Who Else Wants Info About Supplies In Balance Sheet Interest Paid And Received Cash Flow Statement

After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000.

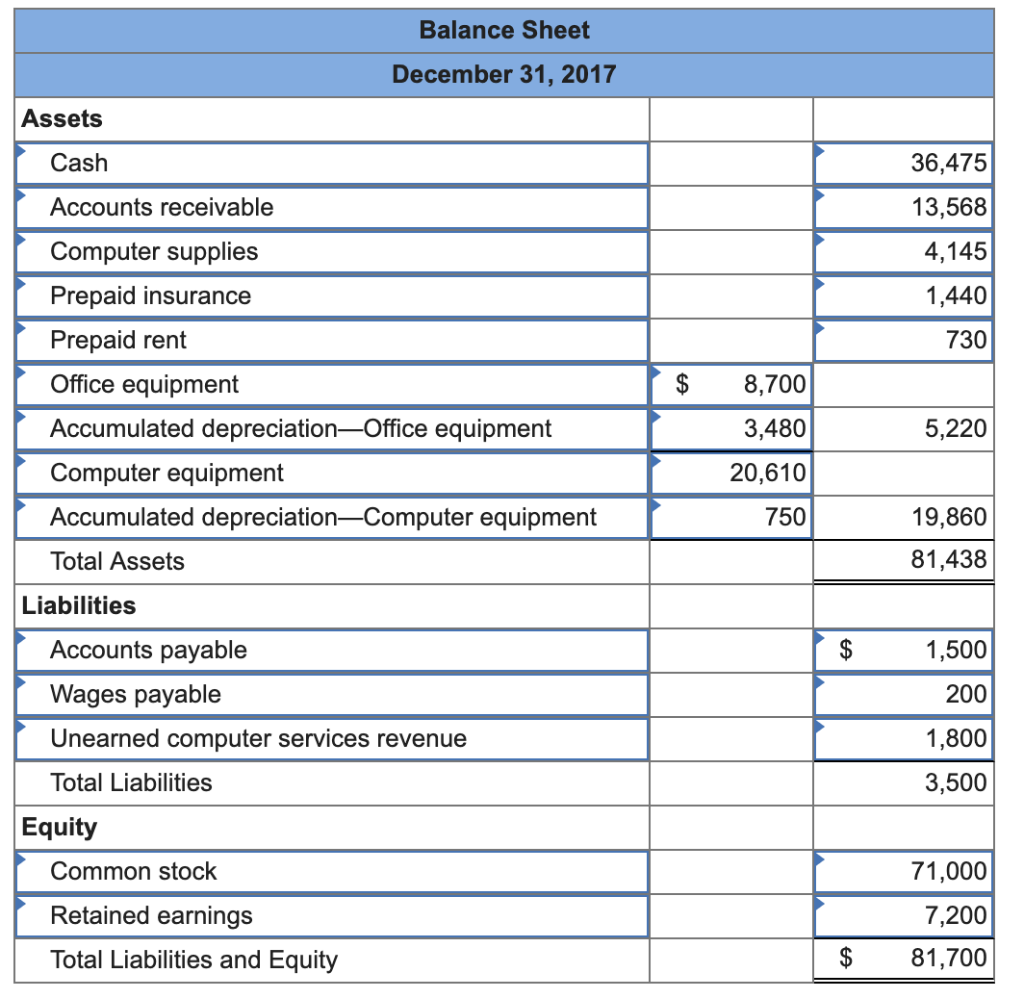

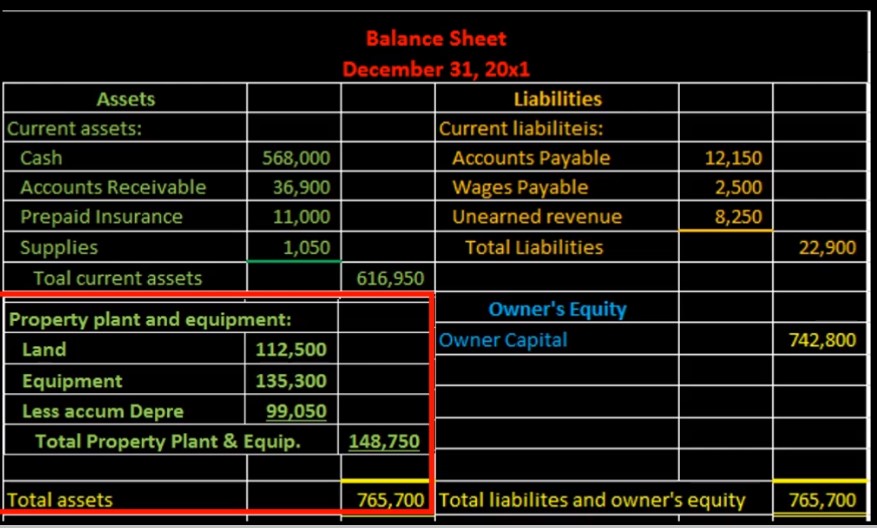

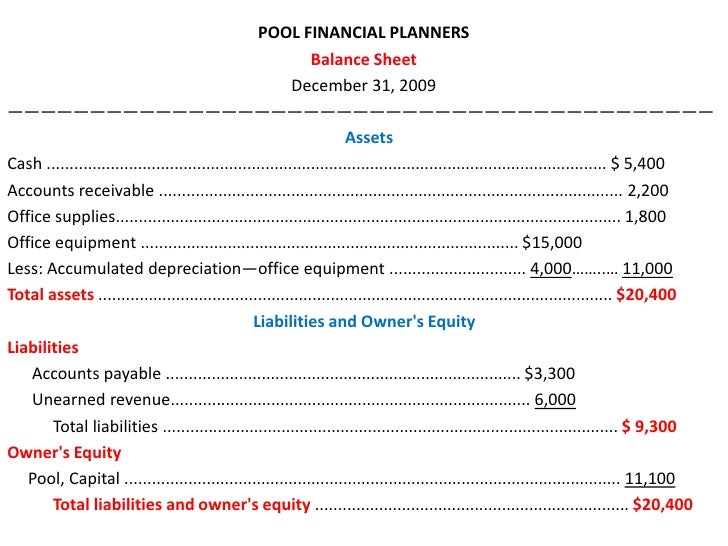

