Unique Info About Sba Financial Statement Template What Goes Into A Profit And Loss

As such, it shows your collection of total assets plus how they were paid for.

Sba financial statement template. You are using an outdated browser. Sba personal financial statement template. Score , an sba partner, has templates and online tools to help small business owners set up each of these financial statement documents at score.org.

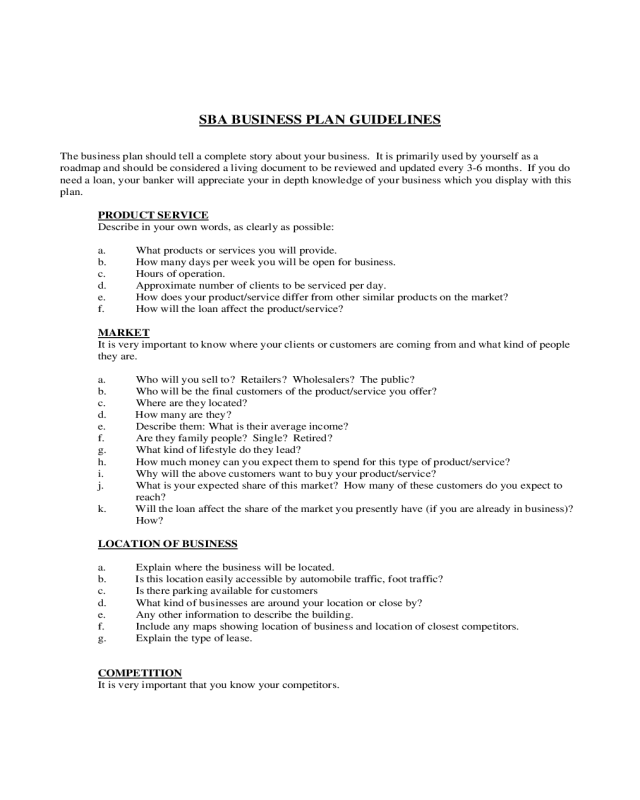

Andrew wan if you’re applying for a loan from the small business administration (sba), there’s a good chance that you’ll need a business plan to get approved. Templates include calculations for revenue, expenses, and overall profit and loss, and they are used to document, analyze, and project business finances. Provide a prospective financial outlook for the next five years.

