Amazing Tips About Cash Flow Sources And Uses Kgid Balance Sheet

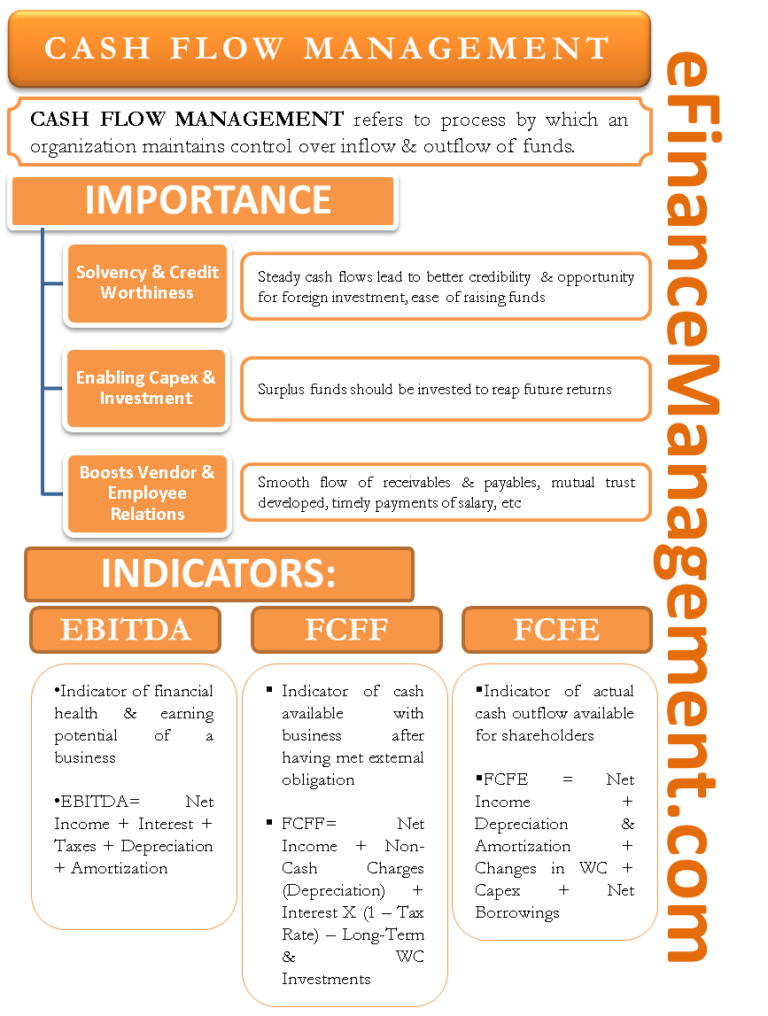

Cash flow sources can be divided into three different categories on a cash flow statement:

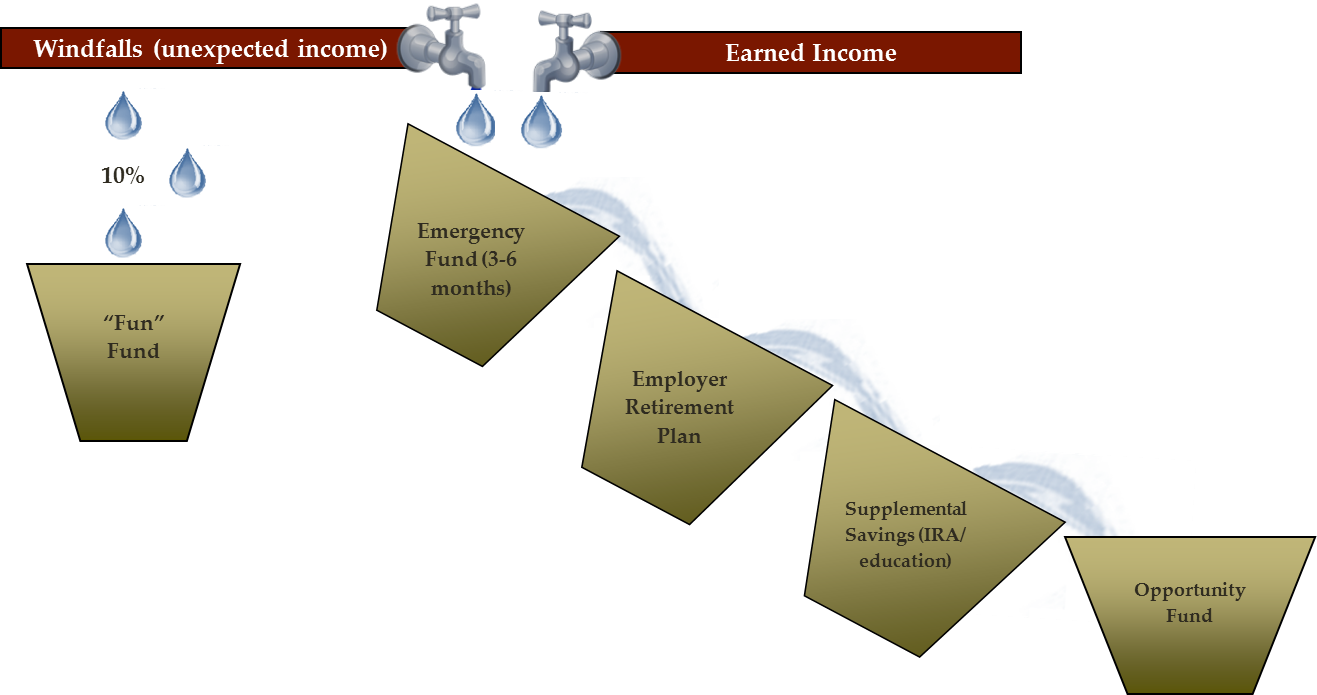

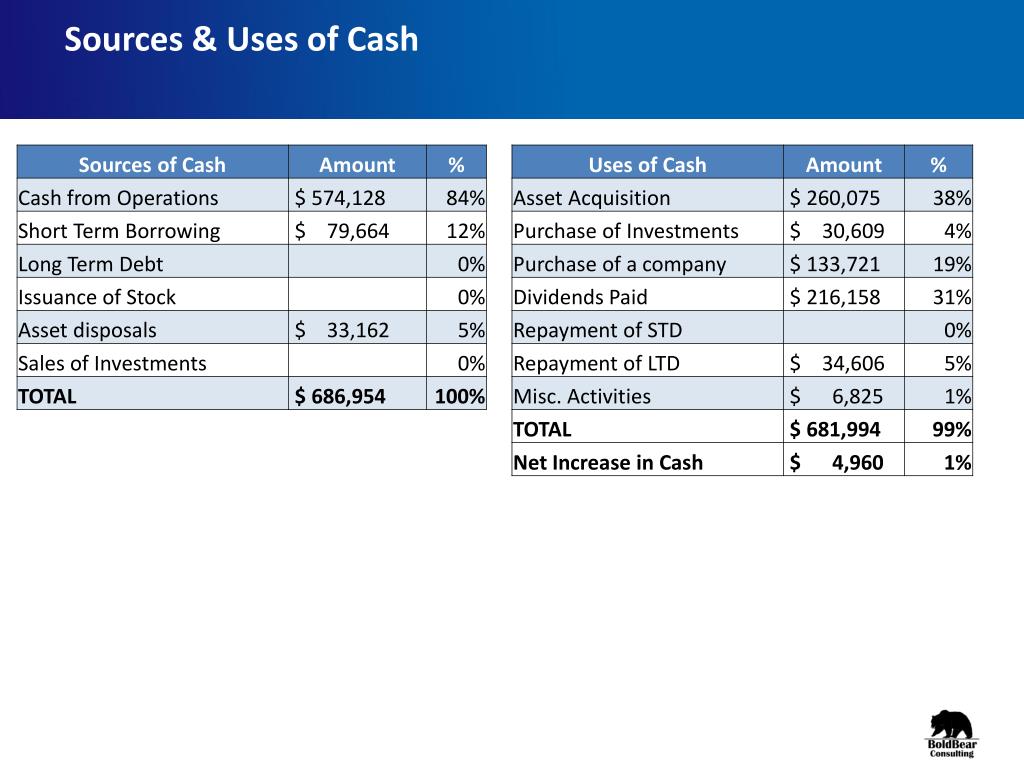

Cash flow sources and uses. The cash flow statement. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out. If sources > uses, plug with the use category “cash flow distribution.” if sources < uses, plug with the source category “additional equity required.” apply for financing major.

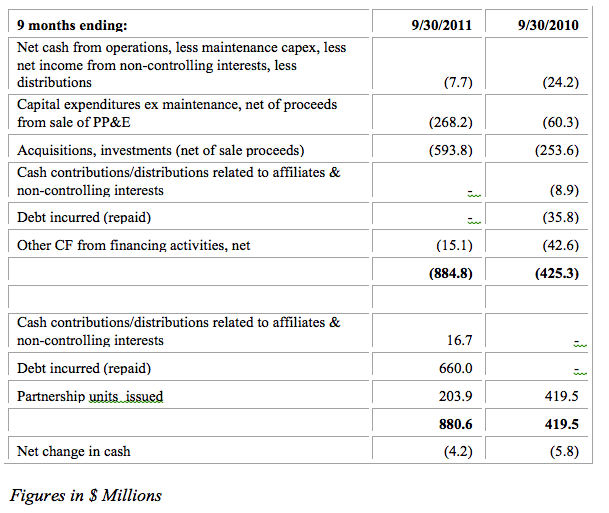

Cash flow is a measure of the money moving in and out of a business. These three sources align with the. Sources and uses of cash schedule is essential for balancing the total inflows (sources) and outflows (uses) of cash, reflecting a company's financial health.

The final financial statement is the. A cash flow statement is a financial statement that illustrates the sources and uses of cash during a specified period. Here is an example of a sources and uses schedule.

