Cool Info About Daycare Income Statement View Form 26as Online

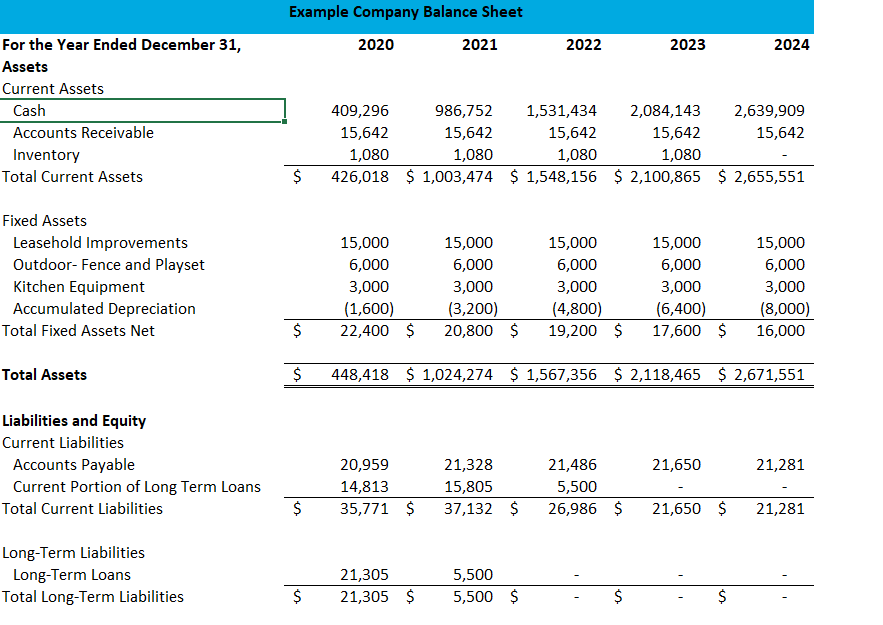

The statement of cash flows.

Daycare income statement. The parents will use it to claim a. A child centered approach our mission is to provide the highest quality care and education of children that is child. Research suggests young children are going hungry in early childhood centres, being given food that doesn't meet dietary standards, and childcare.

