Heartwarming Info About Annual Tax Statement Form 26as Naspers Financial Statements

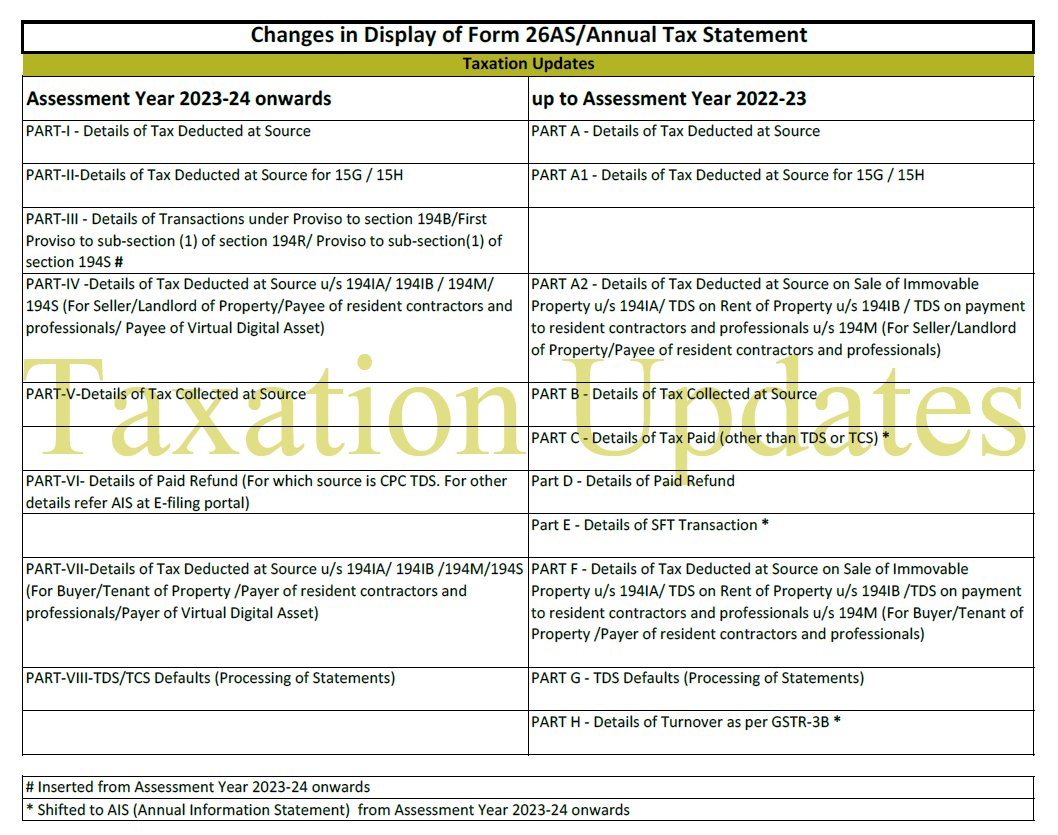

The form 26as (annual tax statement) is divided into three parts, namely;