The two sides must equal each other. In broader terms, the sources of cash flow include the following − profitable operations of a firm decrease in assets except cash proceeds from sale of ordinary. Assets are typically a source of cash as they can be sold.

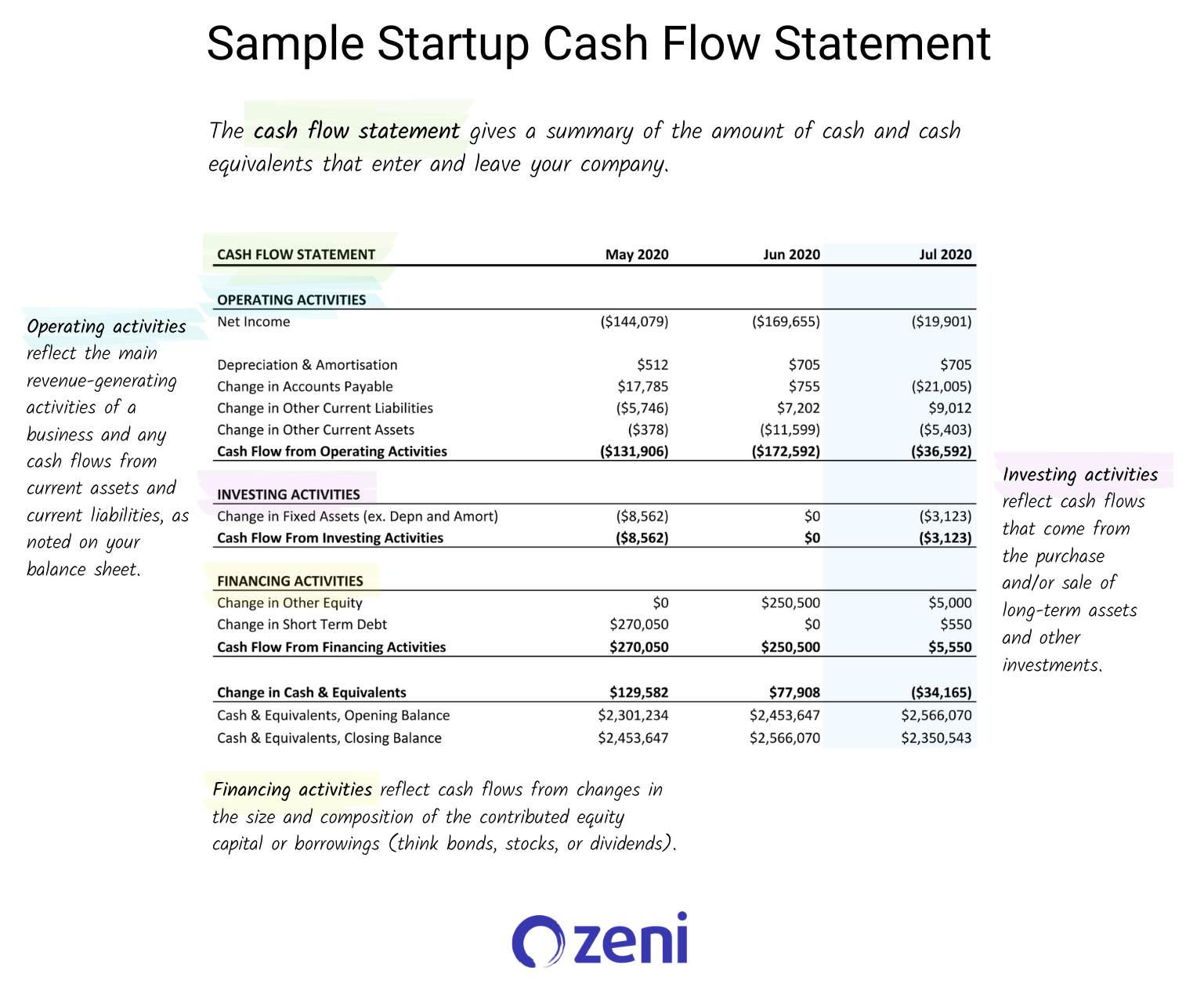

Overview of the statement of cash flows the statement of cash flows (scf) shows the sources (inflows) and uses (outflows) of cash during a fiscal period. Cash flows from operating activities: Cash generated from the general.

Identify the structure and key elements of the statement of cash flows. It gives valuable insight into an. Cash flow represents revenue received — or inflows — and expenses spent, or outflows.

Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in. Balancing these sources is crucial for. Outline the purpose and importance of the statement of cash flows.

Cash flow from investing activities is an item on the cash flow statement that reports the aggregate change in a company's cash position resulting from any gains. The cash flow statement is typically broken into three sections: Operating activities investing activities financing activities operating activities detail cash flow.

The statement of cash flows identifies the sources of cash as well as the uses of cash, for the period being reported, which leads the user of the financial statement to the period’s. The table illustrates the sources and uses of cash in a transaction. The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period.

It’s essential because it mirrors your financial health and is the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)