Divine Info About Statement Of Financial Position Calculator Personal Profit And Loss Template

This forms the initial basis of our assessment of your financial health and need.

Statement of financial position calculator. Enter your income, expenditure, debts and assets, then click calculate. This is why we require a complete set of current financial statements. Submitted financial statements will be assessed for an accumulated surplus or an accumulated deficit.

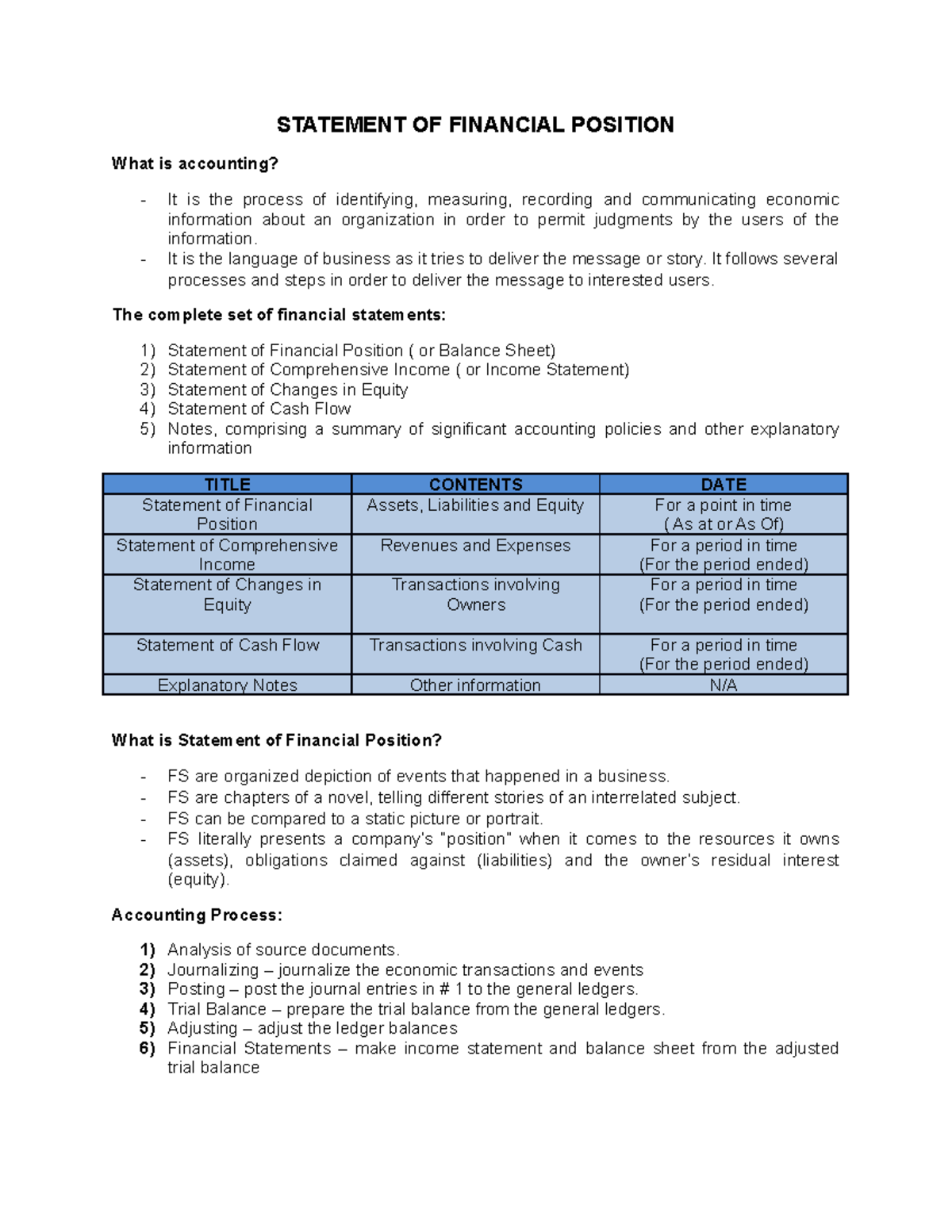

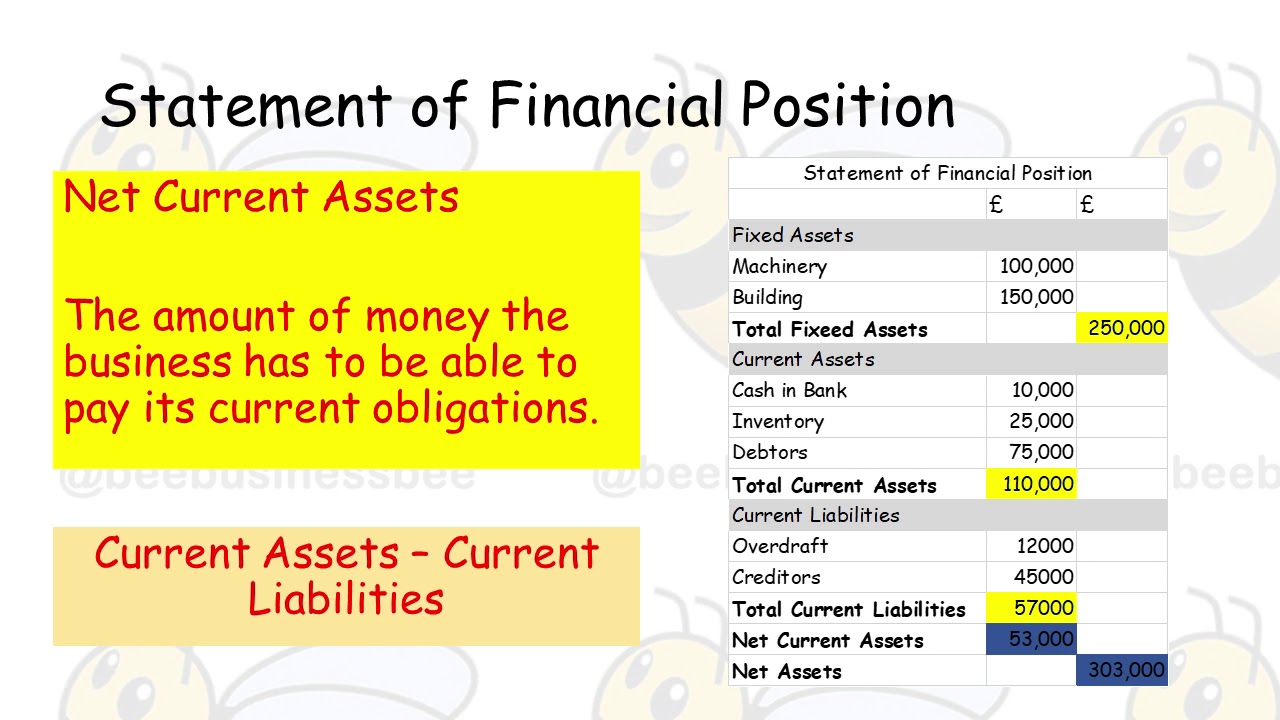

There are three important financial statements, namely the balance sheet, the income statement, and the cash flow statement. For a corporation the format will be: The structure of the statement of financial position is similar to the basic accounting equation.

