Here’s A Quick Way To Solve A Info About Common Size Statement Example Simple Profit And Loss Sample

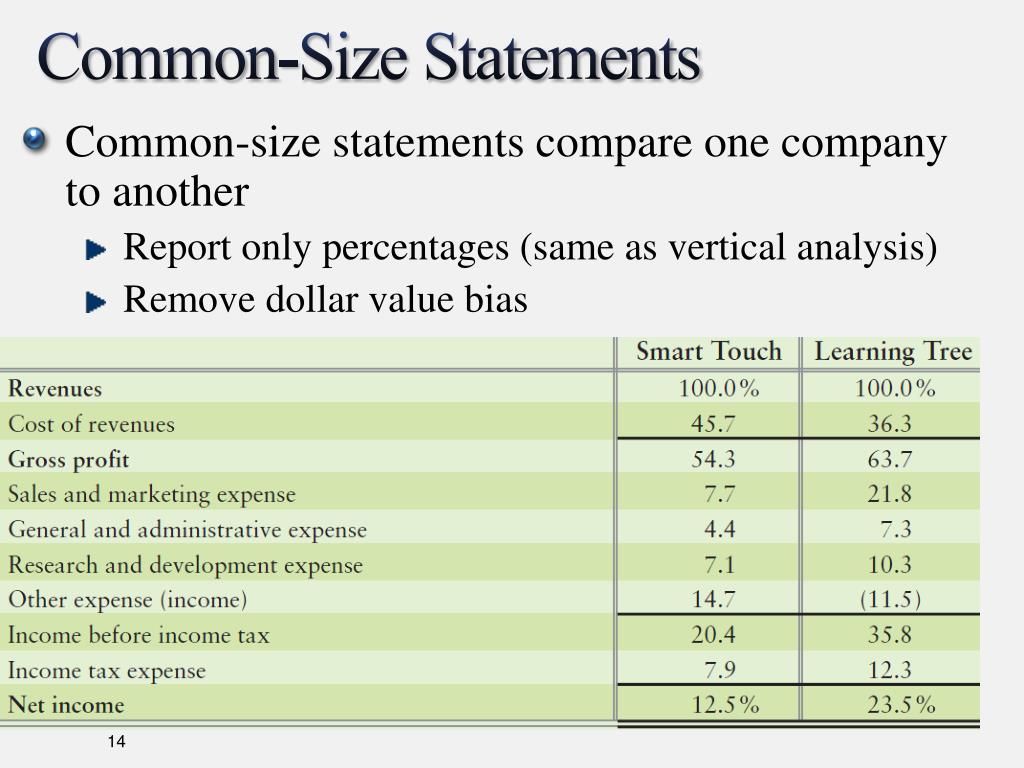

(1) to evaluate information from one period to the next within a company and (2) to evaluate a company relative to its competitors.

