Awesome Info About Income Statement Administrative Expenses Understanding Profit And Loss

To calculate administrative expenses, follow these steps:

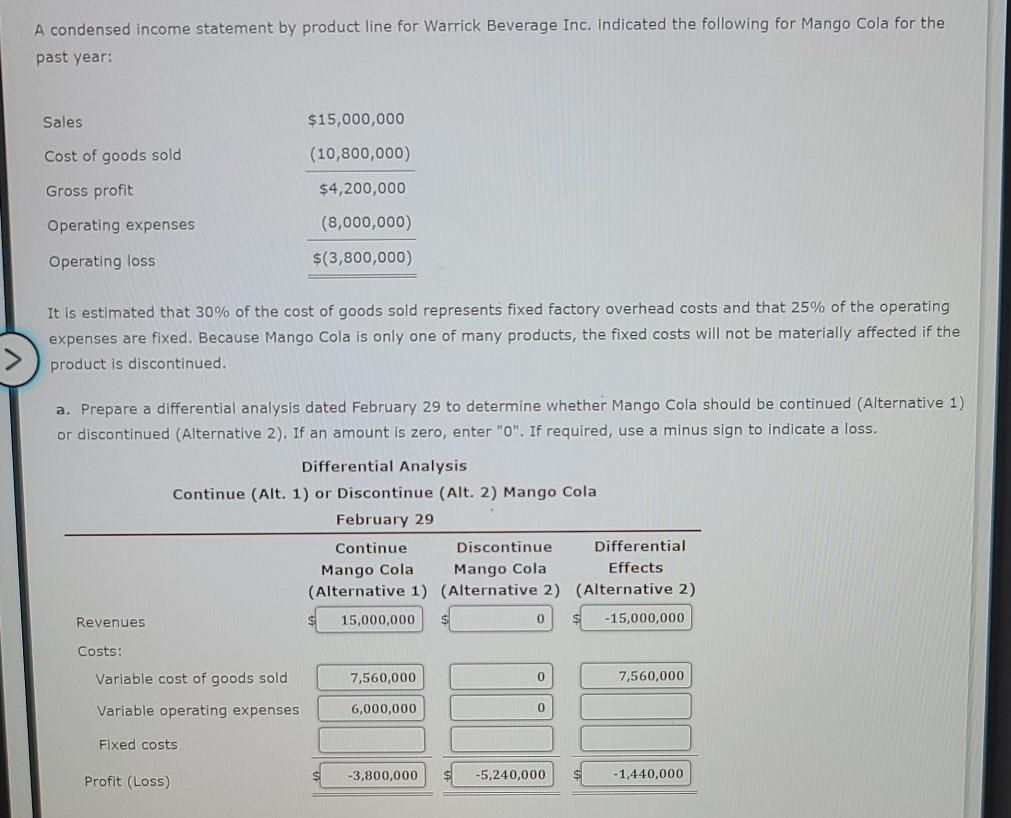

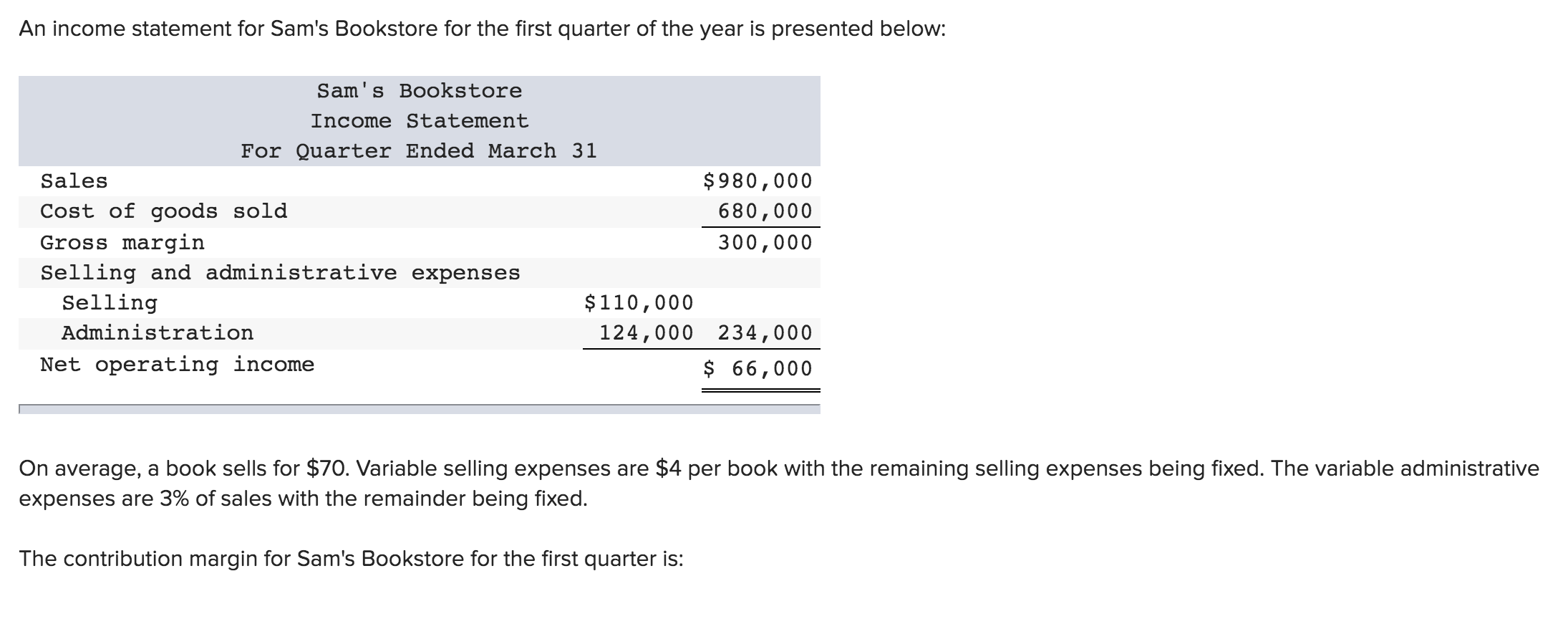

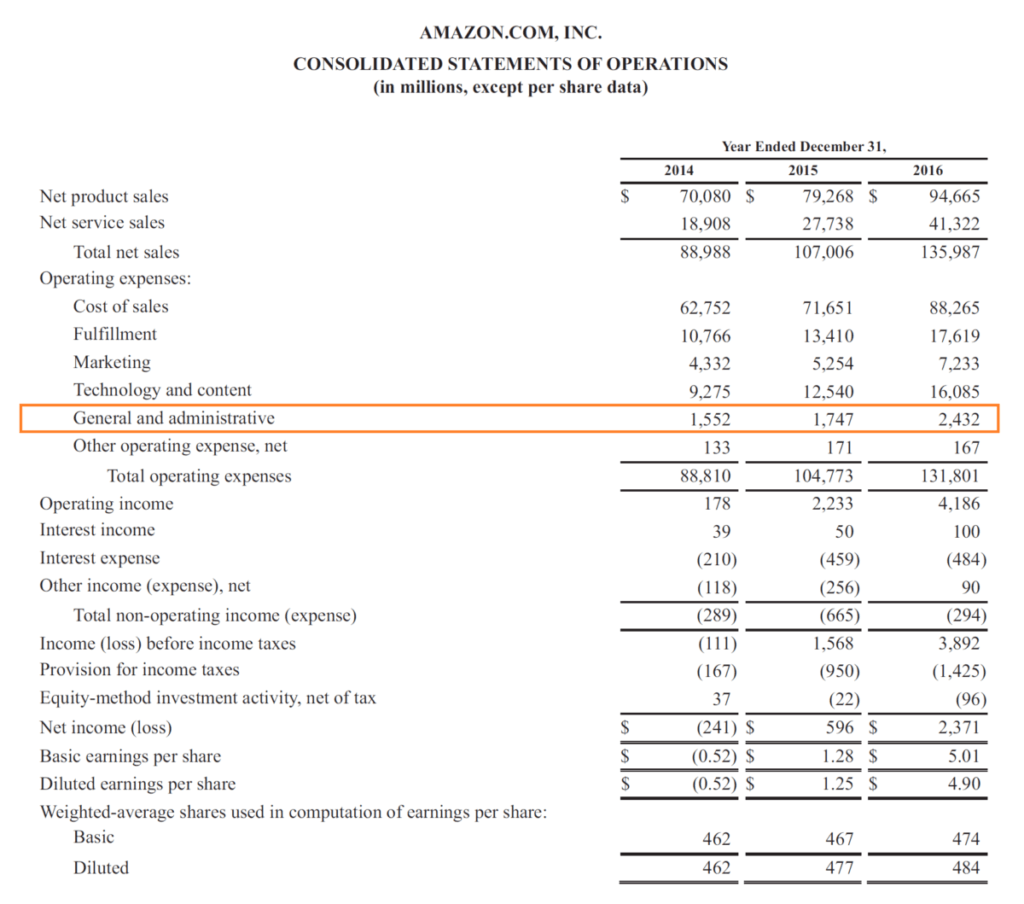

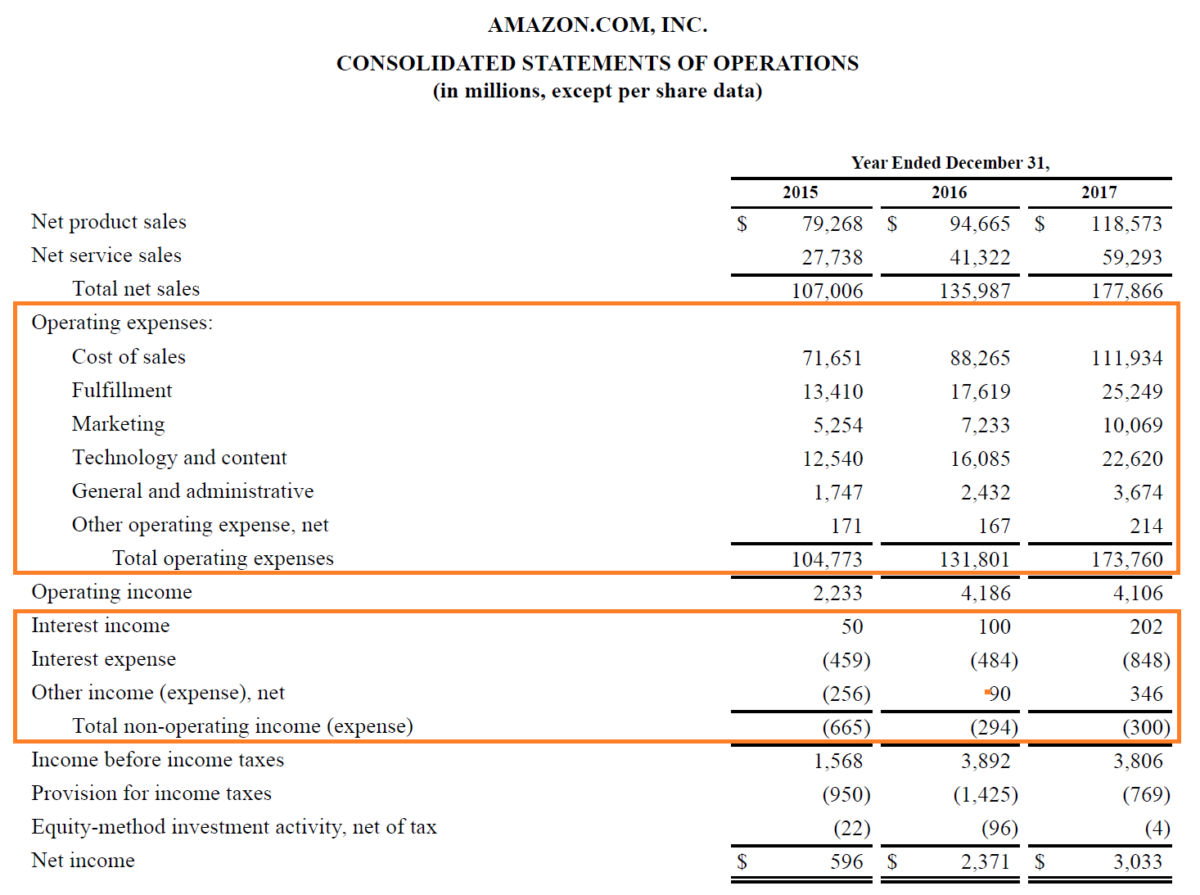

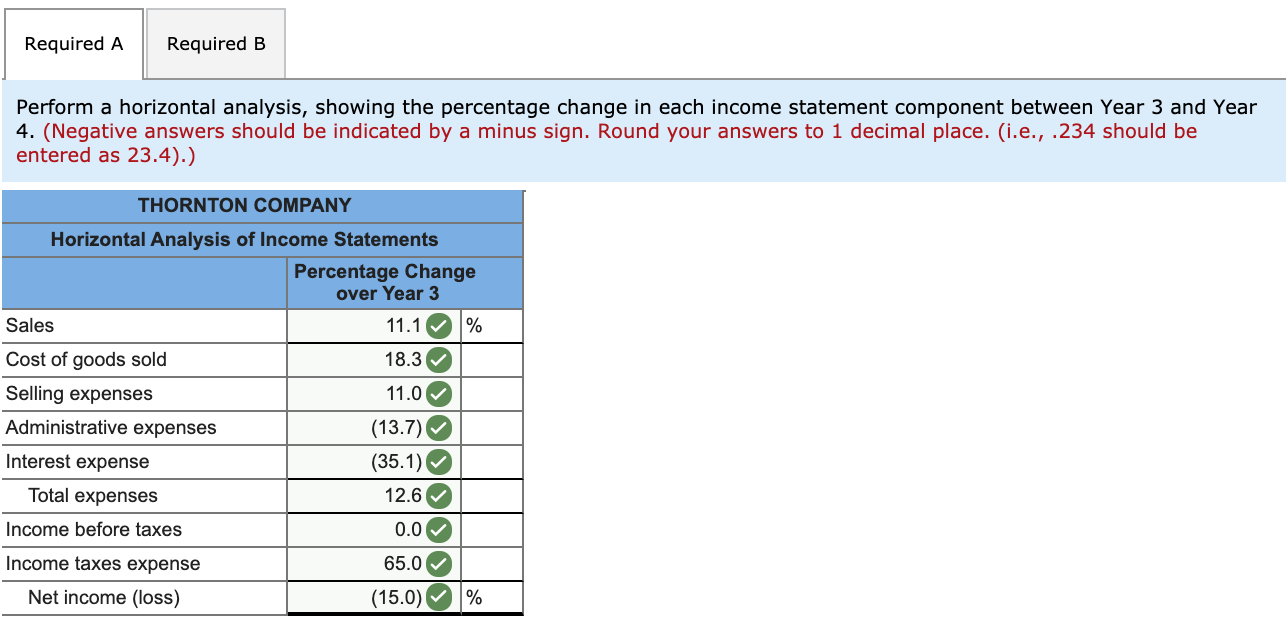

