Fabulous Info About Provision For Doubtful Debts Example Leasing Company Financial Statements

Accounting for doubtful debts.

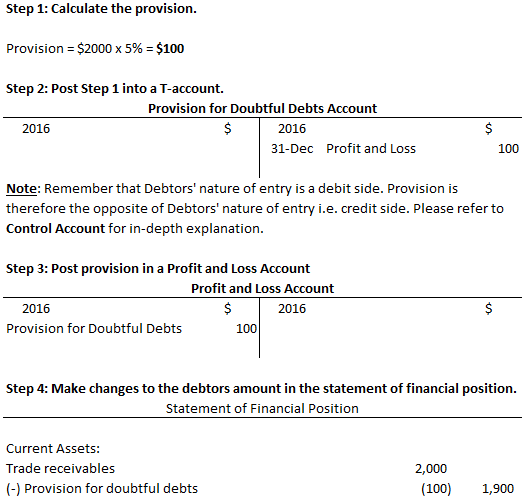

Provision for doubtful debts example. However, david still wants to maintain a provision for bad debts at 2% of debtors. Provision for doubtful debts when an amount becomes irrecoverable from debtors the amount is debited to the baddebts account and credited to the personal account of the. Example on 31 december 2017, david's trade debtors stood at $432,000 only.

Learn more about this accounting technique, including how to calculate the provision for bad and doubtful. Creating a provision for doubtful debts for the first time. Example abc ltd has trade receivable of worth $50,000 as at 31 december 2010.

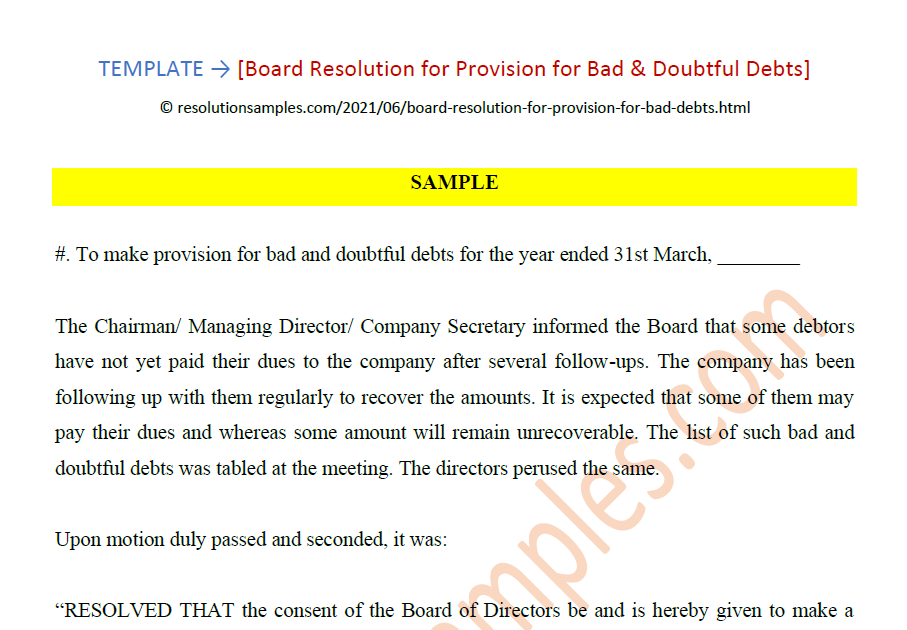

November 05, 2023 what is the provision for doubtful debts? In other words, they are doubtful in. Xyz ltd, a receivable owing $10,000 to abc ltd at the year end, has been recently been.

