Unbelievable Info About Gross Profit Cost Of Sales Expected Credit Loss Double Entry

It announced a new cost savings program focused on.

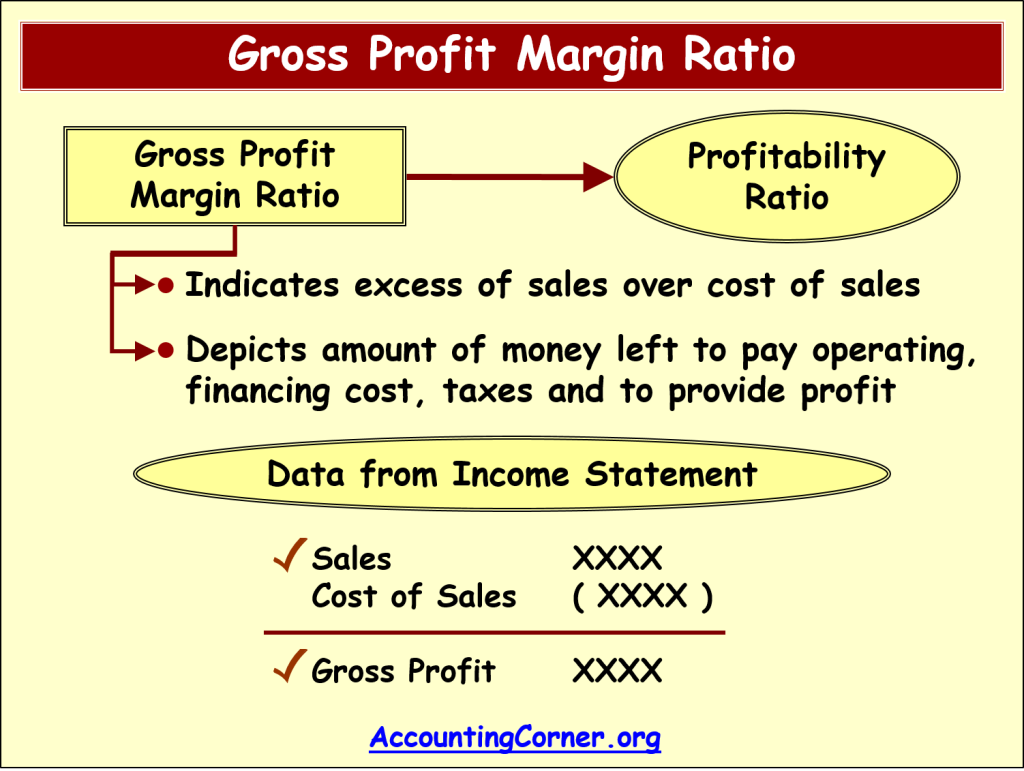

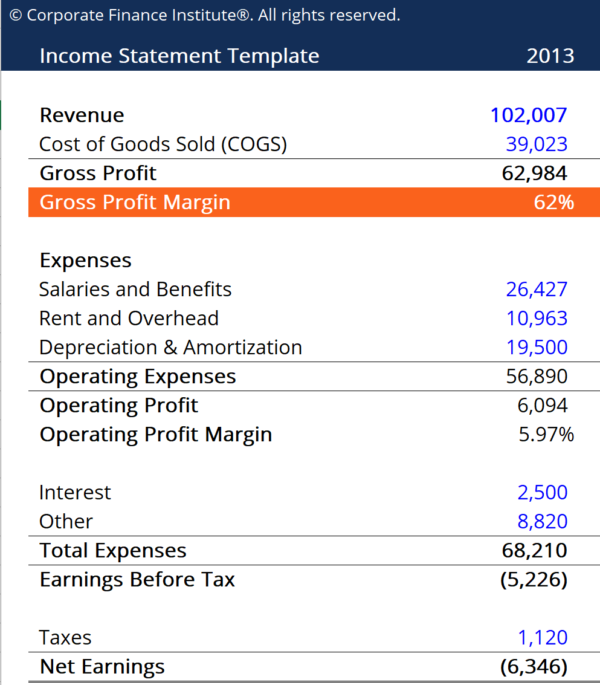

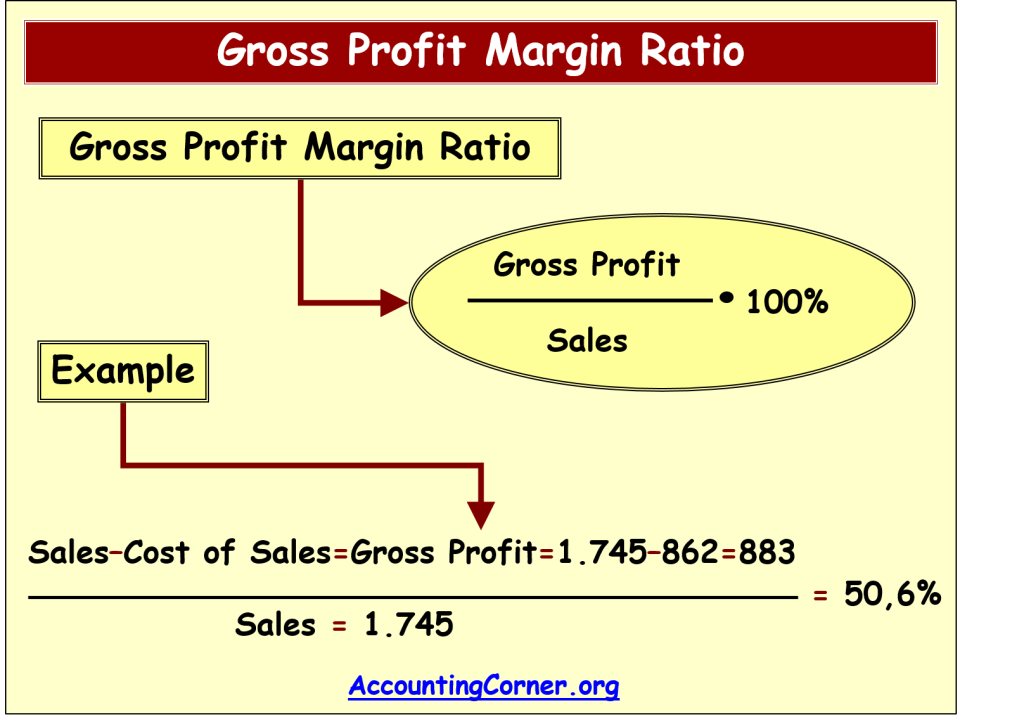

Gross profit cost of sales. The gross profit margin is a good way to measure your business’s production efficiency over time. Sales are defined as the dollar amount of goods and services you sell to. Gross margin is expressed as a percentage.

In addition, the following calculation is applied for gross profit: So, for example, we may have sold 100 units this year at $4 each, and. Subtract the cost of goods sold from revenue to obtain a gross profit of:

Finally, it is calculated by dividing the gross profit. Cost of sales is one of the key performance metrics for businesses that sell physical products in understanding the profitability of their goods. If she used lifo, the cost would be 10 plus 20 for a profit of 15.

The formula for calculating gross margin is: Barclays has today reported a 6% fall in annual profit in line with expectations as chief executive cs venkatakrishnan set out plans including bumper buybacks, an. The formula for gross profit is calculated by subtracting the cost of goods sold (cogs) from the company's revenue.

