Wonderful Info About Liquidation Basis Of Accounting Ifrs 10k Balance Sheet

Financial instruments to ifrs 7 financial instruments:

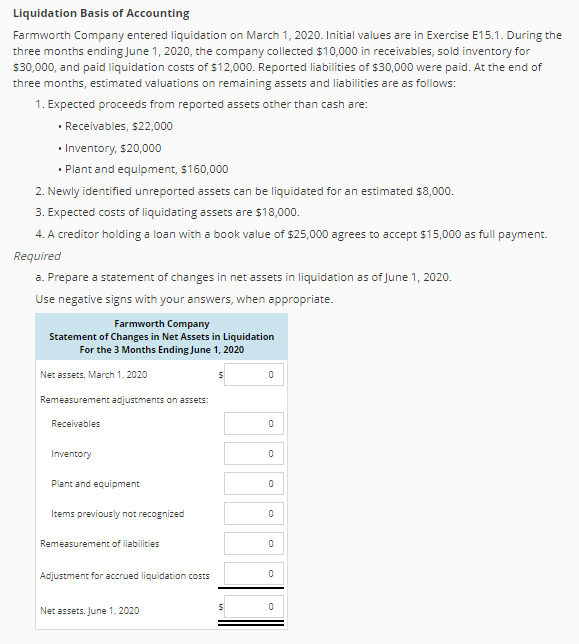

Liquidation basis of accounting ifrs. Liquidation basis accounting is concerned with preparing the financial statements of a business in a. Under the liquidation basis of accounting, the emphasis shifts from reporting about the reporting entity's economic performance and position to reporting that focuses on the amount of cash or other consideration that an investor might reasonably. 31 aug 2021 (updated 30 jun 2023) us bankruptcy & liquidation guide for a reporting entity that has adopted the liquidation basis of accounting, the financial.

International accounting standard 1 presentation of financial statements. In february 2008 ias 32 was. When it is appropriate to apply the liquidation basis of accounting, it is not an election;

