Have A Tips About Statement Of Financial Position Accounts Startup Cash Flow Template

The balance sheet presents three key pieces of information, including assets, liabilities, and equity.

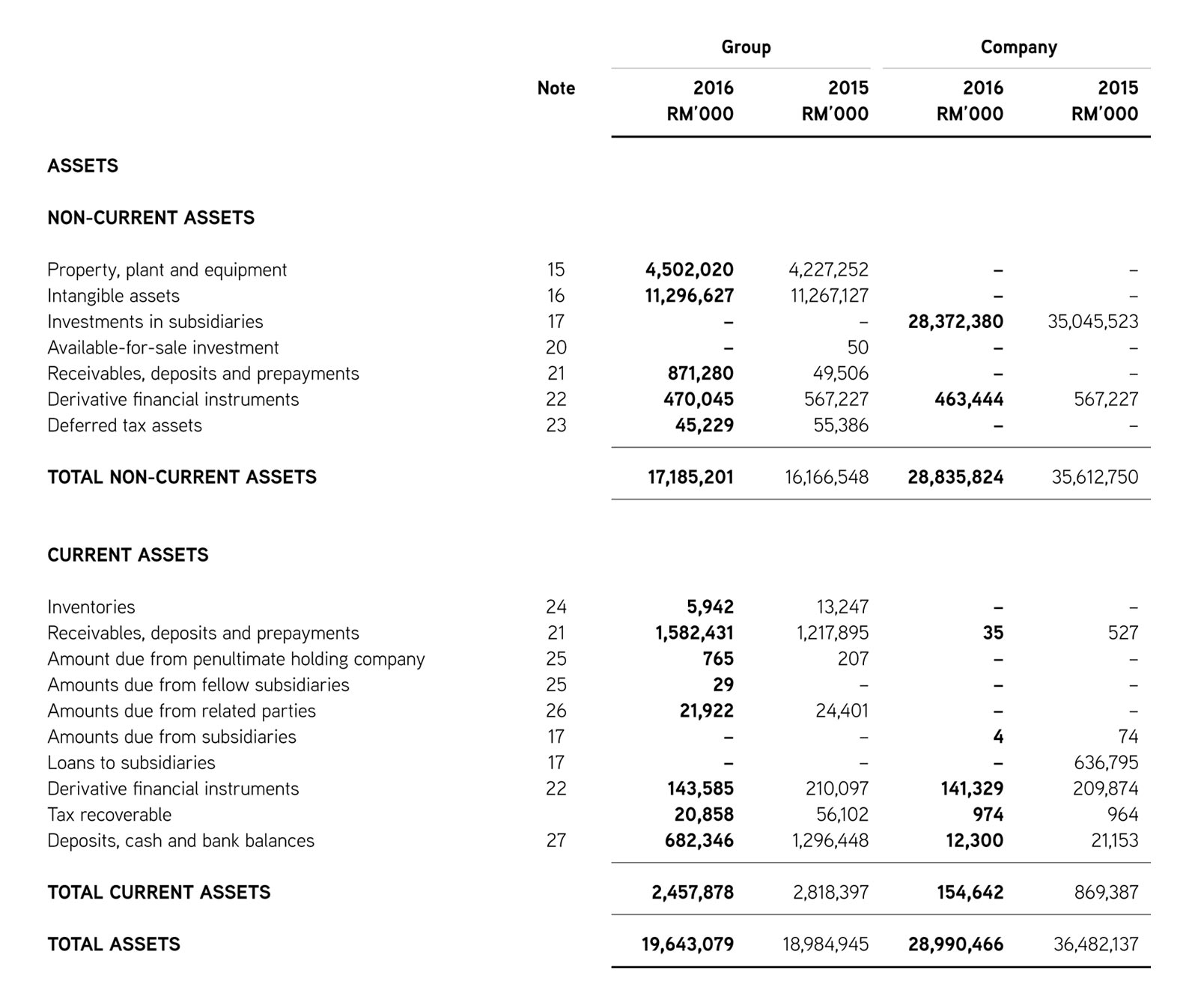