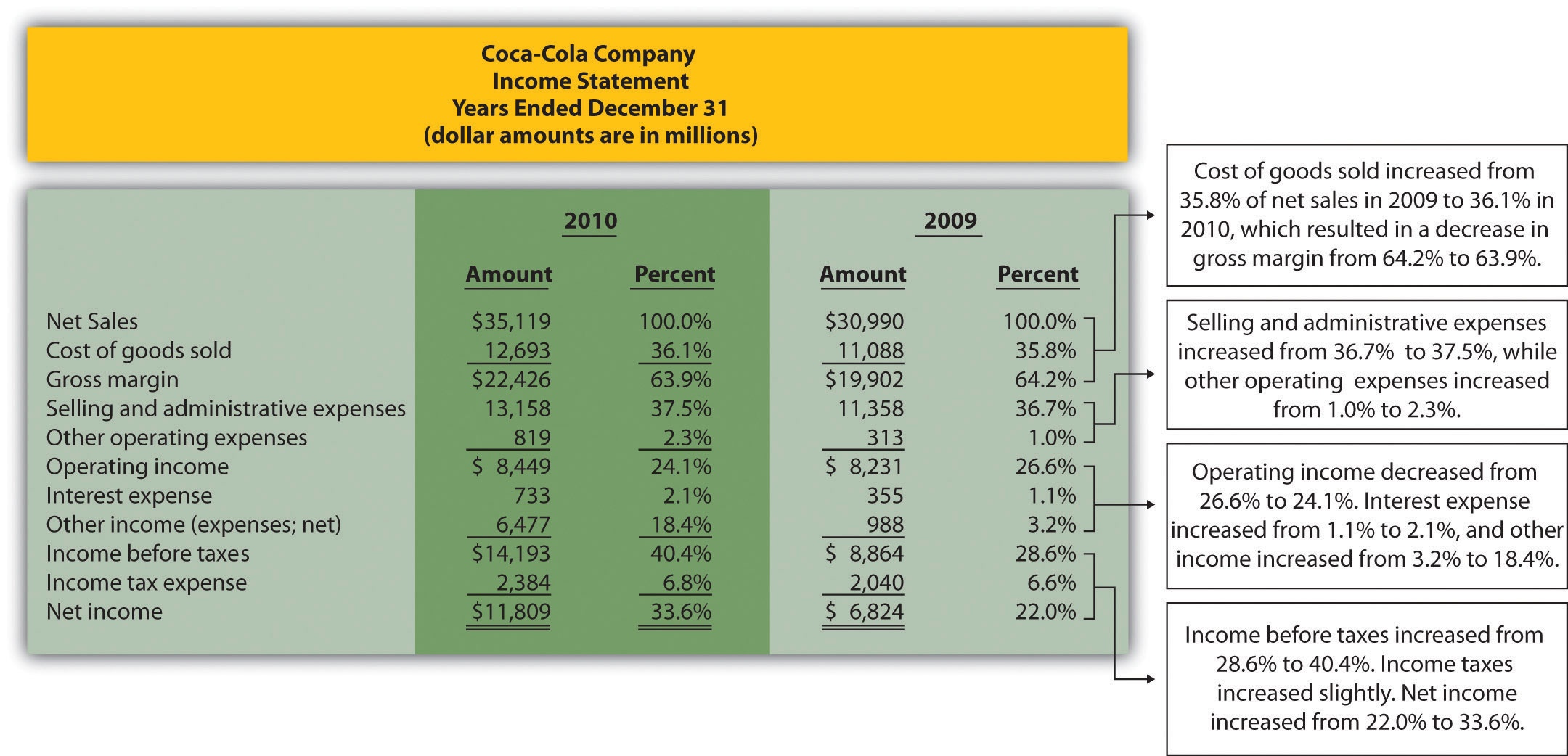

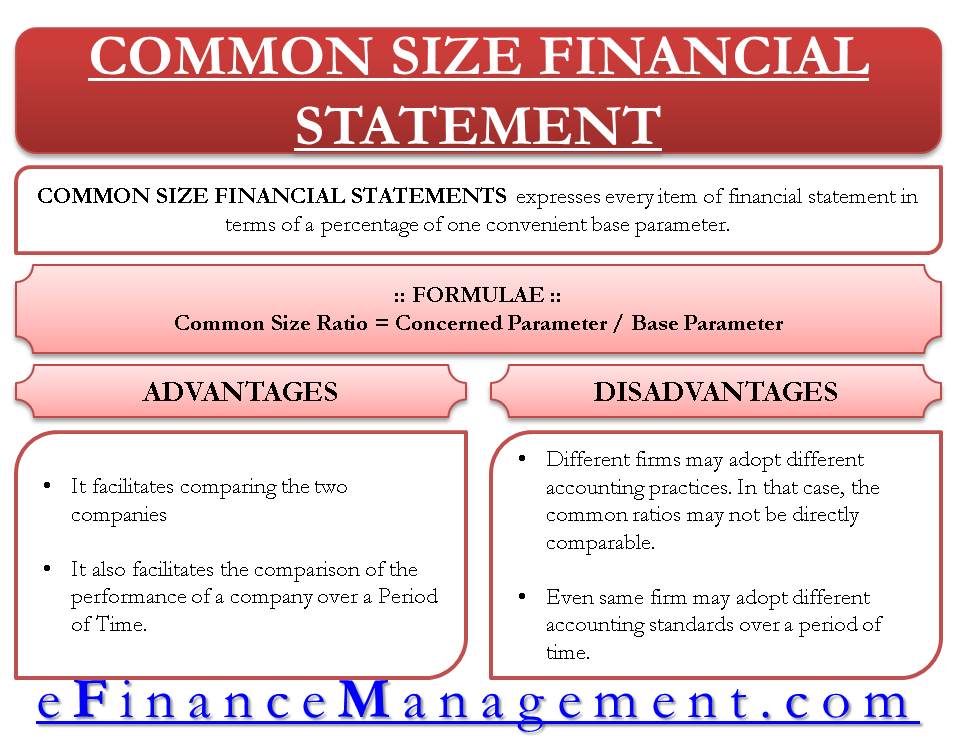

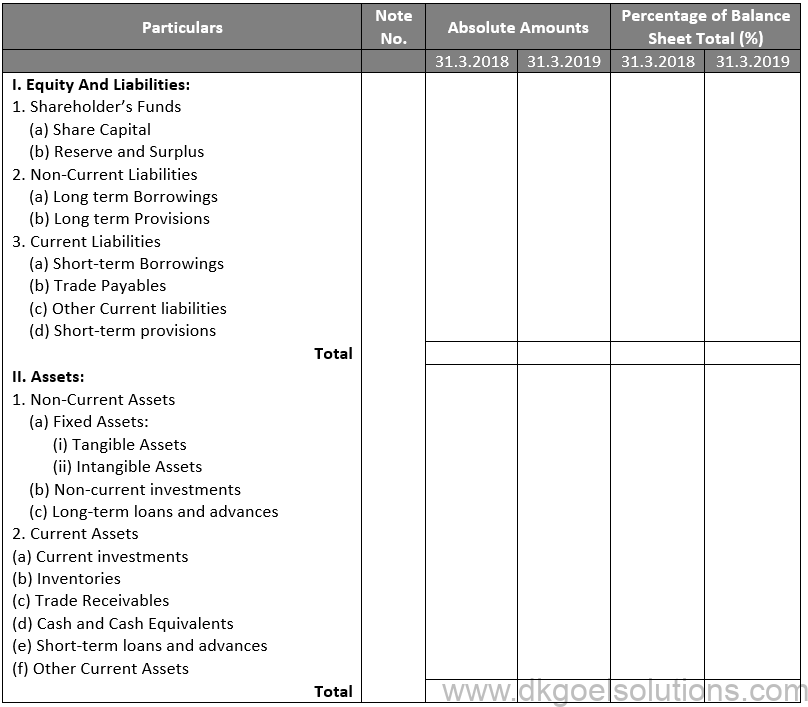

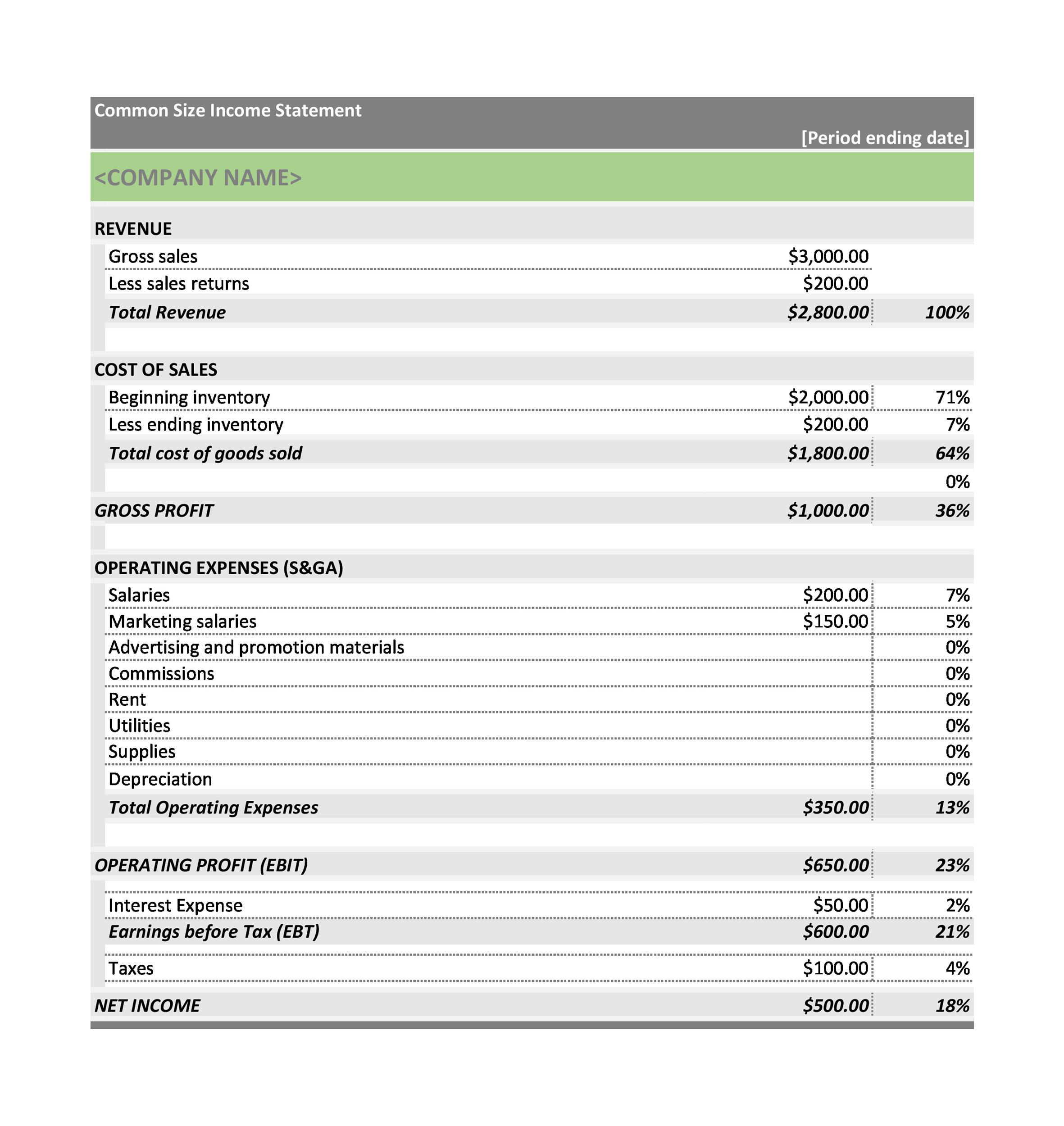

