Outrageous Tips About Non Current Investment In Cash Flow Audit Report Of Indian Company

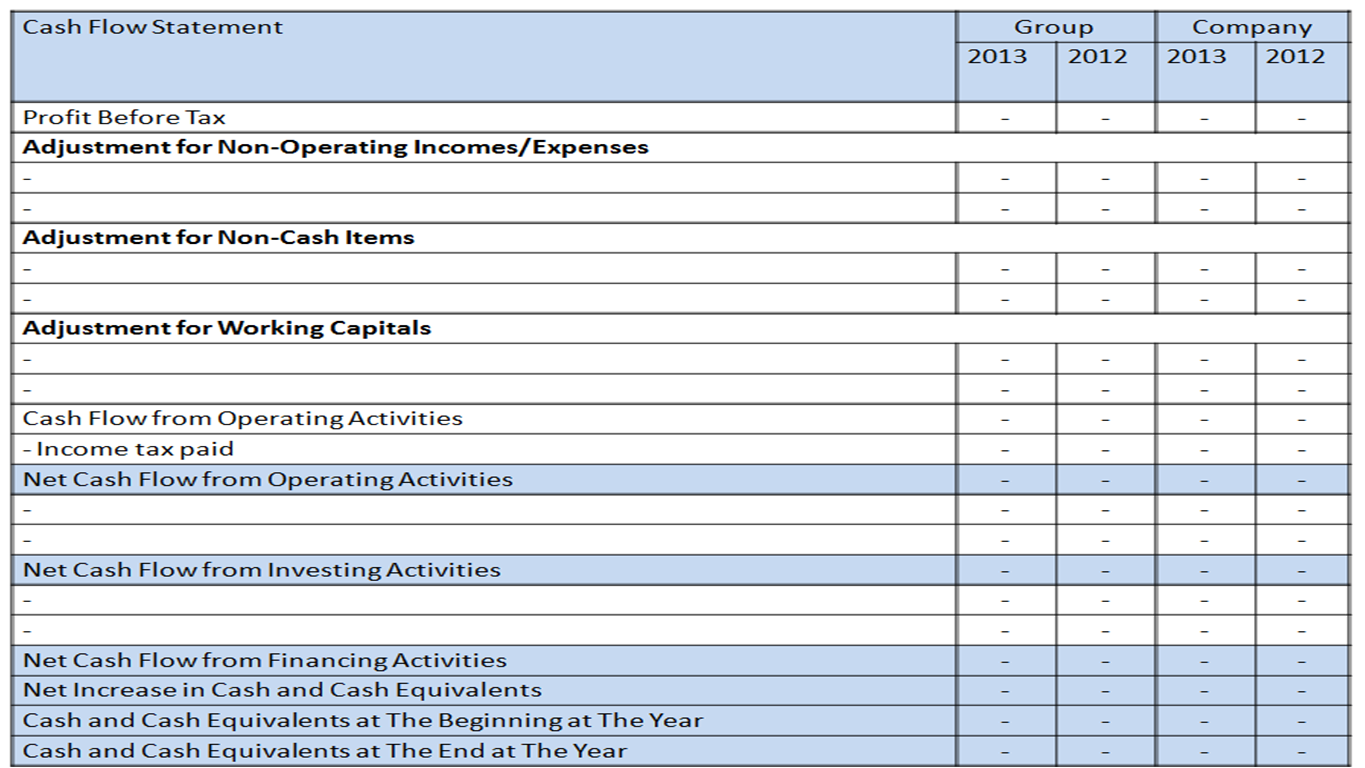

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

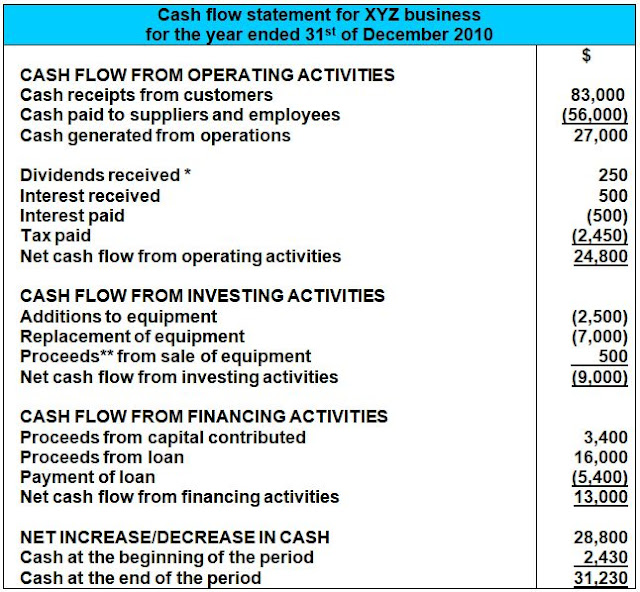

Non current investment in cash flow. It is inflow for the company. Consumer bank capital one plans to acquire u.s. Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued.

Financing activity cash flows relate to cash flows arising from the way the entity is financed. Entities are financed by a mixture of. Working capital is sometimes used to refer only to current assets, while net working capital is defined to be the difference between current assets and current liabilities.

This key fundamental metric can help analysts to determine. *divestitures = the sale of investments investing activities example: This disclosure may be in a narrative or tabular format.

Why is cash flow from investing activities important? Although a company may report a negative cash flow in investing activities, it doesn’t necessarily mean that it’s going to have a negative impact on the business. Any increase in assets mean purchase of assets, it is outflow for the company.