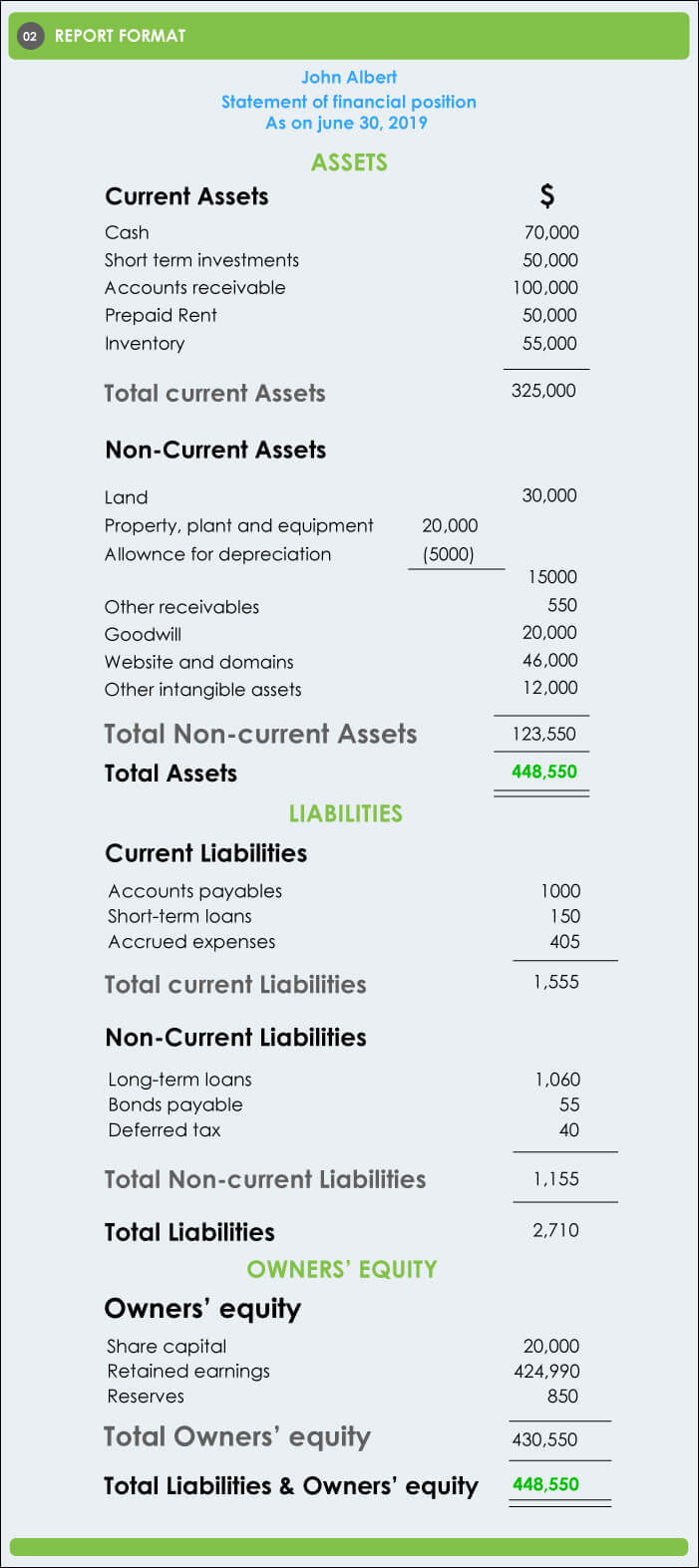

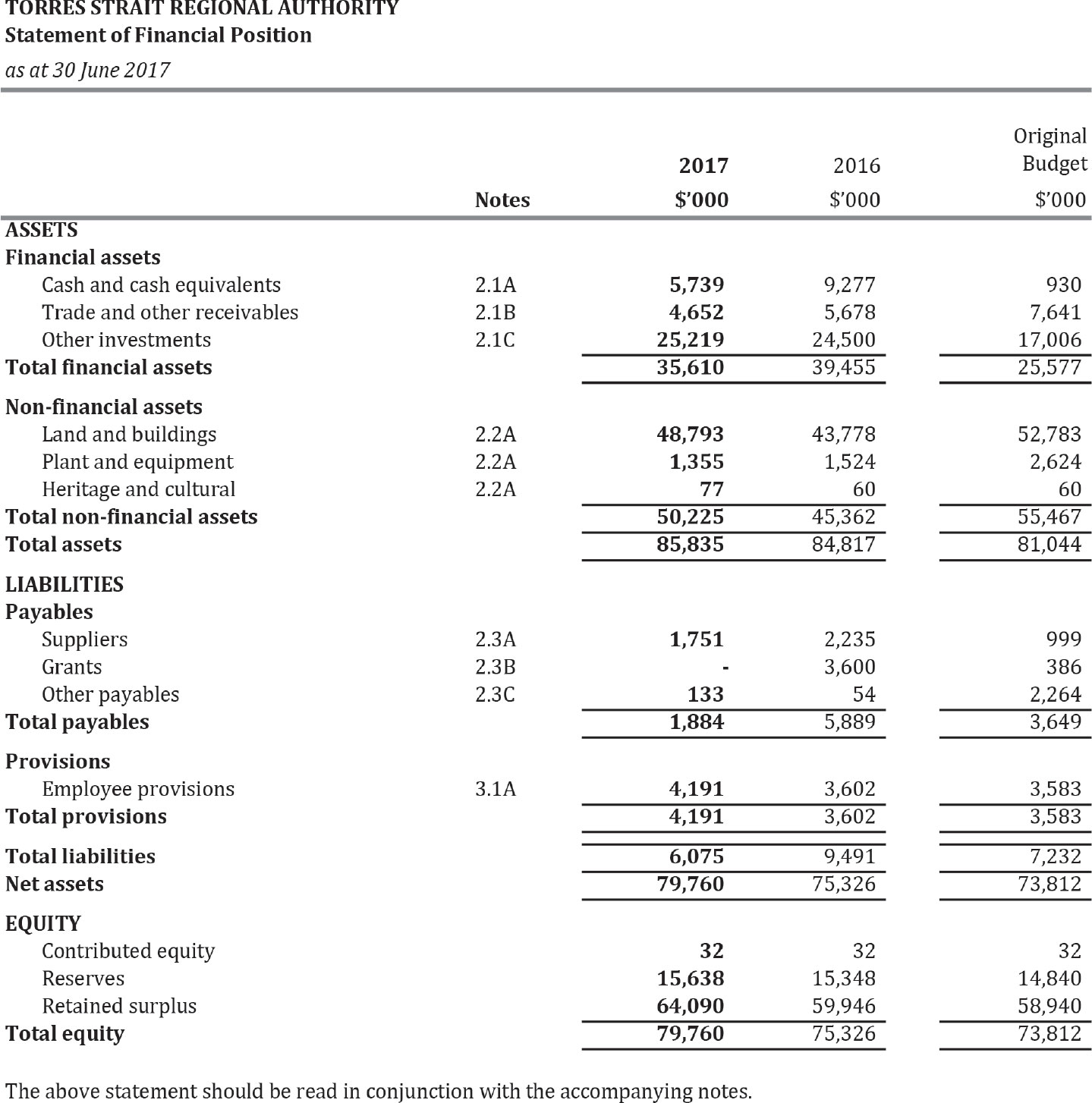

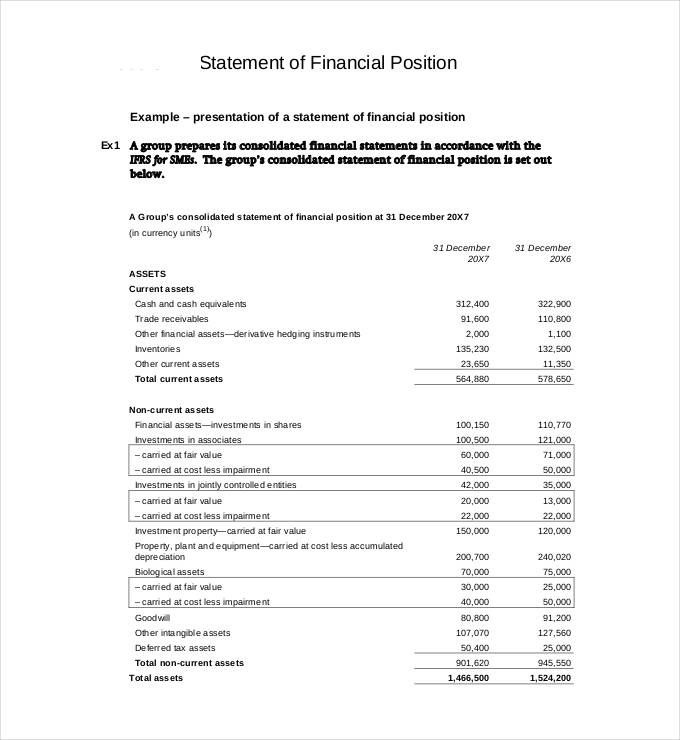

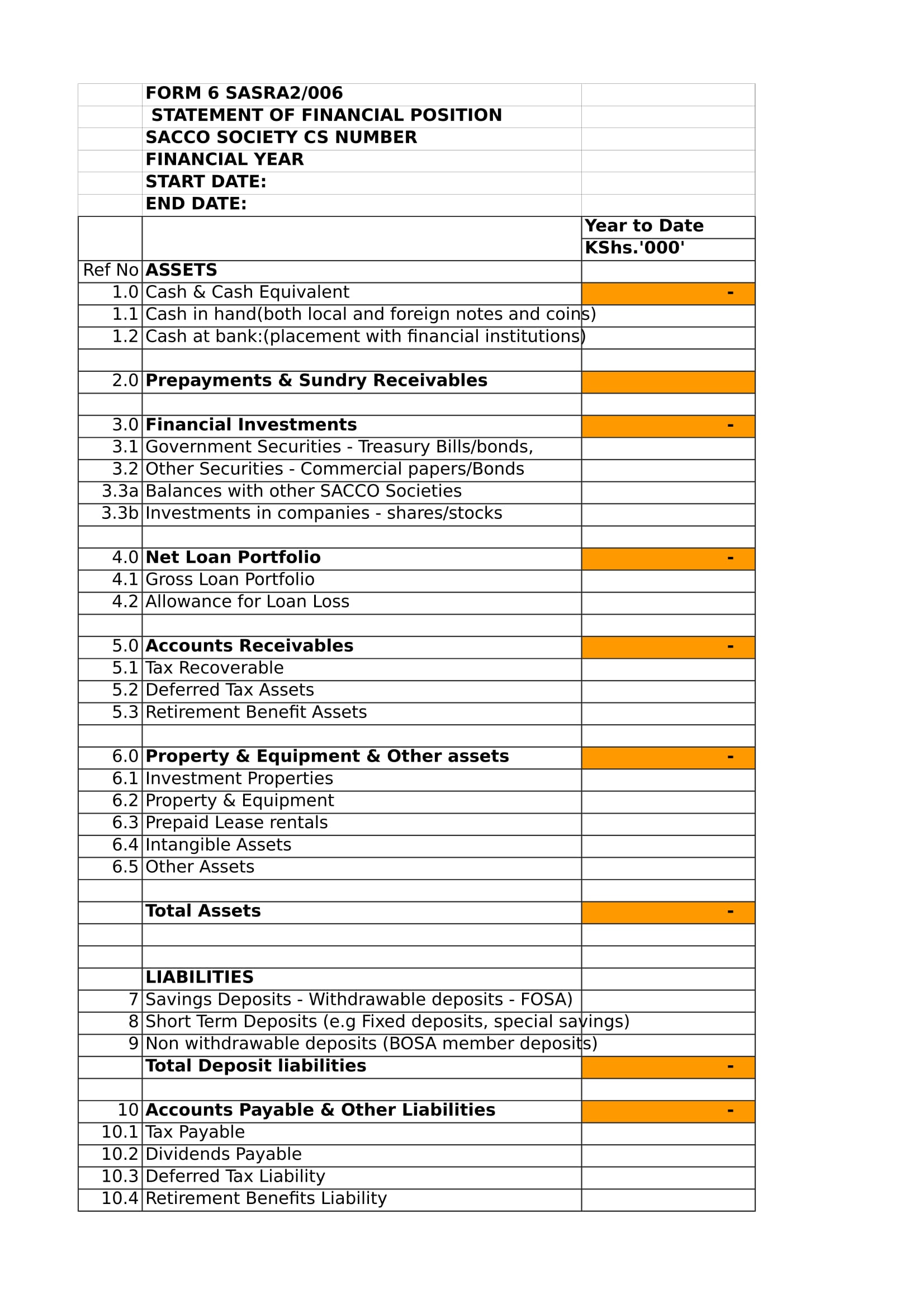

Statement of financial position accounts. Statement of financial position, statement of comprehensive income, and statement of changes in equity examples from ias 1 (ig 6) representing ways in which the requirements of ias 1 for the presentation of the statements of financial position, comprehensive income and statement of changes in equity might be met using detailed. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows. A statement of financial position is another name for your company’s balance sheet.

