Brilliant Tips About Increase In Accounts Payable Effect On Cash Flow 3 Activities Of

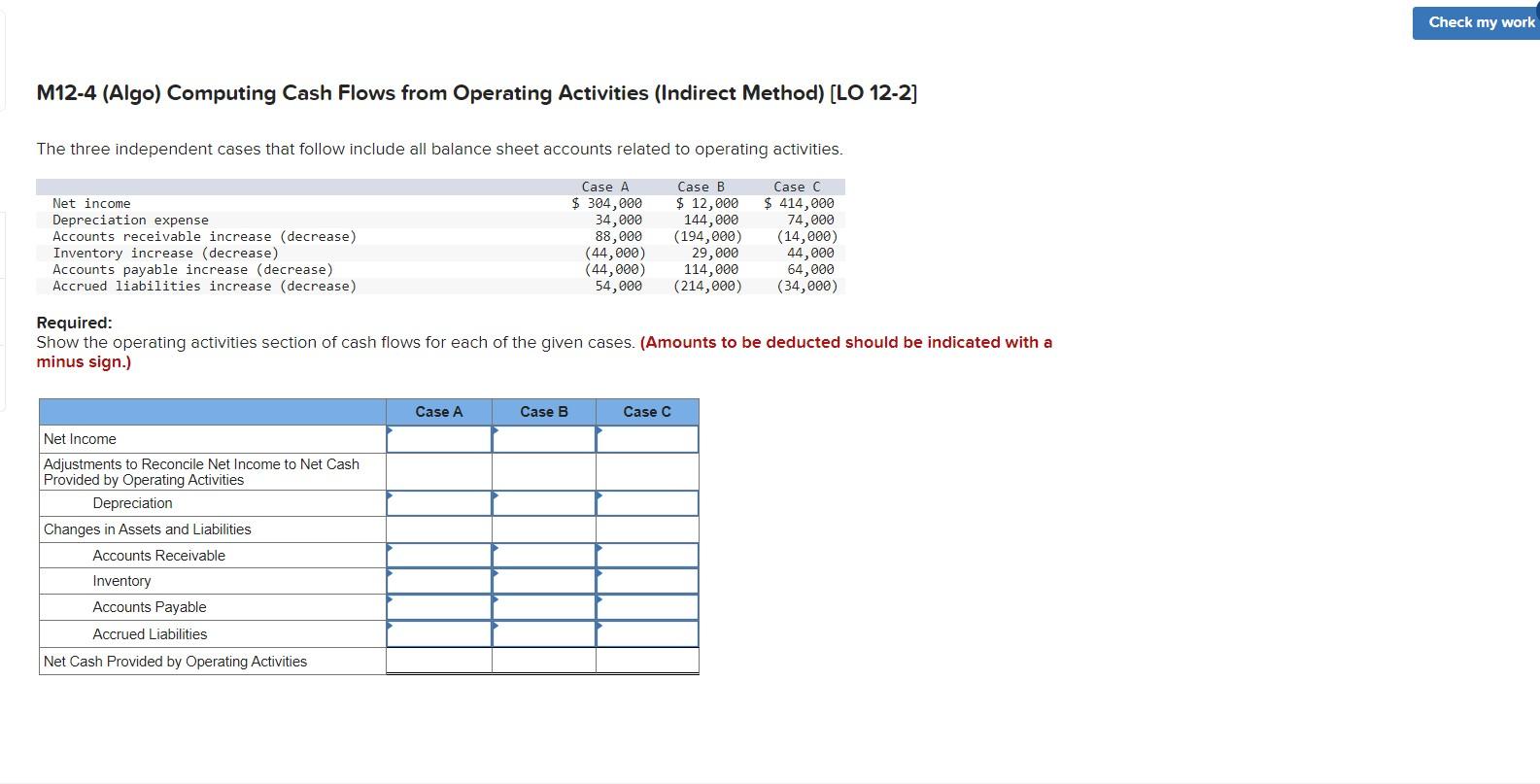

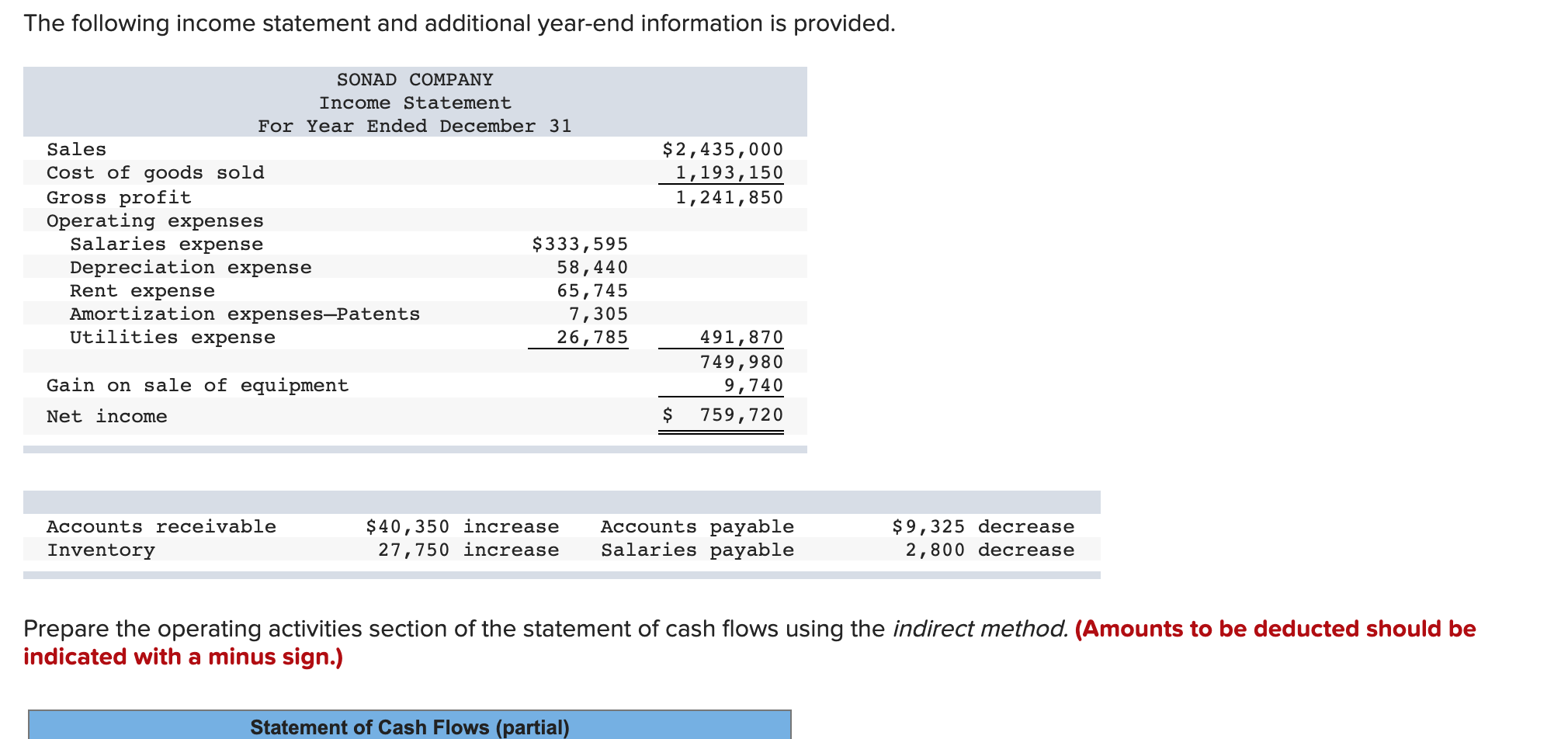

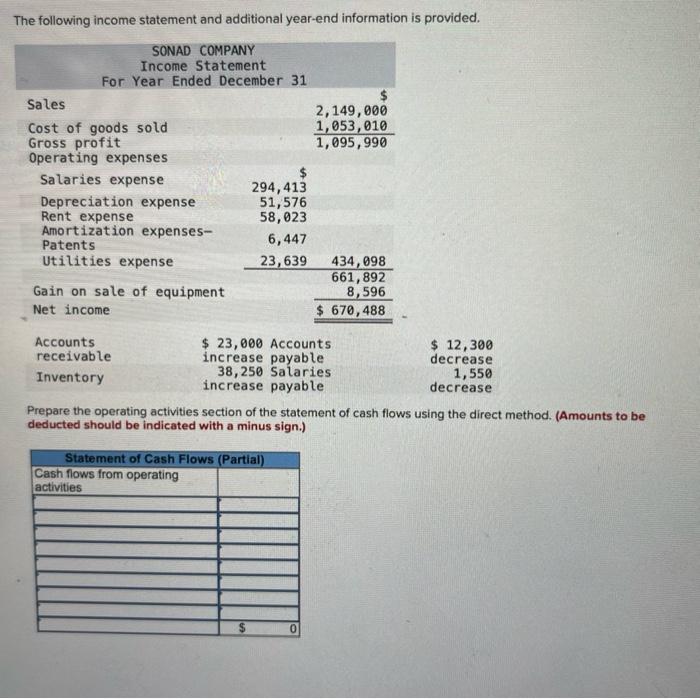