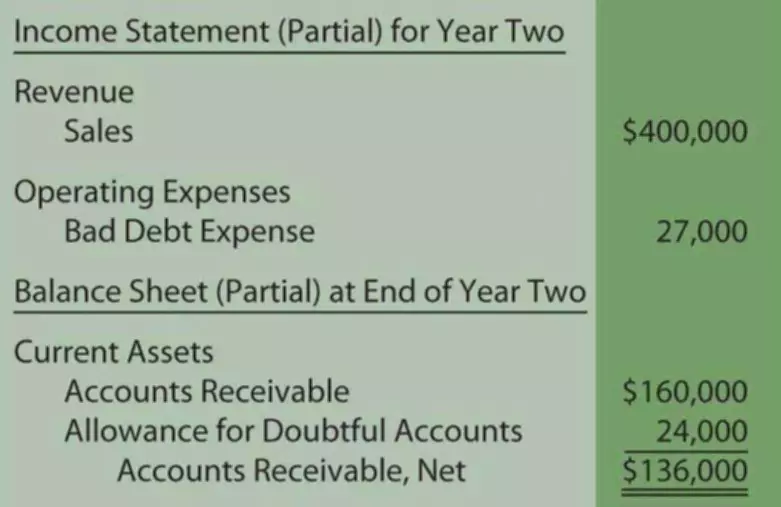

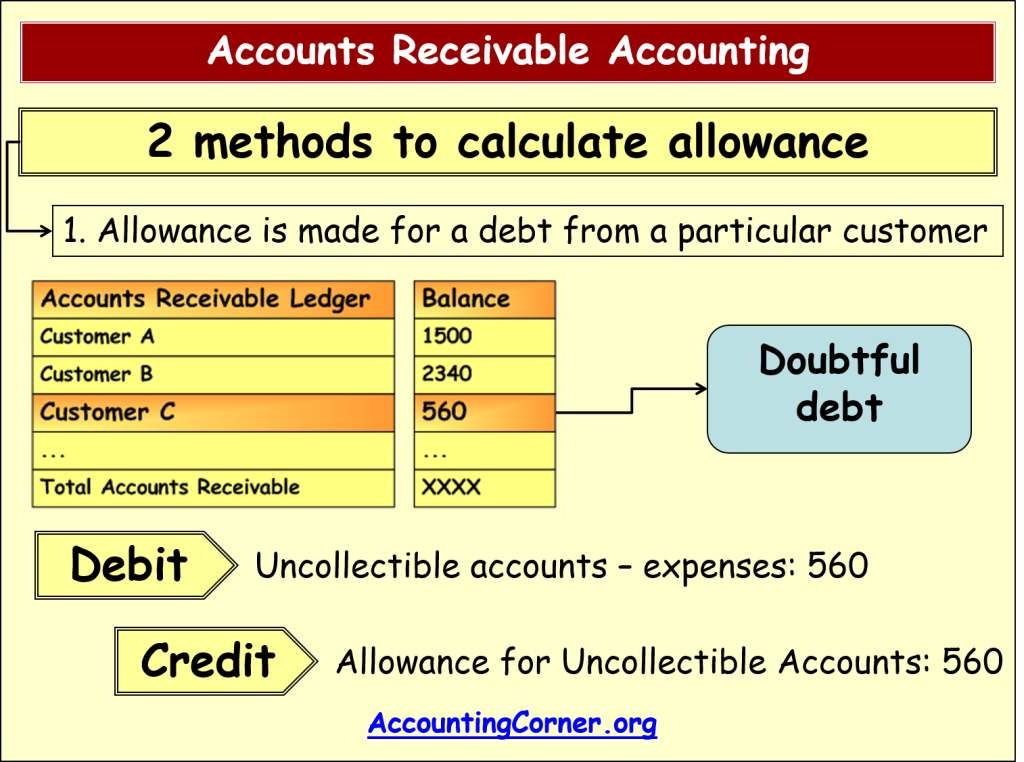

The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the. Bad debt is an amount of debt that a business fails to recover from its debtors. Sells 100 desktops worth 4,000 each to xyz ltd.

Recovers only 40% of the amount due as xyz ltd. Although a debt may not actually have become bad, there may be doubt as to whether it will be paid; Doubtful are those debts that carry an uncertainty of the collection of the debts.

Example suppose dell ltd. Allowance for doubtful accounts journal entry example. Recoverability of some receivables may be doubtful although not definitely irrecoverable.

How do you do that? Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write. A provision for bad and doubtful debts is created so that the debtors who are not able to make the payment of their liability on the due date has no major effect on.