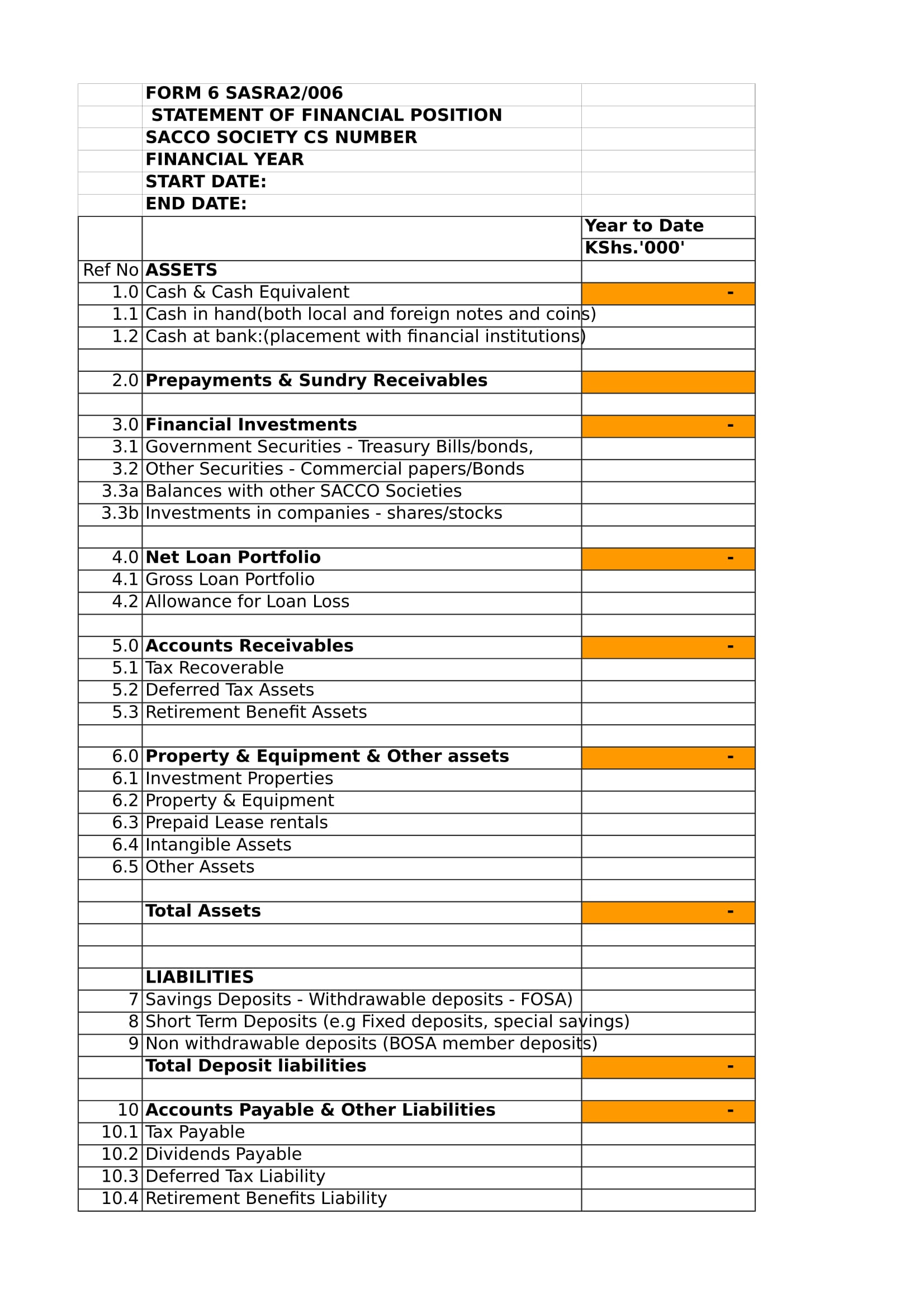

Financial statement calculations and examples. It involves the review and analysis of income statements, balance sheets, cash flow statements, statements of shareholders’ equity, and any other relevant financial statements. It is comprised of three main components:

Financial statement analysis is the process of evaluating a company’s financial information in order to make informed economic decisions. Assets = liabilities + equity this means that all asset line items are presented first, with a total that matches the totals for liabilities and equity, which are presented next. In this worksheet we will focus on calculating and interpreting financial position and cash flow performance indicators.

Updated february 7, 2021. The balance sheet, also known as the statement of financial position, is one of the five essential financial statements that provide crucial financial information about an entity at the end of the balance sheet date. Anything that can be profitable is acceptable.

A statement of financial position is prepared at the end of an accounting period—which is typically 12 months—and provides a snapshot of the overall financial position of your company at a given time. Vertical analysis, income statement = income statement line item ÷ revenue. It calculates yearly and should be balanced, which means both assets and liabilities or shareholders’ equity value should be the same.

The financial statement calculator is a tool that helps you create your own financial statements. In contrast, the process is practically the same for the balance sheet, but there is the added option of using “total liabilities” instead of. Liquidity profitability financial position and cash flow.

The statement of financial position has two sections, assets and liabilities. The formula to perform vertical analysis on the income statement, assuming the base figure is revenue, is as follows. Assets in financial accounting, every resource that a business and perhaps other organizational forms own or manages is referred to as an asset.

Assets = liabilities + stockholders' equity. The statement of financial position is formatted like the accounting equation (assets = liabilities + owner’s equity). You can use the financial position calculator below to conduct a simple assessment of your.

A statement of financial position or balance sheet gives a complete overview of the company’s financial health by evaluating its assets and liabilities. The overall aim of a balance sheet is to get the assets and capital employed to match, thus balancing the sheet. Contents of the statement of financial position common line items in the report are noted below.