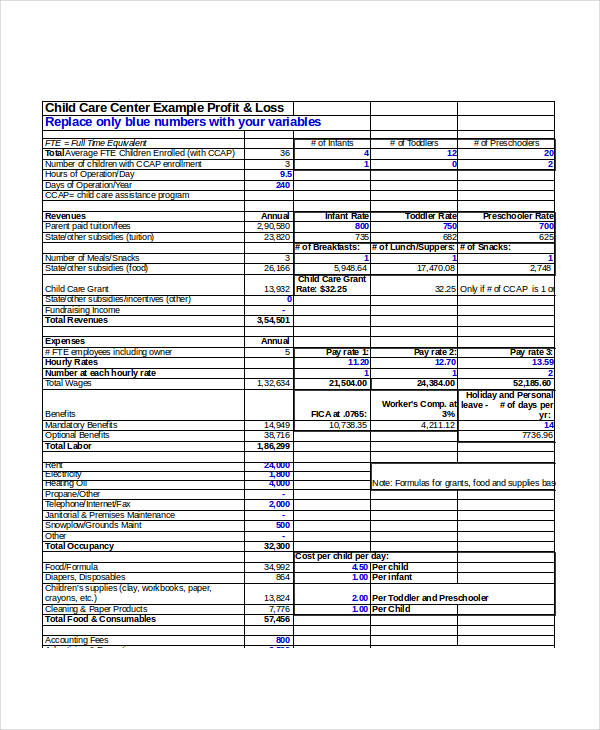

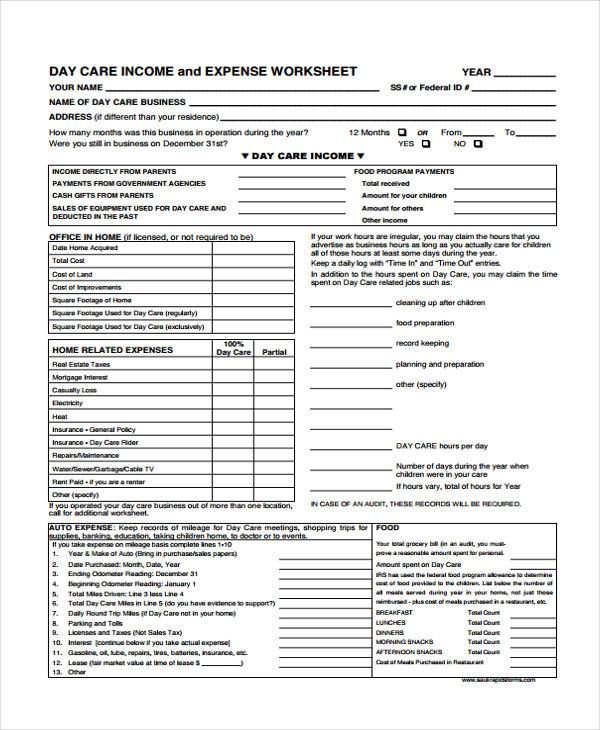

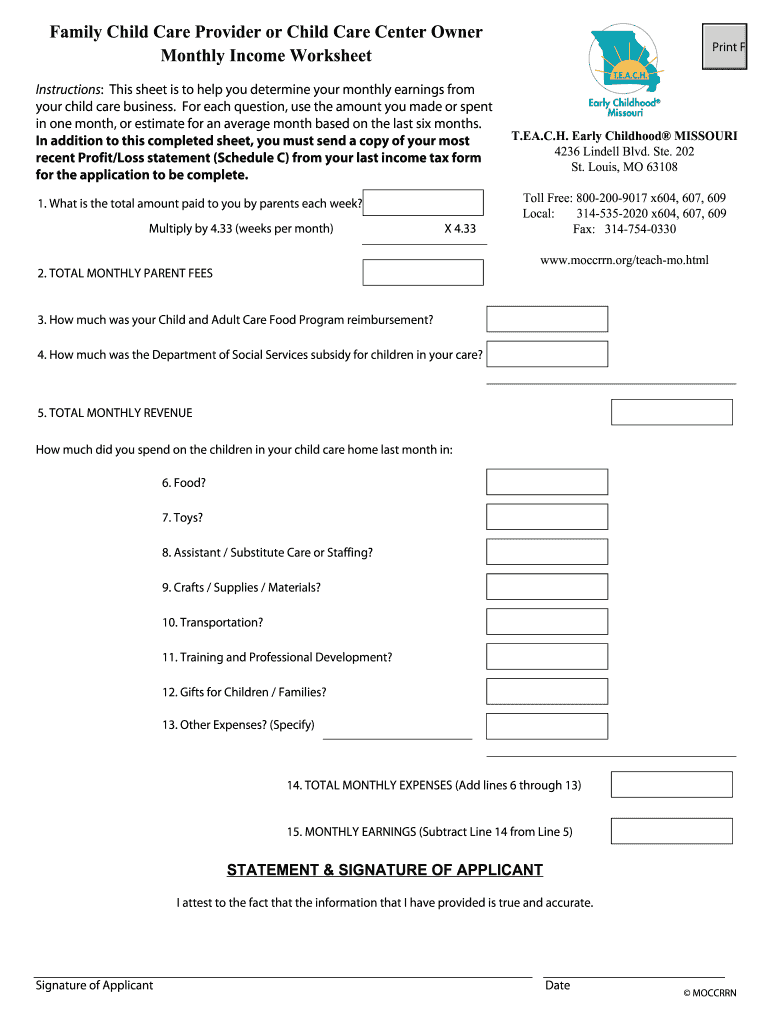

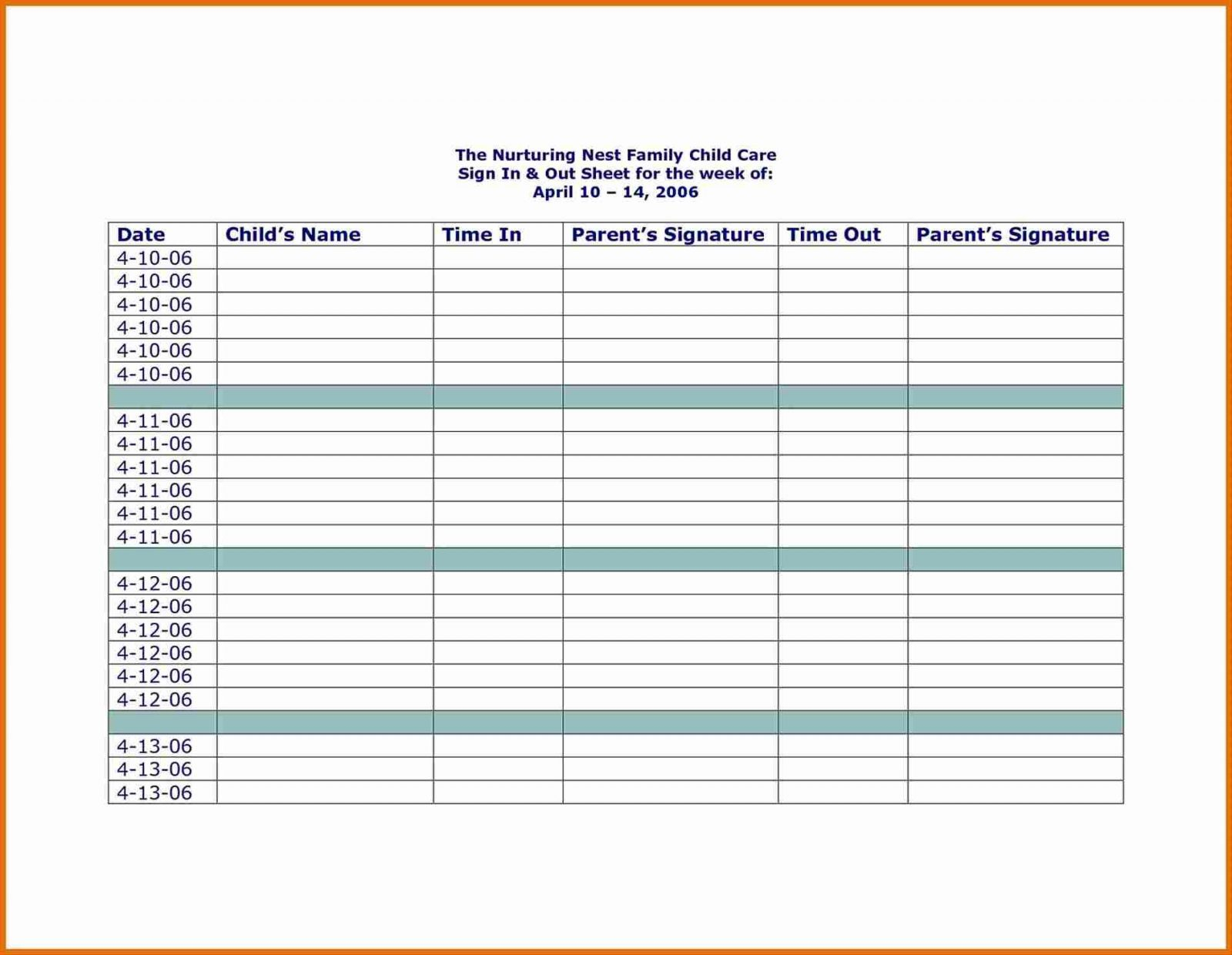

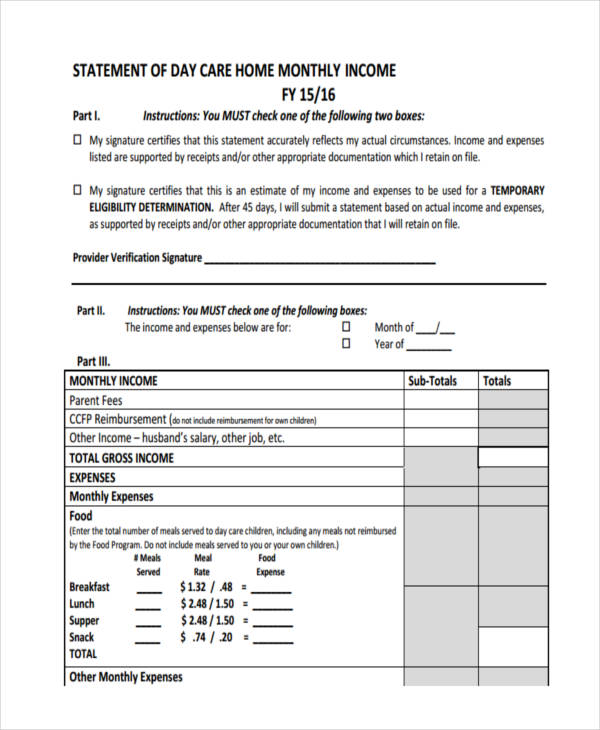

The income sheet is where you’ll list all of the ways that you collect money. In addition to the hours spent on day care, you may claim the time spent on day care related jobs such as: Subtract the total expenses from the total income to calculate the net profit or loss.

Child care resource center strategically manages expenses, mitigating costs while optimizing the services, programs and supports afforded to families. You have a modified adjusted gross income, or magi, of $200,000 or less, or $400,000 or less if you're filing jointly.; Completing the daycare income and expense worksheet with signnow will give greater confidence that the output template will be legally binding and safeguarded.

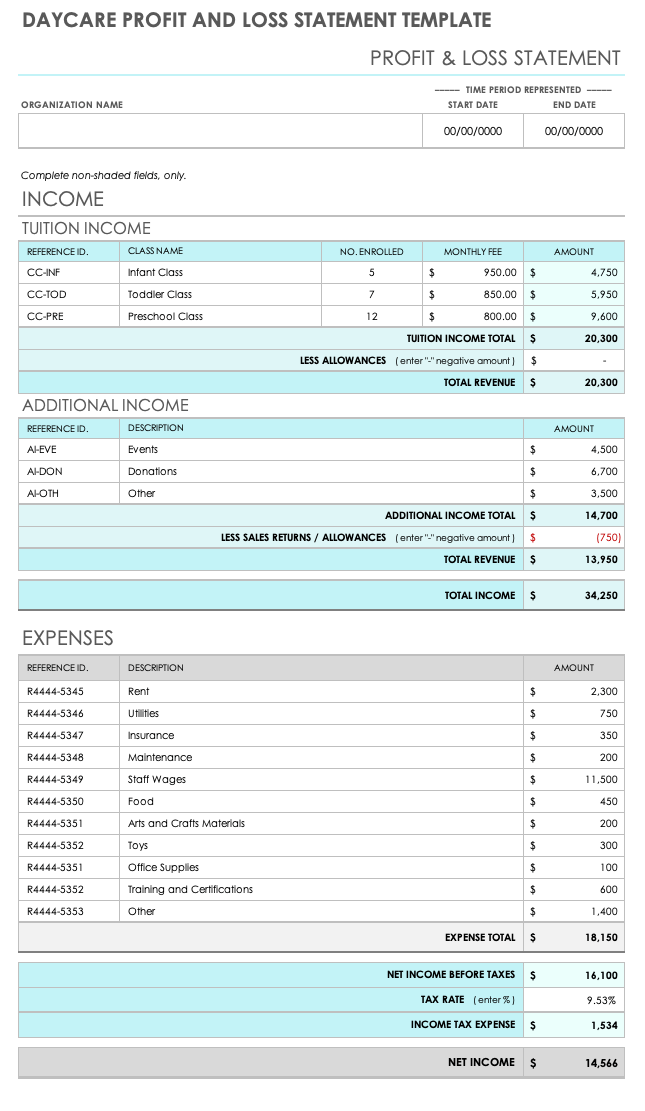

Record all daily income and expenses meticulously. The day care/daycare industry in the united states is a significant and growing market. Analyze the profit and loss statement to identify areas of improvement or potential.

