Wonderful Info About Prepare Balance Sheet From Ratios Corning Financial Statements

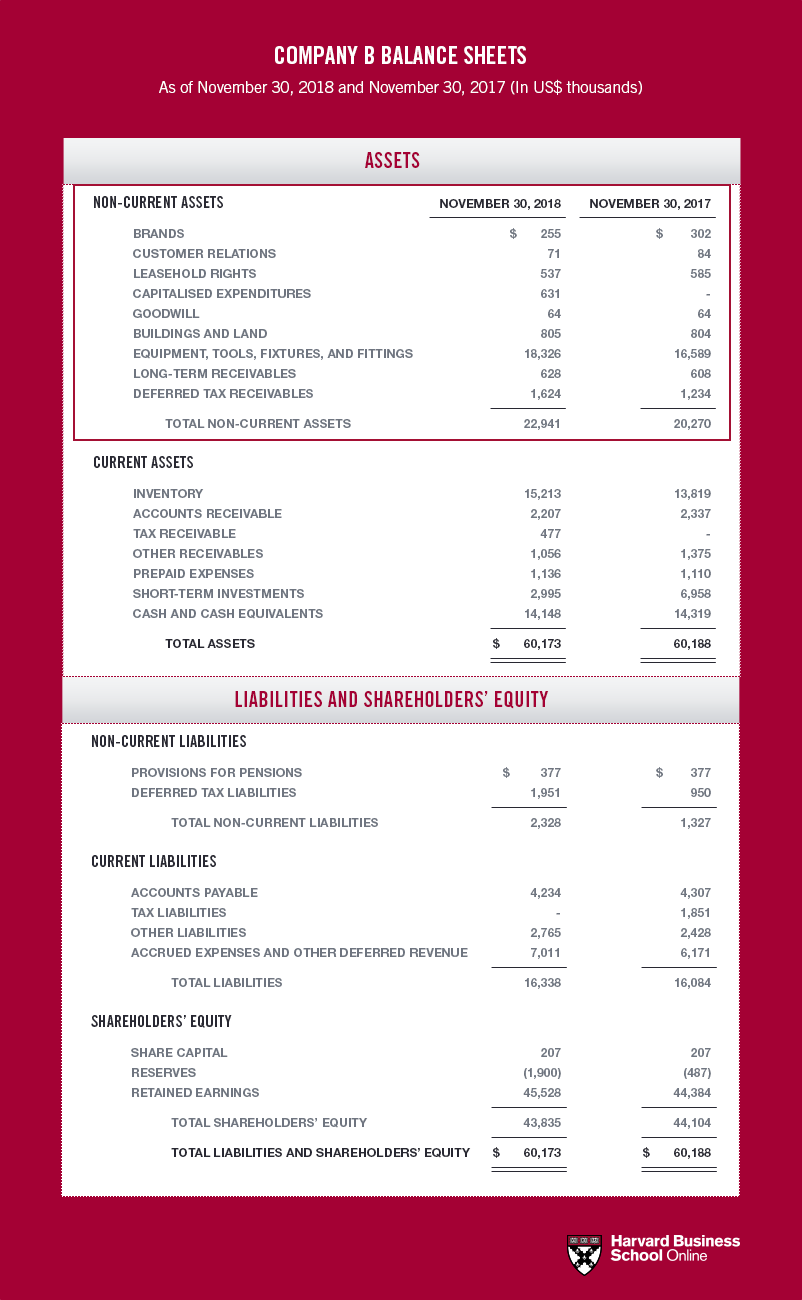

A balance sheet shows the financial position of a business as of the end of a reporting period.

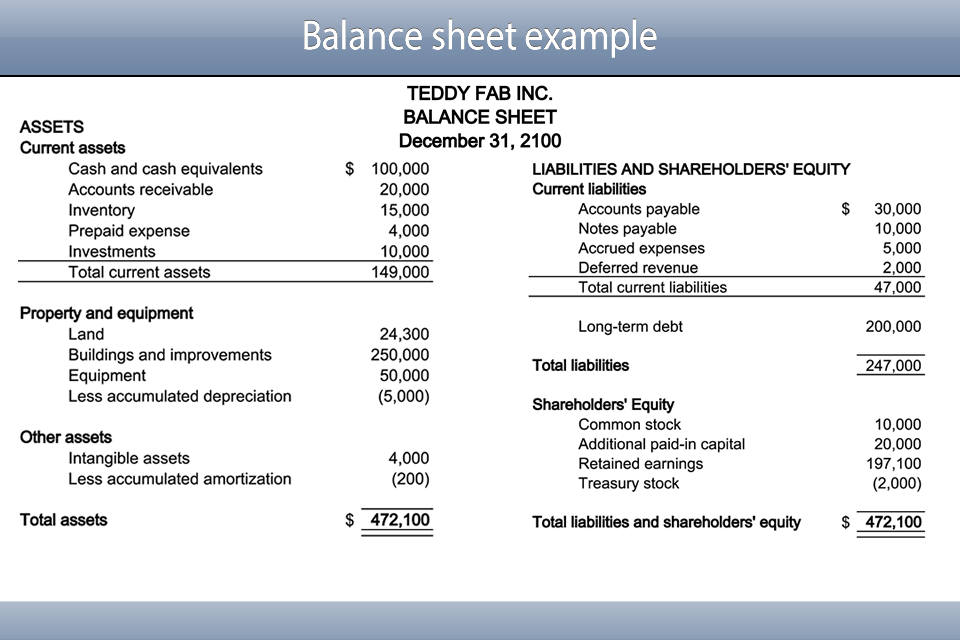

Prepare balance sheet from ratios. To calculate missing figure of assets or liabilities by using accounting ratios formula it is you logic, how will you reach to your required balance sheet item. Ratio #10 receivables turnover ratio While all financial statements are closely intertwined and necessary to understand the true financial health of a company, the balance sheet tends to be particularly useful for ratio analysis.

A balance sheet should always balance. How to prepare a balance sheet. 239 views 3 years ago.

The information it contains can be used to derive a number of ratios that can be used to infer the liquidity, efficiency, and financial structure of a business. Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information. You can get more insight about your business by looking at and using balance sheet ratios.

Ratio #5 debt to total assets. Example 1 calculate the quick ratio from the balance sheet shown below. Assets = liabilities + shareholders’ equity the equation above includes three broad buckets, or categories, of value which must be accounted for:

Financial ratios using amounts from the balance sheet and income statement in this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement. The balance sheet is based on the fundamental equation: The following list includes the most.

Ratio #4 debt to equity ratio. There are two additional financial ratios based on balance sheet amounts. Remember that we have four financial statements to prepare:

After all, that’s what analysts, proprietary traders, and institutional investors do. Assets = liabilities + equity. Preparation of balance sheet from ratios by karale urmila.

Specifically, we will discuss the following: Assets must always equal liabilities plus owners’ equity. Days sales in inventory ratio = 365 days / inventory turnover ratio.

Here are a few ratios to consider: Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). Each of these balance sheet components can tell a story.

Quick ratio = quick assets / current liabilities quick assets = $140,000 + 250,000 + 300,000 = $690,000 current liabilities = $300,000 + 40,000 + 20,000 = $360,000 quick ratio = 690,000 / 360,000 = 1.916 times Ratio #3 quick (acid test) ratio. Ratio #1 working capital.

![Download [Free] Balance Sheet with Ratios Format in Excel](https://exceldownloads.com/wp-content/uploads/2021/09/Balance-Sheet-Template-Feature-Image.png?v=1685413421)