Out Of This World Info About Inventory Loss Double Entry Ecb Weekly Balance Sheet

5 methods of calculating cost of inventory.

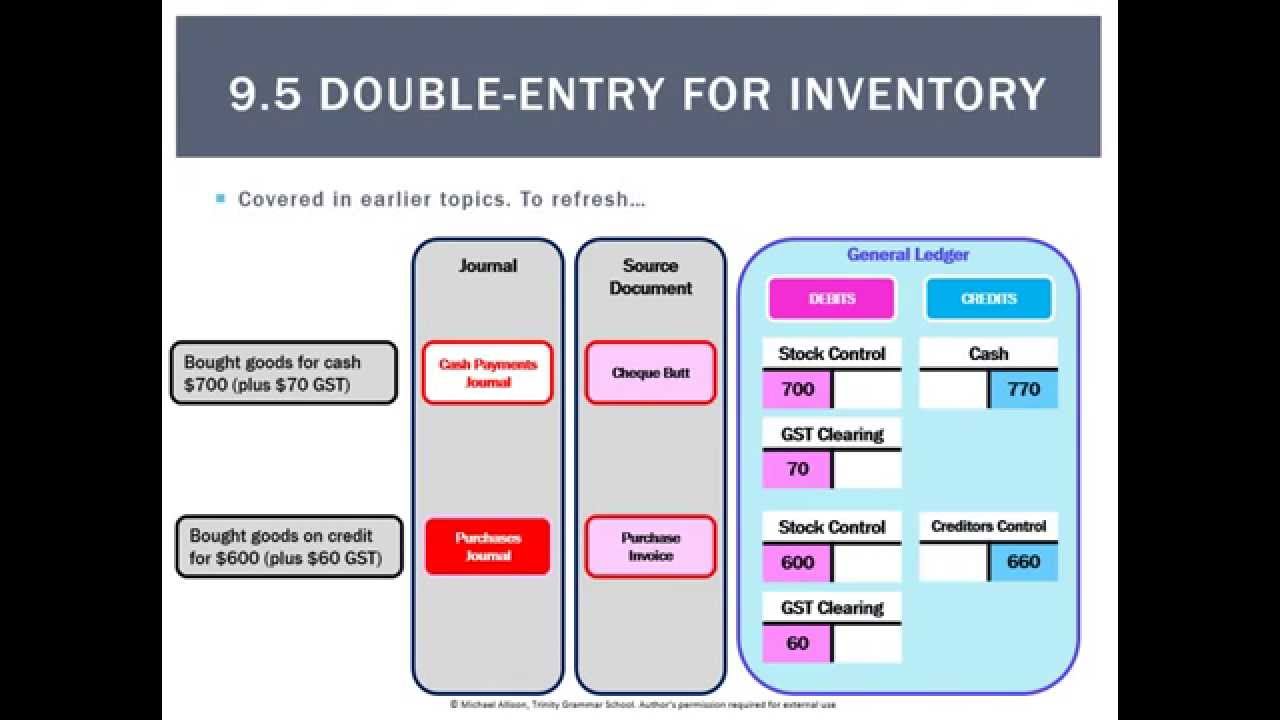

Inventory loss double entry. When it comes to inventory accounting entries, you have a few options: Opening inventory is brought forward from the previous period’s ledger account and charged to the income statement as follows: In this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances.

