Exemplary Info About Understanding A Balance Sheet Uk Trial Prepared After Adjusting Entries Are Posted

This article will show you how a balance sheet is laid out, how to understand it, and how to use the information to make informed decisions based on the balance sheet.

Understanding a balance sheet uk. Let’s start with a quick summary of one of the main financial statements. Assets are the things (tangible and. Understand how a balance sheet works;

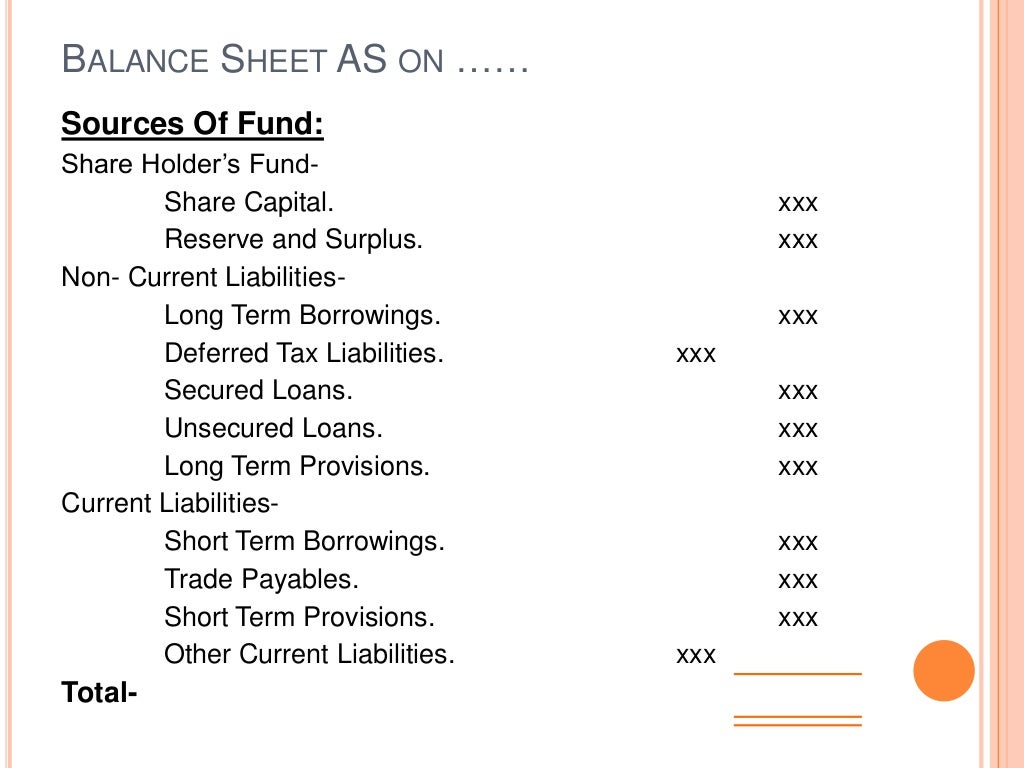

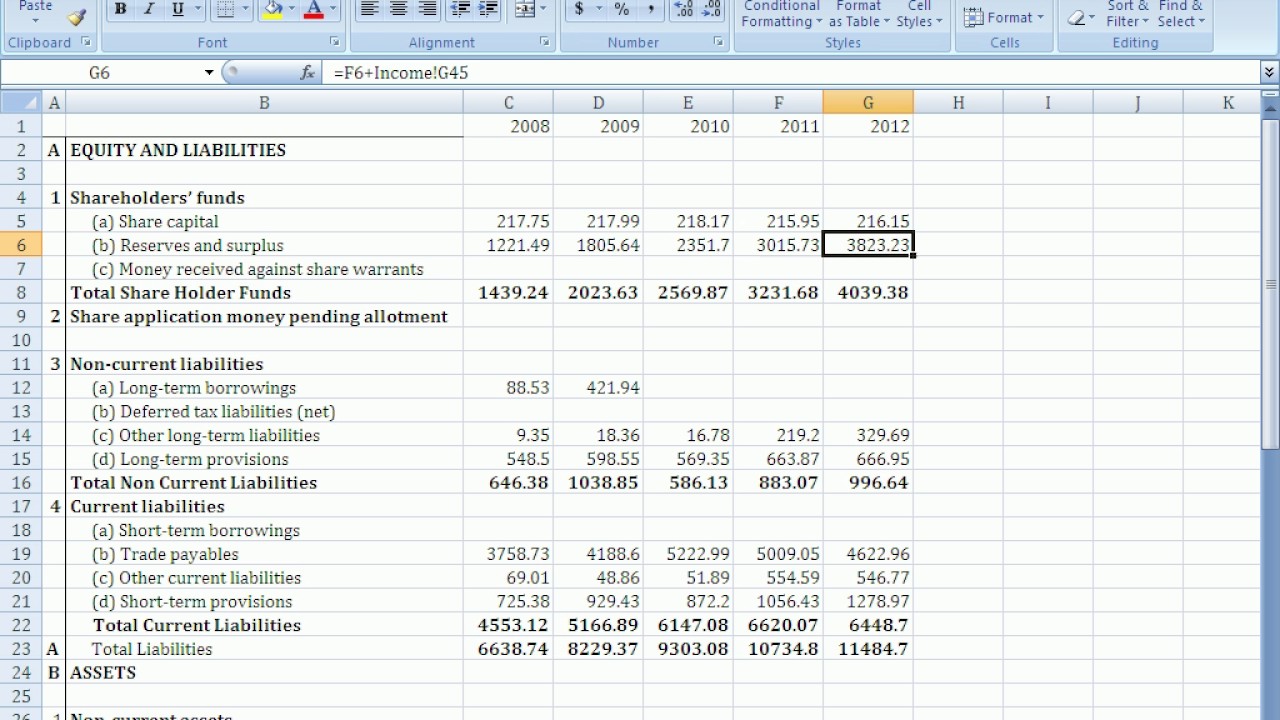

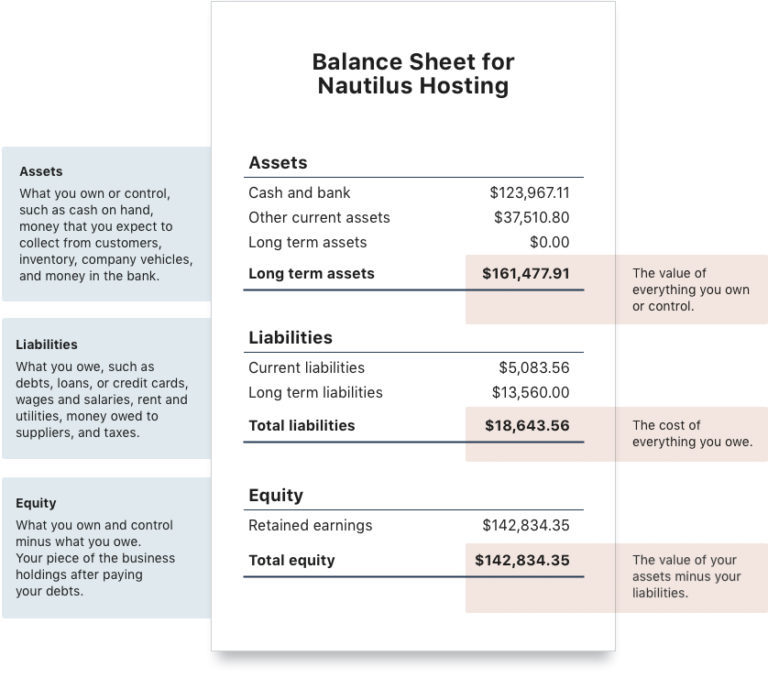

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. When comparing balance sheets from different companies, it is easy to become confused; The report can be used by business owners, investors, creditors, and shareholders.