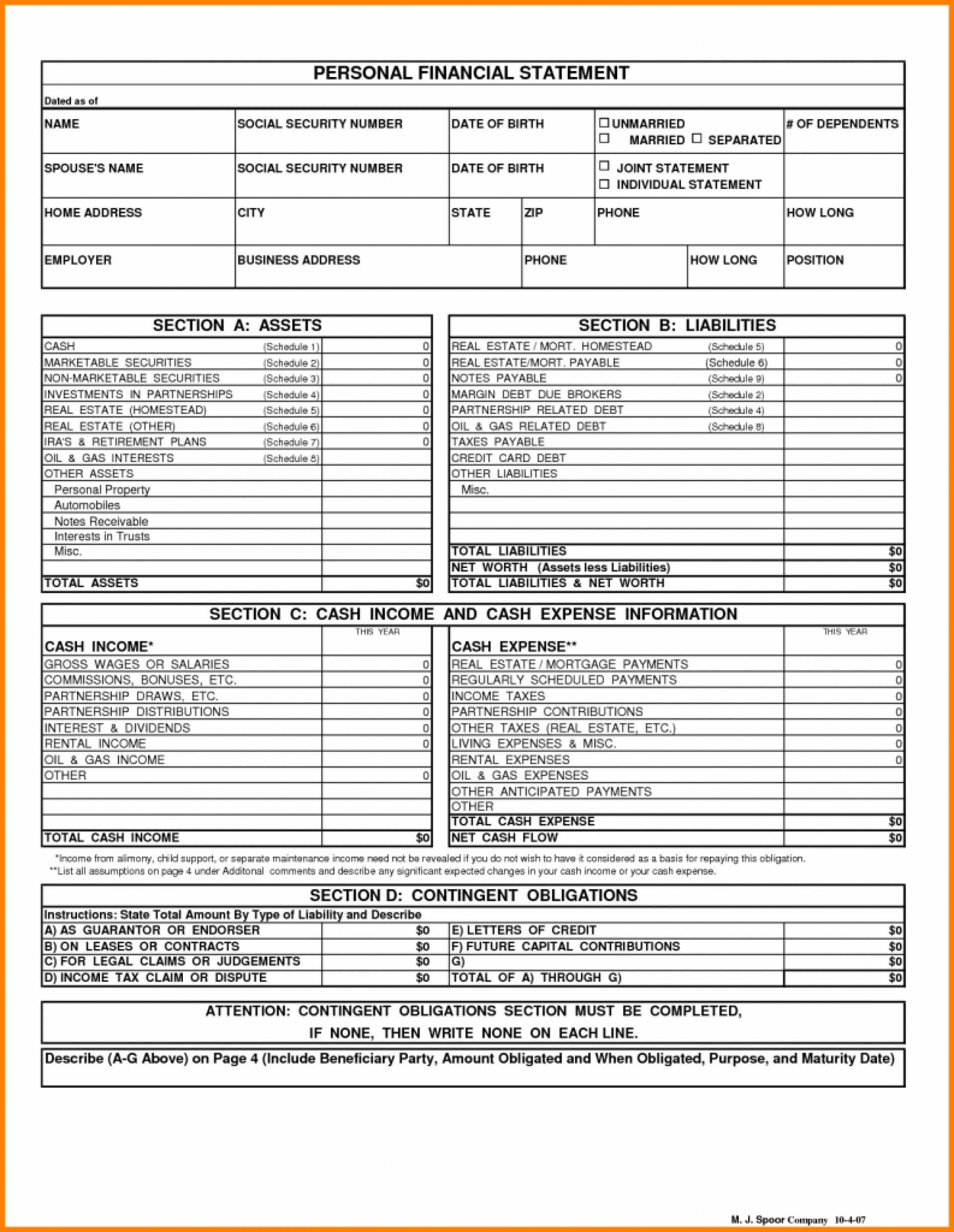

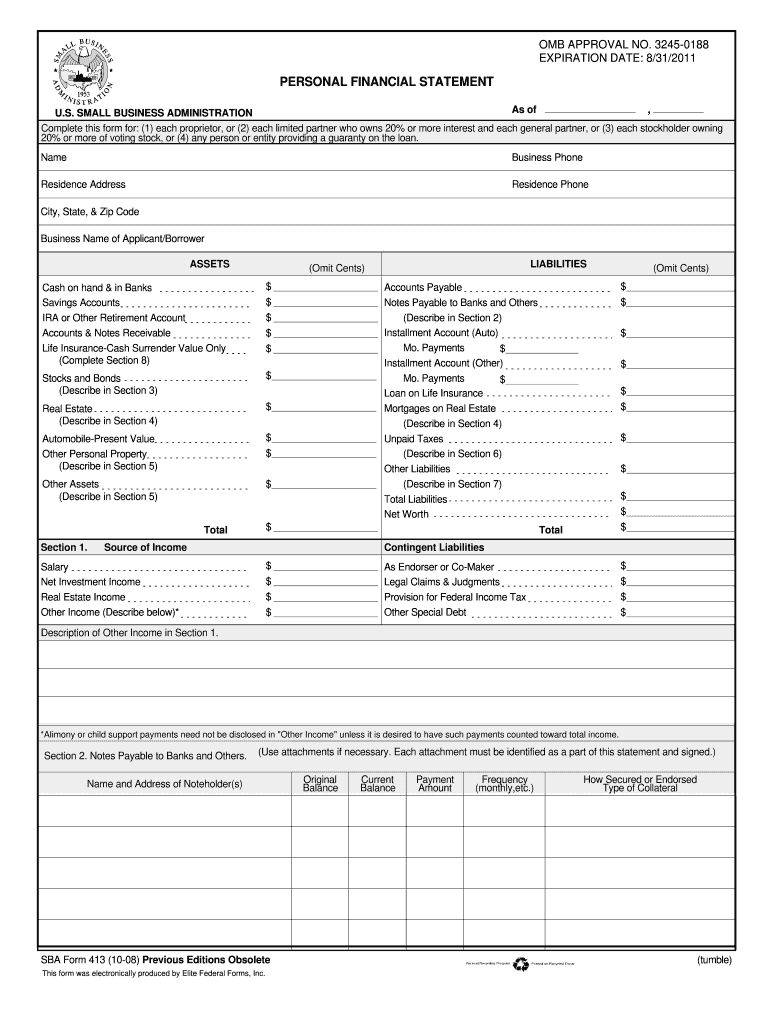

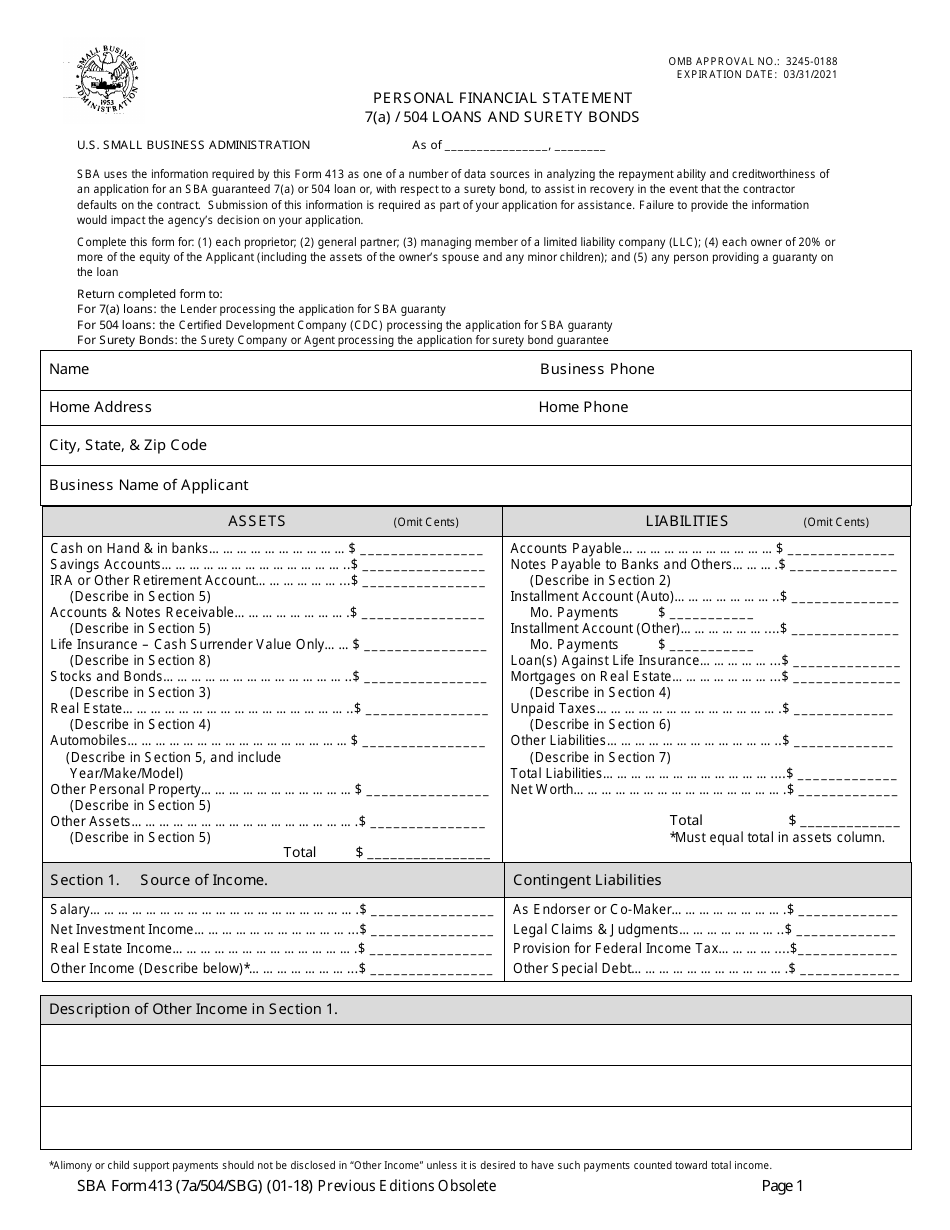

Sba form 413, formally titled “personal financial statement,” is a document that the u.s. What are financial projections used for? You can use this free, downloadable template to document your assets, liabilities and net worth.