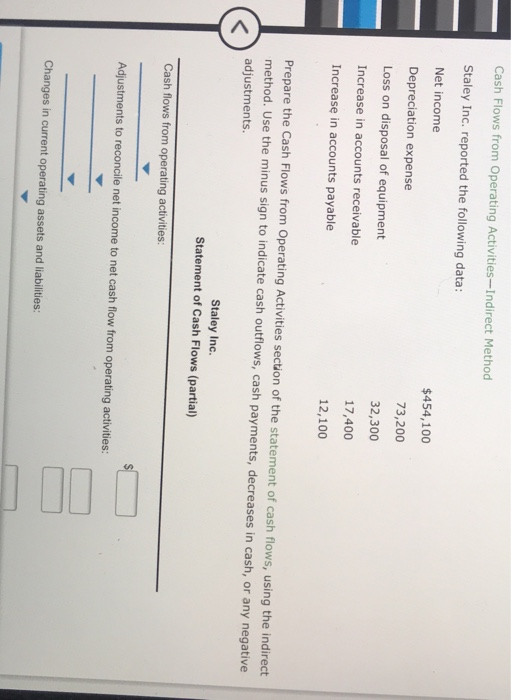

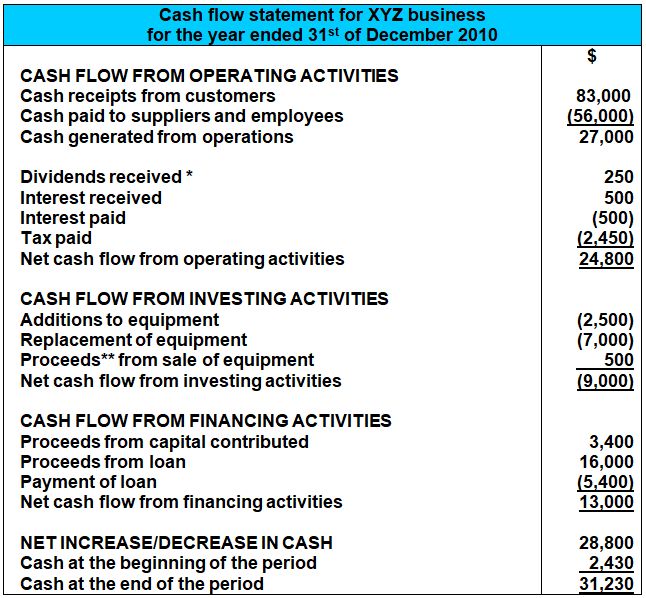

To prepare the statement of cash flows for clear lake sporting goods, we need the beginning cash balance from the balance sheet, net income and depreciation expense.

Increase in accounts payable effect on cash flow. Suppose the company’s average accounts payable per day are $150. Suppose a company has an average accounts payable period of only 30 days. Paying it will reduce the accounts payable.