The balance sheet, the profit and loss statement and the cash flow statement. How to read a balance sheet for beginners. A balance sheet is one of the major financial statements used by a business owner or accountant.

Equity and debt securities that can be traded on a liquid market July 5, 2022 guides accountancy guides most business owners can get their head around the basics of a profit and loss account. Value of things owned (including cash) versus things owed.

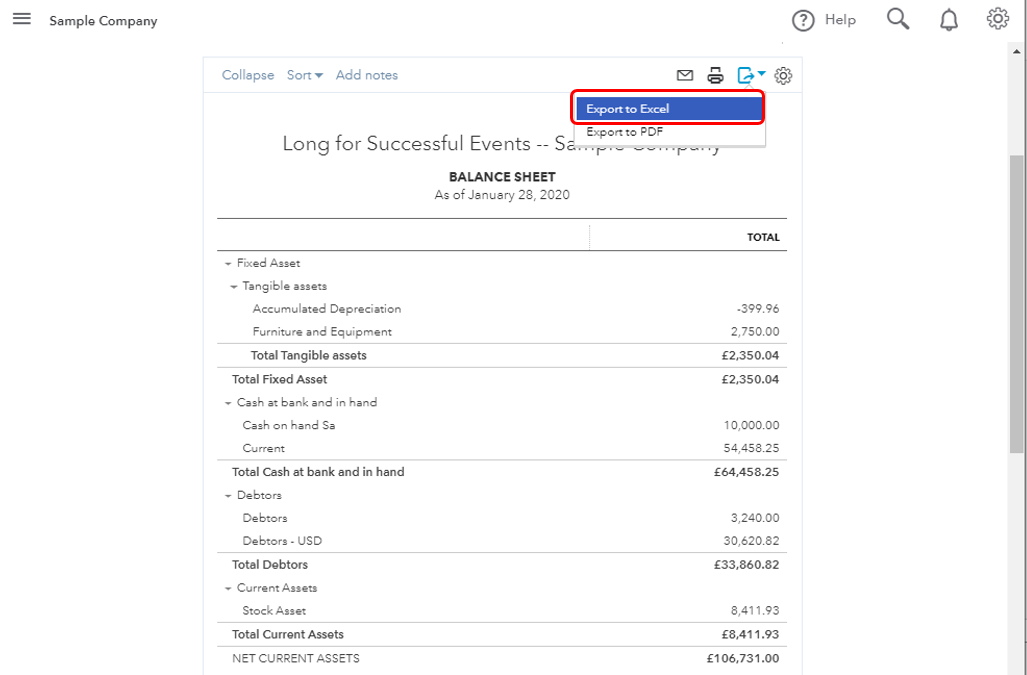

It provides an overview of the value of a business’s assets, liabilities, and owner’s equity. In other words, a company’s assets must equal its liabilities plus its equity. If you want to understand your company's or business's financial statement, then understanding how to create a balance sheet is essential.

Intro balance sheet uk explained (how to read a balance sheet & understanding balance sheet terminology) rebecca's finance tutorials 8.47k subscribers subscribe subscribed 13k views 2 years. In this article, we describe what a balanced sheet is, how to create it, its components, examples and importance. Assets = liabilities + equity.

A balance sheet is a financial report that summarises the financial state of a business at a point in time. What is a balance sheet? Read the liabilities on the balance sheet

A balance sheet is a snapshot of what your business owns (assets), and what it owes (liabilities), at a specific point in time. Read the assets on the balance sheet; A balance sheet, also known as a statement of financial position, is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time.

Balance sheets provide the basis for. A balance sheet is a business statement that shows what the business owns ( assets ), what it owes ( liabilities ), and the value of the owner’s investment (owner’s equity) in the business. The balance sheet formula is simple:

By analysing the balance sheet and comparing it with information from your income and cash flow statements, you can make a realistic assessment of the financial health of your business. This report forms part of your financial reporting and is vital not only for lending purposes but also to ensure that your books balance. A balance sheet comprises three components:

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)