Simple Tips About Market Value Balance Sheet Example The Four Basic Financial Statements

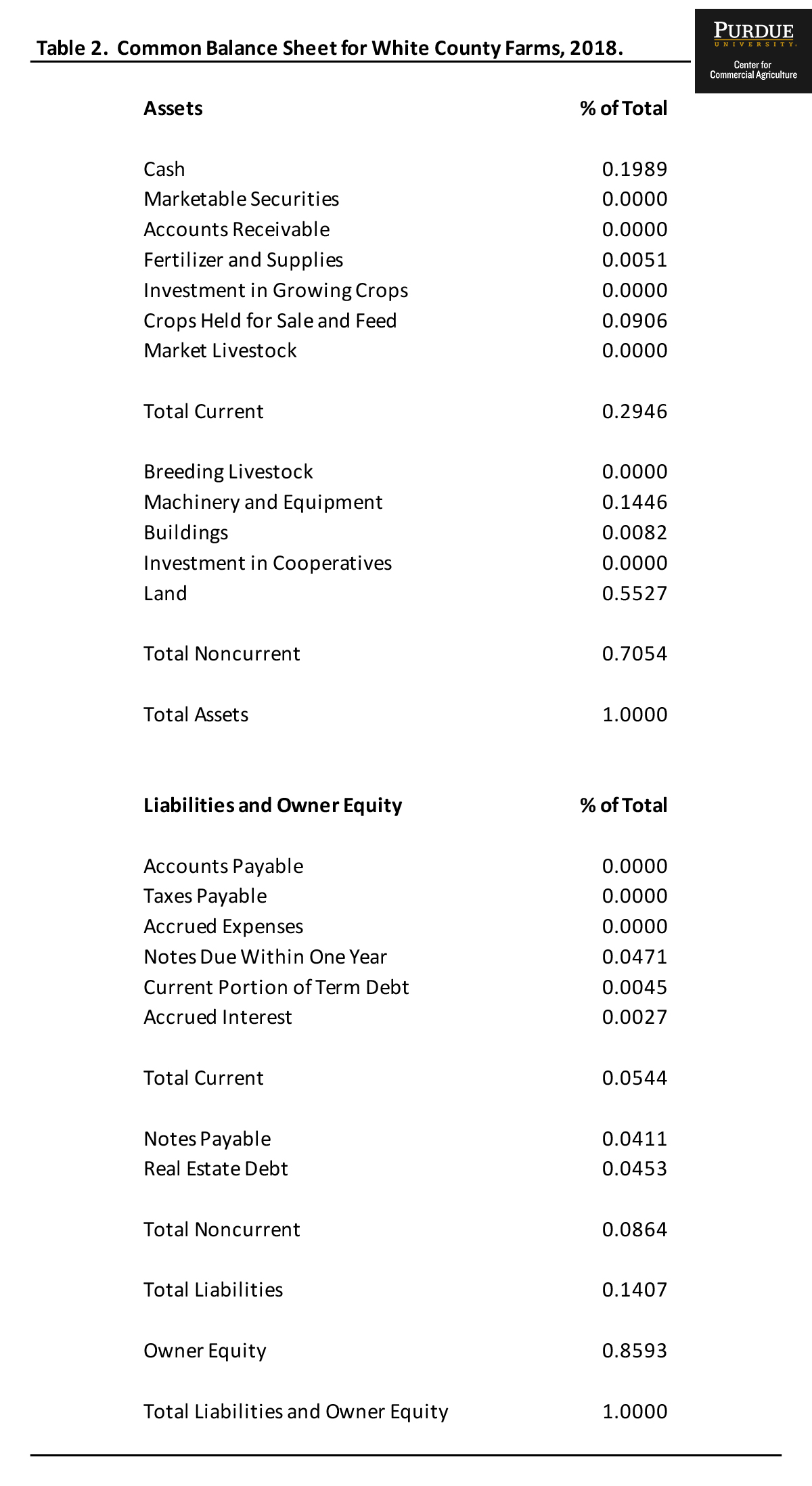

Historical cost, market value or lower of cost or market.

