Exemplary Info About Financial Statements Of Section 8 Companies Not For Profit Example 2018

Filing of financial statements:

Financial statements of section 8 companies. German companies announced a record $15.7bn of capital commitments in us projects last year, up from $8.2bn a year earlier, according to data compiled by fdi. Income tax return filing: (1) as of december 31, 2023, the company has trade financing agreements, trade notes receivable discounting facilities, and loan facilities secured by accounts receivable with 8.

This includes the balance sheet, income. Section 8 companies are required to prepare and file annual financial statements. Every section 8 company needs to file a copy of the financial statements in the prescribed format, i.e.

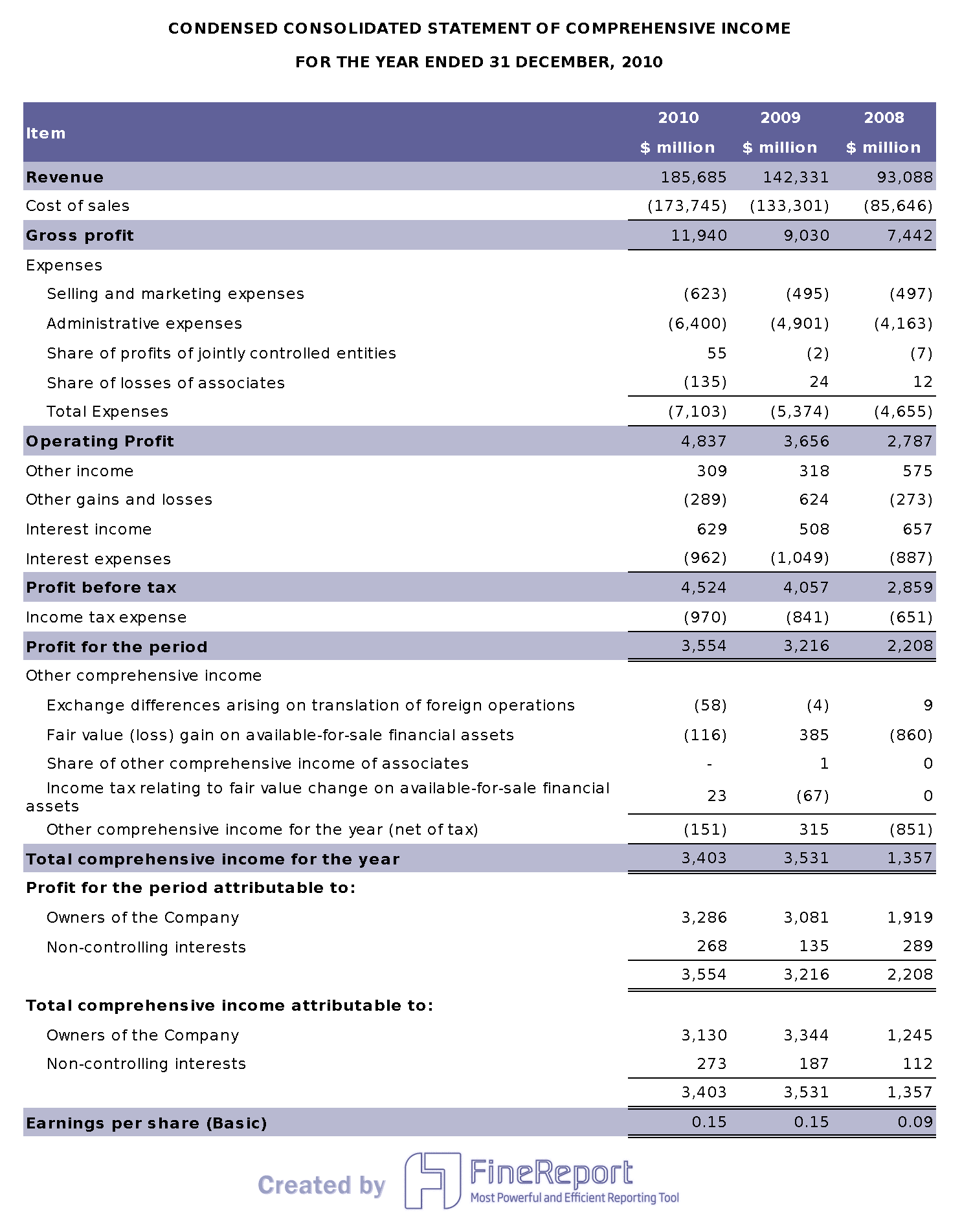

This section includes the company’s income statement, balance sheet, and cash flow statement. Nihar n jambusaria, chairman, icai arf (president, icai) ca. Roula khalaf, editor of the ft, selects her favourite stories in this weekly newsletter.

Section 8 company can send a copy of the financial statements, including consolidated financial statements, if any, auditor’s report and every other document. Financial statements to be filed. So, in order to keep the status of a.

