First Class Tips About Profit And Loss Expenses Assets Liabilities Capital

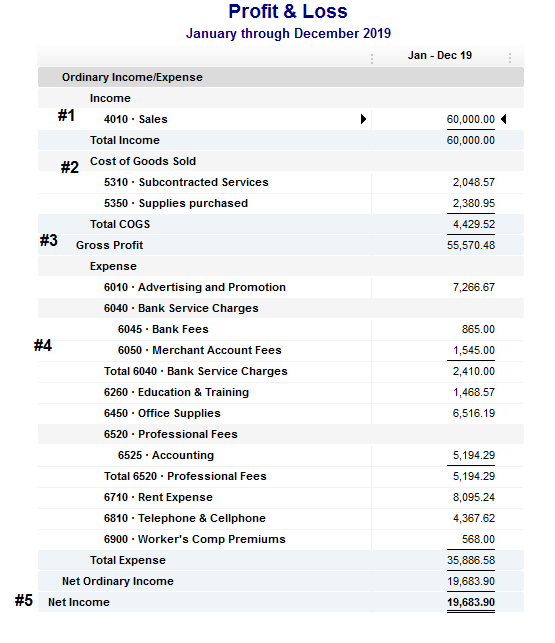

The single step profit and loss statement formula is:

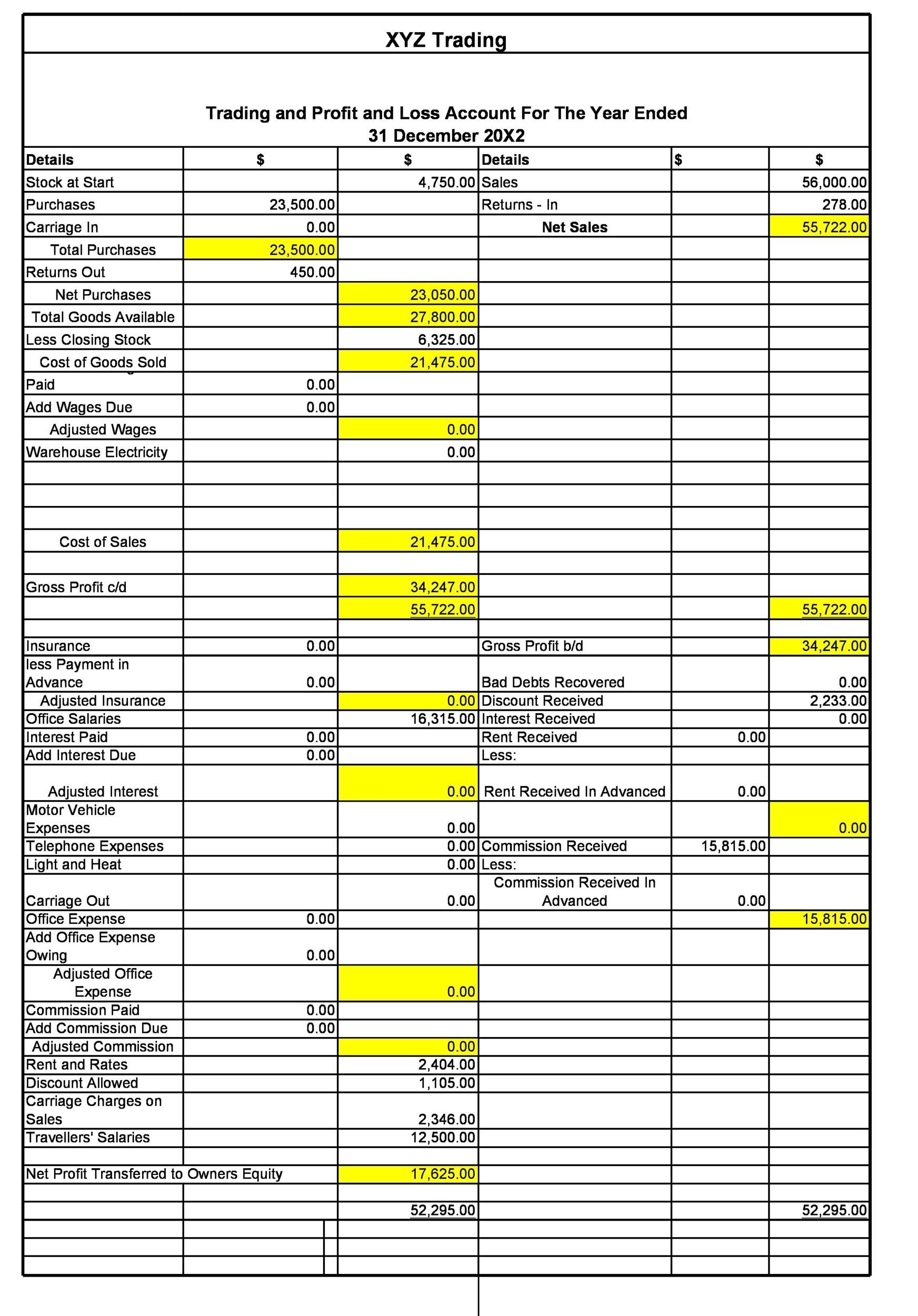

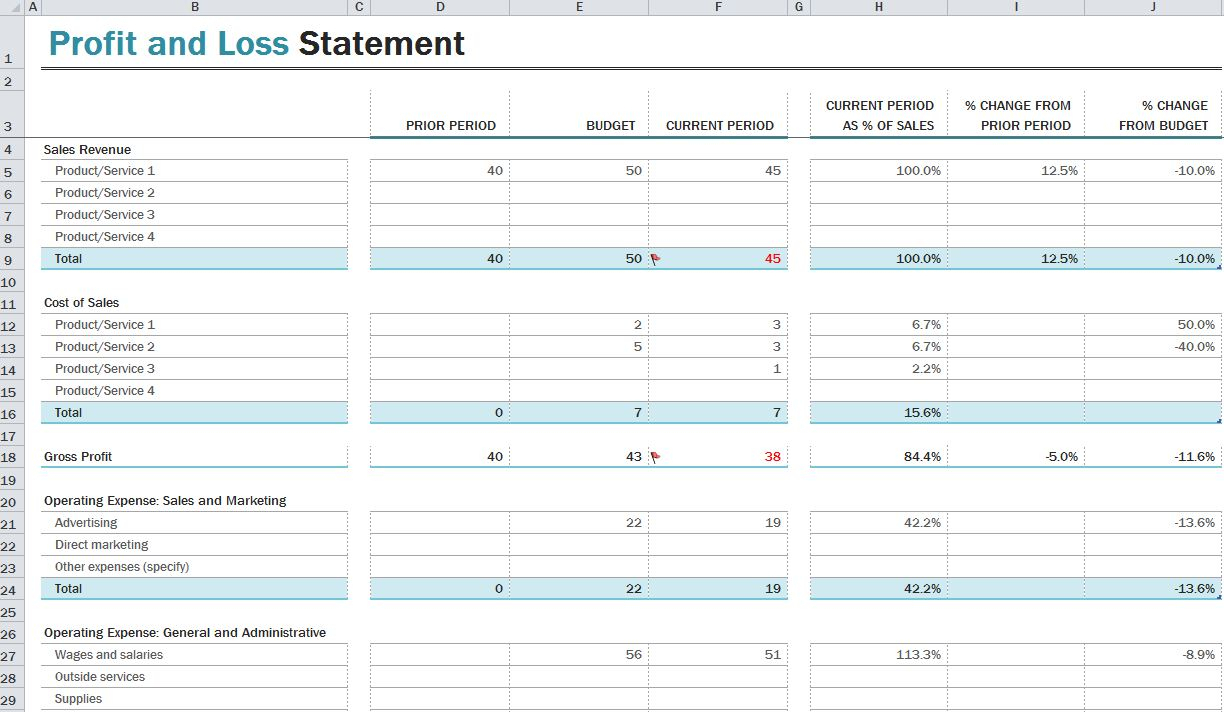