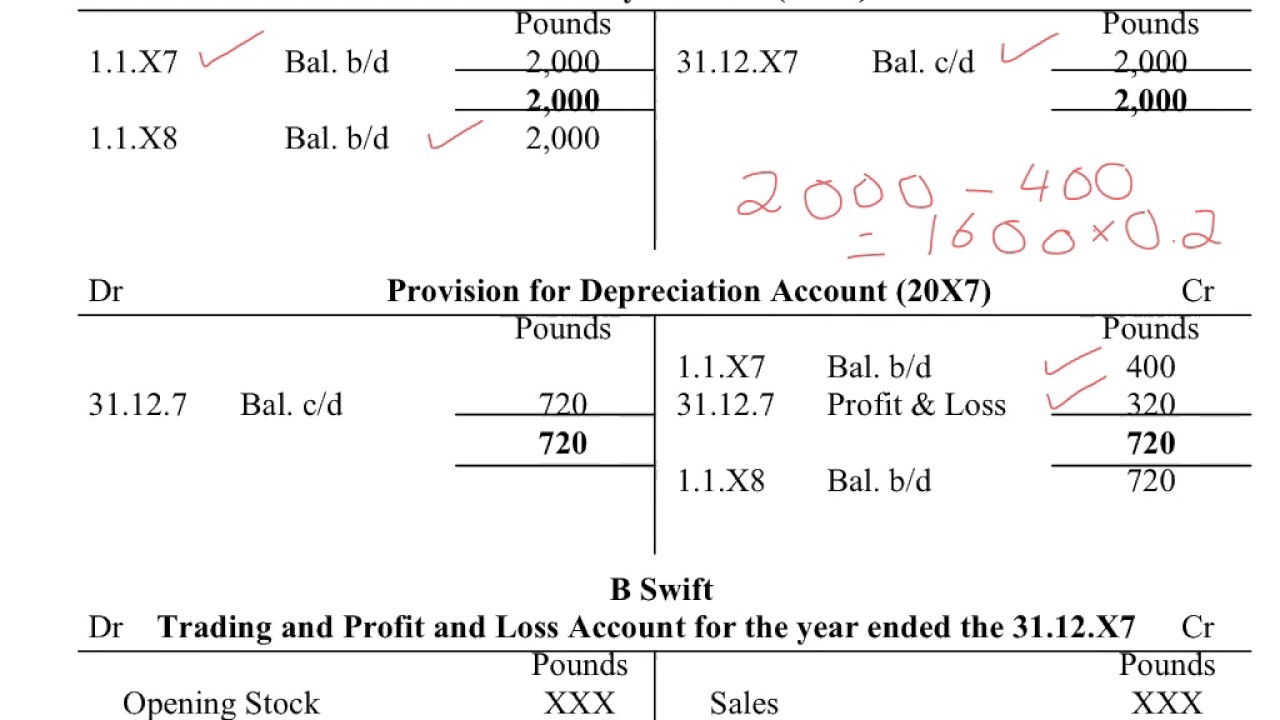

Each of the accounting systems can use one of three main costing methods to determine which inventory has been sold and therefore the cost of the sale. The cost of goods sold has been reduced by 1,000 and the balance sheet inventory account will now show an final closing inventory of 4,000 plus 1,000 equal to 5,000. A chart of accounts can help you decide which entry to make.

The inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and eventually sold to customers. A number of inventory journal entries are needed to document these transactions. The credit entry ensures that the cost of inventory taken is notincluded as part of the cost of inventory sold in the income statement.

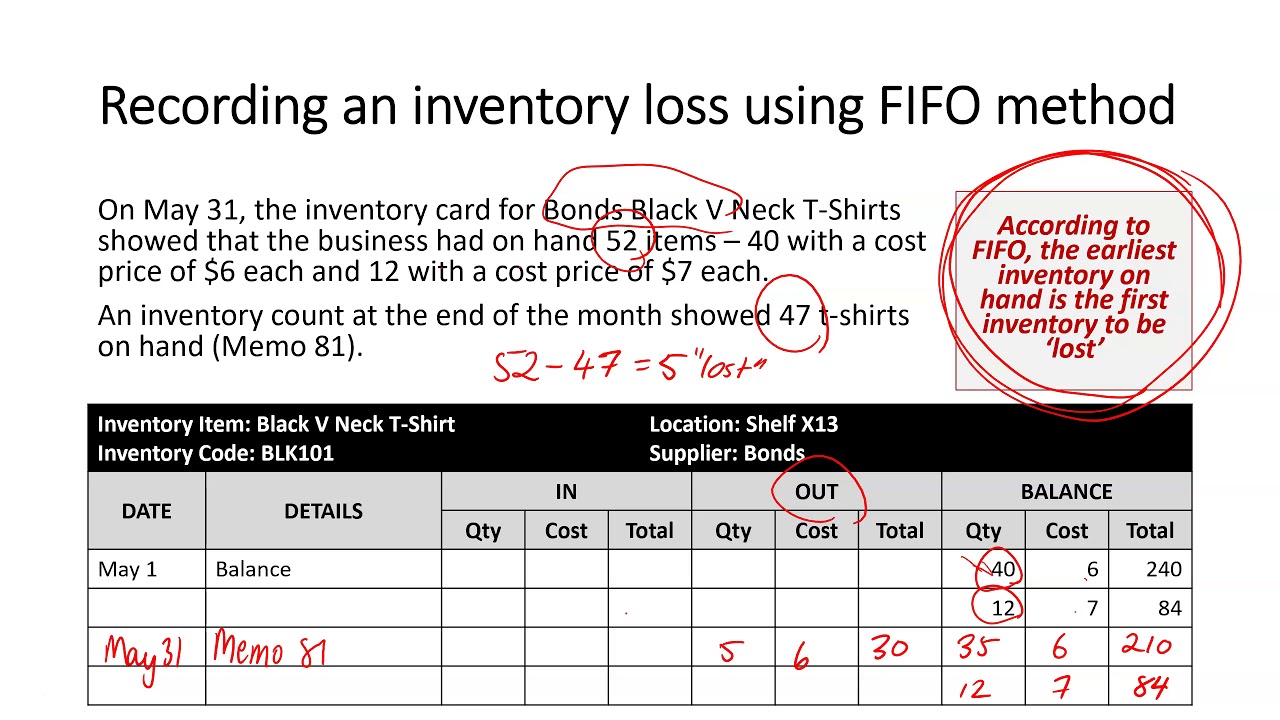

The inventory may lose its value due to damage, deterioration, loss from theft, damage in transit, changes in market demands, misplacement etc. It has become more popular with the increasing use of computers and perpetual inventory management software. This reflects the reduced asset value and acknowledges the cost associated with the lost inventory.