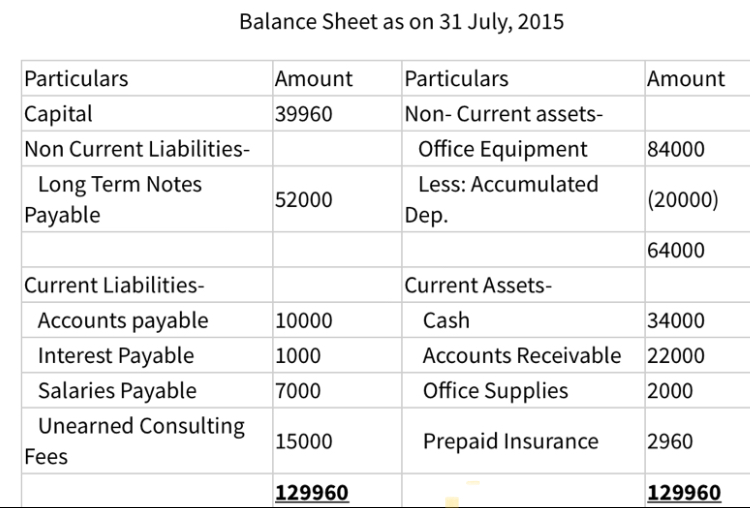

Supplies in balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. Supplies on hand are shown on the balance sheet of the business as a current asset as they are expected to be used within one year. When supplies are purchased 2.