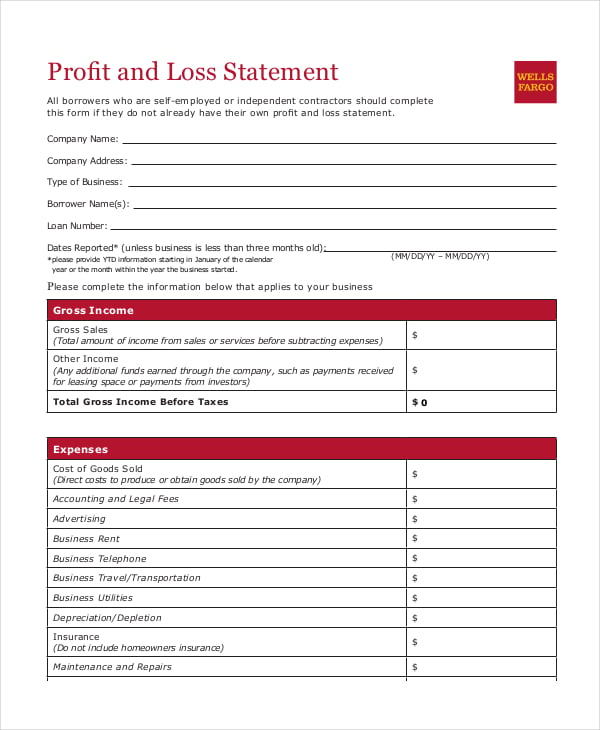

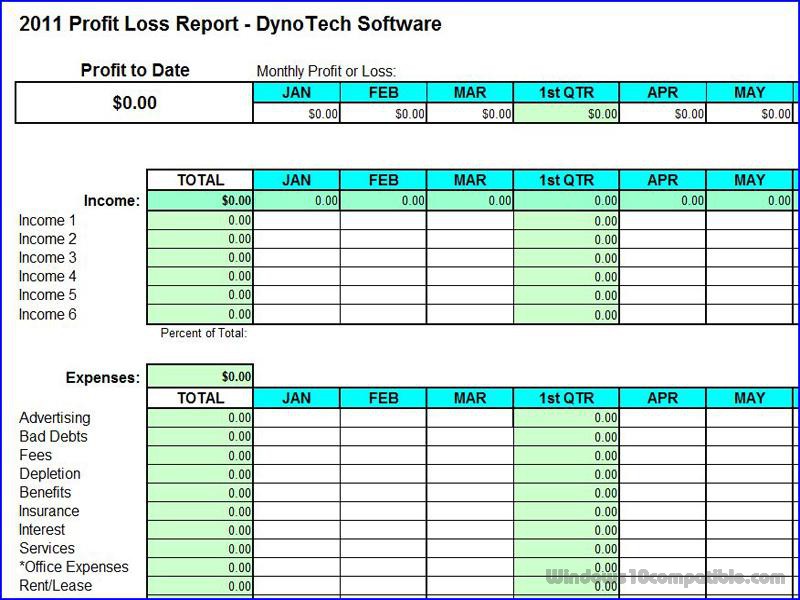

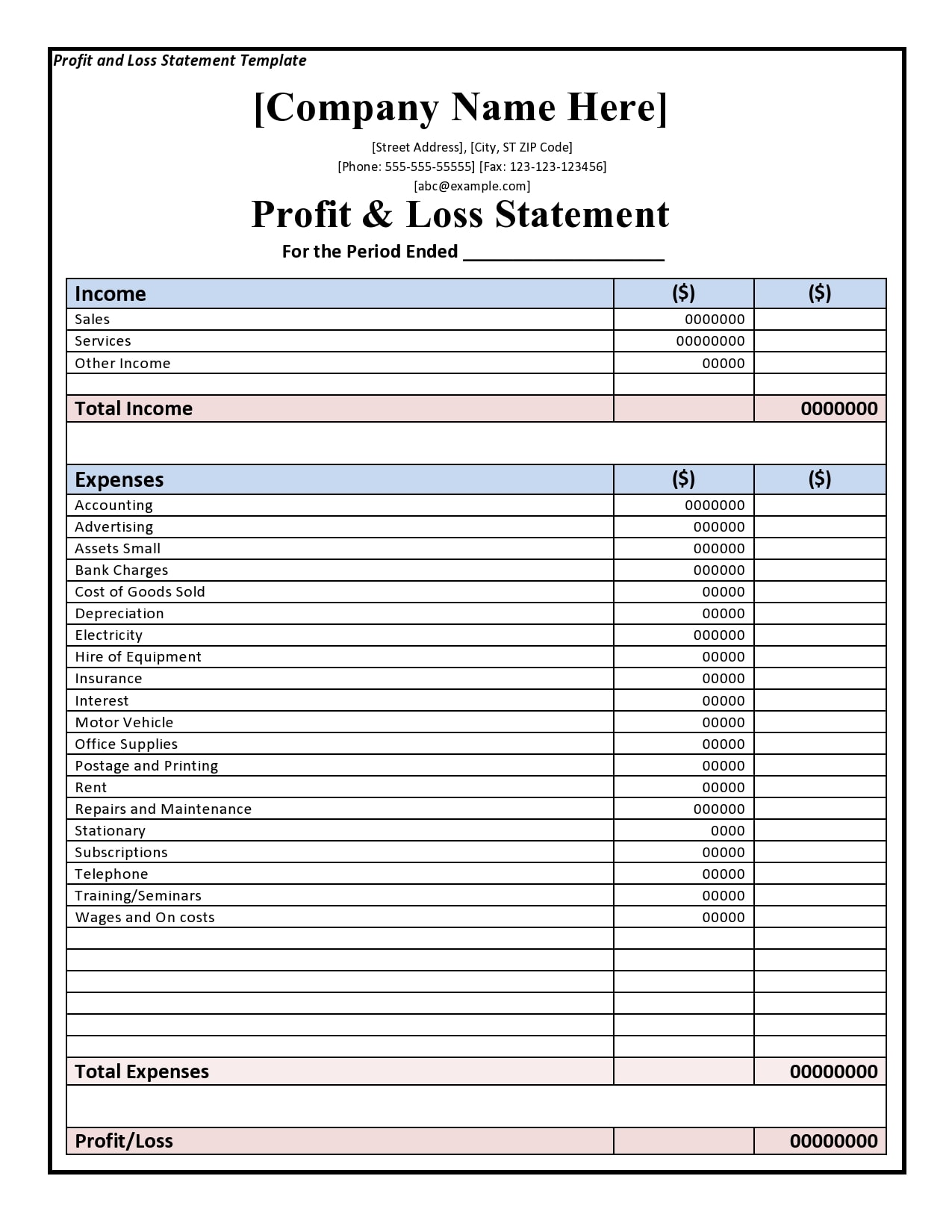

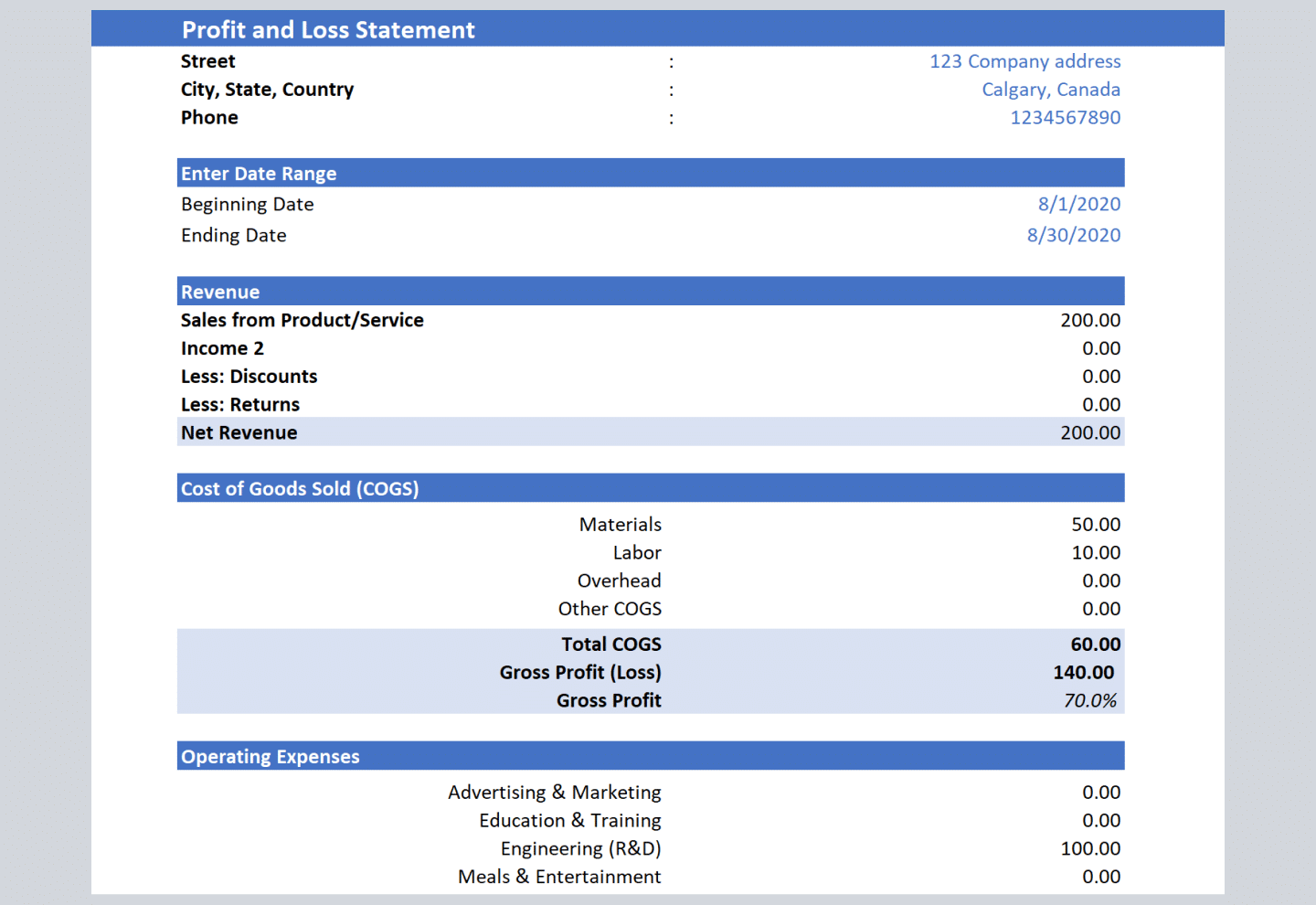

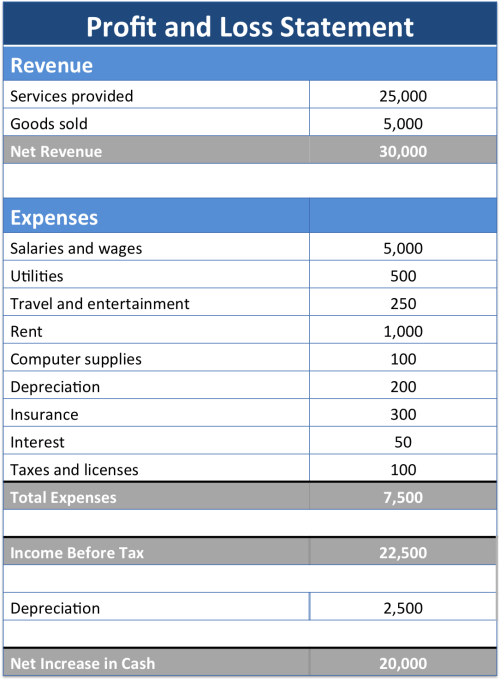

Profit and loss expenses. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and. They begin with revenue, also referred to as the. Subtract operating expenses from business income to see your net profit or loss.