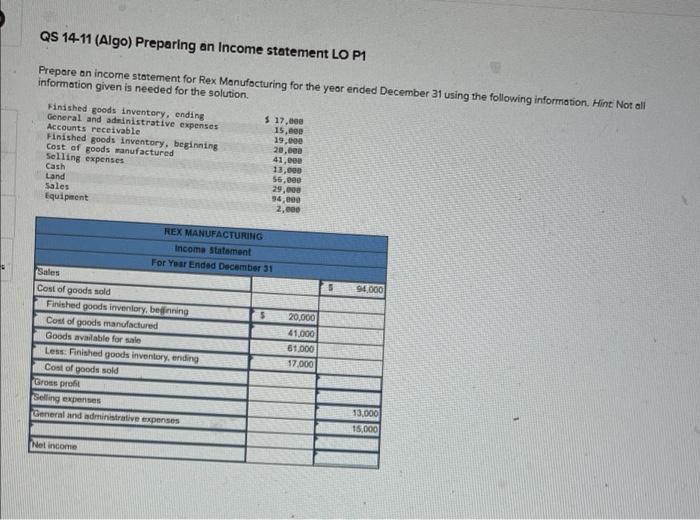

Income statement administrative expenses. Examples of general and administrative expenses. The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period. The first step in calculating the g&a expenses is to review the income statement and note which expenses may relate to g&a.

