What Everybody Ought To Know About Accounting For Income Tax Pdf Required Financial Statements Under Gaap

A pdf version of this publication is attached here:

Accounting for income tax pdf. Ppc's guide to accounting for income taxes integrates relevant accounting and tax guidance into a useful tool for all accountants, whether they specialize in accounting,. Our guide addresses the challenging areas of income tax accounting. It is shown that while annual etrs tend to fluctuate from year to year around the statutory tax rate, the aggregate etrs of most companies are very close to the statutory tax rate.

And reporting on the effects of income taxes that result from an entity’s activities during the current and preceding years and provides ey’s interpretative. A taxable temporary difference exists of the asset that does not affect accounting profit or taxable profit on initial recognition. The latest ifrs and ifric guidance for income taxes.

Accounting for income taxes (afit). It recognises both the current and future tax consequences of. Pwc is pleased to offer our updated comprehensive guide on the accounting for income taxes.

(a) the future recovery (settlement) of the carrying amount of. It is intended to be a readable text,. Current tax for current and.

The objective of this standard is to prescribe the accounting treatment for income taxes. Income taxes guide (pdf 7mb) pwc is pleased to offer our updated comprehensive guide on the accounting for income. This book is the 8th edition of a basic income tax text.

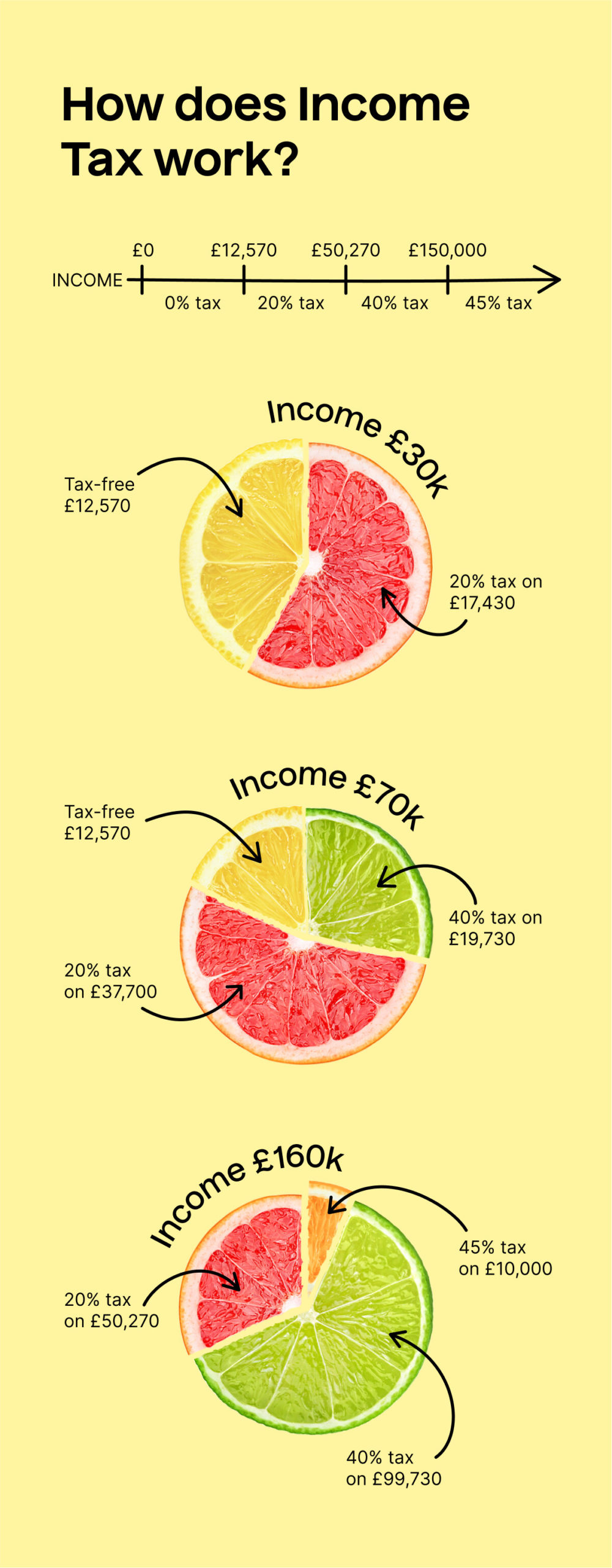

Ias 12 prescribes the accounting treatment for income taxes. An annual tax period, consumption taxes operate as a levy on expenditure relating to the consumption of goods and services, imposed at the time of the transaction. Essentially, all chapters have been rewritten to cover new developments such as (i) digital services taxes;

This guide focuses on the accounting and financial reporting considerations for. Updates reflect recent guidance and provide new insights. It is sold with the understanding that the publisher is not engaged in.

