Inspirating Tips About Debit Balance In Profit And Loss Account Means Uk

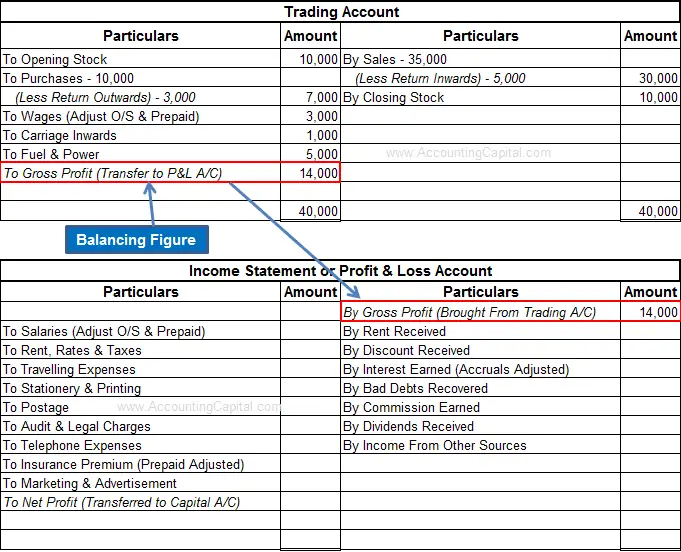

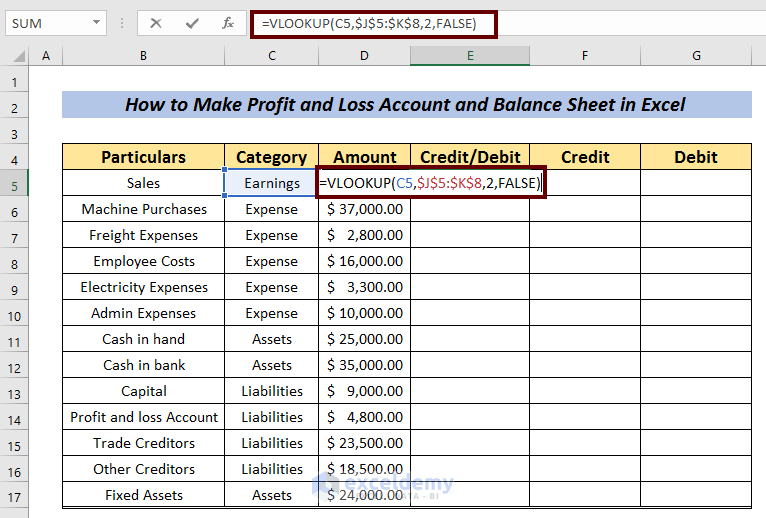

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a.

Debit balance in profit and loss account means. This debit balance is called net loss. There are several meanings for the term debit balance that relate to accounting, bank accounts, lending, and investing. The income side is in excess of the debit side i.e.