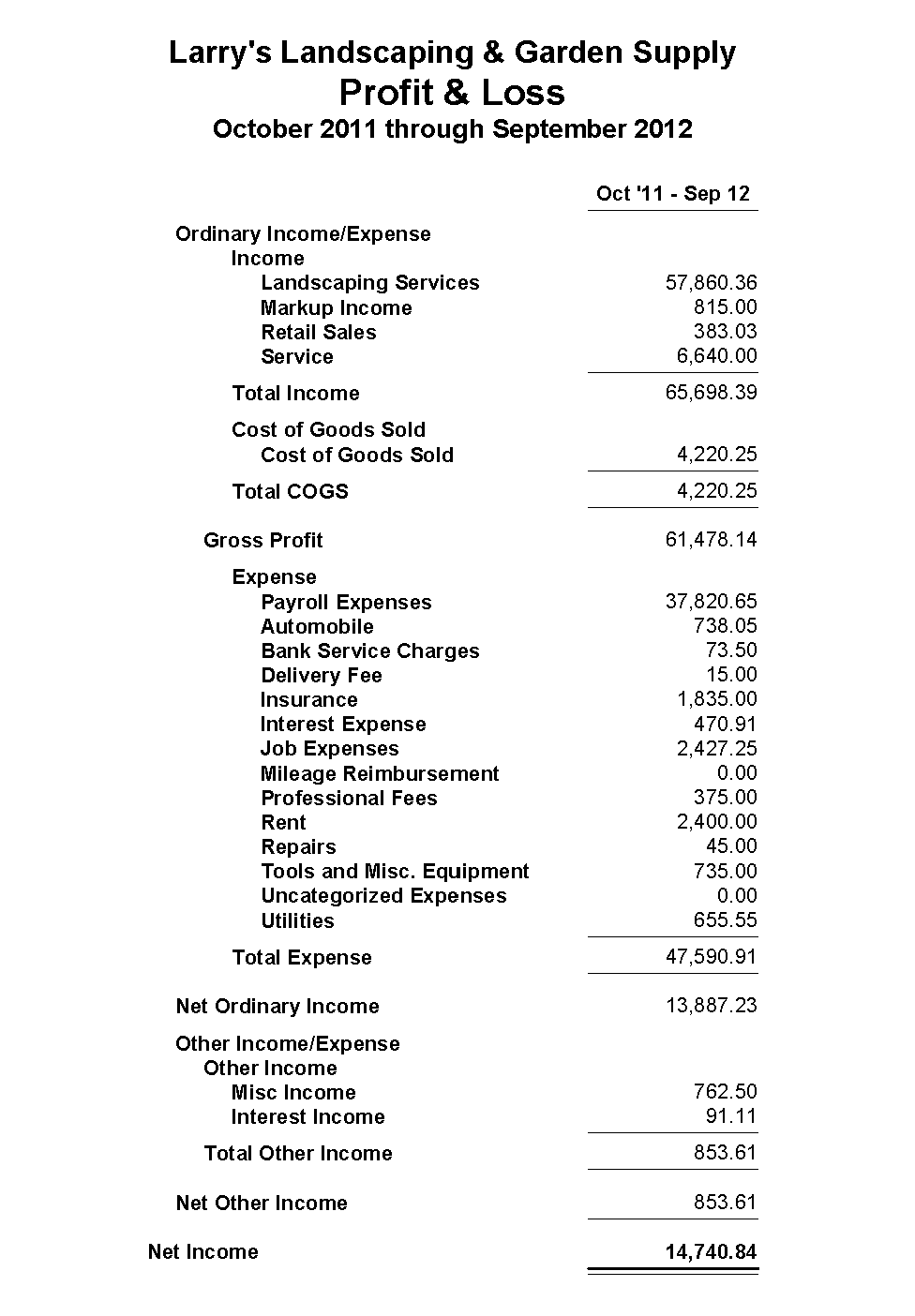

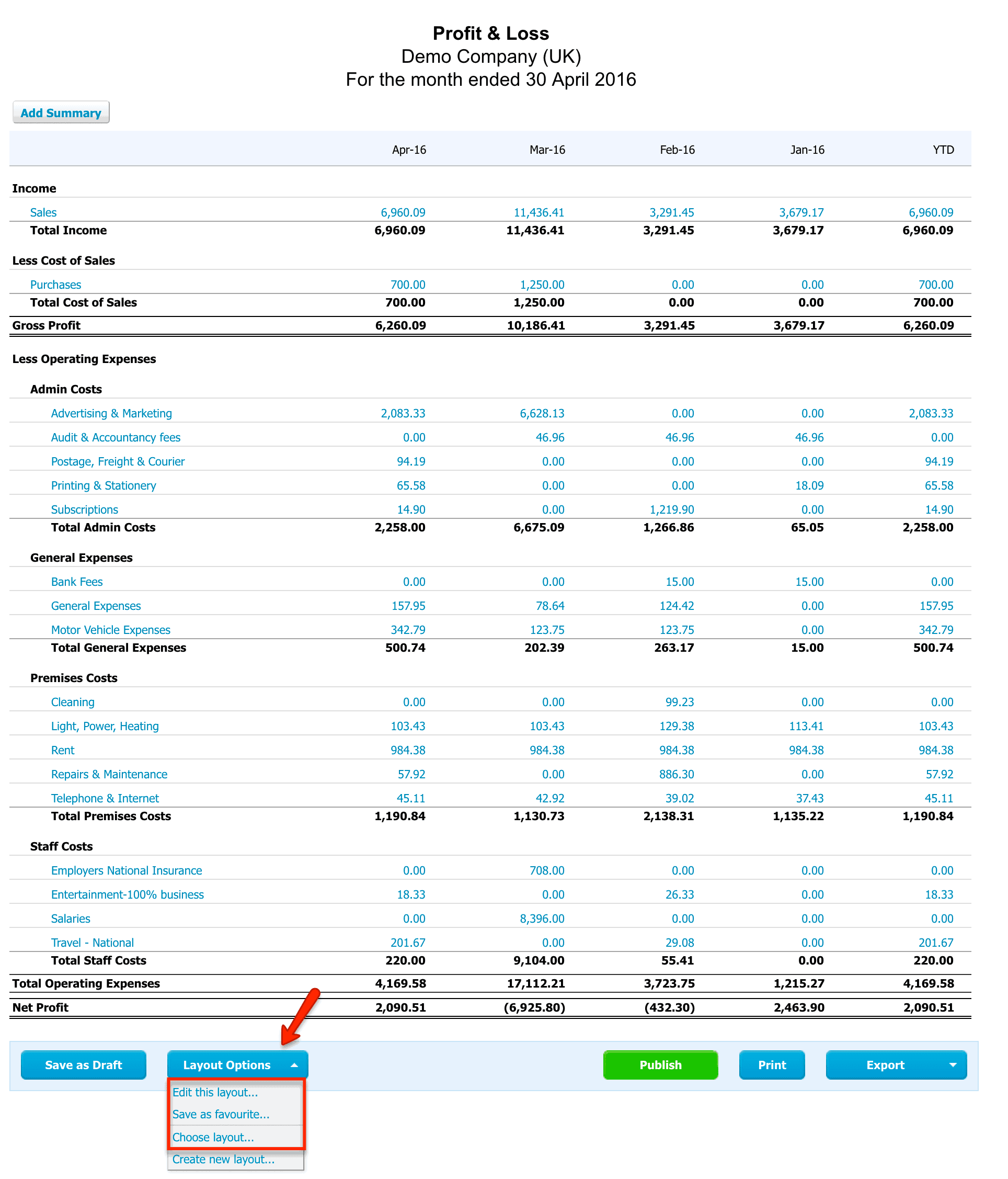

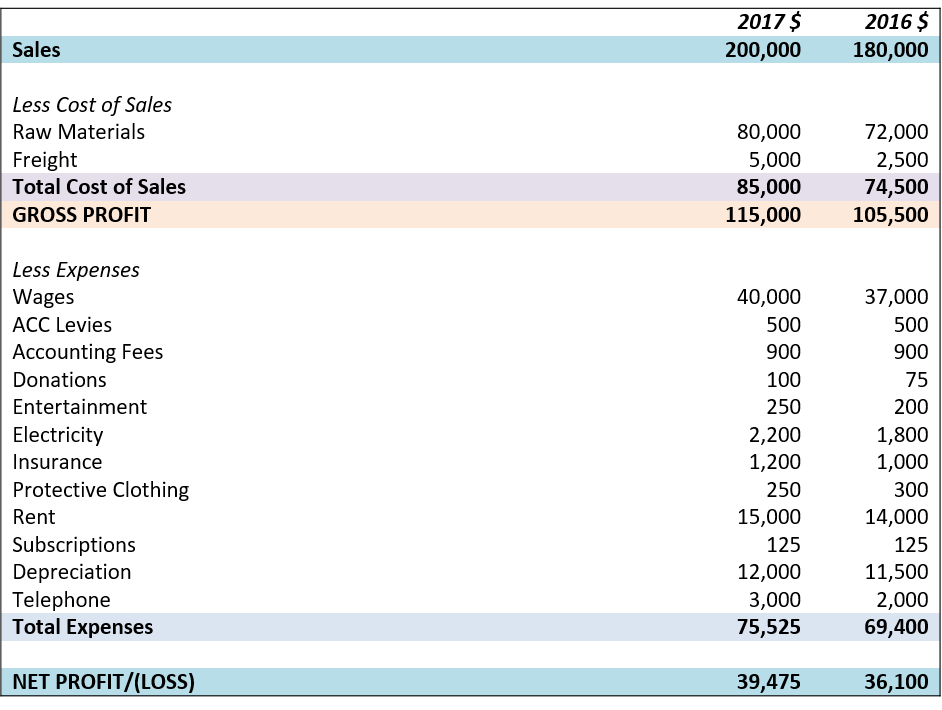

Management analyzes a p&l to determine how to increase profitability. Head to thekredible for a detailed expense breakup. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year.

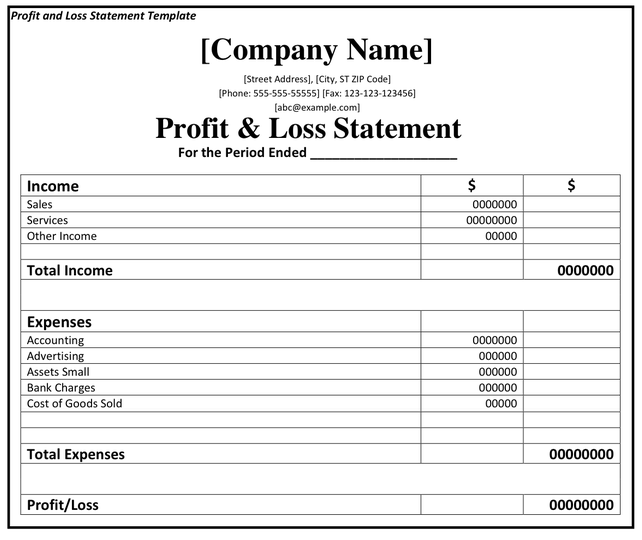

It's a straightforward presentation of a. It shows your revenue, minus expenses and losses. This summary provides a net income (or bottom line) for a reporting period.

A p&l statement explains the income and expenses that lead to a company’s profits (or losses). There are a few strategies to keep top of mind when tracking business expenses and income so you keep from going in the red. The p&l is made up of two types of transactions:

What does the profit and loss statement show? June 23, 2023 want to know how to keep track of expenses and profits in your small business? The rising costs overshadowed a decent holiday quarter.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. By examining a p&l statement, business owners and. It starts with the top line (total revenue) and ends with t he bottom line (net income or net profit/loss).

Every product has a cost price and a selling price. What is a profit and loss statement? Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

A profit and loss statement contains three basic elements: The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

A p&l statement provides information about whether a company can. Profit and loss profit and loss formula is used in mathematics to determine the price of a commodity in the market and understand how profitable a business is. A p&l statement compares company revenue against expenses to determine the net income of the business.

Net income is a result of revenues (inflows) being greater than expenses (outflows). A p&l statement is also known as: A profit and loss statement is a straightforward way to summarise expenses and income during a period of time.