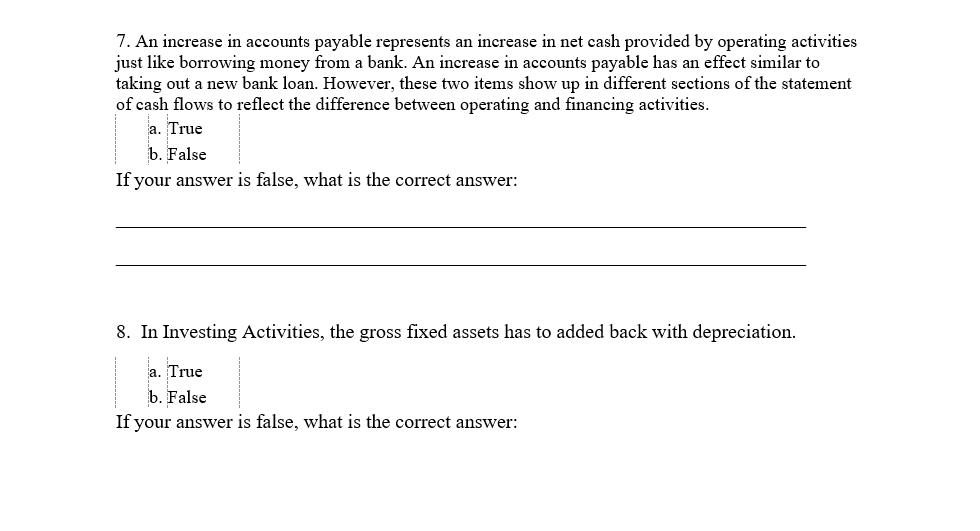

Accounts payable are amounts you owe to your suppliers that are payable sometime within the near future, near meaning. An increase in accounts payable indicates positive cash flow. It means the company pays its suppliers and vendors within 30 days.

If accounts payable is high, it means that the company has more money flowing out than flowing in. So, the monthly payables balance would be $4,500. Our case study shows you how to calculate your average.