Retail method the retail method is primarily used by retailers who maintain records of inventory at retail value. The perpetual inventory method is a method of accounting for inventory that records the movement of inventory on a continuous (as opposed to periodic) basis. In some cases, the lost inventory is not found until the end of the period when the.

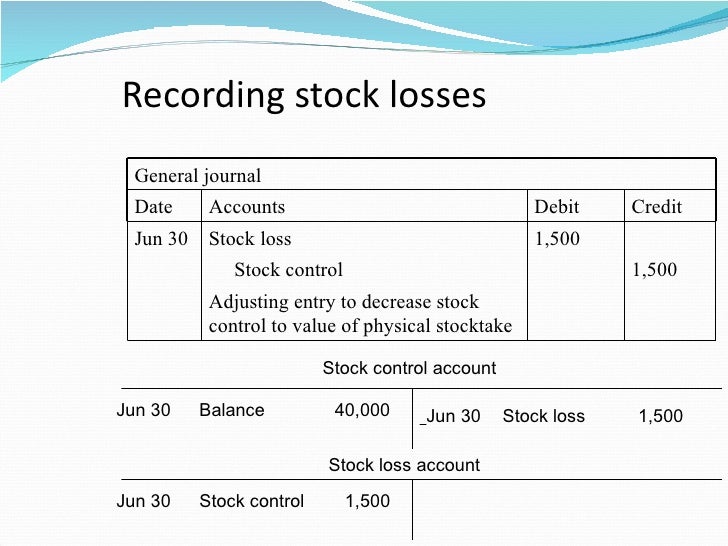

Last modified march 7th, 2023 by michael brown. The journal entry above shows the inventory write down expense being debited to the loss on inventory write down account. Inventory loss can occur if an item or product gets damaged, expires, or is stolen.

The inventory write off can occur for a number of reasons such as loss from theft, deterioration, damage in transit, misplacement etc. Double entry refers to an accounting concept whereby assets = liabilities + owners' equity. Sam started her business on 1 january and provides details of the following.

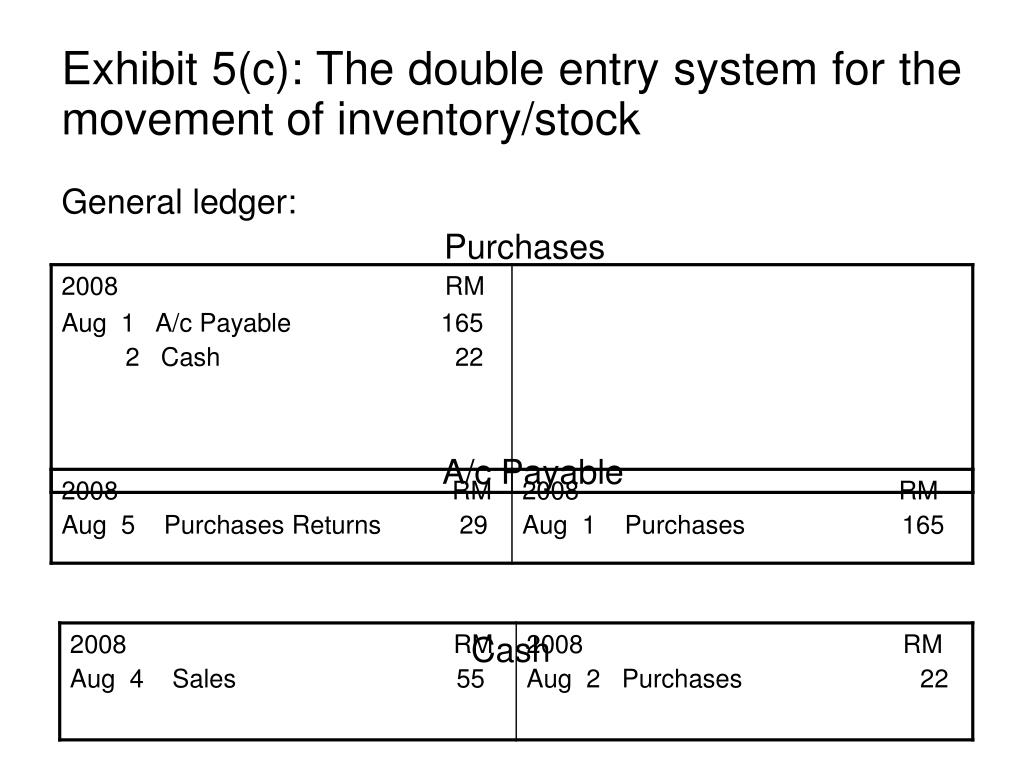

A chart of accounts lists each account type, and the entries you need to take to either increase or decrease. The journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting under a periodic system. A debit entry is made to one account, and a credit entry is made to another.

The correct double entry to account for such drawings is: Closing inventory at the period end is. This includes both tangible and intangible assets.

Inventory (asset account: There are two methods companies can use to write off. An inventory write off is the process of reducing the value of the inventory of a business to record the fact that the inventory has no value.