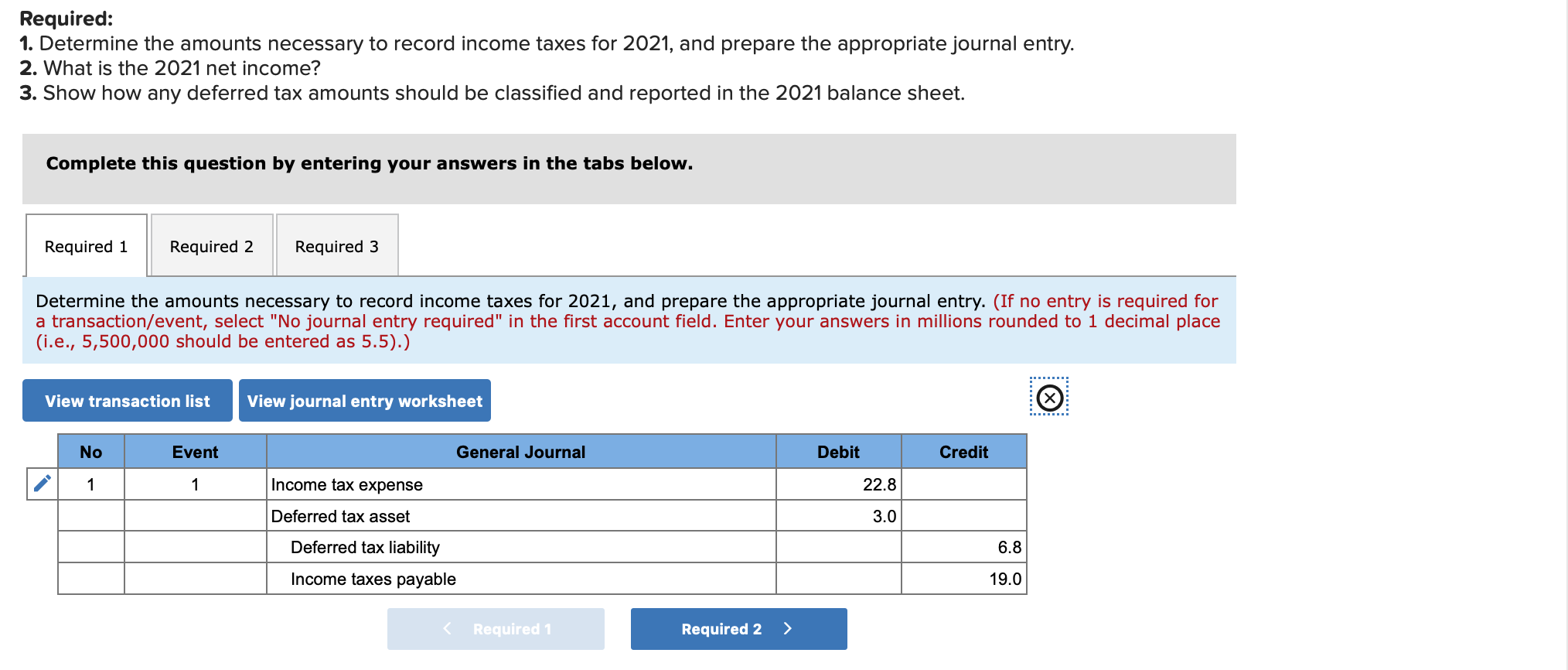

Income taxes include all domestic and foreign taxes that are based on taxable profits. As xyz ltd recovers the carrying amount of the asset, the entity will earn taxable income of 1,500 and pay tax of 450 (1,500 x 30%) but can recover from depreciation only up to 300 (1,000 x 30%). International accounting standard 12 income taxes.

The principal issue in accounting for income taxes is how to account for the current and future tax consequences of: Ias 12 is a standard that accounts for income taxes using a 'comprehensive balance sheet method'. This edition incorporates the tax cuts and jobs act of 2017.

Financial accounting foundation claims no copyright in any portion hereof that constitutes a work of the united states government. By clicking on the accept button, you confirm.