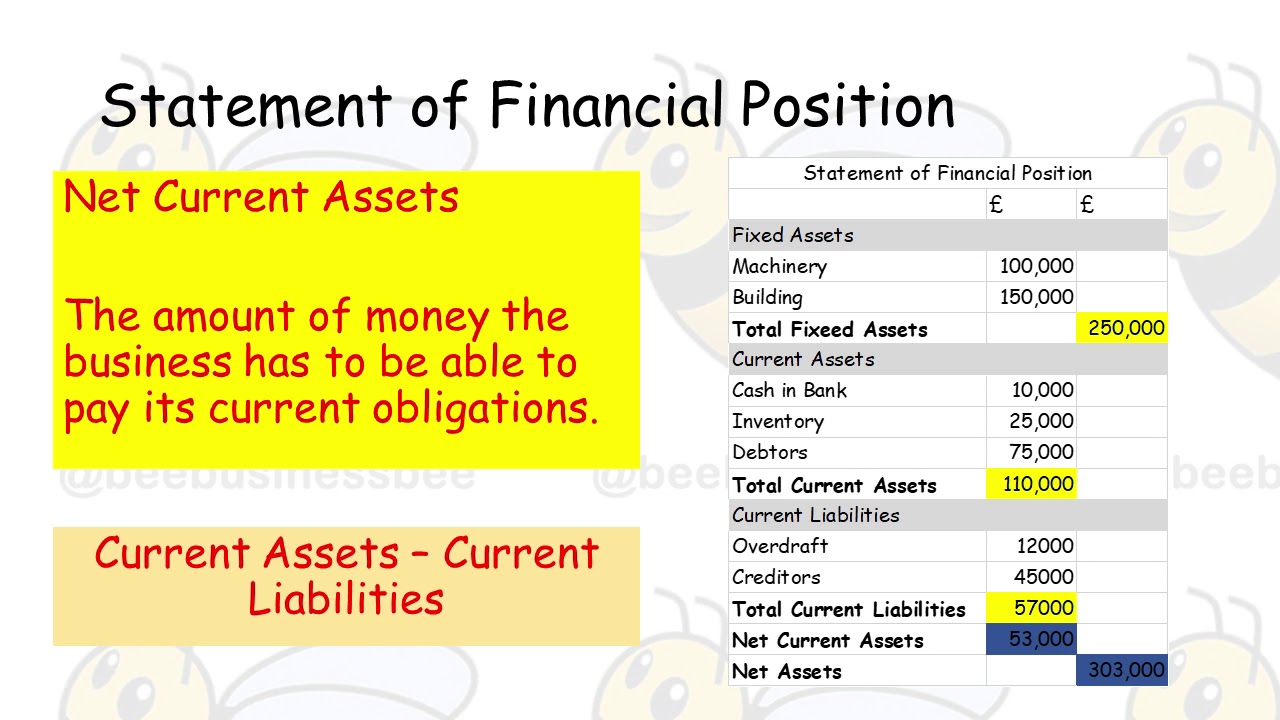

How to read a balance sheet. The statement of financial position also called a balance sheet is a statement that is prepared to show the financial position of the company at specific date, through which this statement shows all the owned assets and the liabilities at a certain moment, so that the assets accounts appear in one side and the accounts for the liabilities and ow. Statement of financial position, showing the financial position of a business at a point in time, and , showing the financial performance of a business over a period of time.

2.1 statement of financial position overview. The statement of financial position, often called the balance sheet, is a financial statement that reports the assets, liabilities, and equity of a company on a given date. Assets , liabilities and equity.

In other words, it lists the resources, obligations, and ownership details of. What is a statement of financial position? It reveals what your firm owns (assets), how much it owes (liabilities), and the value that would be returned to the investors if your business was liquidated (equity).

It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). The financial statements show the effects of business transactions. The balance sheet as traditionally known is a tool used to represent the financial position of the business.

Liabilities are how much the firm owes. The balance sheet, also known as the statement of financial position, is one of the five essential financial statements that provide crucial financial information about an entity at the end of the balance sheet date. Balance sheet (statement of financial position) profit and loss account (income statement) cash flow statement

In this guide, we show an example of a statement of financial position and we’ll explain the various elements. Statement of financial position helps users of financial statements to assess the financial soundness of an entity in terms of liquidity risk,. Assets = liabilities + equity.

This chapter provides an overview of the key elements of balance sheets prepared under the nfp reporting model, including the statement’s format,. It is one of the main financial statements. The statement of financial position (balance sheet under aspe), reports a businesses assets, liabilities and shareholders’ equity at a specific date (at a point in time).

Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009. The statement of financial position reports an entity's assets, liabilities, and the difference in their totals as of the final moment of an accounting period. The statement of financial position is another name for the balance sheet.

Financial statements play an important role in helping you to understand the financial position of your business. A statement of financial position shows the value of a business on a particular date. It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)