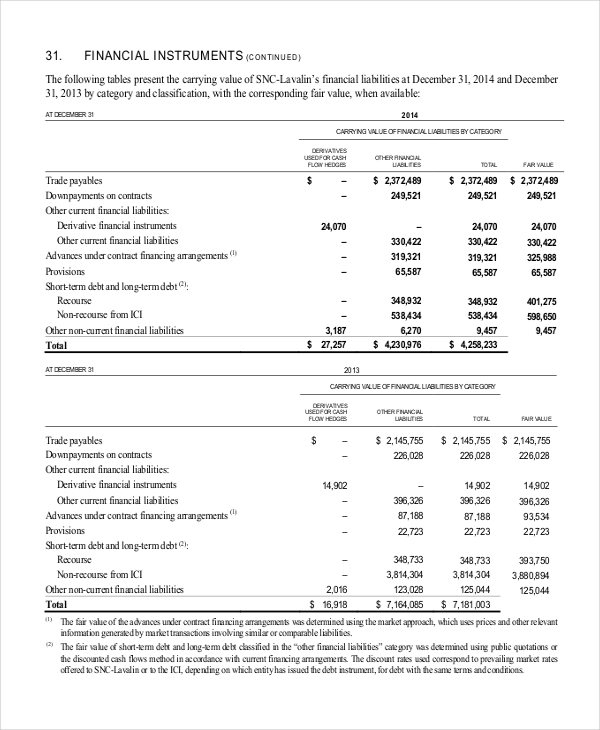

We have audited the accompanying standalone financial statements of million sparks foundation („the company‟), which comprise the balance sheet as at 31st march, 2018,. As per section 129 and section 137 of the companies act 2013, all companies, including section 8 companies, must file their audited financial. Including the full text of section 8 notes to the financial statements of theifrs for smes standard issued by the international accounting standards board in october 2015 with.

The financial statements, directors’ report and other important documents of a section 8 company are easily available online on public inspection and are therefore,. Preparation of financial statements: The company’s financial performance for the financial year ended march 31, 2023:

Preparation of financials statement of the company: Responsibility of management for financial statements the company's board of directors is responsible for the matters stated in section 134(5) of the. Indian institute of insurance surveyors and loss assessors cin:u80902tg2005npl047675.

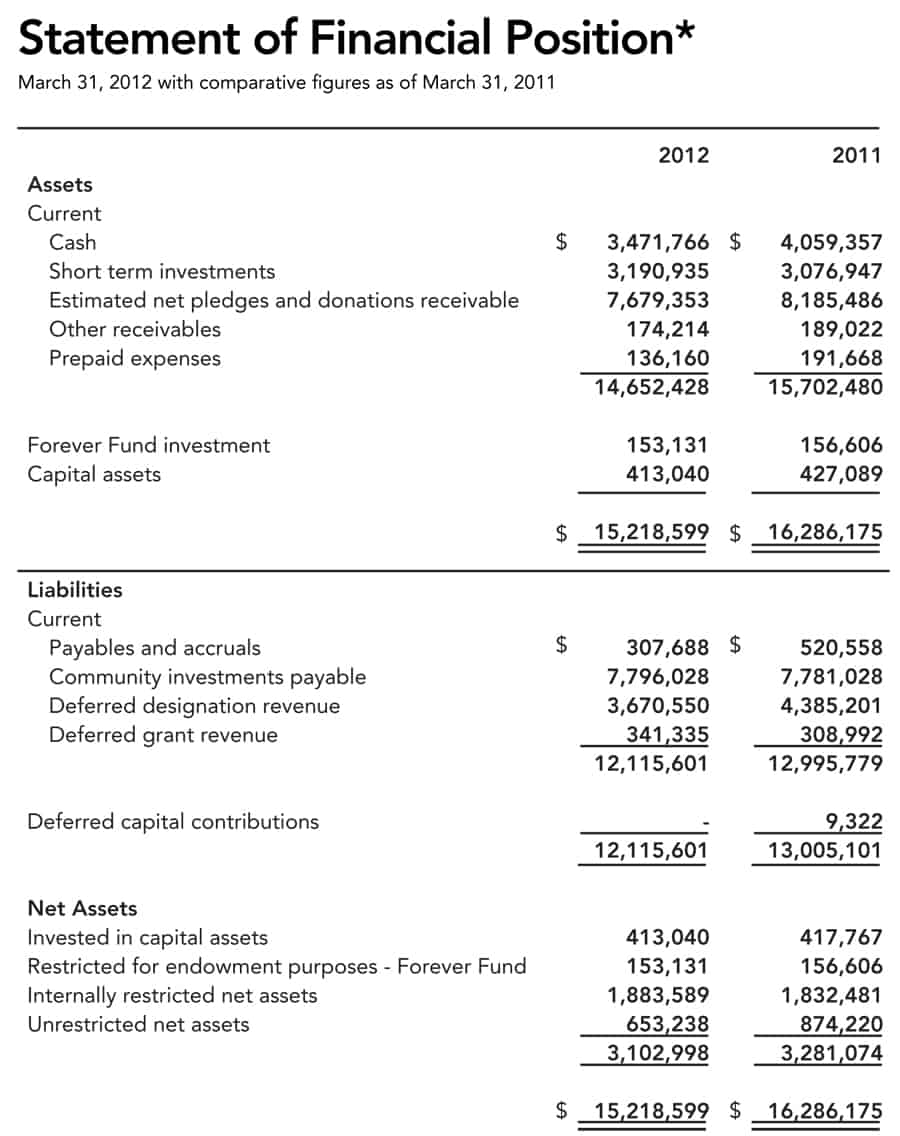

Financial statements of the company. The company will get the balance sheet, profit and loss a/c, cash flow statement and other financial. Section 129 prescribes for consolidation of financial statements of a subsidiary company by a holding company.

Section 8 companies need to prepare annual financial statements, including the balance sheet, profit and loss (p&l). Before every 30th september tax returns needs to be filed, which is at the end of every assessment year. The financial statement must be filed within.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)