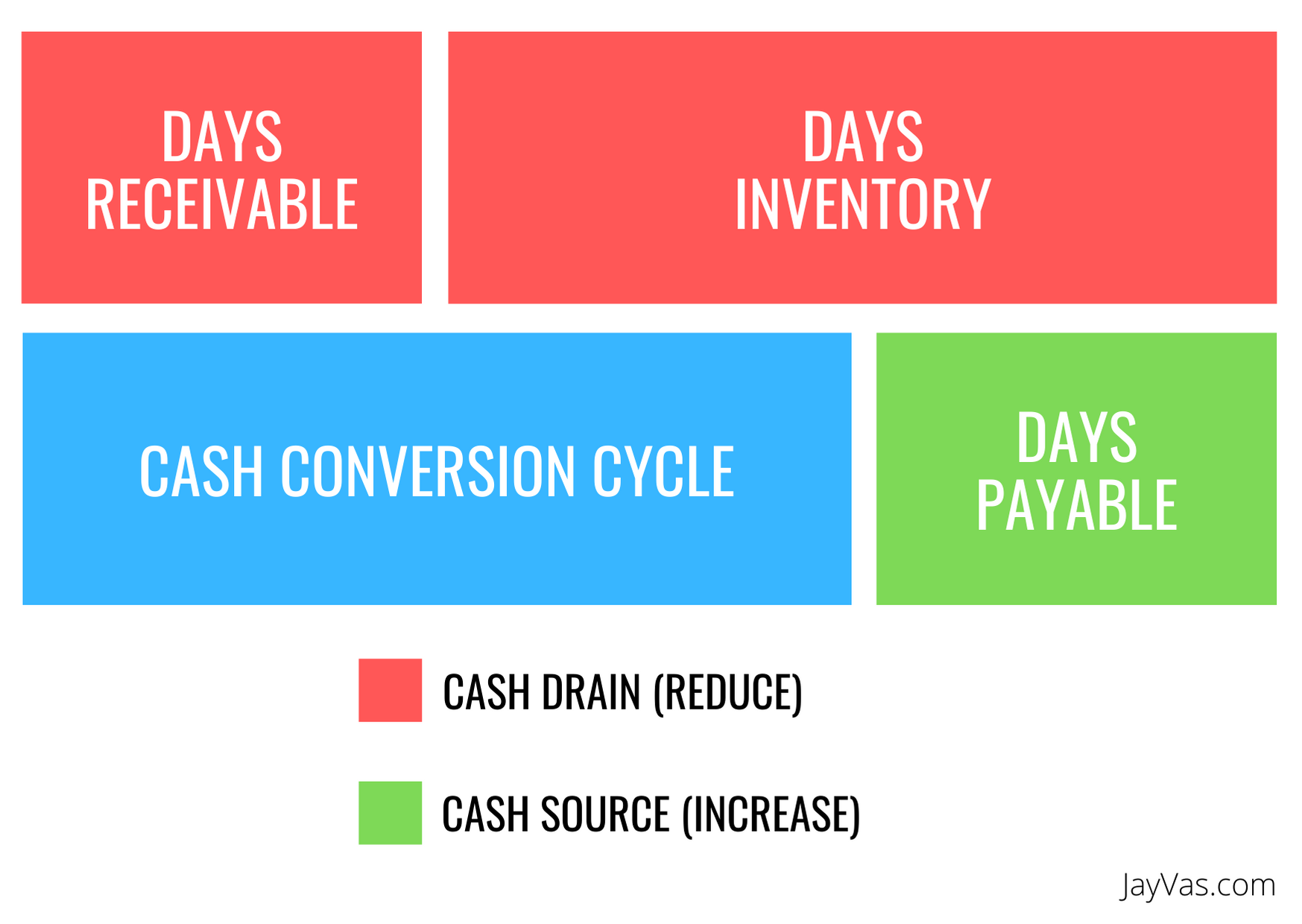

Accounts payable vs receivable. Accounts payable and the cash flow implications. An increase in accounts payable is favorable for a company's cash balance it may help to view the positive amounts on the scf as being favorable or good for a company's.

Improving supplier relationships, implementing processes and looking to the future will help you keep your accounts payable at the right level, along with your cash. A key aspect of managing accounts payable is understanding your financial obligations. In this blog, we’ll explore the impact of both an increase and a decrease in.

Essentially, a bill that is due to be paid represents an increase in accounts payable; By delaying payments, businesses can retain more cash for other essential. This transaction of the credit purchase has saved us.

The average payable period is the best indicator of your success in managing your cash outflows. Increasing accounts payable is a source of cash, so cash flow increased by that exact amount. Increasing accounts payable by extending payment terms can improve cash flow in the short term.

The cause of the increase in accounts payable (and cash flows) is the increase in days payable outstanding, which increases from 110 days to 135 days. If the company can negotiate better. The reason for this comes from the accounting nature of accounts payable.

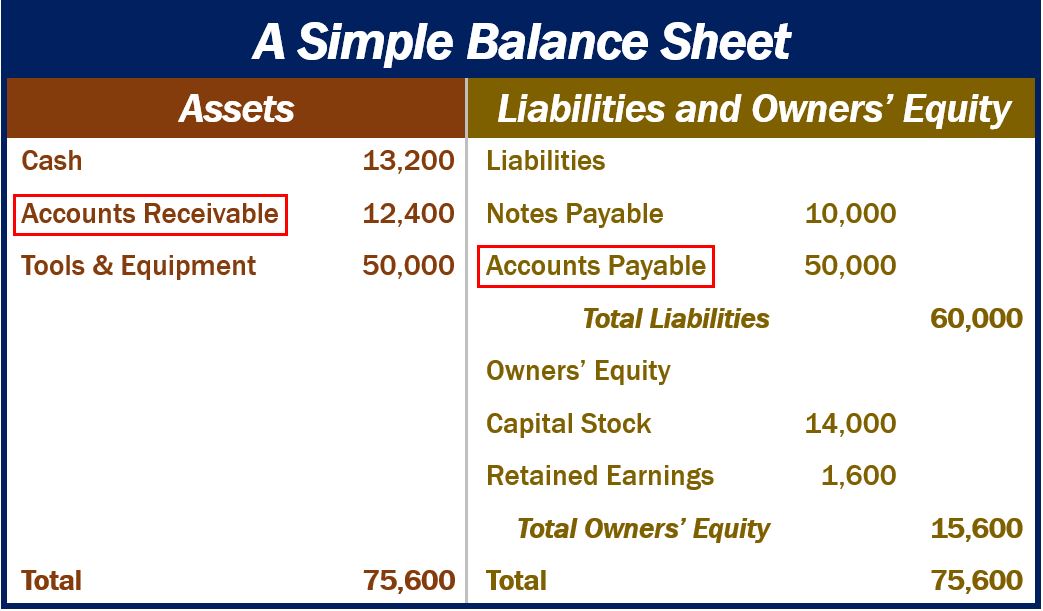

When looking at accounts payable vs receivable, both are accounts that are found on the balance sheet. But how does an increase in accounts payable affect cash flow, exactly? In this journal entry, there is an increase in accounts payable increase (credit) as a result of making the purchase on credit.

Accounts payable and cash flow. By extending the payment period. Among the various factors influencing cash flow, accounts payable (ap) plays a significant role.