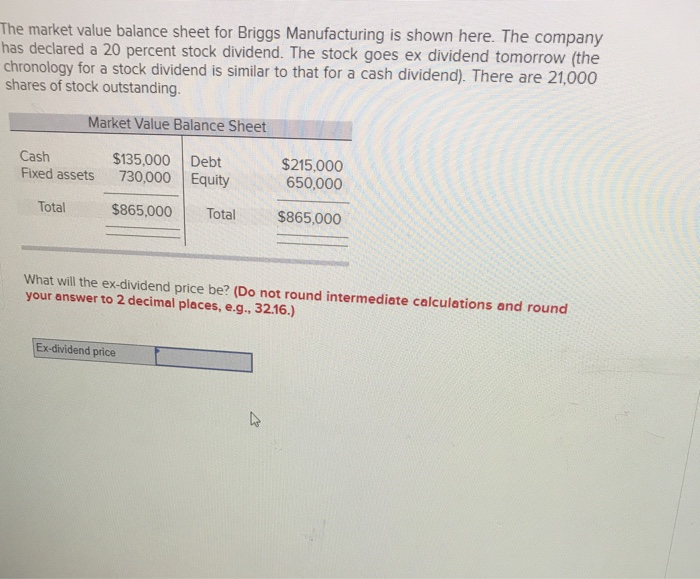

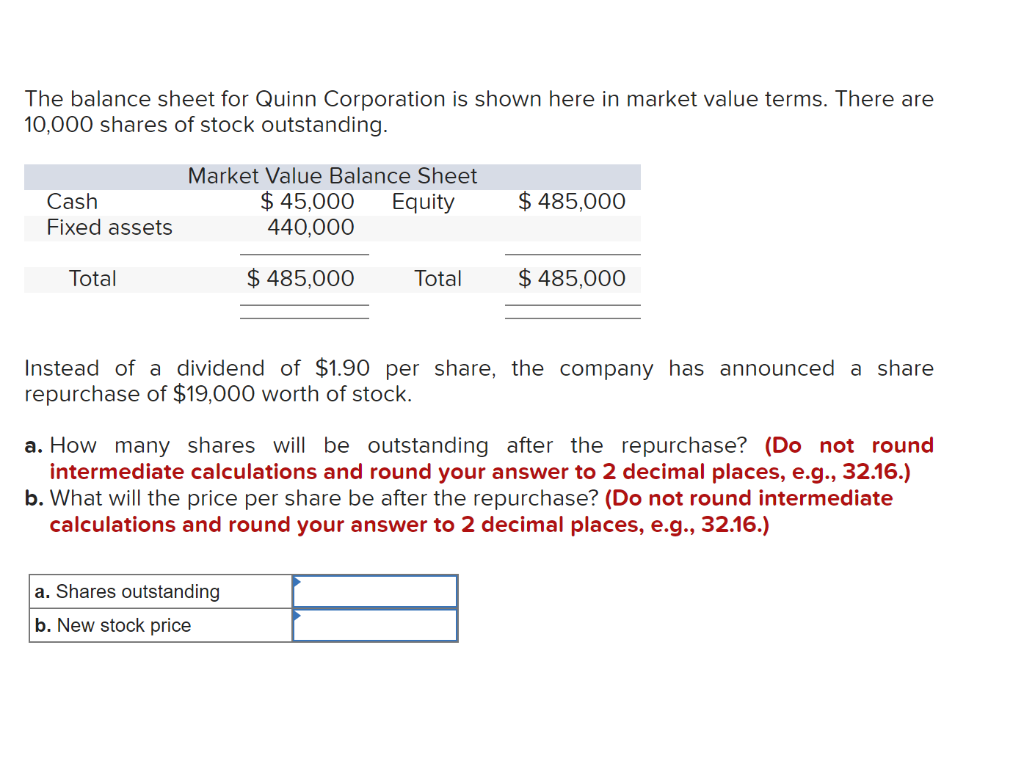

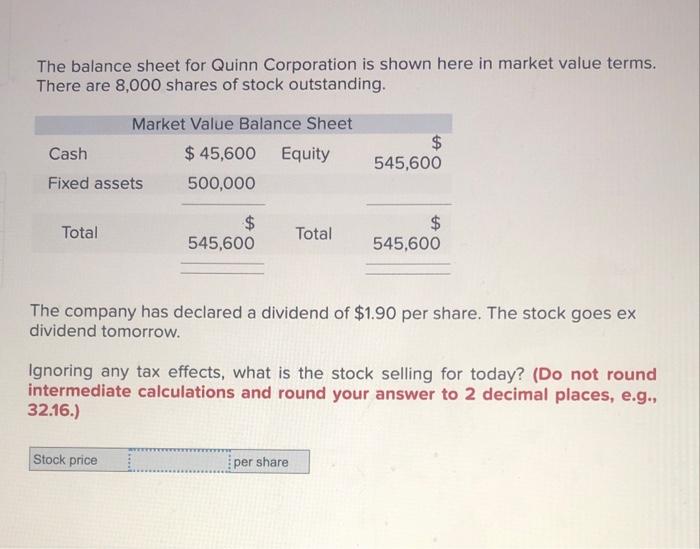

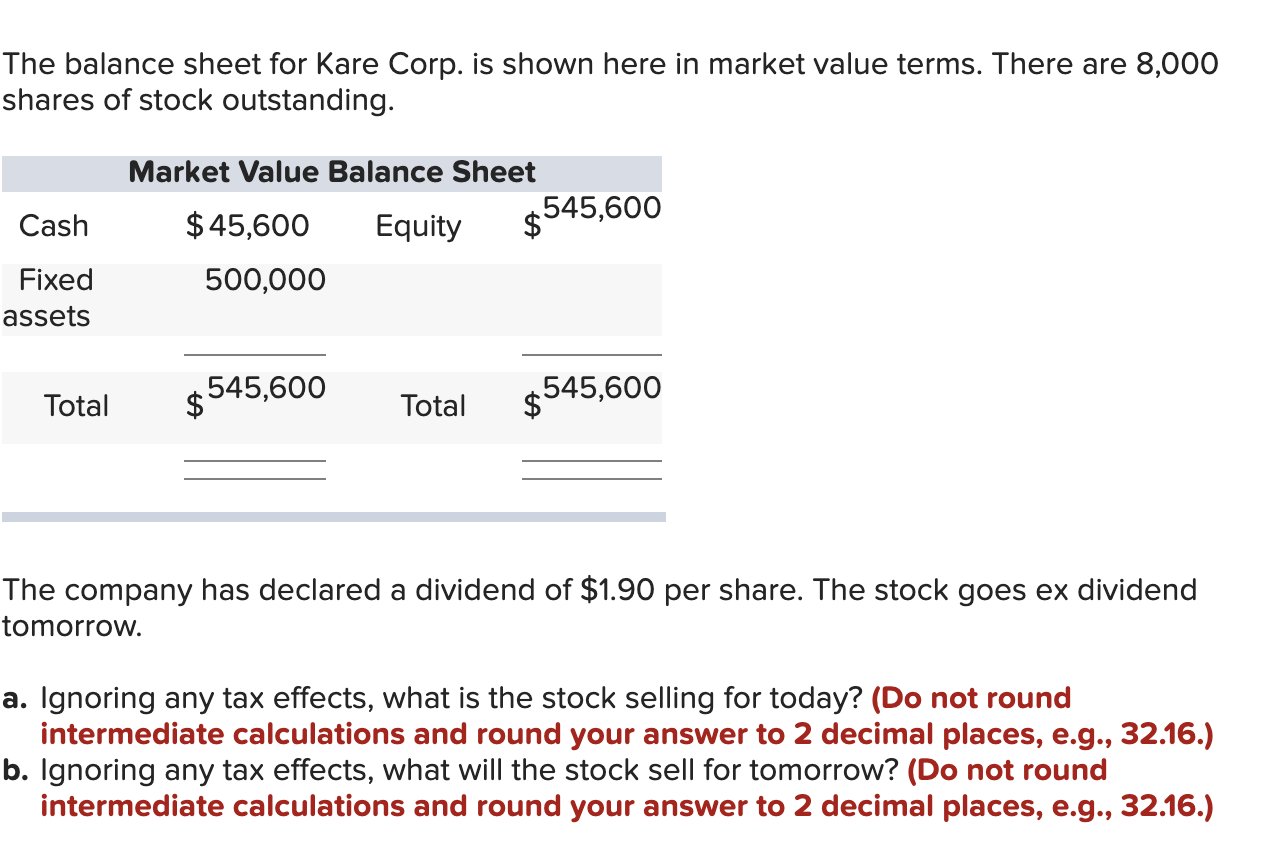

Market value balance sheet example. For example, if company xyz has total assets of $100 million and total liabilities of $80 million, the book value of the company is $20 million. The valuation account is used to adjust the value in the trading securities account reported on the balance sheet. The market value of a good is the same as its market price only when.

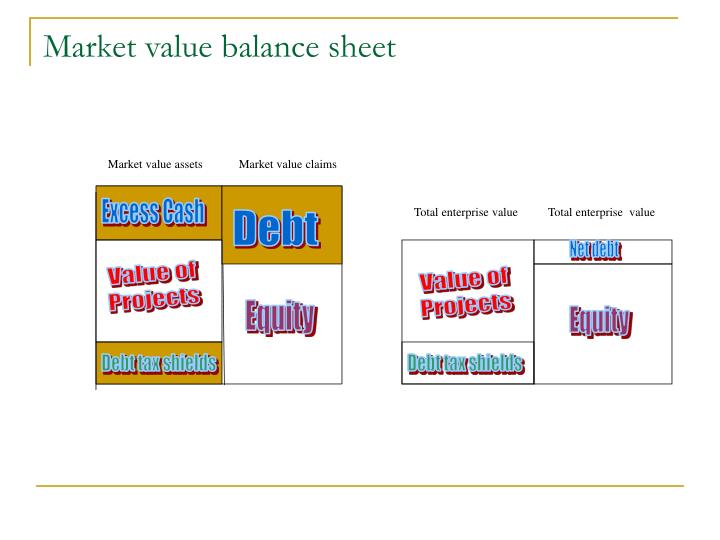

This refers to items of monetary value. The book value is the amount that would be left. In this video, i show a simple example in excel to illustrate the difference between a balance sheet expressed in book values and a balance sheet expressed i.

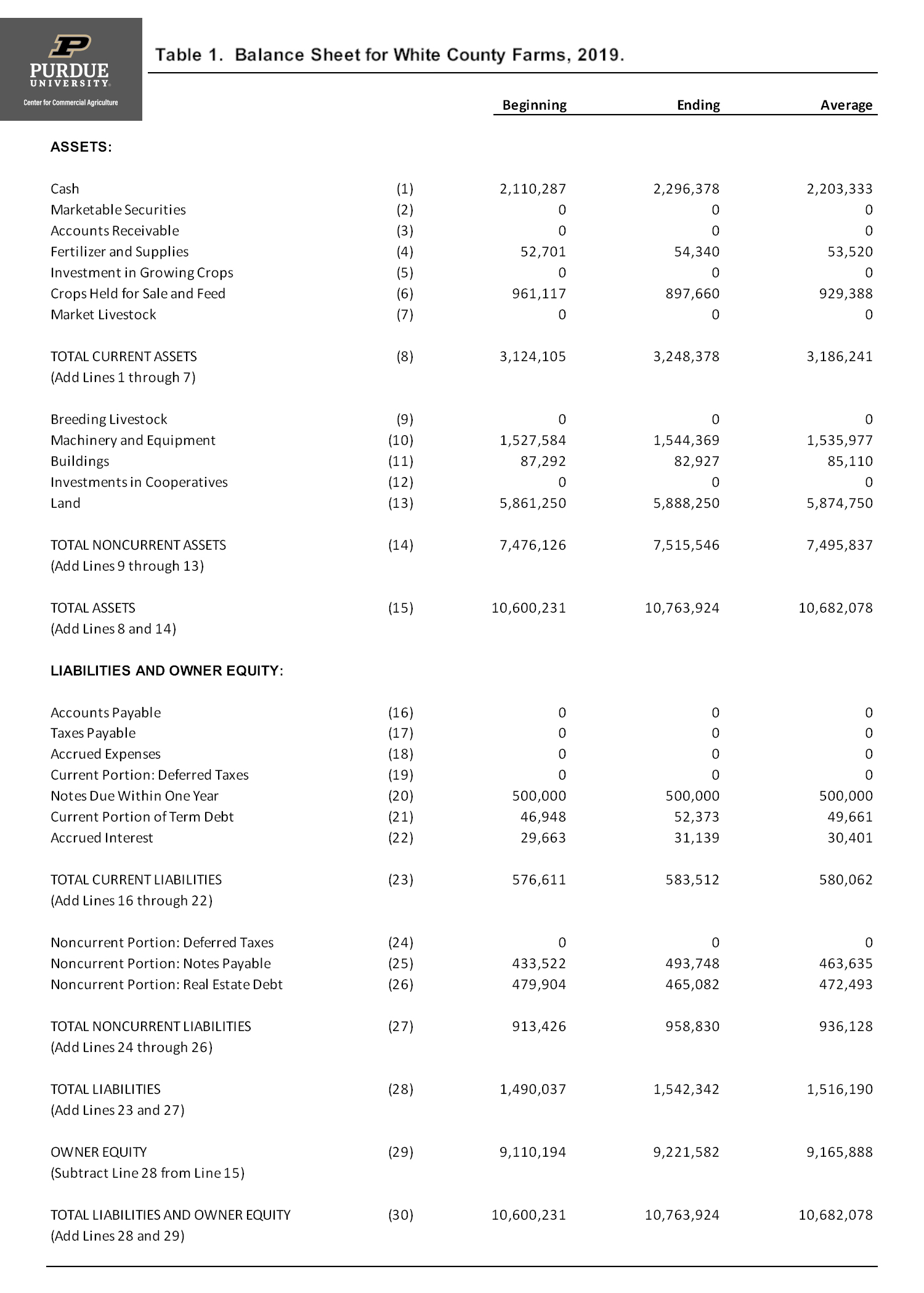

If a firm will produce shirts, for example, it will need equipment such as. If the company’s book value exceeds its. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