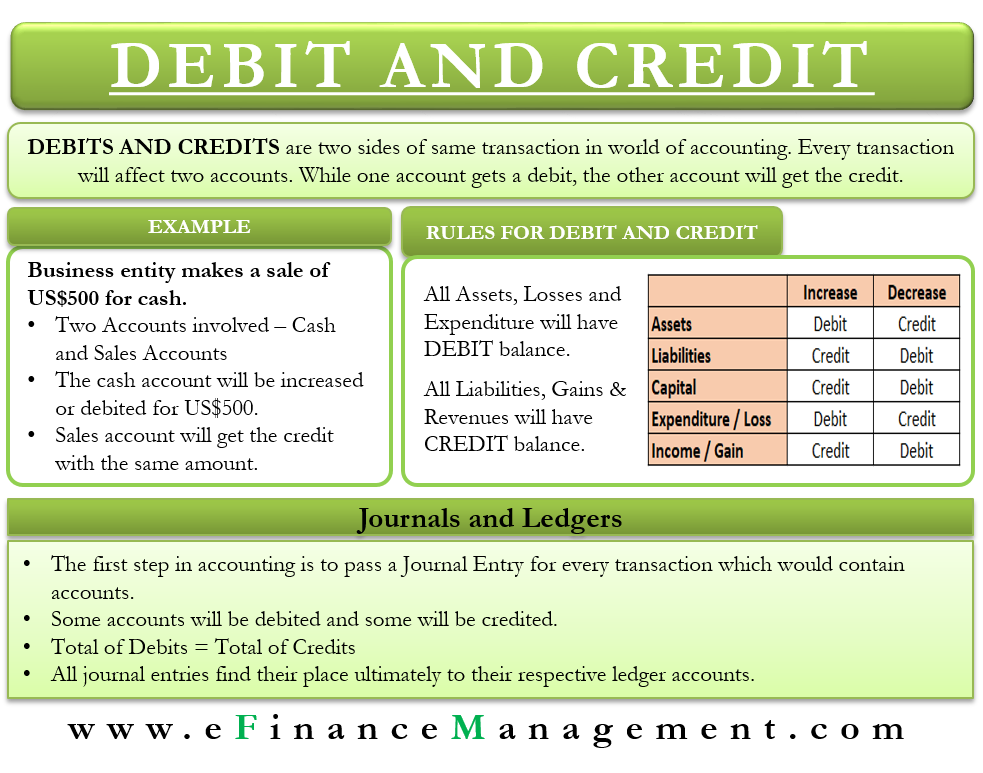

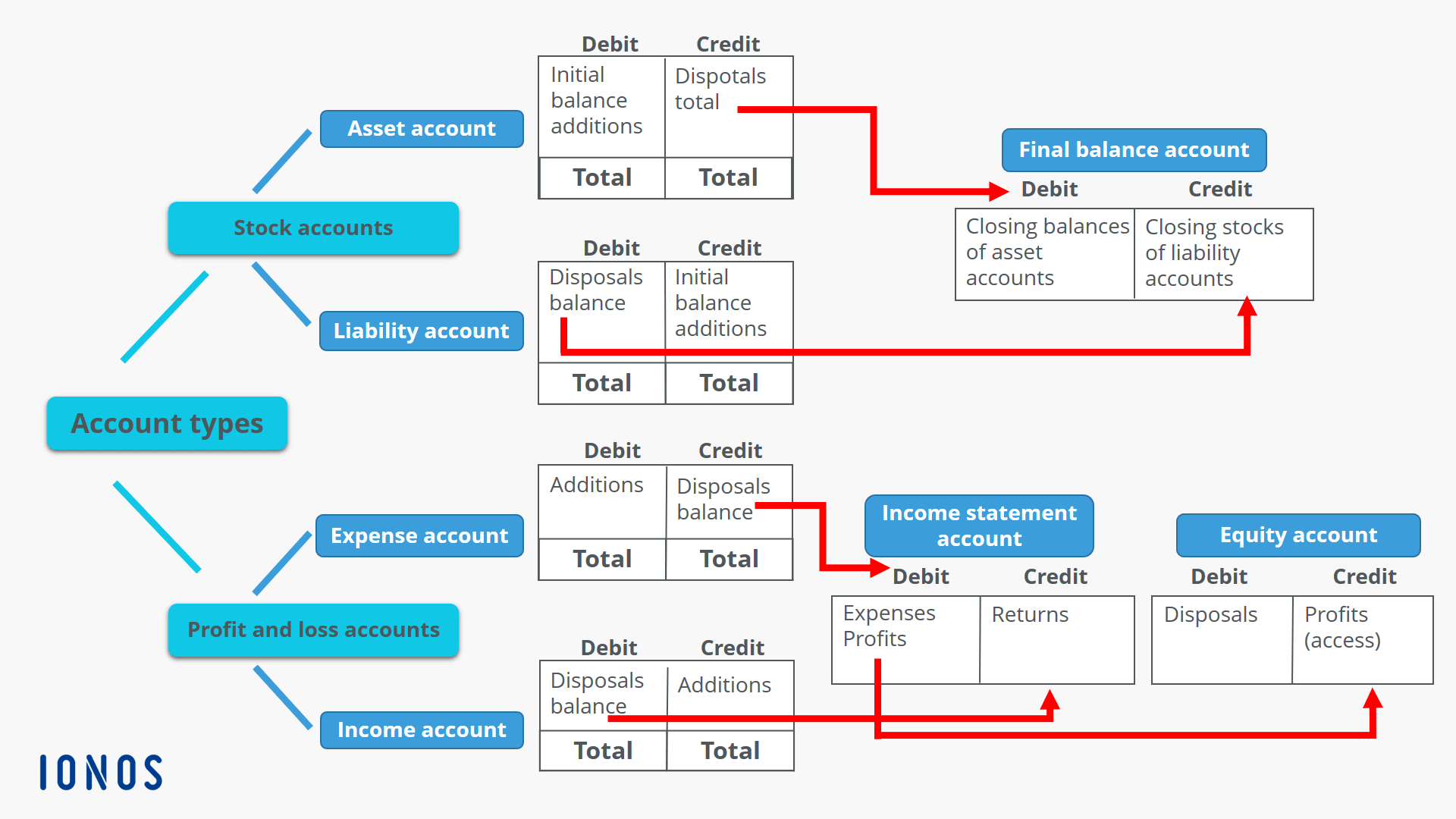

The expense side it is said to have earned a net profit. Balance of profit and loss appropriation account. Account balances of both the former and the latter form the basis for profit and loss accounts.