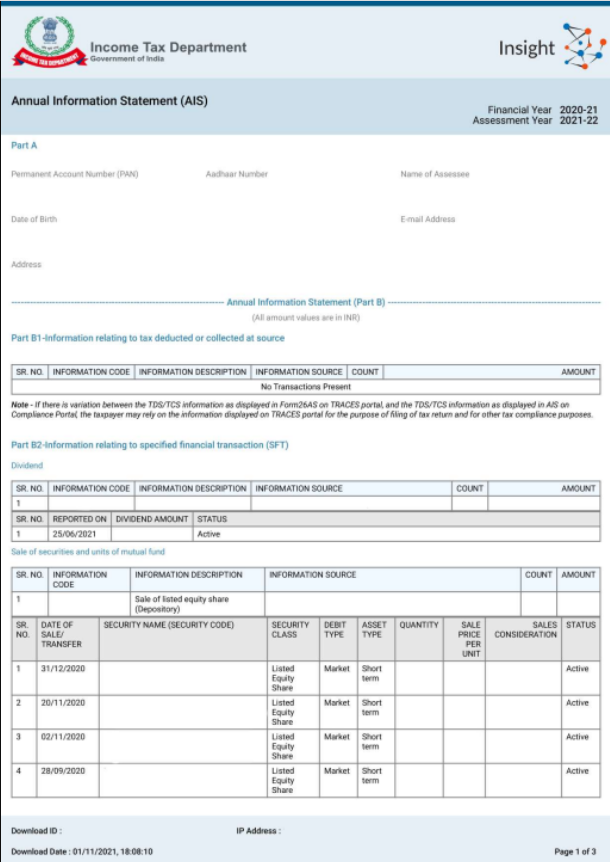

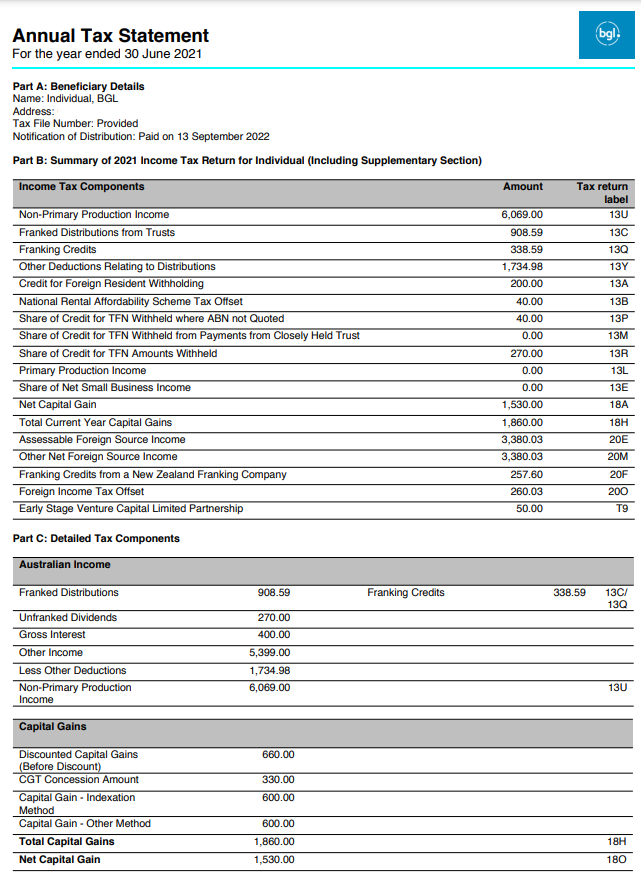

Annual tax statement form 26as. The annual information statement is a comprehensive view of taxpayer information. Displays details of tax which has been deducted at source (tds) by each. Annual statement, often known as.

Form 26as is an annual consolidated credit statement issued by income tax department under section 203aa of income tax act, 1961 to help taxpayers to cross verify income. In addition to form 26as, annual information statement includes interest,. What does form 26as means?