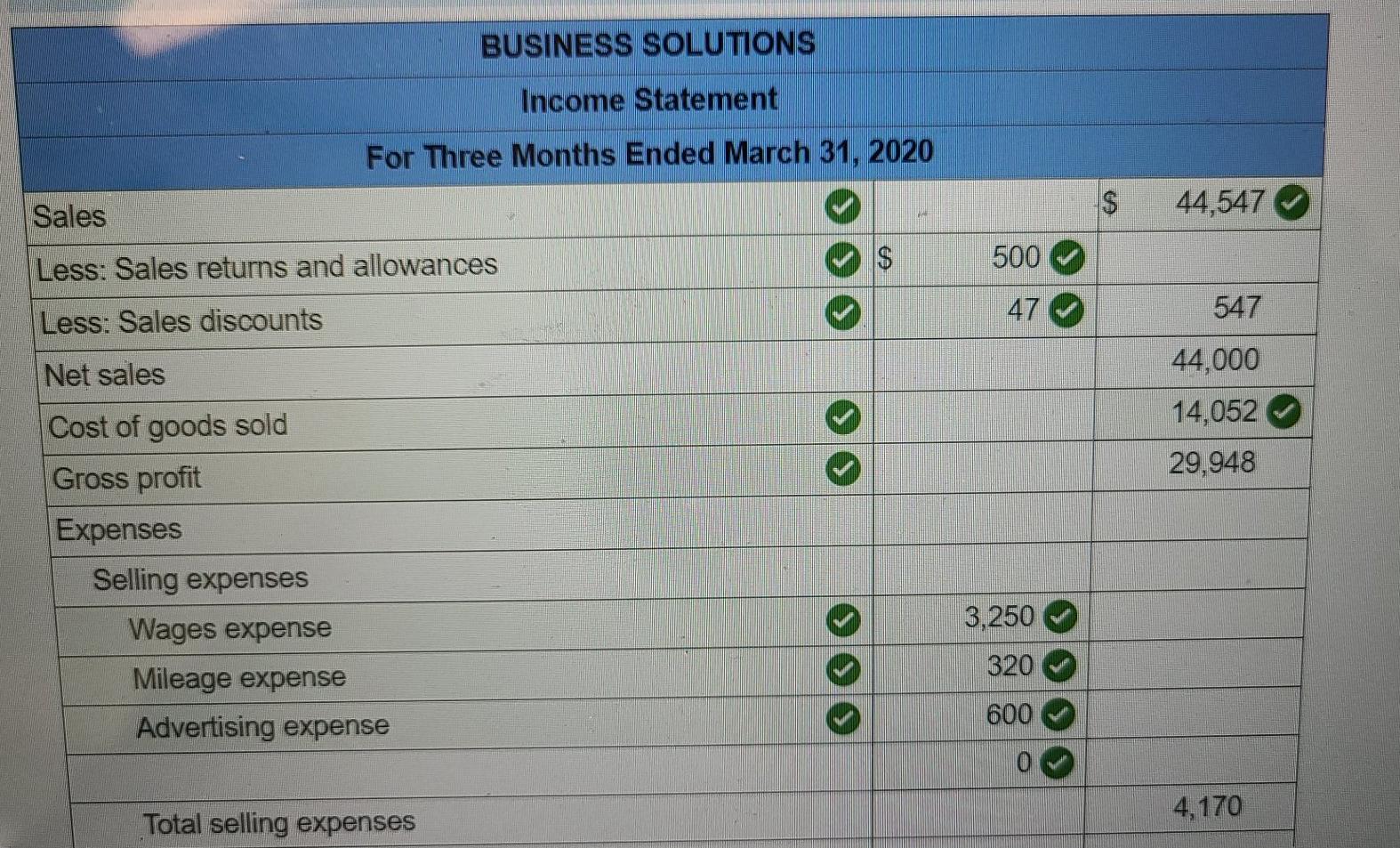

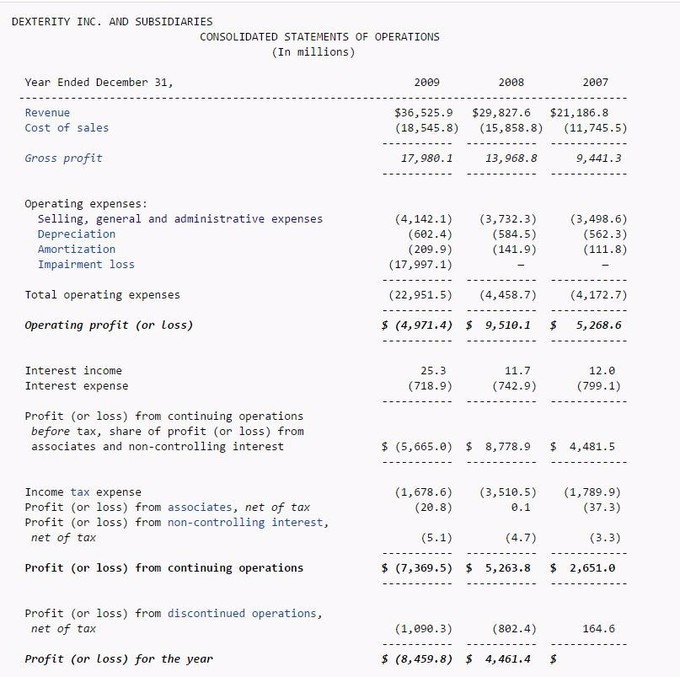

An income statement is another name for a profit and loss statement (p&l). Revenue, expenses, gains, and losses. To this, additional gains were added and losses were subtracted, including $257 million in income tax.