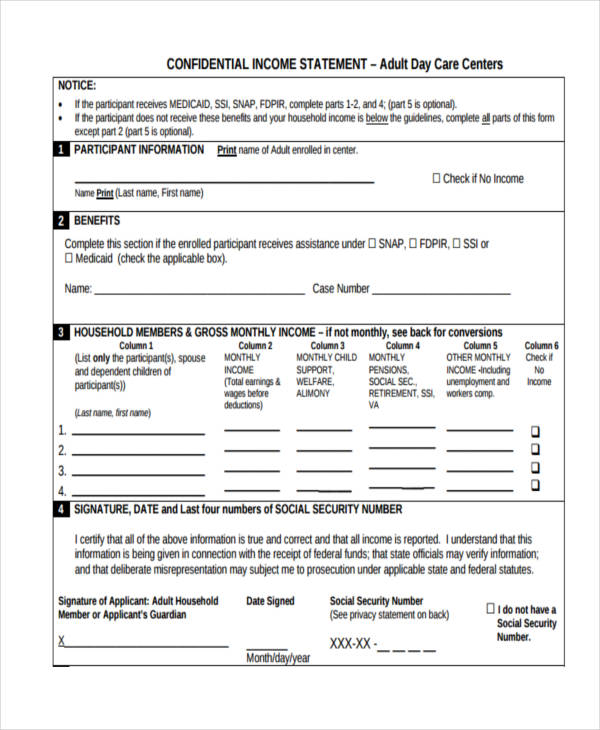

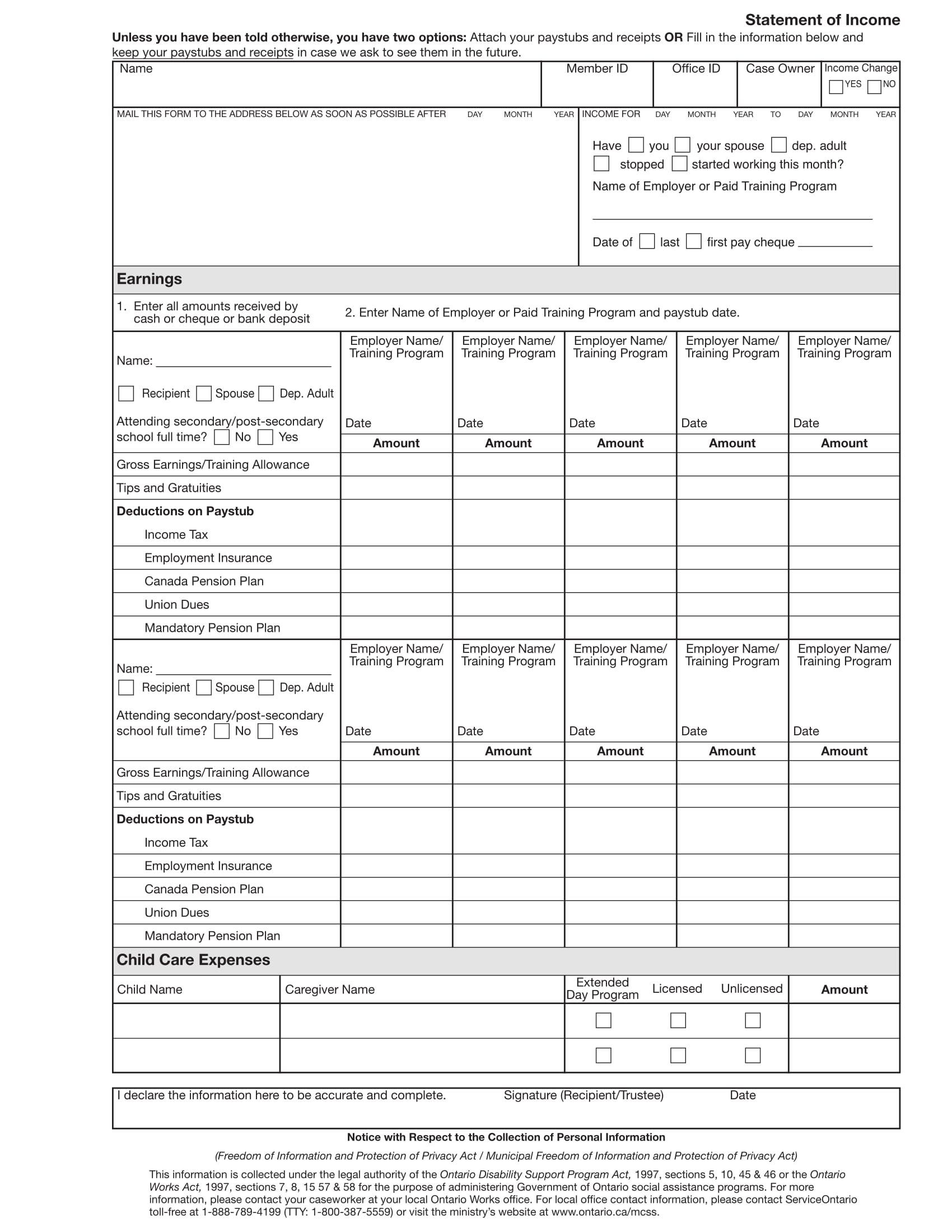

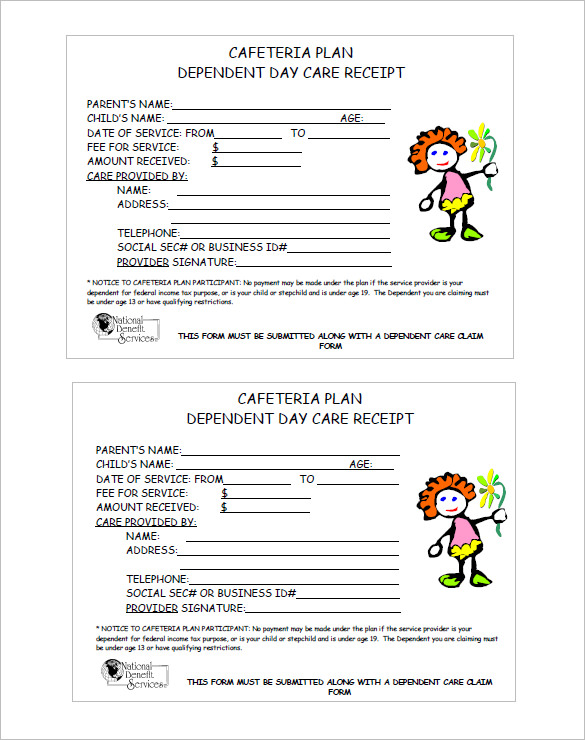

Daycare tax statement a daycare tax statement must be given to parents at the end of the year. In missouri, republican gov. The average annual gross salary for day care caregivers is $30,520 in 2022.

Daycare supplies (toys, books, cots, pillows, etc.): $10 per day $15 per day $20 per day $25 per day $30 per day $40 per day $50 per day in order to calculate your estimated revenue, the spreadsheet. Credits & deductions individuals credits and deductions childcare template sample template for use by childcare providers ask the childcare provider’s office to.

The child you're claiming the credit for was under. Currently, the industry generates over $56 billion in revenue annually,. 25 childcare mission statement examples 1.

You will use it to claim all income received. Day care teachers instead were paid an average annual salary of $52,000. Day care wonders income statement teacher:student ratio required students teachers 1 1 assumptions 7 2 number of children/day 7 13 3 average days per year 250 19 4.

It tracks costs like salaries, rent, supplies,. The best way to evaluate financial performance is by analyzing the daycare’s profit and loss statement, which outlines revenue, expenses, and net income. We have included the most common income sources and approximate.

The most useful tool for daycare businesses is a profit and loss statement template, which details revenue, expenses, and net income. There are three primary financial statements that every company has: Maintain separate records for tuition fees, subsidies, grants, and any.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-Daycare-TemplateLab.com_-790x1085.jpg)