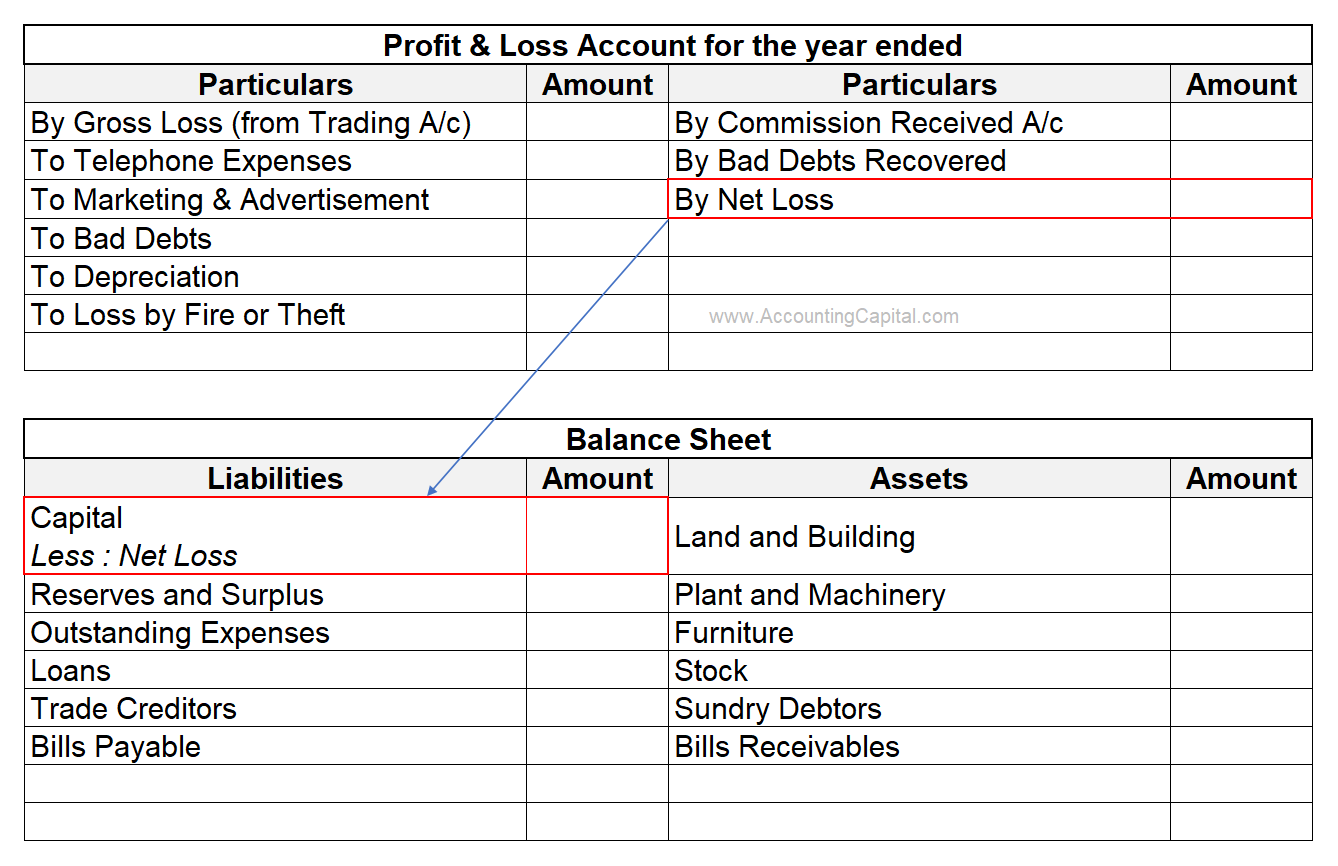

In a p&l account, when the expenses (debit) are greater than the incomes. Statutory requirements (companies act, partnership act or any other law) traditionally,. Debit balance of p/l ac means a loss to the firm!

