Casual Info About Income Tax Form 26as Tally P&l Format

Initially, form 26as was synonymous with.

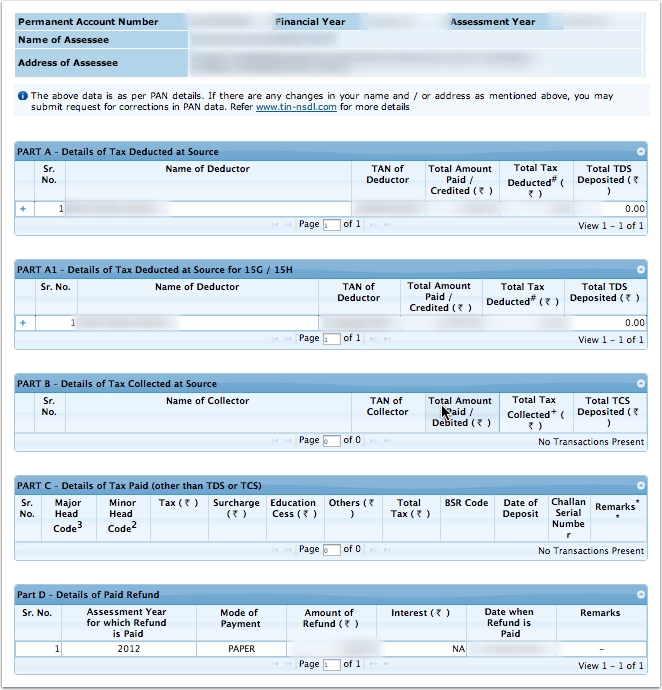

Income tax form 26as. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and. Do not forget to check status of pan of the deductee. On 9 th september 2021, cbdt has announced enhancing the timelines for some compliance.

Is filing income tax return mandatory? Click on the income tax forms tab. Form 26as provides a detailed overview of your financial activities for a specific year, going beyond just tds (tax deducted at source) and tcs (tax collected.

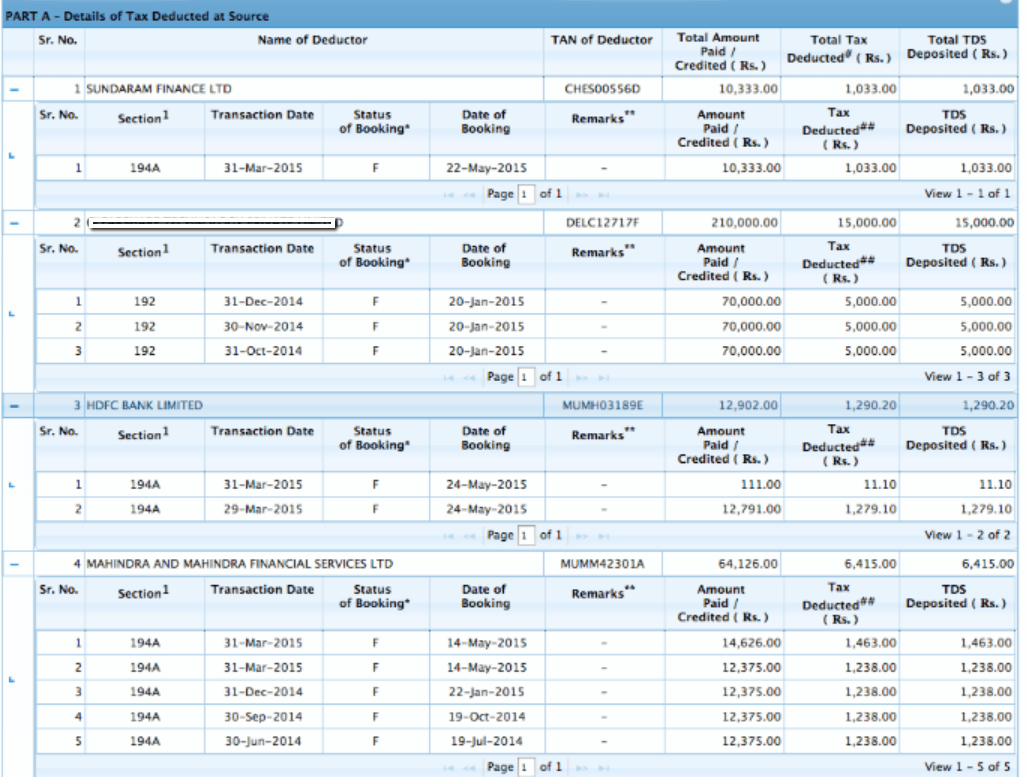

Income tax form 26as: Tax deducted on income: Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

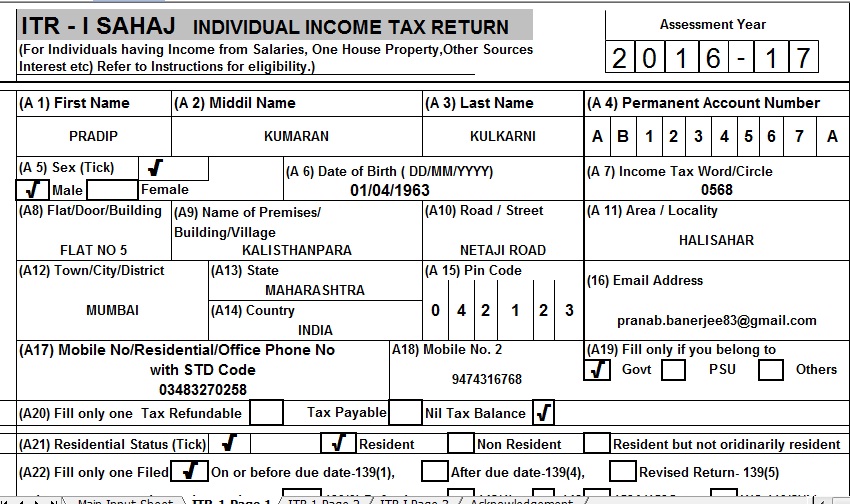

Form 26as is an annual tax statement, specific to a permanent account number (pan) furnished under the income tax act, 1961. The website provides access to the pan holders to view the details of tax credits in form 26as. Eligible outstanding direct tax demands have been remitted and extinguished.

Form 26as displays the amount of tax deducted at source (tds) from various sources of income, such as salary, interest, or dividends. Transparency in taxation | hdfc bank know everything about income tax form 26as form 26as is a consolidated statement from the income tax. Here are some steps to easily download form 26as on the new income tax portal.

Read the disclaimer, click 'confirm' and the user. If you are not registered with traces, please refer to our e. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and.

Income tax return filing 2024: You can find information related to your. Locate and select the form 16 option from the frequently used forms section.

How to get form26as form 26as can be. Form 26as is an annual declaration that shows the amount of tax levied against a taxpayer. What is form 26as?

Form 26as is an important tax filing as it is tax credit statement. Learn about the new revamped form 26as that contains information from various sources and will help taxpayers with updated financial transactions. Srishti, an nri, discovered inr 20,000 tds.

The assessee’s submissions were that the services were rendered in a.y. Click on the link view tax credit (form 26as) at the bottom of the.