First Class Info About Three Types Of Cash Flow Mastercard Balance Sheet

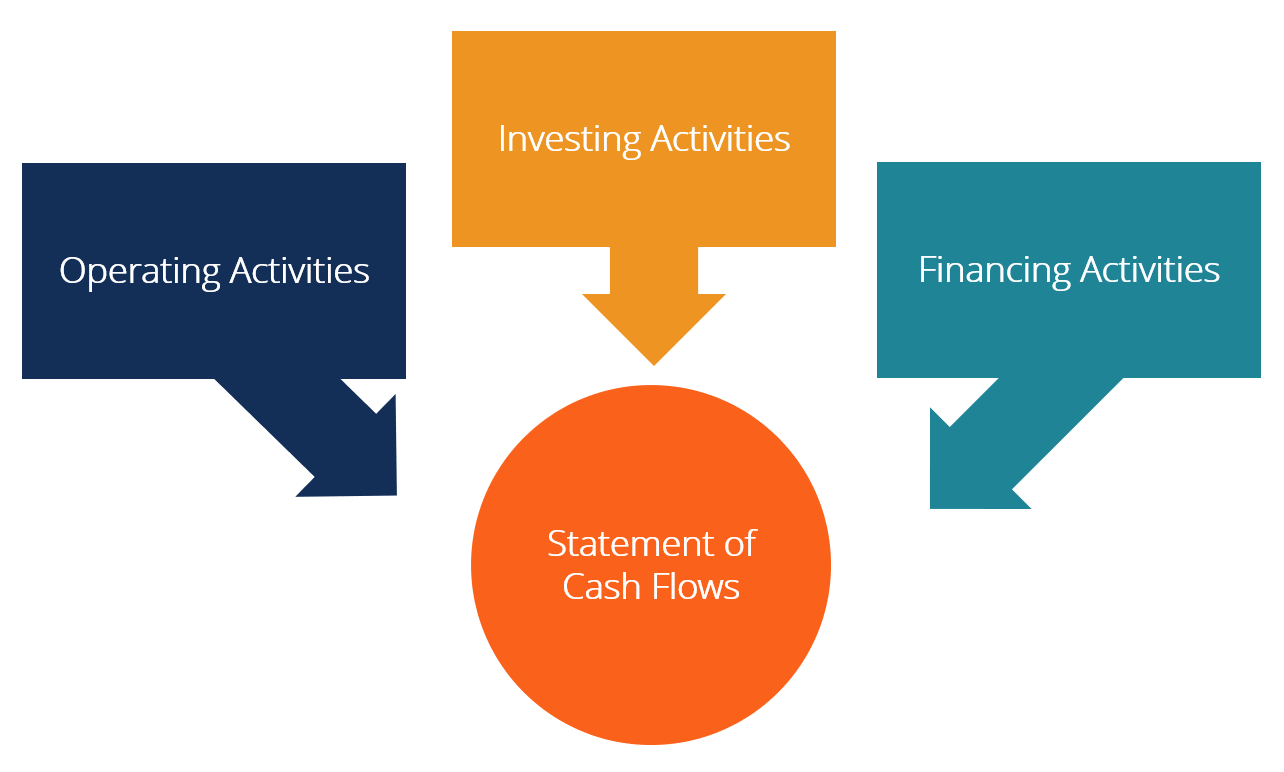

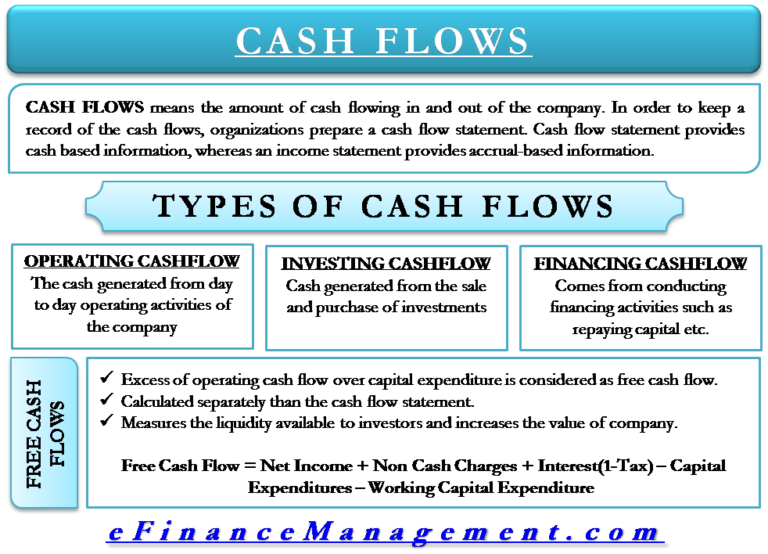

The three categories of cash flows are operating activities, investing activities, and financing activities.

Three types of cash flow. The cfs highlights a company's cash management, including how well it. Financing activities cash flow =. Kinross gold :

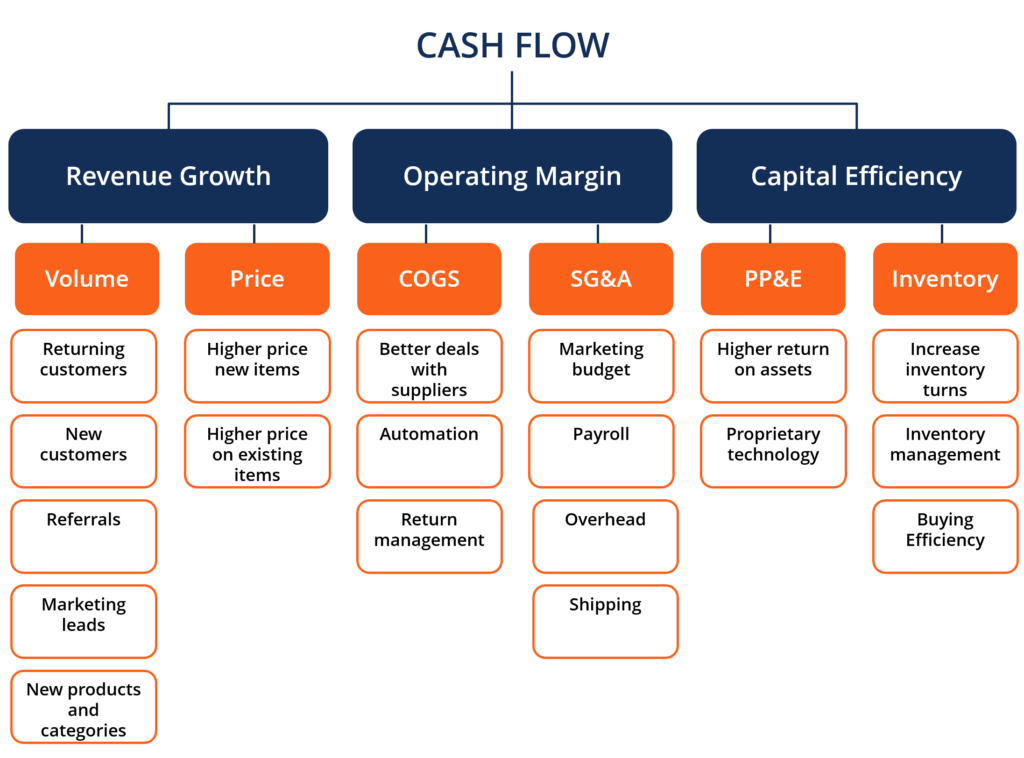

An investment grade balance sheet with high cash flow potential for organic and acquisition driven growth. The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing. Cash inflow is the money you collect, while the definition of cash outflow is the money you're spending.

The german luxury car maker said the new buyback will begin immediately after the conclusion of an ongoing programme, worth four billion euros. Cash flow is money coming into your business or going out. Cash flow is an inward and outward movement of cash and cash equivalents during a specific period.

The financing activities of a business provide insights into the business’ financial health and its goals. These represent cash paid or received from the company’s core business activities, the purchase or sale of securities, and raising money or paying down debt. Cash flows from financing activities include three main types of cash inflows and outflows:

A cash flow (cf) shows inflows (receipts) and outflows (payments) of cash during a particular period. This article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business. Cash flow is generally broken down into three categories:

There are mainly three types of cash flow in a company's cash flow statement, namely operating cash flow, investing cash flow & financing cash flow. Leverage different contract types to enhance cash flow management. Cash flow from operations, cash flow from investing and cash flow from financing.

The three common forms of cash flow business owners deal with are operating cash flow, investing cash flow, and financing cash flow. Some of the most common include asset turnover, the quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity. The 3 types of cash flow how to read a cash flow statement cash flow analysis 5 tips for cash flow management cash flow you can bank on what is cash flow?

Adam hayes updated july 31, 2023 reviewed by amy drury fact checked by melody kazel what is cash flow? Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Stay vigilant about your cash flow by regularly monitoring and analyzing your financial statements.

The 3 main types of cash flow; Repurchase of debt and equity, or rp; 3rdtimeluckystudio / shutterstock over the last 12 months, the s&p.

In addition, it analyzes the reasons for changes in the balance of cash between the two balance sheet dates. Three types of cash flow activities The three common forms of cash flow business owners deal with are operating cash flow, investing cash flow, and financing cash flow.