Marvelous Info About Factored Accounts Receivable Financial Statements Quarterly Income Statement Example

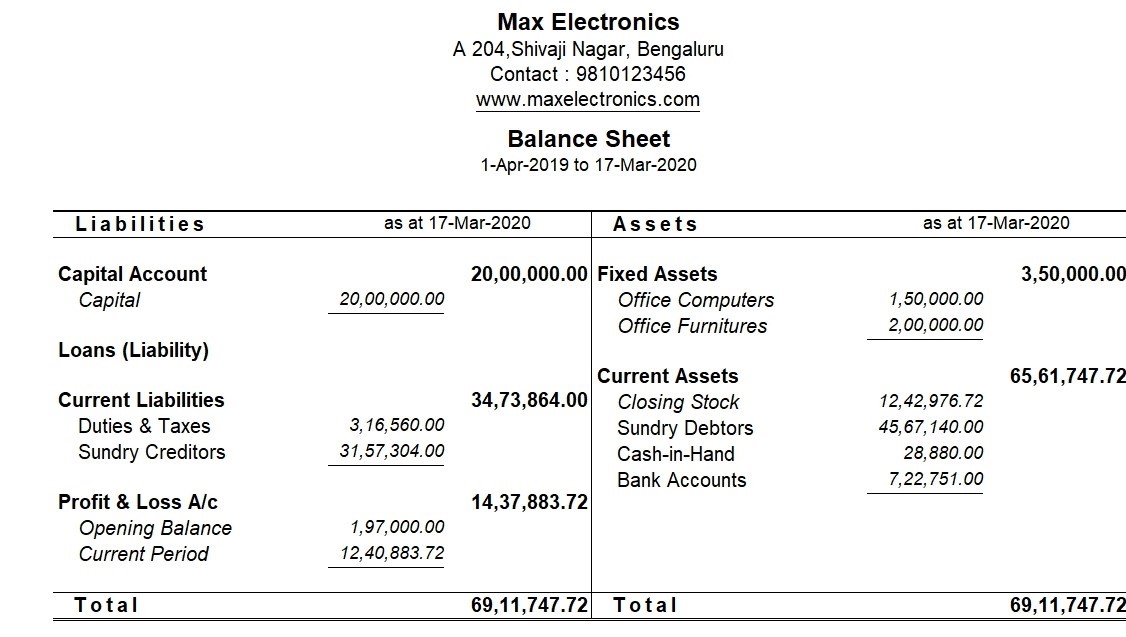

On a company’s balance sheet, receivables can be classified as accounts receivables or trade debtors, bills receivable, and other receivables (loans, settlement amounts due.

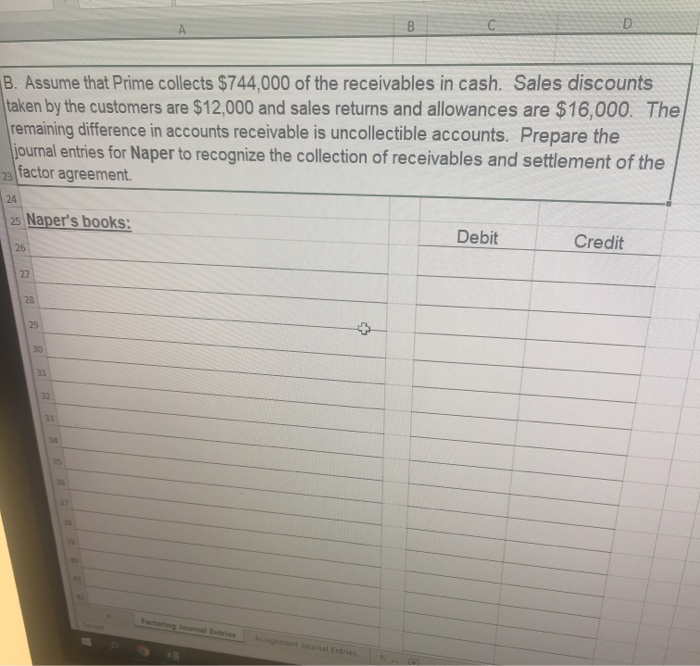

Factored accounts receivable financial statements. Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital. Review and analyze form 5472 and the audited financial statements of both the domestic entity and the related foreign entity for any footnotes reflecting the sales. Line item on balance sheet for cash that you still need to collect from customers.

Factoring accounts receivable and financial documents. A company will receive an initial advance, usually around 80% of the amount of an invoice when the invoice is purchased by the lender. Factoring is a financial transaction where a business sells its outstanding accounts receivable to a third party, known as a factor, at a discounted price rather.

Accounts receivables are usually listed on a balance sheet. Factoring of accounts receivable is the practice of transferring the ownership of accounts receivable to a company specialized in receivable collection, in. Recorded it as revenue, but haven’t received the cash.