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. December 16, 2023 what is a debit balance? From april 1, 2017, they decided to share.

So, if credit side > debit side, it is a credit balance. The debit balance, in a margin account, is the amount of money owed by the customer to the broker (or another lender) for funds advanced to purchase securities. It means that the indirect income.

In a company’s income statement if the credit side i.e. It is reflected as a negative amount, indicating the company has suffered losses. This reduction in equity signifies that.

This indicates that the company has not made enough money to cover its costs. A debit to the balance sheet is good (increasing an asset or reducing a liability) a debit to the profit and loss is bad (increasing an expense or reducing. A and b are partners sharing profits and losses in the ratio of 2:1.

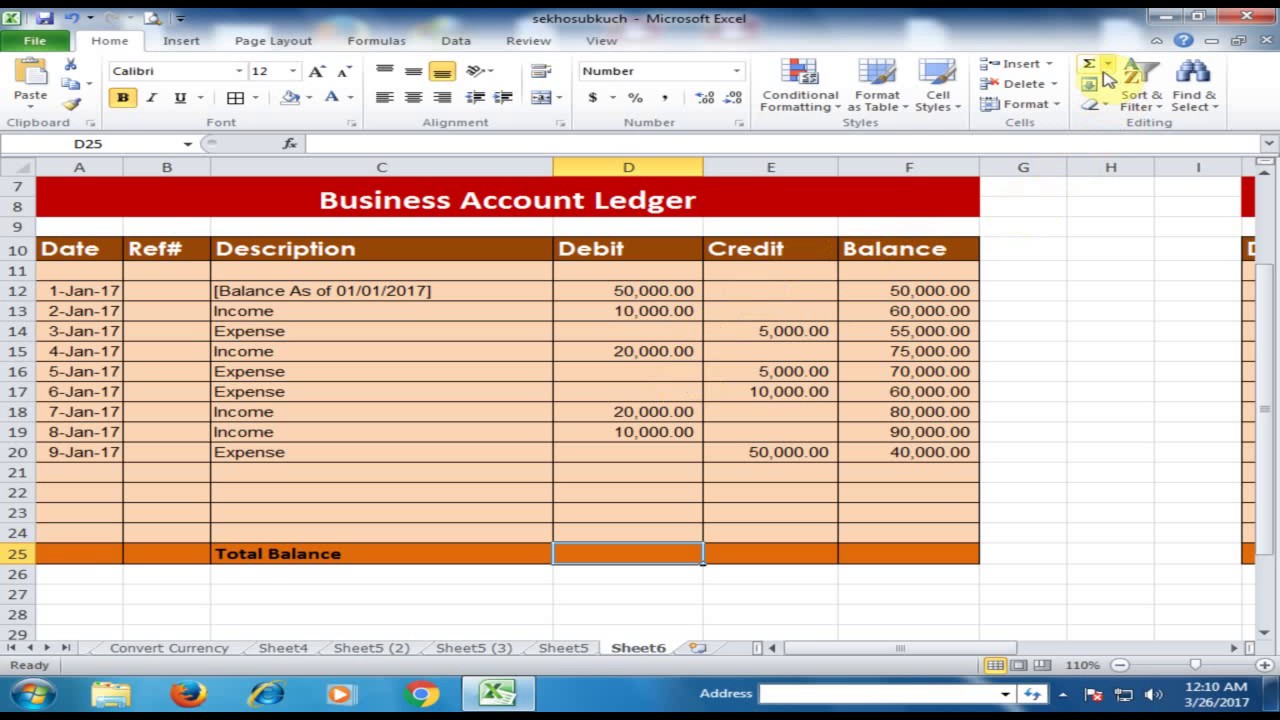

The balance of the credit side shown on the debit side of the profit and loss account is the net profit for the business for the particular accounting period for which. It is something that the firm is not liable to pay to the members of the firm (owners). The debit balance in the profit & loss account is ___________.

Definition of debit balance in accounting and bookkeeping, a debit balance is the ending amount found on the left side of a general ledger account or subsidiary ledger account. When the debit side of the profit and loss account is greater than the credit side, it is a debit balance. What is the profit and loss statement (p&l)?

Credit balance when the credit side is greater than the debit side the difference is called “credit balance”. At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital.