Sensational Info About Common Size Cash Flow Profit Excel Template

Moreover, this analysis facilitates decision.

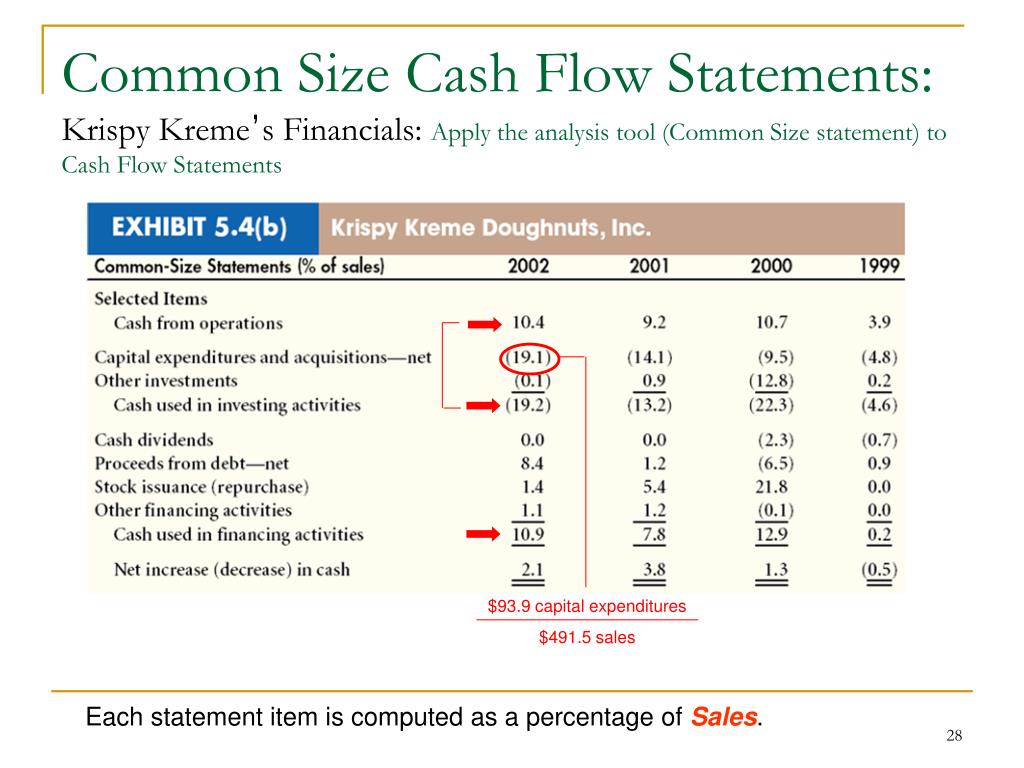

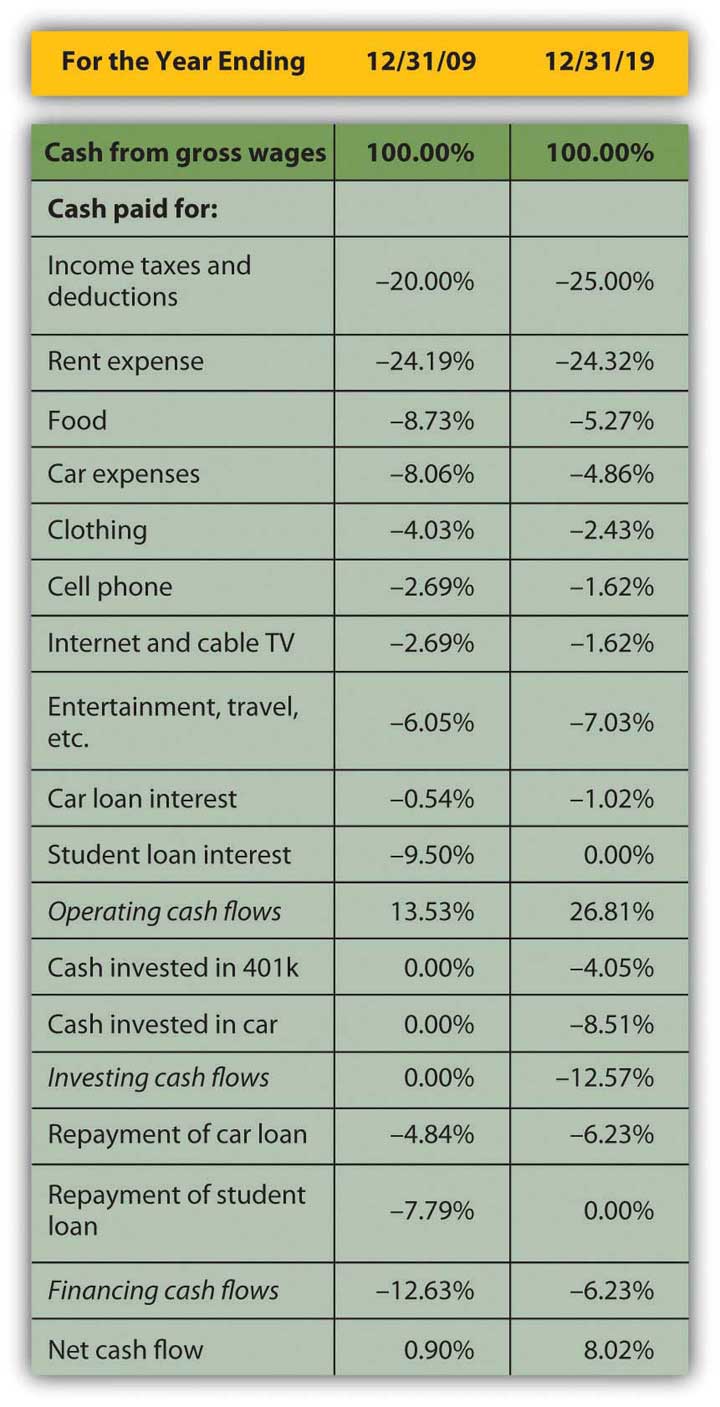

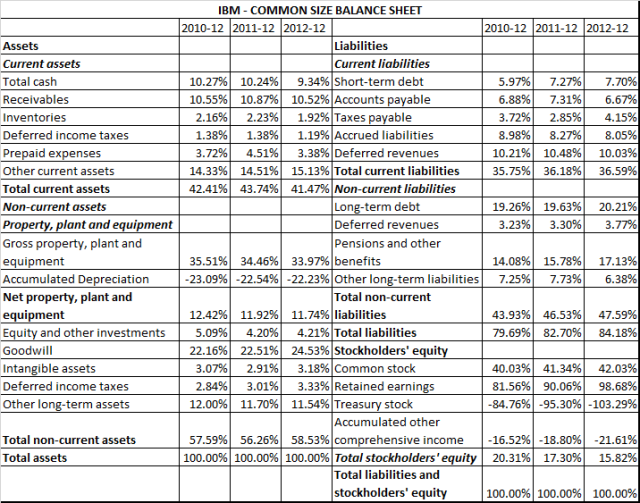

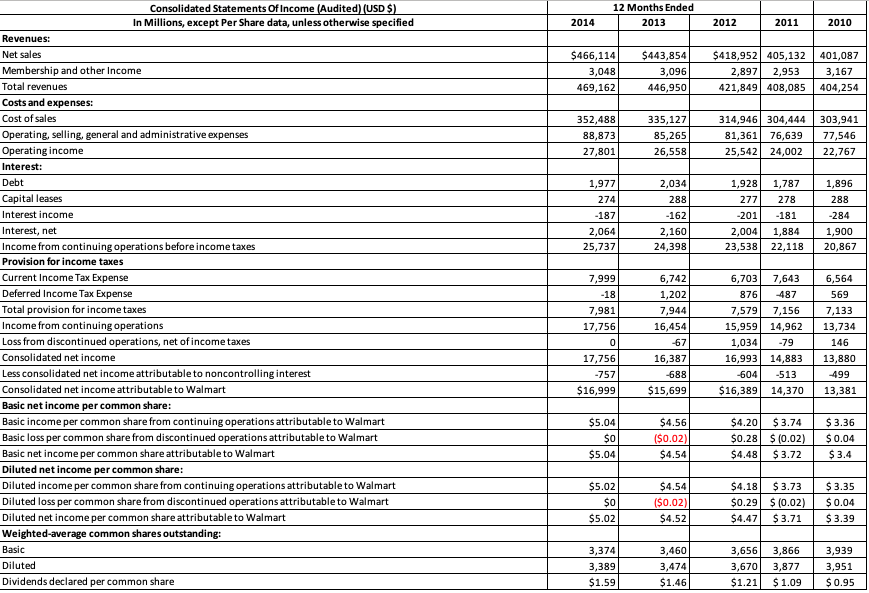

Common size cash flow. Komponen laba rugi ⁄ pendapatan bersih × 100%. The common size ratio is used as a tool for analyzing the company's financial statements, such as the statement of profit and loss, balance sheet, and cash flow. Common size analysis can also be performed on the balance sheet, the cash flow statement, and the retained earnings statement.