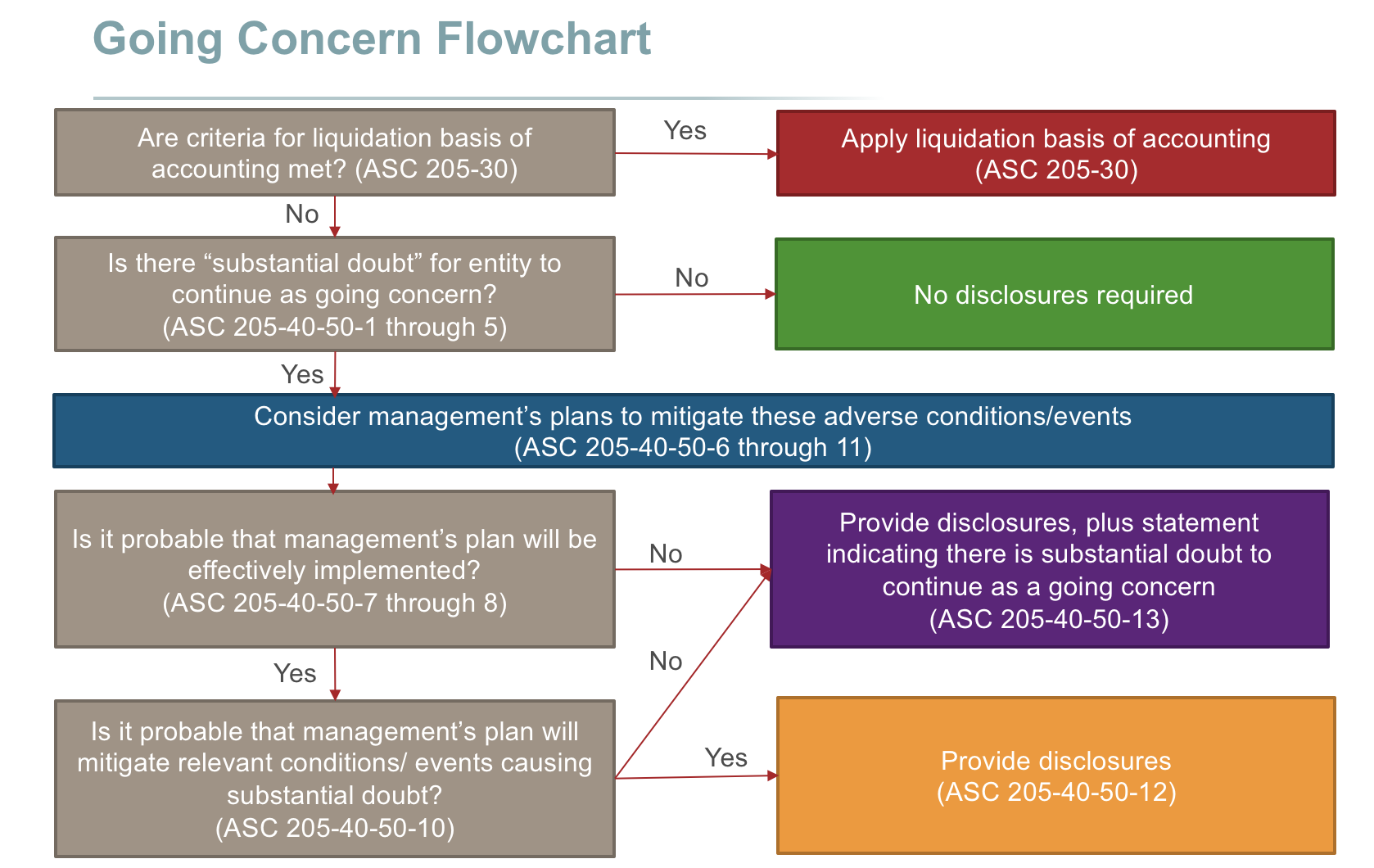

This standard prescribes the basis for presentation of general purpose financial statements. 31 jul 2023 us bankruptcy & liquidation guide in the period in which a reporting entity adopts the liquidation basis of accounting (discussed in blg 6 ), it. Under ifrs standards, financial statements are prepared on a going concern basis, unless management intends or has no realistic alternative other than to liquidate.

An informative description of the preparation basis adopted will often be more. To our clients and other friends this publication is designed to assist professionals in understanding the financial reporting issues associated with. 6.1 liquidation basis of accounting:

The fasb has tentatively decided to change the definition of imminent for liquidation and to require entities to apply the liquidation basis of accounting when. Overview under the asu, an entity is required to use the liquidation basis of accounting to present its financial statements when it determines that liquidation is. The ifrs interpretations committee (committee) received a submission about the accounting applied by an entity that is no longer a going concern.

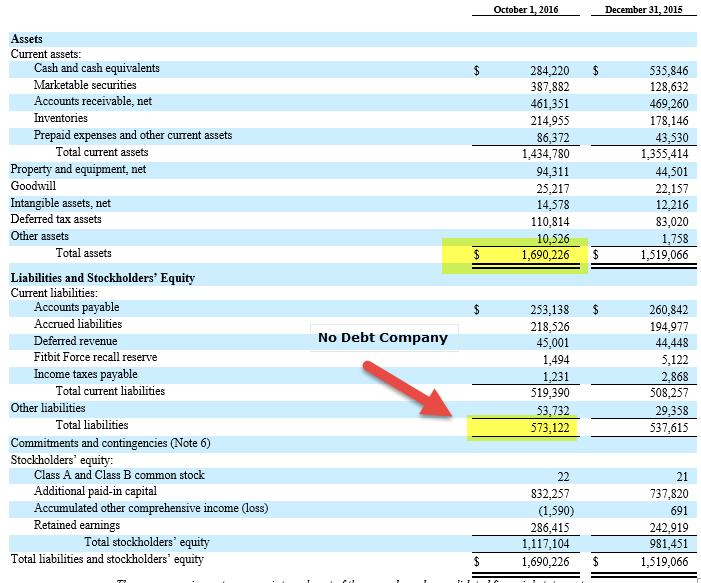

Ias 1 sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial. When a reporting entity has adopted the liquidation basis of accounting, its financial statement requirements change from a balance sheet and statements of.

01 aug 2021 (updated 30 jun 2023) us bankruptcy & liquidation guide most businesses. The ifrs standards as endorsed in the ksa do not provide an appropriate basis for an entity that enters into liquidation to prepare its financial statements.

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)