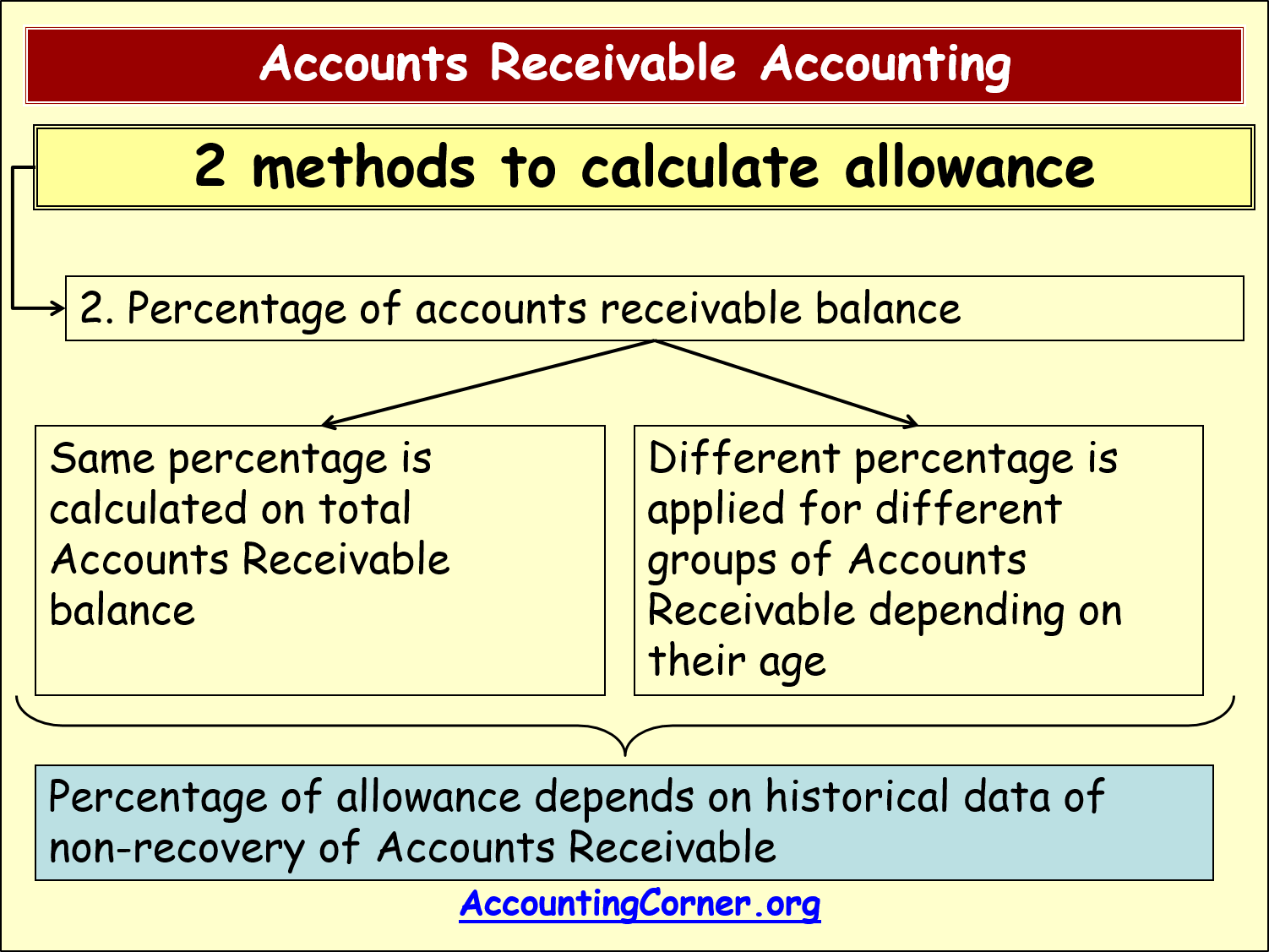

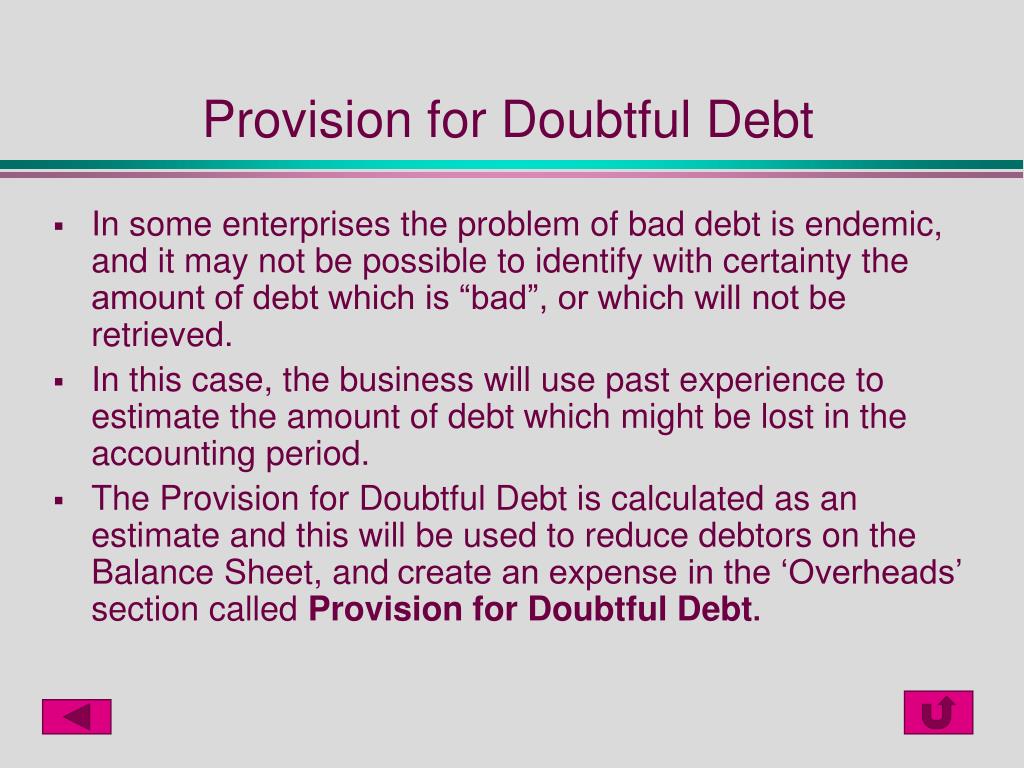

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that. Provision is the amount equal to the aggregate of doubtful debts. Provision for doubtful debts.

Meaning and example doubtful debts, as the name suggests, are those receivables which might become bad debts at some point in future. Provision for credit losses / provision for doubtful debts. You create a provision for doubtful debts.

It may eventually turn out to be a bad debt. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. Suppose a company generated $1 million of credit sales in year 1 but projects that 5% of those.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)