It is used for vertical. Percentage of overall base figure = (line item / overall base figure) x 100 in this formula, the percentage of the base is the. Could that mean that the company’s plant is too old and depreciated?

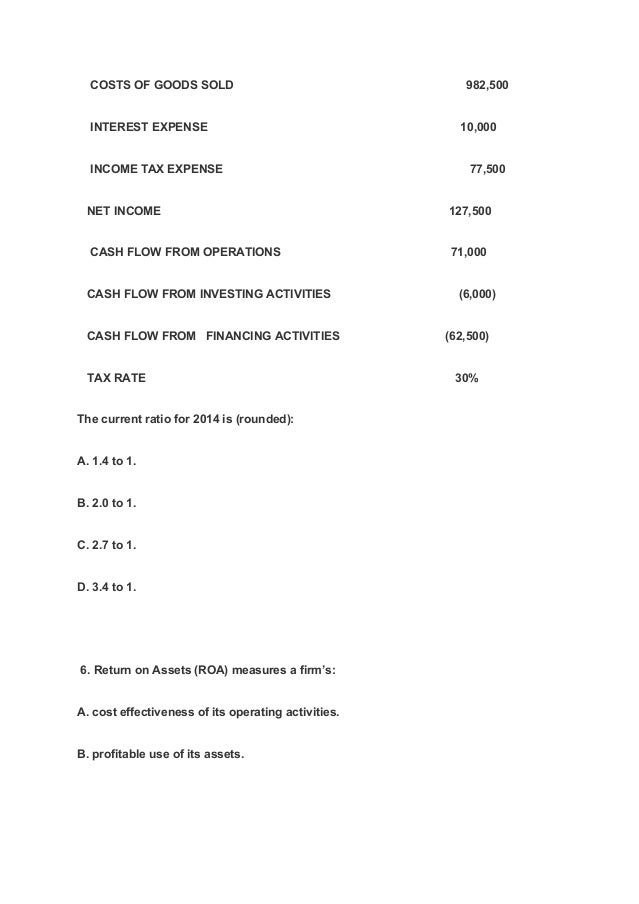

Global common size ratios global common. Total income on the income statement, total positive cash flow on the cash. The common size ratio refers to any number on a business’ financial statements that is expressed as a percentage of a base.

A common size income statement is an income statement in which each line item is expressed as a percentage of the value of revenue or sales. Rumus laba rugi common size: One can identify key trends, patterns, and relationships within the financial statements by using common size analysis.

Sementara itu, dalam laporan neraca, formula untuk menghitung common size. This is a free excel template displaying how to convert a. Total income on the income statement, total positive cash flow on the cash.

Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year.

:max_bytes(150000):strip_icc()/IBMCashFlowCommonAnalysis-3e1a06ef5711419db8a7db93b9f56f35.jpg)