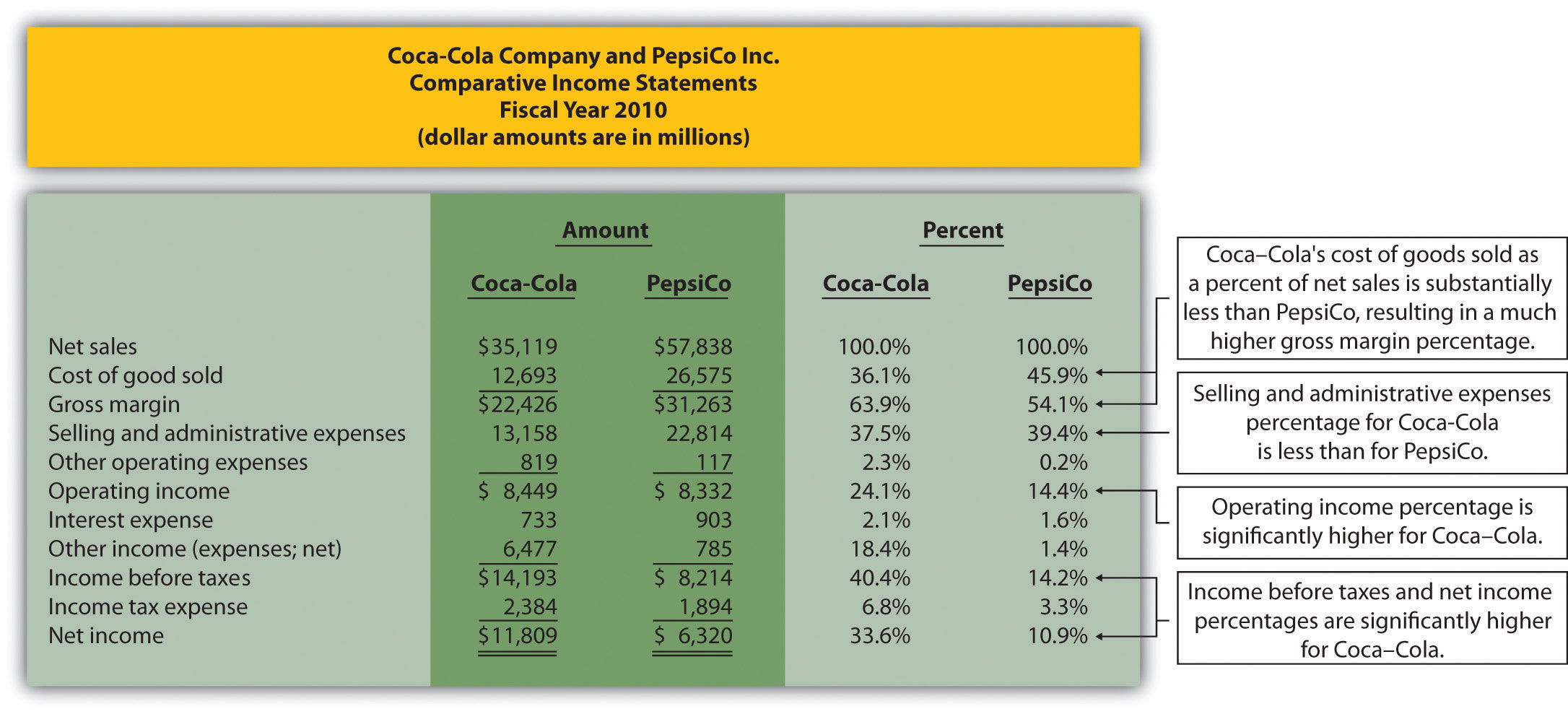

Common size statement example. This type of financial statement allows for easy analysis between. For example, a vertical common size analysis may look at an income statement or balance sheet and compare the amounts on each financial document. To evaluate a company relative to its competitors.

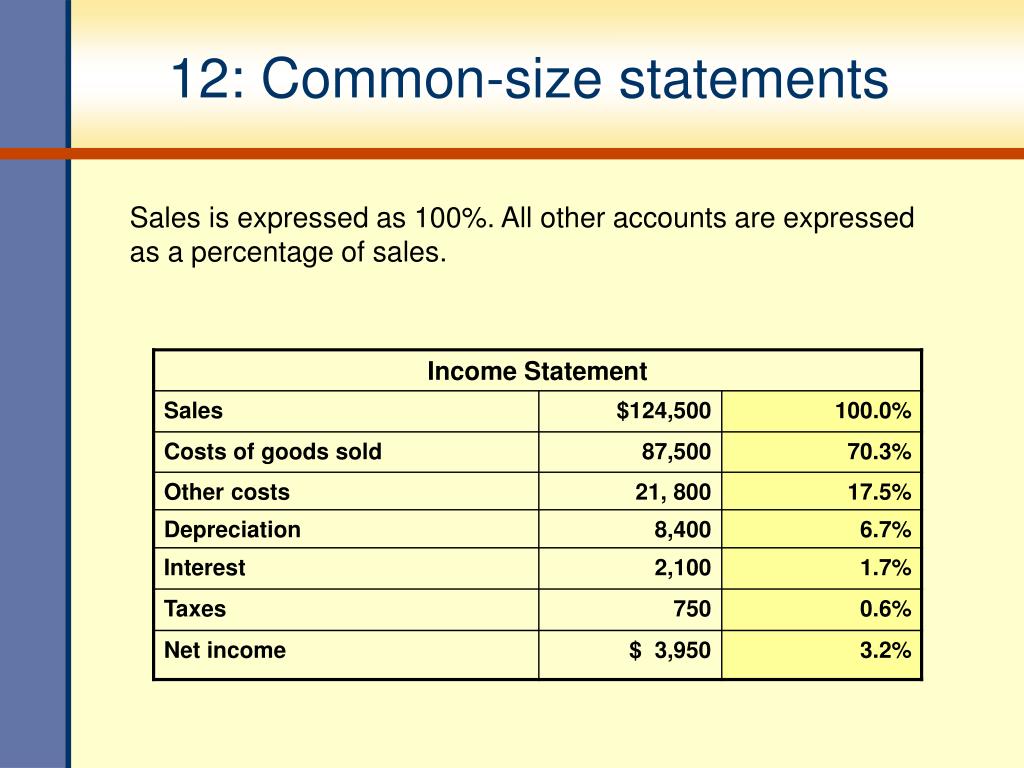

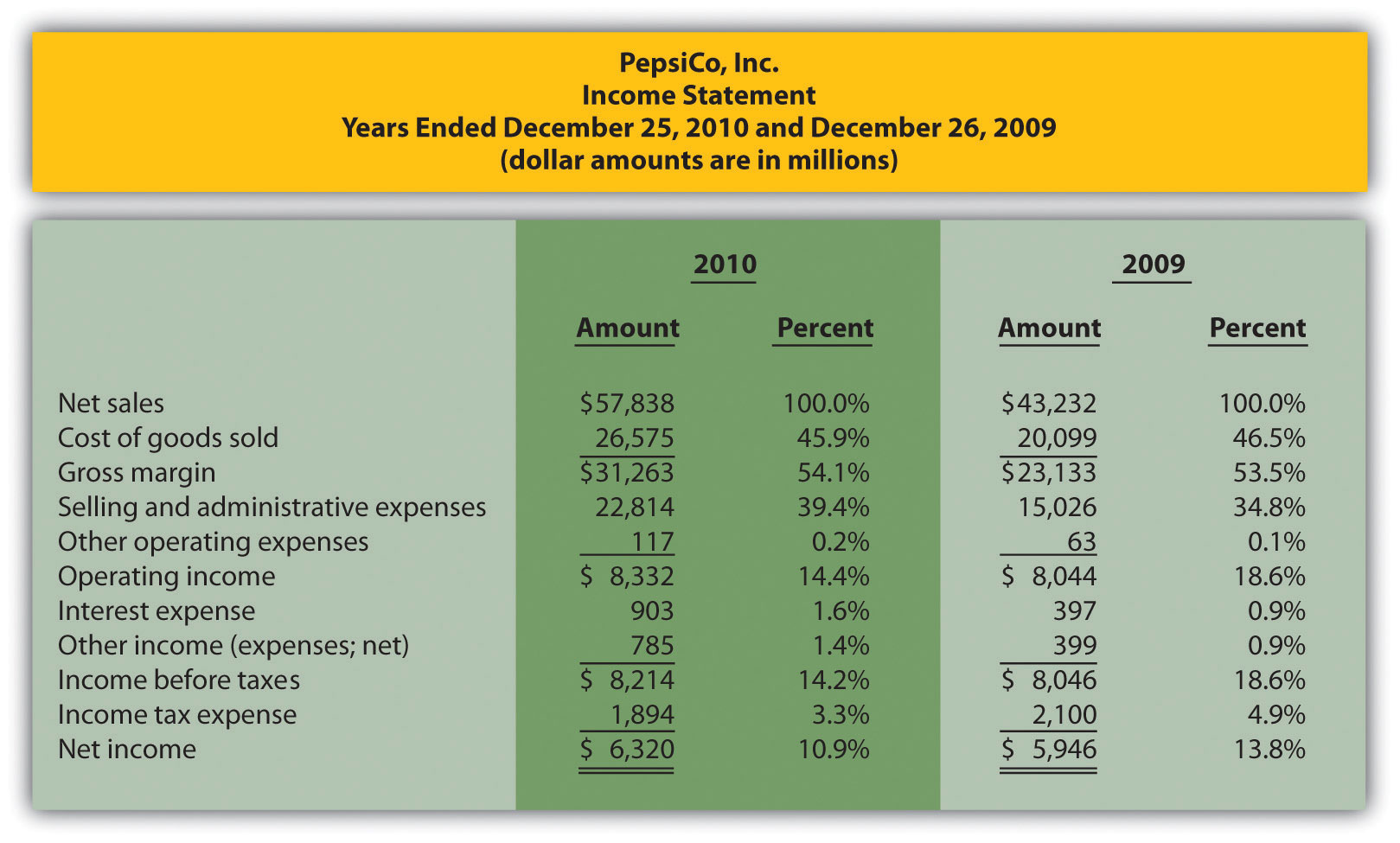

The following example of company xyz's income statement and revenue and expense calculations helps you understand how common size income statement analysis works. Cash ranges between 5% and. Example of a common size income statement the standard figure used in the analysis of a common size income statement is total sales revenue.

Suppose company abc reports sales of $100 million and operating profits of $25 million. Example of common size income statements. Here is a hypothetical example of how a common size income statement can be used in vertical analysis.

Common size analysis. The company has $1 million in cash, which is. Creates an annual traditional income statement on the left, along with a common size statement on the right.

A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. Use of common size income statement One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement.

A common size financial statement is a financial document where each item is expressed as a percentage relative to a reference figure, usually the total revenue or assets. An example of common size income statement analysis. To assess data from one period to the next within a company.

Common size analysis, also known as vertical analysis, is used to analyze a company's financial statement information. Common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period. Example of common size income statement—vertical analysis.