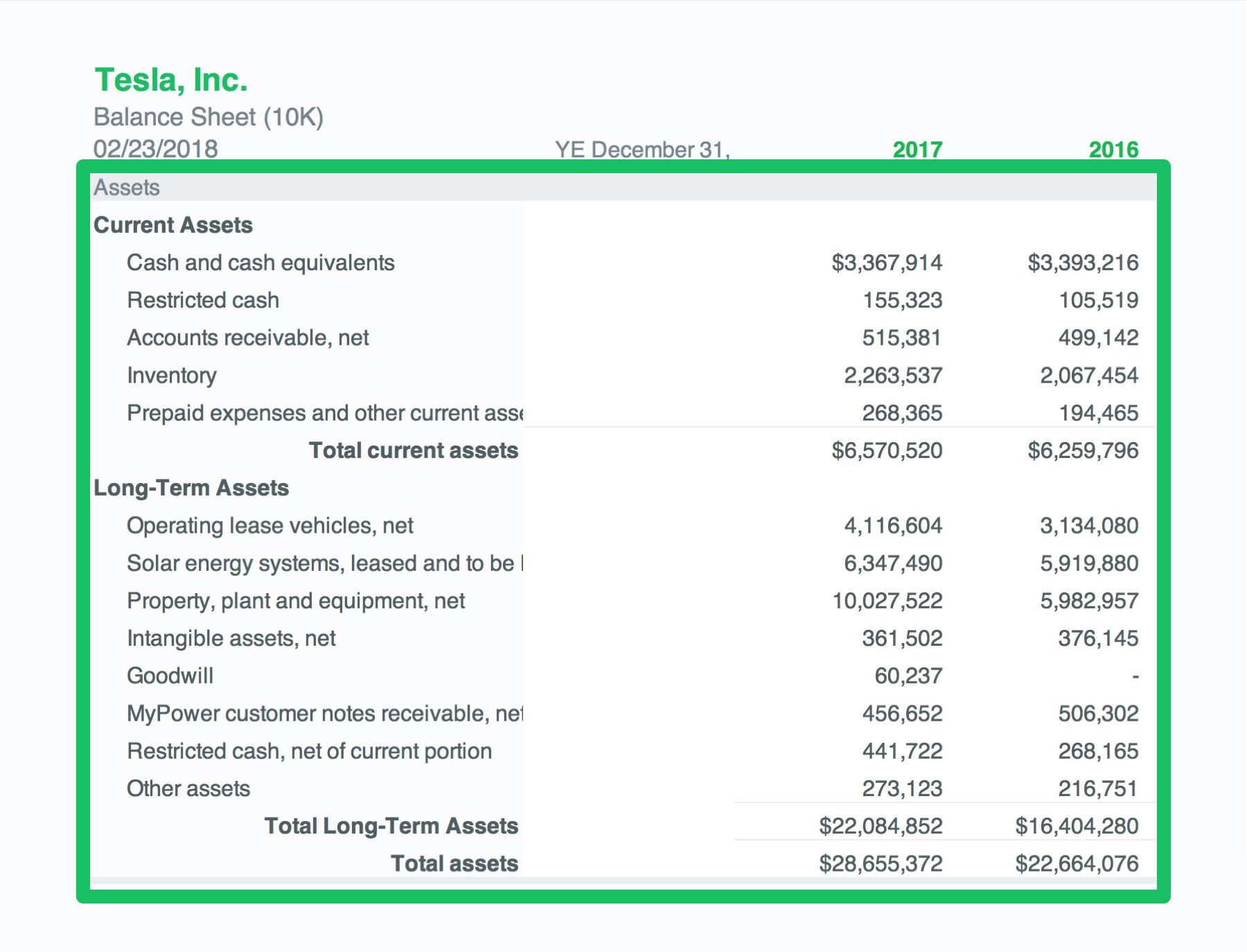

Balance sheet example. For example, one of the key applications of the difference between an asset’s book and market values is the company’s valuation. The market value is the current stock price of all outstanding shares (i.e.

Ways of measuring the value of assets on the balance sheet include: Guide with examples deskera content team table of contents market value ratios are important to track the share values of a company. Market value is usually used to describe how much an asset or company is worth in a financial market.

As fixed assets age, they begin to lose their value. For example if the brothers quartet, inc. Historical cost is typically the purchase price of.

