formal documents that provide information about the financial performance and position of a company. 29 jan 2024 what is the purpose of financial statements?

They are typically prepared by accountants or financial analysts, and are used to help investors, lenders, and other stakeholders understand the financial health of a company. Financial statement analysis helps identify trends, strengths, weaknesses, and areas of concern. It explains the purpose of financial statements and how they can be used to assess the performance of a company.

Having a snapshot of the assets, liability, and equity is an excellent indication of how a company is performing, as well as the stability of a business. The balance sheet tells you overall how your business is doing. If you’re new to accounting or finance, understanding these statements can be a bit daunting at first.