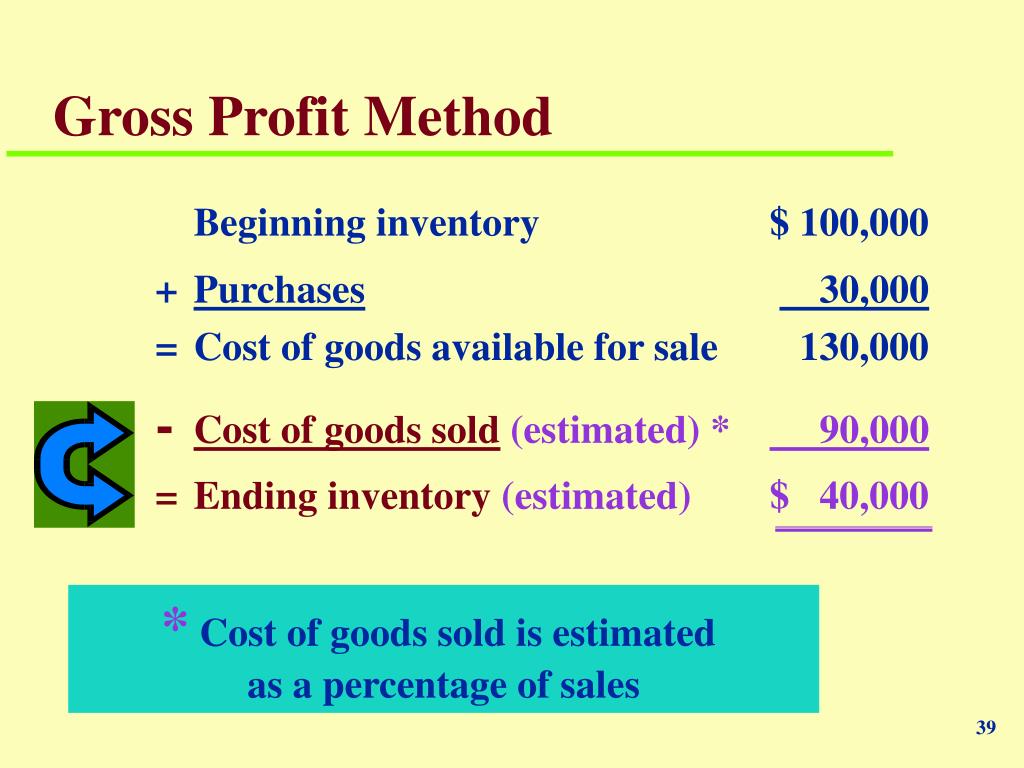

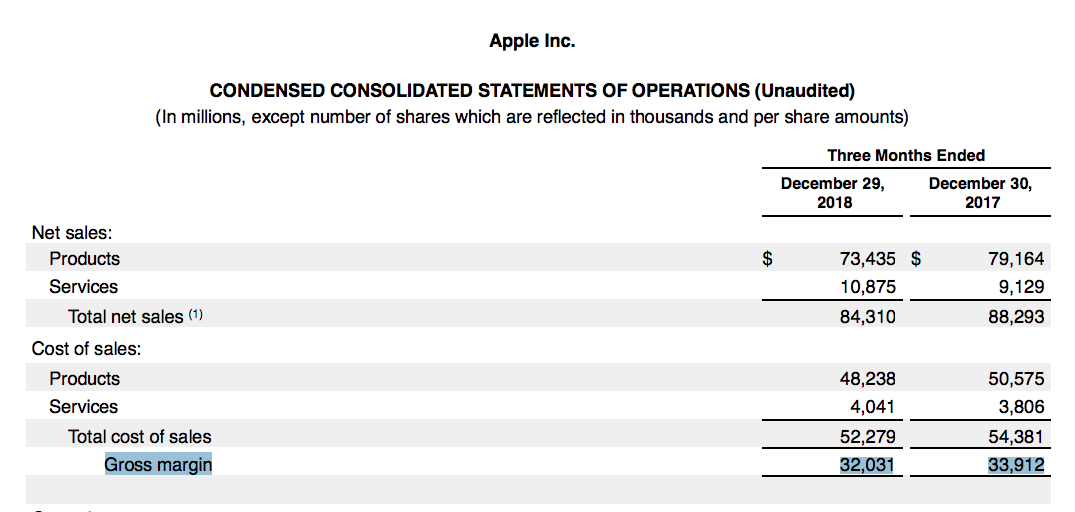

To calculate the gross profit, the cost of goods sold(cogs) totals $126,584 million. [1] whereas gross profit is a dollar amount, the gross. Calculation of costs of goods sold.

Gross margin = gross profit / total revenue x 100. Gross profit is often called gross income or gross. Factoring in your indirect costs then helps.

If she uses average cost, it is 11 plus 20, for a profit of 14. Gross profit formula. The net sales come from the revenue that all sales earn during.

Calculate the total amount in sales find the net sales revenue for the period you're measuring. It does not include indirect expenses like distribution costs, sales force costs, or marketing expenses. The gross profit is calculated by deducting the cost of goods sold from the total sales.

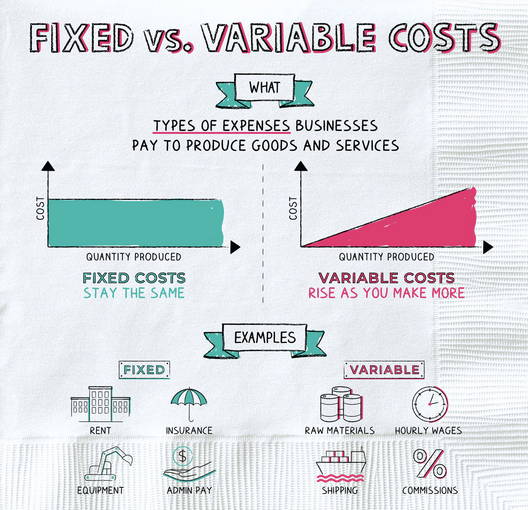

Selling, administrative, and other expenses are not included since they are fixed costs. It shows how much profit the company generates after deducting its cost of. For example, a company has revenue.

In year 3, jane sells the last machine for 38 and.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![Average Gross Profit Margin by Industry 20 Years of Data [S&P 500]](https://einvestingforbeginners.com/wp-content/uploads/2021/07/grossm_2.png)

:max_bytes(150000):strip_icc()/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)