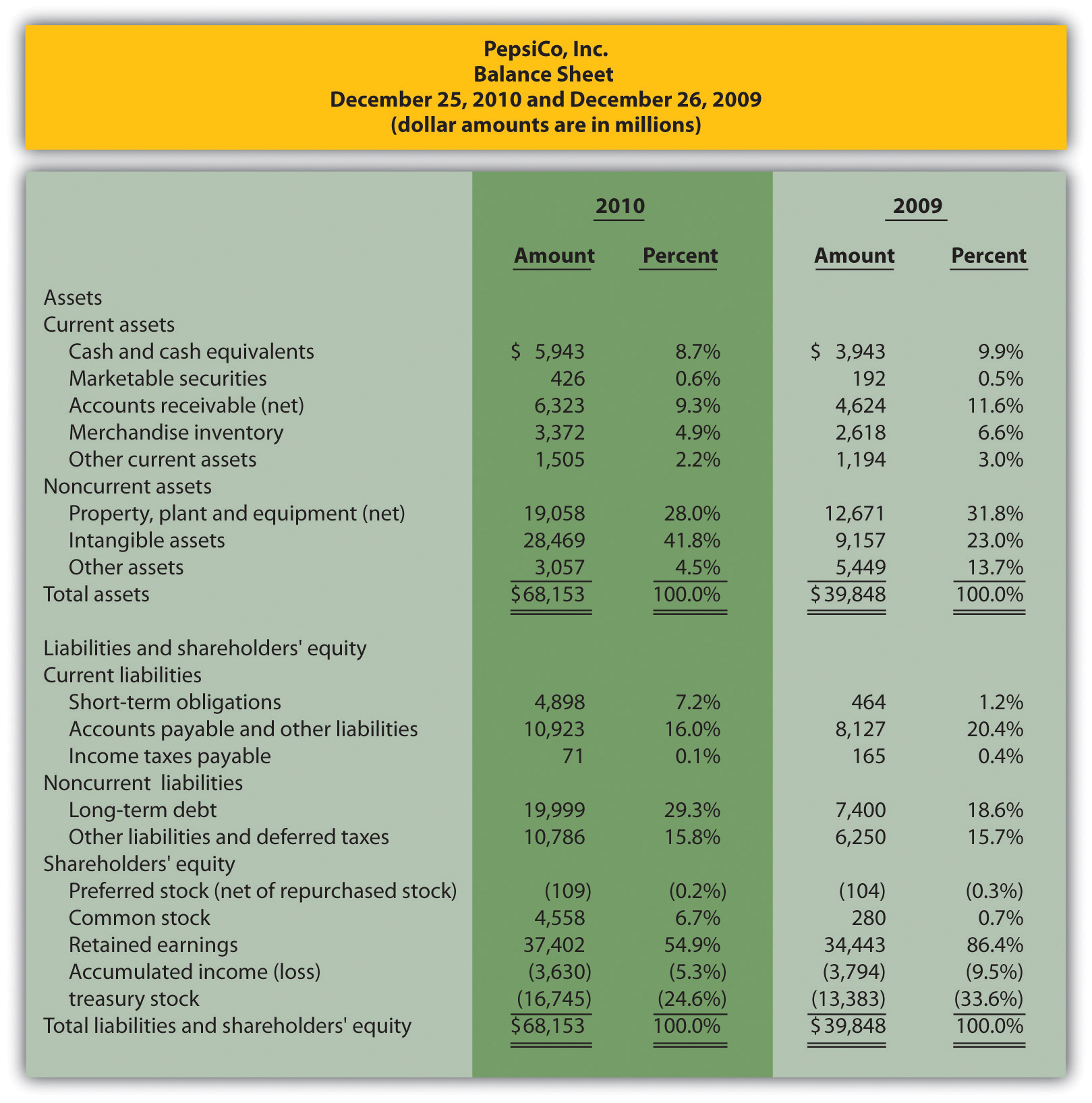

5.0 annual fee $0 read review learn more common size analysis formula accounting software will typically run a common size financial analysis for you, but it's still a good idea to. This method uses one line item on the statement as a. As an example of common size, let us take a balance sheet of the tata group companies as of 30.09.2016.

The common size percentages are calculated to. The common size income statement, is the profit and loss statement of the company where each line item is shown as a percentage of the total sales. To see the trend in the financials of the last three years.

In this case, abc inc. For example, cost of goods sold (line item) divided by revenue (base item). Examples of common size balance sheet analysis let us take the example of apple inc.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)