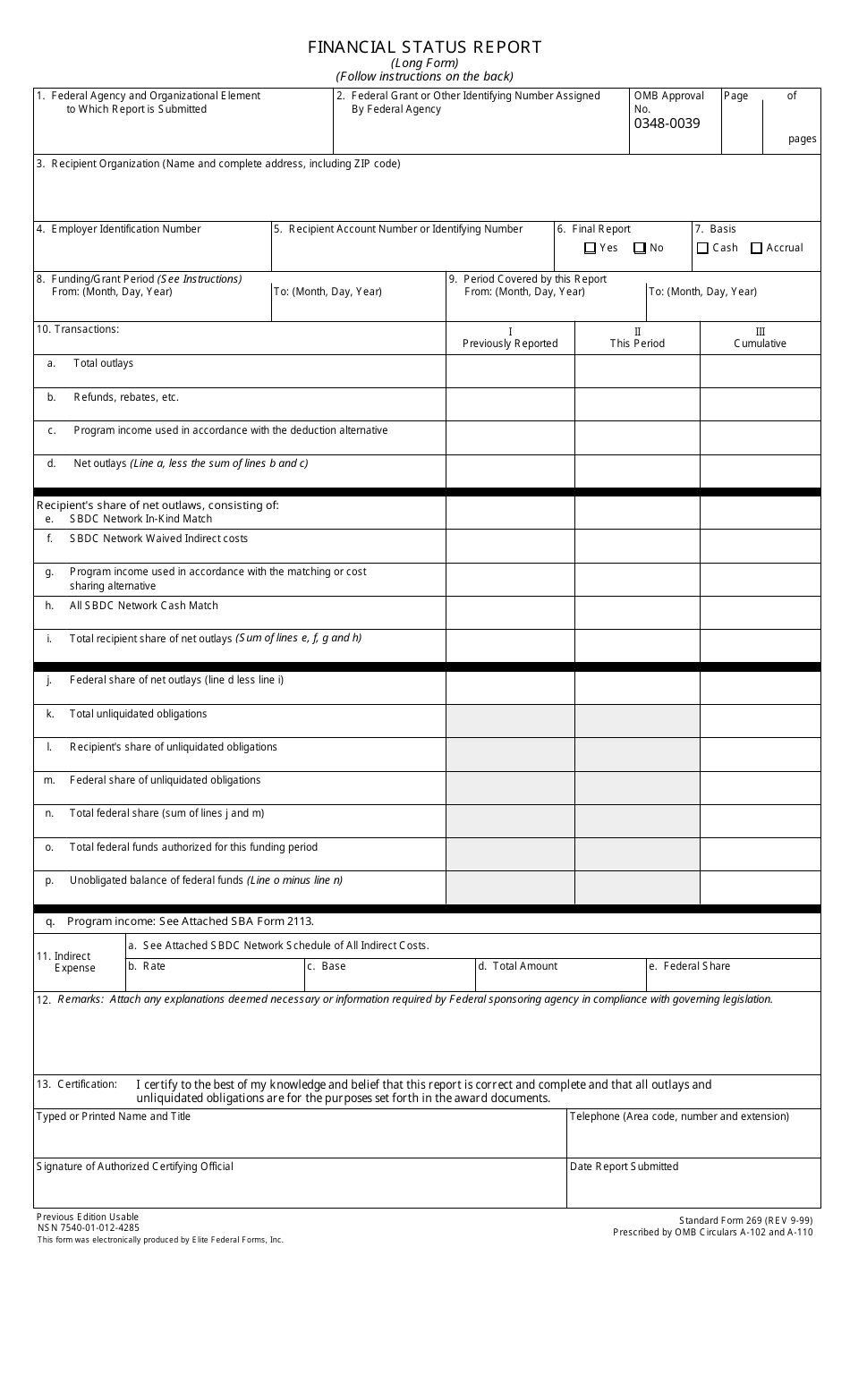

Sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. ( a) except as set forth in paragraph (a) (1) of this section, participants with gross annual receipts of more than $10,000,000 must submit to sba audited annual financial statements prepared by a licensed independent public accountant within 120 days after the close of the concern's fiscal year. Reinvestor sbic exhibit to form 468

Your historic cash flow statements can guide you in projecting your future cash flow to help you plan for the future. Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Sbic licensee financial statements and investment performance.

(1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g There are many strategies for preparing financial statements for a small business. Generally accepted accounting principles, known as gaap or “gap,” provides a common a way to standardize financial reporting using the accrual method.

The goal of a balance sheet is to make sure that your company’s assets are equal to the combination of your liabilities and owners’ equity, i.e., assets = liabilities + equity (net worth). The small business administration (sba) requires form 413, the personal financial statement, for most sba loans, such as the eidl loan, 7(a) loan, and 504 loan. It lists your assets (what you own), your liabilities (what you owe), and your net worth.

A small business income statement template is a financial statement used to report performance. Private companies aren’t required to follow gaap. Business planning & financial statements template gallery.

Gather all of your financial documents and fill out each section. Form 770 is the financial statement of debtor that is used by sba servicing centers for actions that require current financial information for a specific borrower or debtor. A personal financial statement is a snapshot of your personal financial position at a specific point in time.

Financing | templates how to write an sba business plan [+free template] published june 13, 2023 reviewed by: Components included in the personal financial statement The sba form 413 is a personal financial statement that is filled out when applying for an sba 7(a), sba 504, or sba disaster loan.