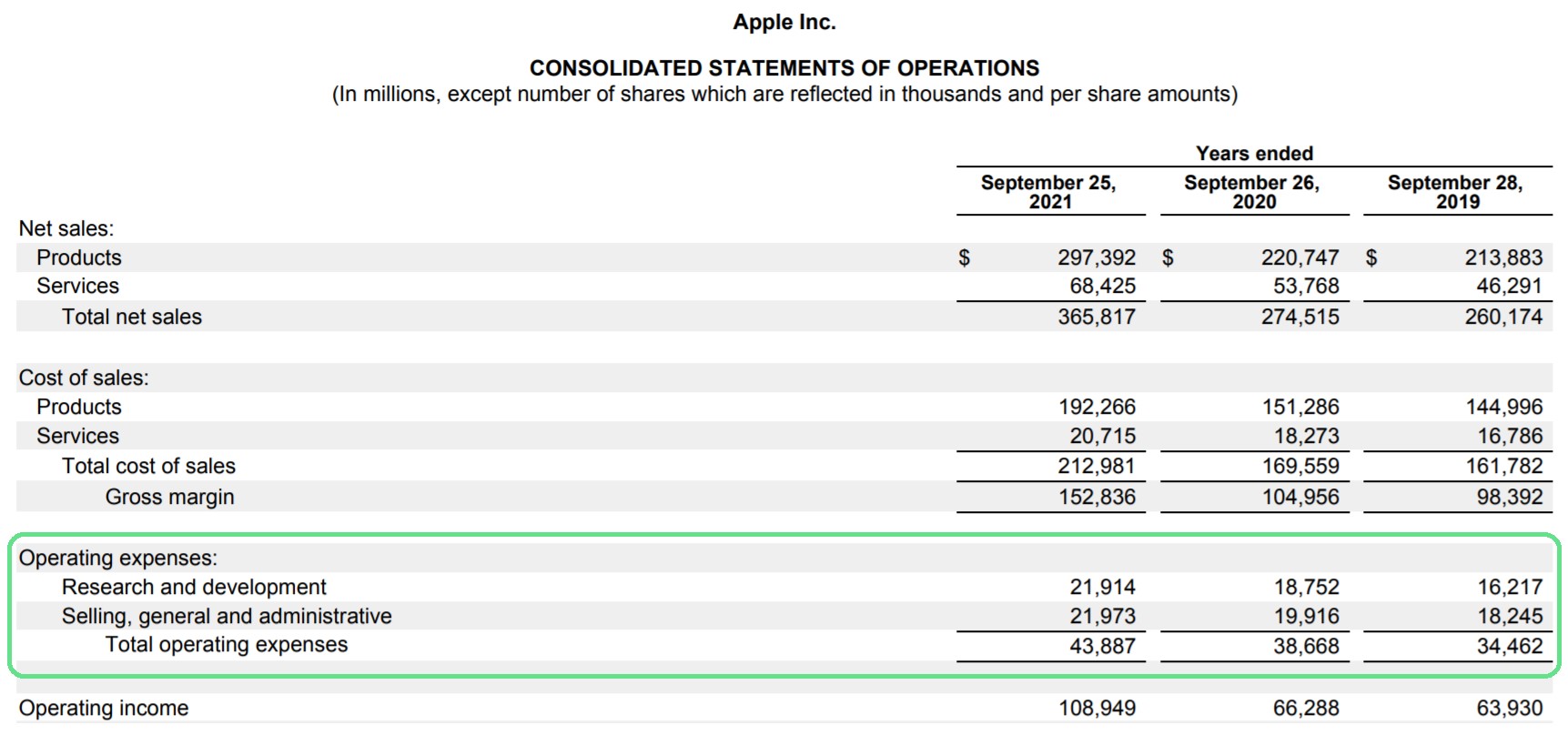

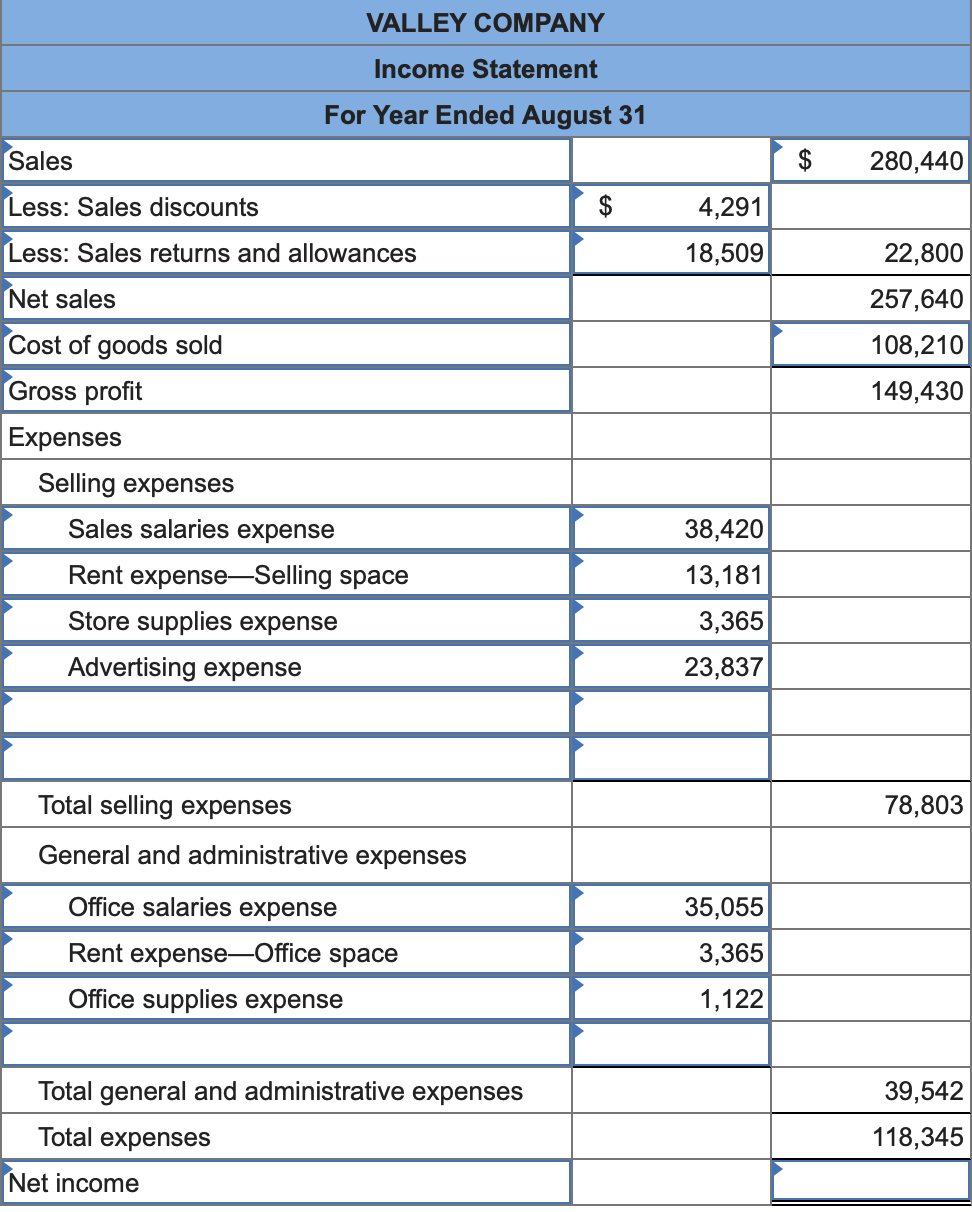

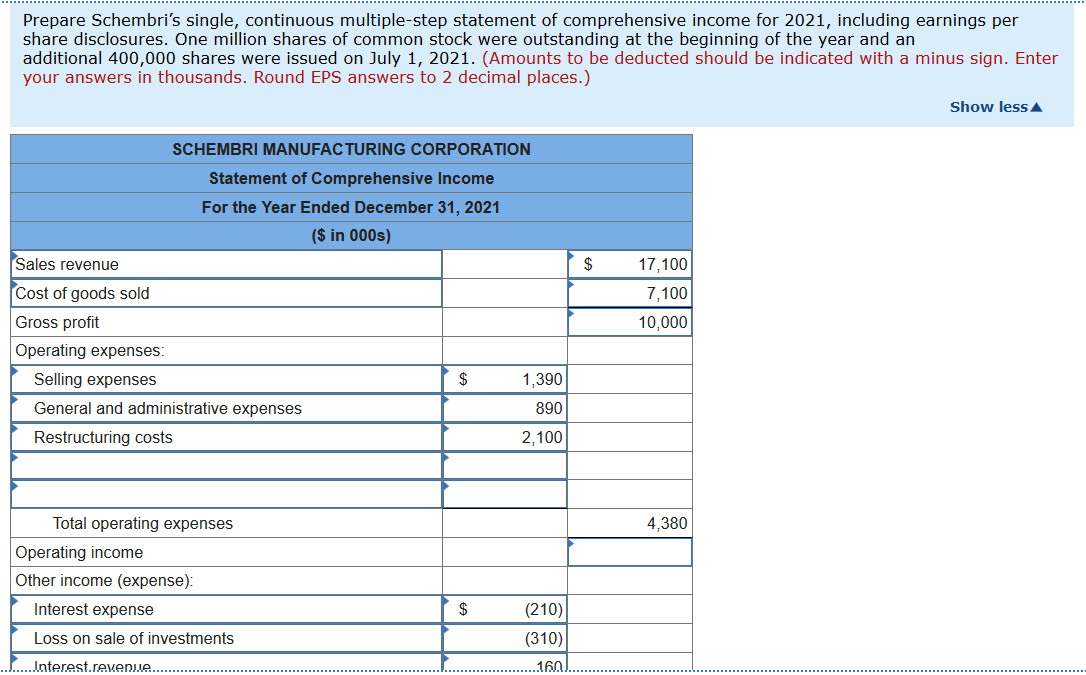

On the income statement, administrative expenses appear below cost of goods sold (cogs) and may be shown as an aggregate with other expenses such as general or selling expenses. Accounting staff wages and benefits. Selling, general, and administrative expenses (sg&a) are included in the expenses section of a company's income statement.