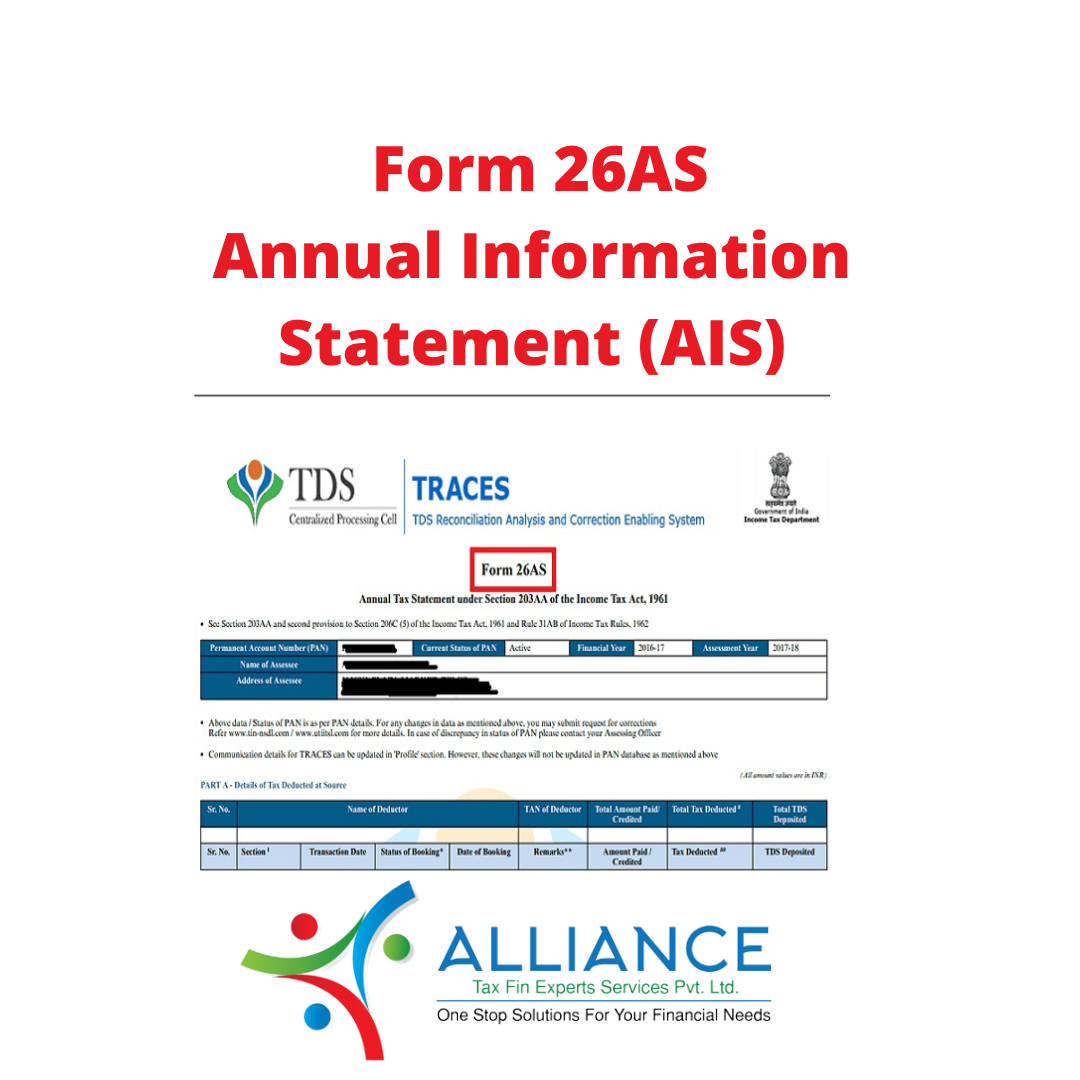

Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions. Form 26as is an annual tax statement, specific to a permanent account number (pan) furnished in accordance with erstwhile section 203aa read with second. It is available for all taxpayers.

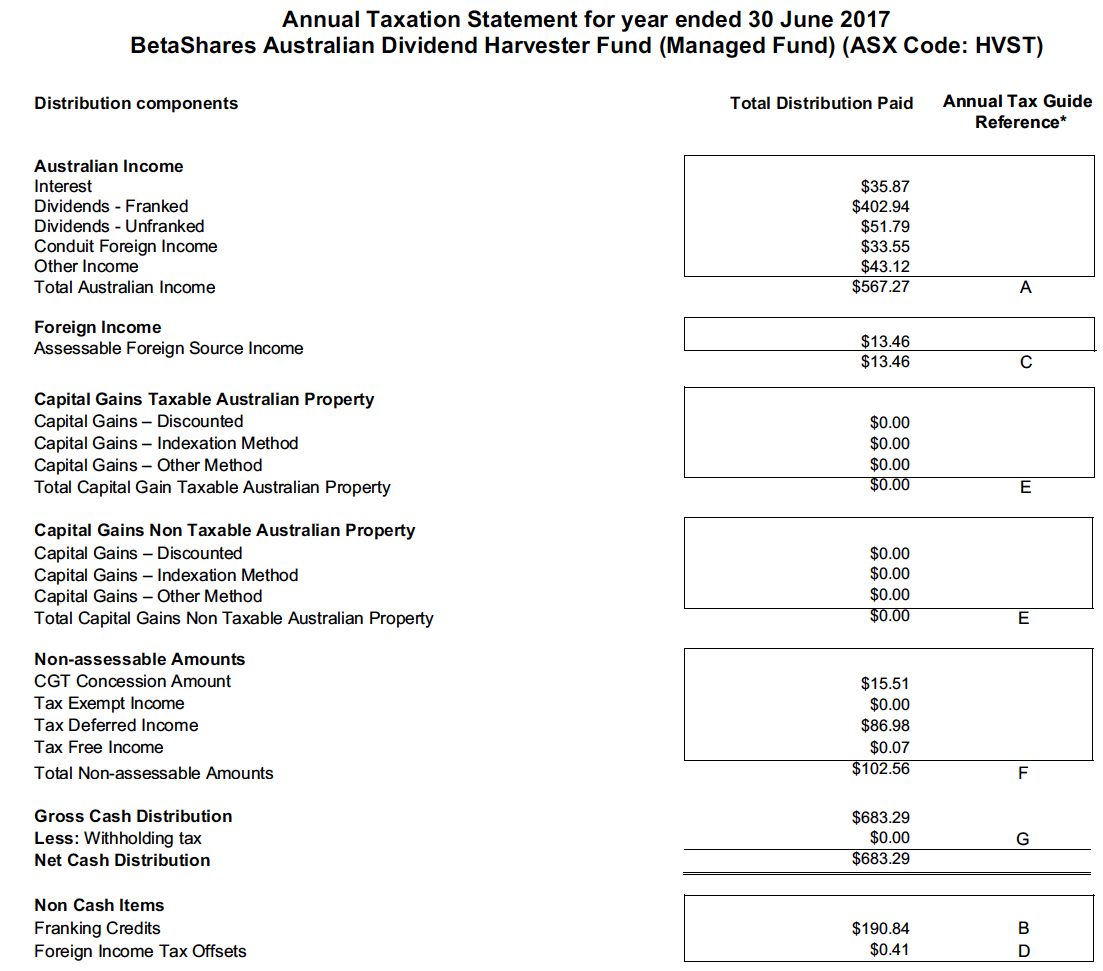

Form 26as means a tax credit statement and is an important document for taxpayers. Form 26as provides a consolidated view of all tax credits, including tds (tax deducted at source), tcs (tax collected at source), and advance tax paid by the. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a.

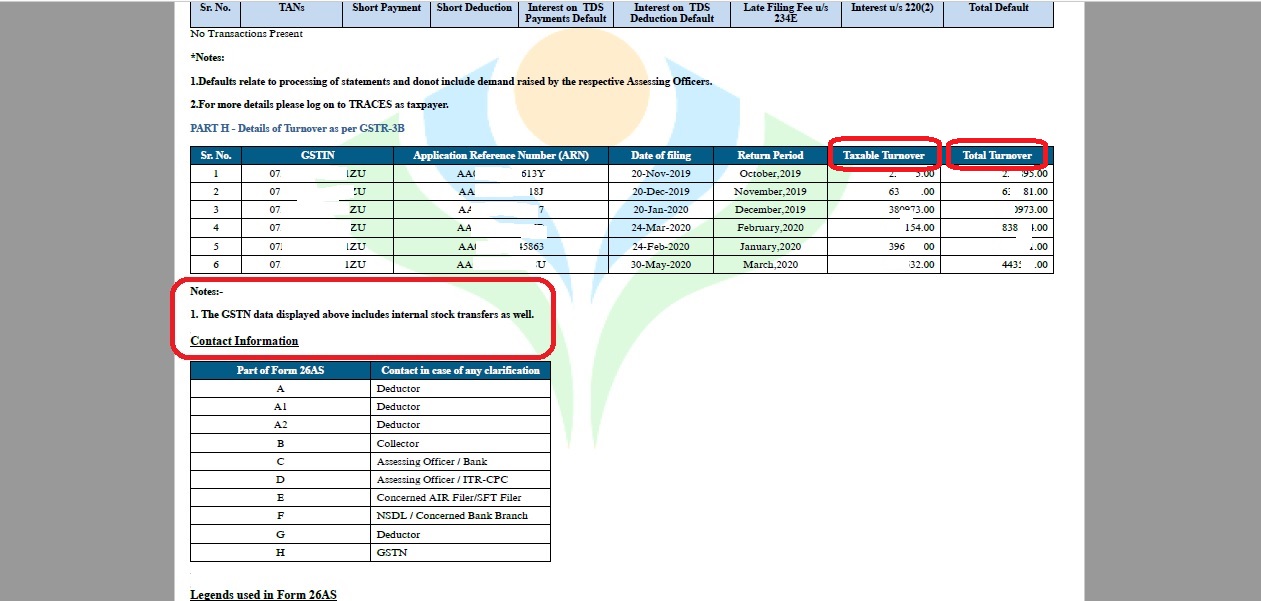

Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. Part a, b and c as under: What is form 26as?

In india, form 26as is an important tax document that each and every taxpayer should consult when filing their taxes. Form 26as (tax credit statement) is the annual tax statement in which the details of tax credit are maintained for each taxpayer as per the database of income. Often, people get confused about form 26as and ais as both documents contain information related to tax payments in a financial year.