Property, plant & equipment, or “pp&e) is calculated. Here is where you retrieve those figures: The noncash activities may be included on the same page as the statement of cash flows, in a separate footnote, or in other footnotes, as appropriate.

February 12, 2024 at 1:31 am pst. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Any decrease in assets mean sales or depreciation of assets.

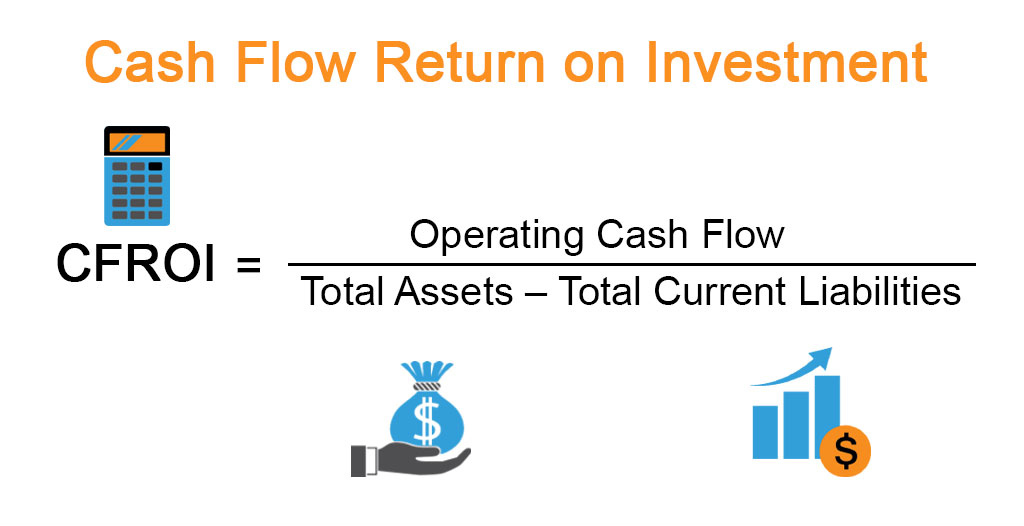

Cash flow from investing is listed on a company's cash flow statement. Use the net income figure from the income statement. The generic formula is:

Investing and financing transactions that don’t directly impact current cash flows are not included in the statement of cash flows. Private equity funds last year returned the lowest amount of cash to their investors since the financial crisis 15 years ago, according to raymond. Asc 230 requires separate disclosure of all investing or financing activities that do not result in cash flows.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)