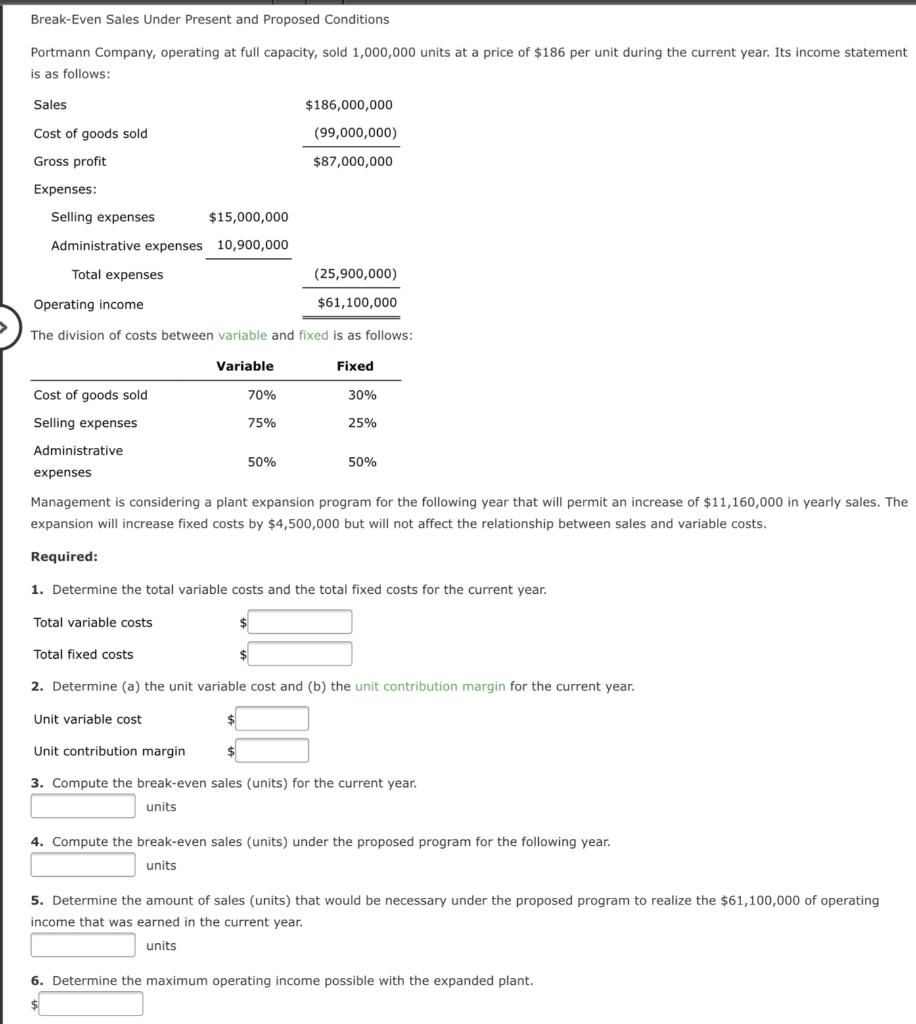

This includes personnel expenses and also everyday operating expenses such as insurance, supplies, travel and entertainment, rent, and payroll taxes. Sg&a expenses are not assigned to a specific product and. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

A total of $560 million in selling and operating expenses, and $293 million in general and administrative expenses, were subtracted from that profit, leaving an operating income of $765 million. There are three main sections on an income statement: They are not part of the cost of goods sold but can constitute a significant portion of a company's expenses.

G&a expenses appear on the income statement. Sales revenue, gross profit and net profit. Administrative expenses include expenses associated with the general administration of the business.

The income statement is one of the most important financial statements a company produces. Examples include the salaries and fringe benefits of the company president, human resource personnel, accounting, information technology, the depreciation expense for equipment and space used in administration, as well as supplies, utilities, etc. The income statement focuses on four key items:

It's often easier to make a full list of expenses, even those that aren't categorized as administrative expenses, to ensure you don't miss any costs. Professional fees and litigation costs; The components of the income statement include:

Each of these line items consists of different types of. Corporate management wages and benefits (such. The top section of an income statement always displays the.

You can look at an income. Administrative expenses are recorded as part of the operating expenses section of an income statement. Revenue minus expenses equals profit or loss.