Brilliant Strategies Of Info About Presentation And Disclosure Of Financial Statements Ratios In Balance Sheet

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

The primary financial statements project was added to the board’s research agenda in july 2014 in response to the strong demand from stakeholders, and in particular users of financial statements, for the board to undertake a

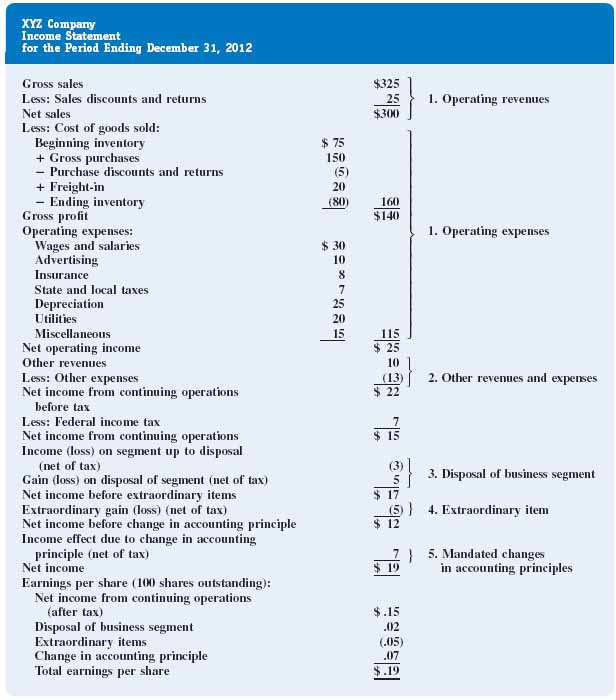

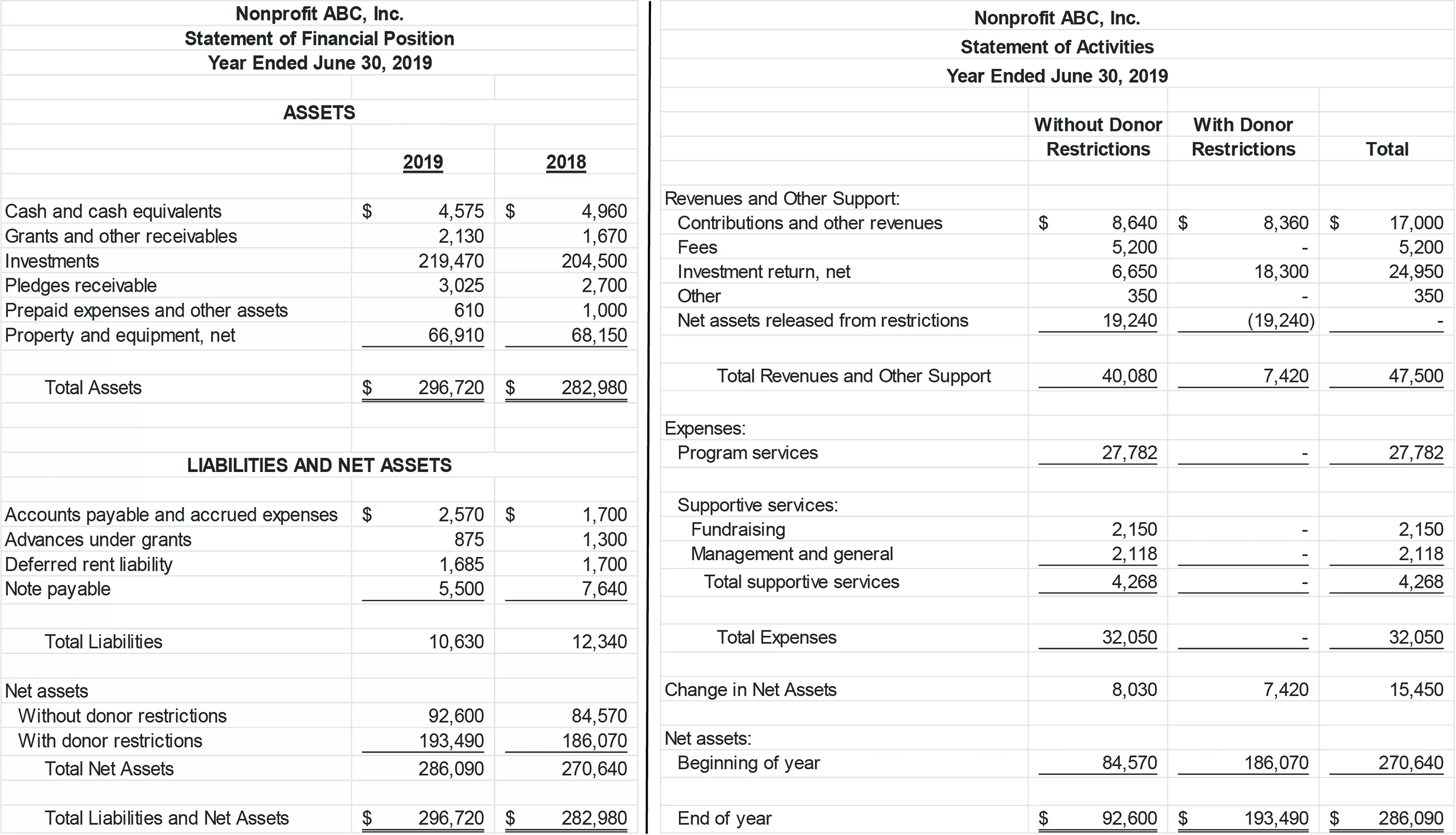

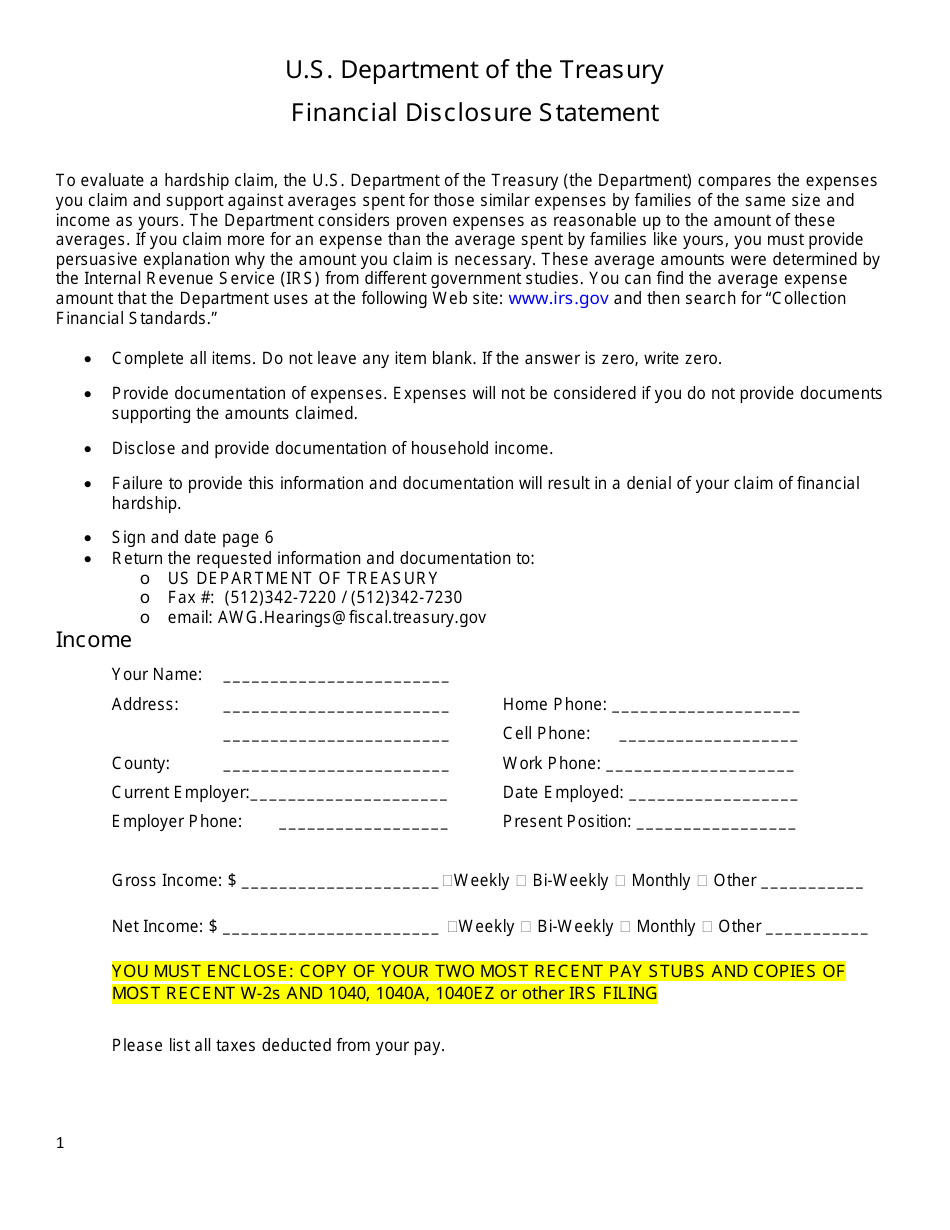

Presentation and disclosure of financial statements. The financial statements must present fairly the financial position, financial performance and cash flows of an entity. Disclosure goes ‘behind the numbers’ and is necessary to fully understand the financial statements. Fair presentation requires the faithful representation of the effects of transactions, other events, and conditions in accordance with the definitions and recognition criteria for assets,.

Once the debits and credits have been settled, presentation and disclosure is how that information is conveyed to financial statement users in a transparent, understandable and consistent manner. Presentation and disclosure in financial statements background. (ii) requirements brought forward from ias 1 with only limited changes to the wording.

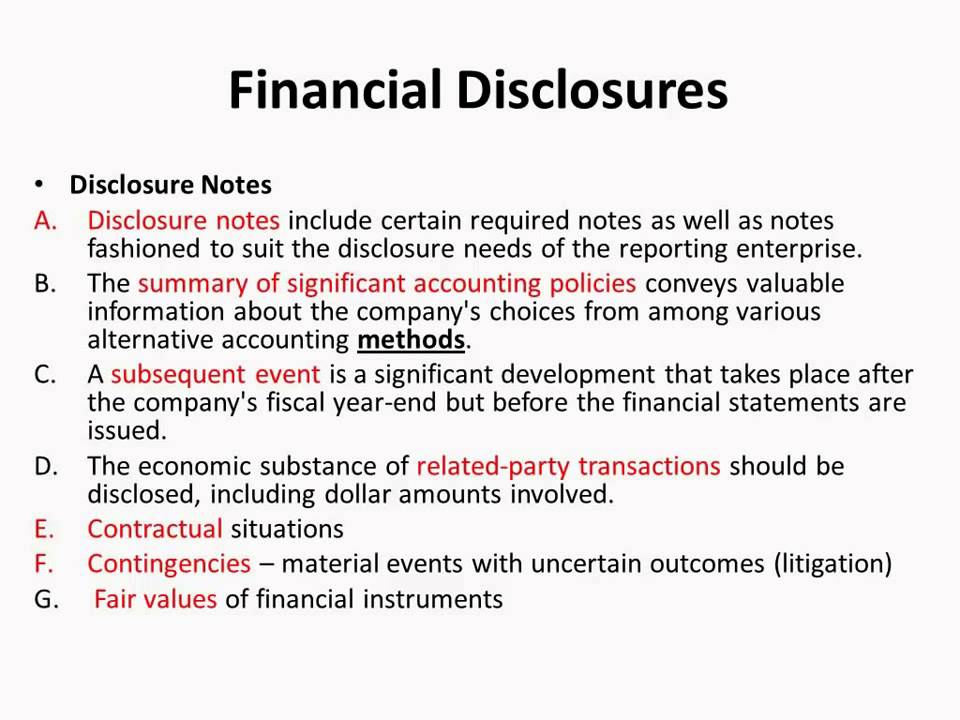

Presentation and disclosure; This is the assertion that all appropriate information and disclosures are included in a. The examples are not intended to illustrate all aspects of ifrs standards, nor do they constitute a complete set of financial statements.

Asc 205, presentation of financial statements, provides the baseline authoritative guidance for presentation of financial statements for all us gaap reporting entities. The standard sets out the presentation requirements for surplus or deficit for the period. It sets out overall requirements for the presentation of financial

The international accounting standards board (iasb)’s primary financial statements project. Presentation and disclosure as communication tools. Presentation and disclosure statement of financial performance in18.

And ipsas 30, financial instruments: This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. Presentation and disclosure of financial information.

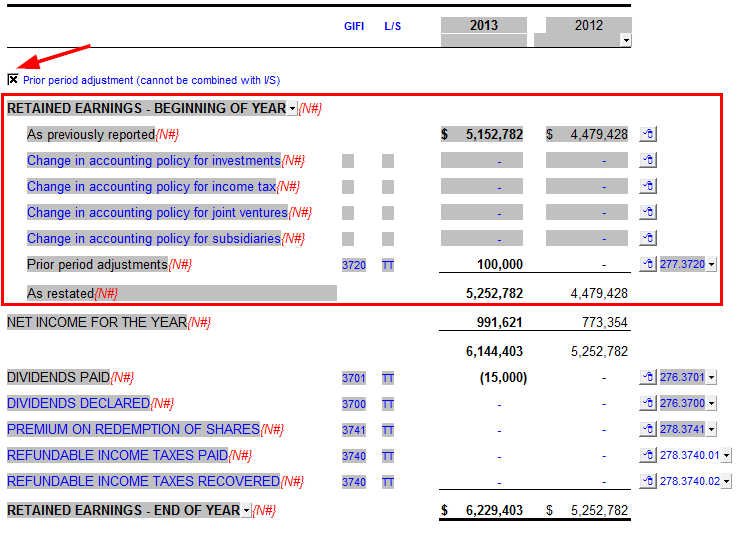

Recent amendments to the presentation and disclosures of financial. Ipsas 1 specifies minimum line items to be presented on the face of the statement of financial position, statement of financial performance, and statement of changes in net assets/equity, and includes guidance for identifying additional line. A statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it.

Presentation and disclosure has been superseded by ipsas 28, financial instruments: With a new standard that would comprise: Our guides to financial statements help you to prepare financial statements in accordance with ifrs accounting standards.

(i) new requirements on presentation and disclosures in the financial statements. This chapter states that presentation and disclosure are communication tools. Certain elements of financial statements (distinguishing liabilities from equity particularly in the context of a written put option on own shares;

Presentation and disclosure. Focusing on presentation and disclosure objectives and principles rather than focusing on rules; Presented in financial statements • reporting principles investors will want to know • reporting ‘extraordinary’ items • ifrs vs us gaap making the most of what’s presented in financial statements the accounting standard that covers the presentation of financial statements, ias 1, might be described as the ‘friend investors never knew