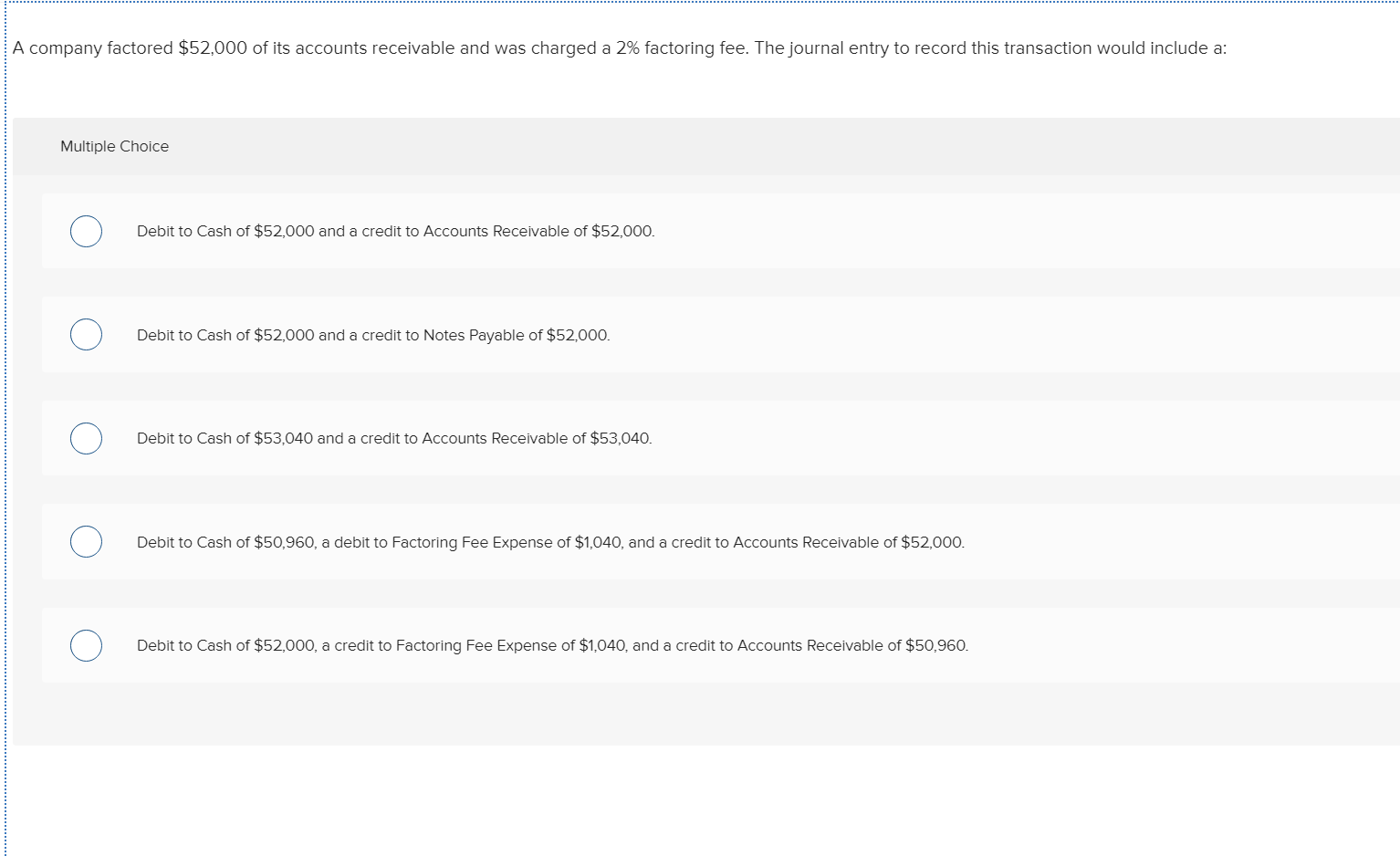

Definition factoring of accounts receivables is a way of raising funds to meet emerging working capital needs. Essentially, a factoring transaction is recorded as a sale of the receivables, and a gain or loss (usually a loss) is recognized on the receivable transferred to the. Dan july 23, 2013 table of contents accounting for factored receivables explanation common mistakes when accounting for factored receivables how to.

Accounts receivable factoring, also known as factoring, is a financial transaction in which a company sells its accounts receivable to a financing company that specializes in. Factoring receivables is the sale of accounts receivable for working capital purposes. Accounts and notes receivable and financing receivables, including allowances for credit losses and impaired loans;

Accounts receivable factoring, also known as a/r factoring or invoice factoring, is a form of commercial borrowing that helps businesses address cash flow. A business sells its accounts receivable to a financing. What is accounts receivable (“ar”)?

The transfers are reported as sales in the accompanying financial statements. Most factoring methods have a business sell the factoring company invoices at a discount. Accounts receivable factoring, also known as invoice factoring, is when a business sells its invoices to turn that static asset into working capital.

The subordinated interest, a receivable from the conduit, is referred to as the “deferred. Factoring is a form of account receivables financing, however, it's considered off balance sheet financing. Upon fulfillment, an accounts receivable invoice is created or a promise of future payment is made to you by a third party.

When they collect the invoice, the lender pays the remaining 20% (less a fee) to the borrower.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)