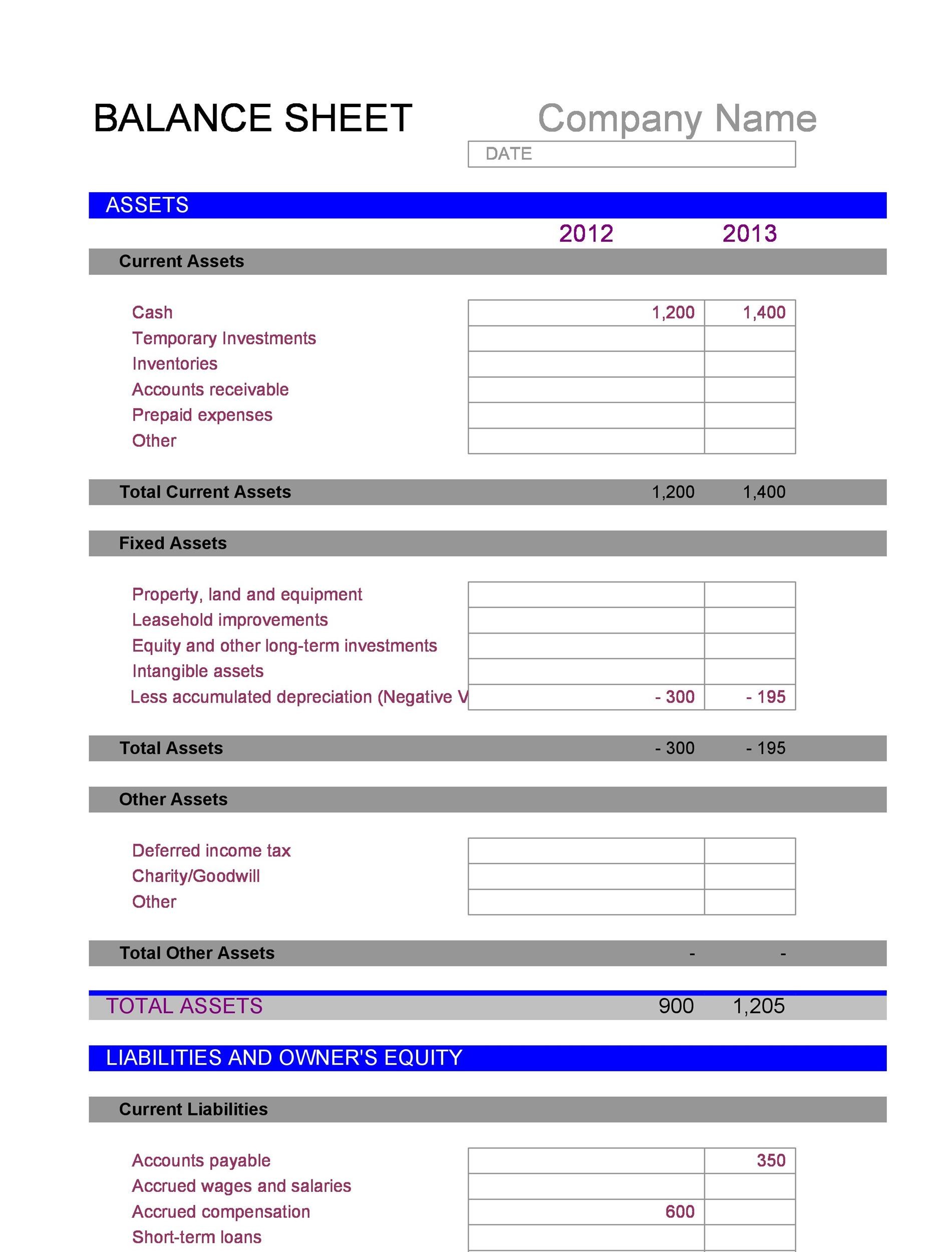

Fair value accounting gives you the estimated value of an asset or liability at today's current market price. To illustrate the fact, let’s consider the example below: The basic balance sheet in order to produce and sell its products or services, a company needs assets.

Here's an example for how to determine fair value. The price that the market believes the company is worth). A fair market value balance sheet is not often used in business today because assets are usually listed based on their costs minus depreciation, rather than.

Here is an example of a balance sheet as of december 31, 2022. Fair value accounting reflects the current prices of the items in the balance sheet items in the balance sheet assets such as cash, inventories, accounts receivable, investments,. Assets = liabilities + equity let's review what these parts mean individually:

You see, the balance sheet typically shows the historical cost of. In a very broad sense, this means.