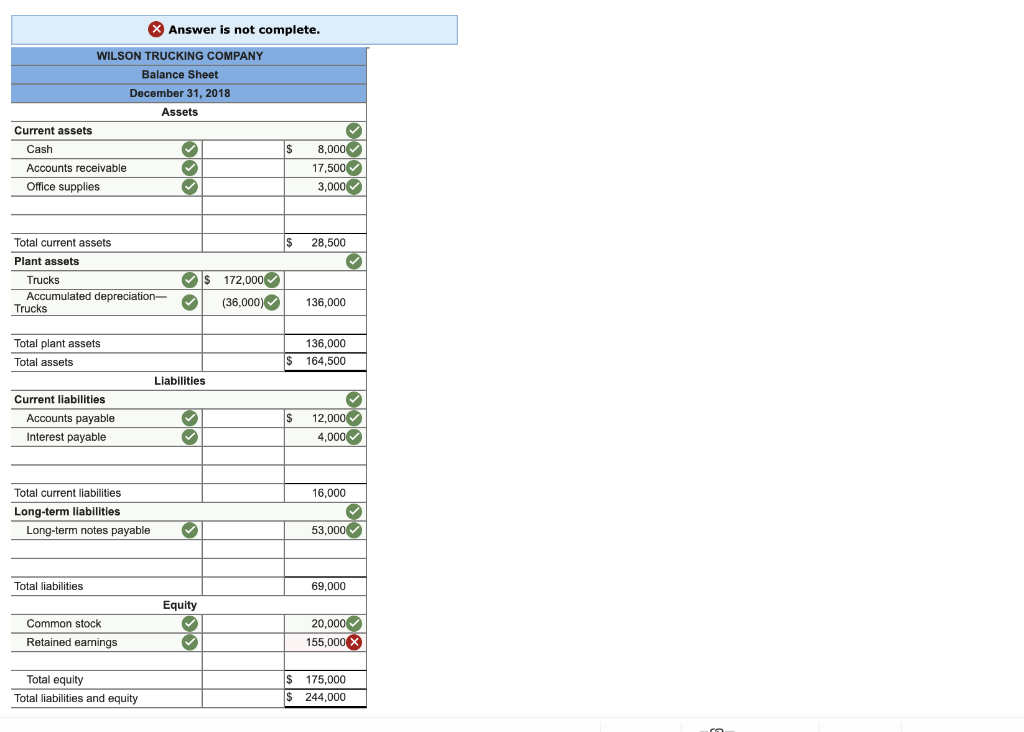

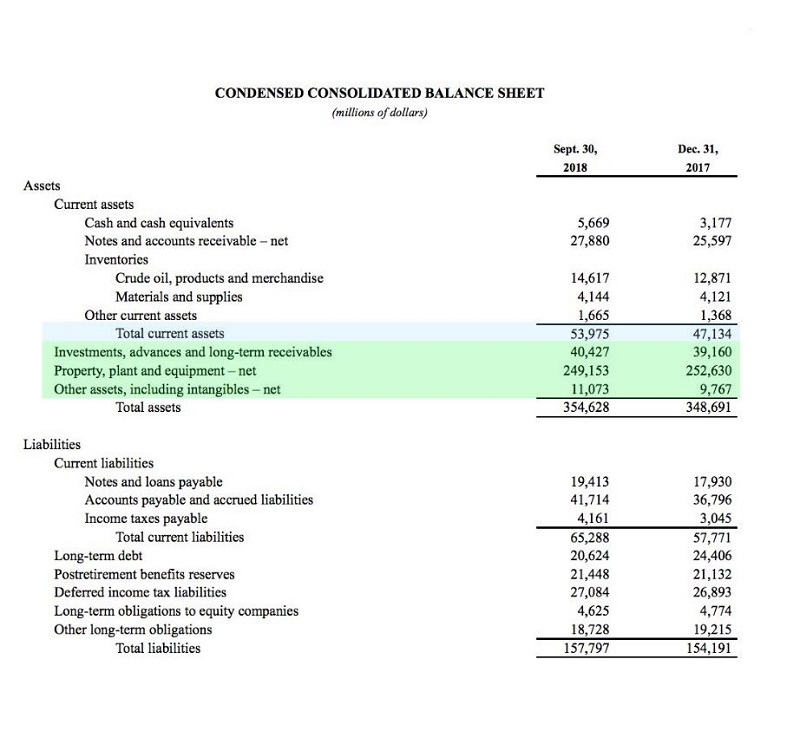

A current asset representing the cost of supplies on hand at a point in time. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. By using this later approach, the supplies will appear on your balance sheet as a current asset, until you use them and charge them to expense with this entry:

If so, supplies then appear within the “inventory” line item in the balance sheet. Typically, the balance sheet places assets on the left and liabilities on the right. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

In accounting, supplies are typically classified as current assets on a company’s balance sheet. As with all assets, supplies are recorded at their cost, which is the amount paid to acquire them. Supplies can be considered a current asset if their dollar value is significant.

Yes, supplies can be considered an asset before it gets used up. Bad debts expense will start the next accounting year with a zero balance. Balance sheets are typically prepared and distributed monthly or quarterly depending on the.

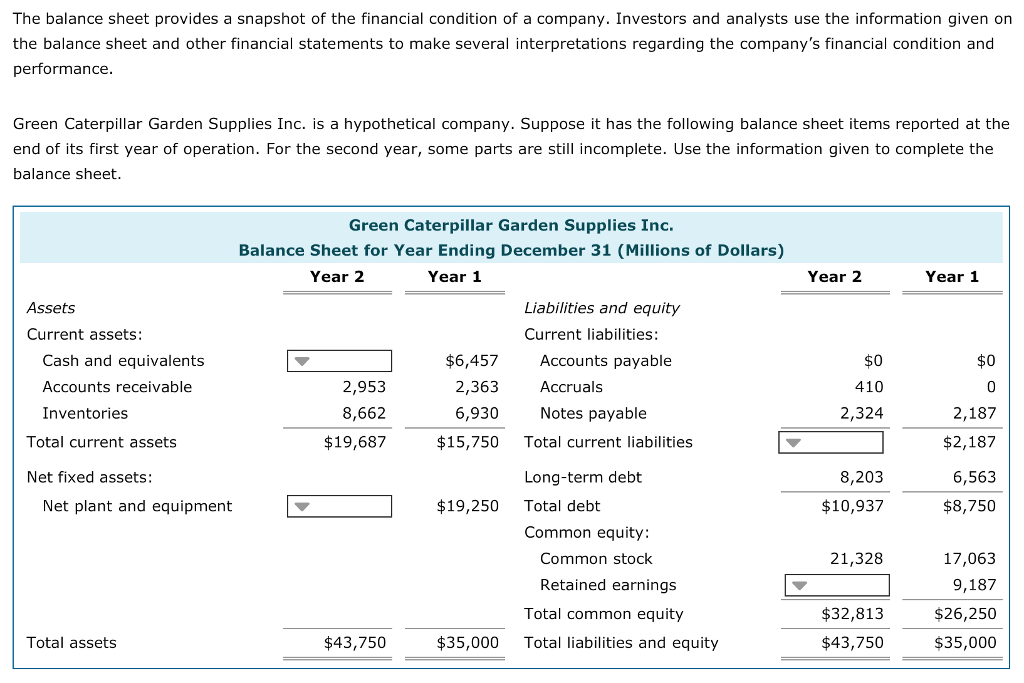

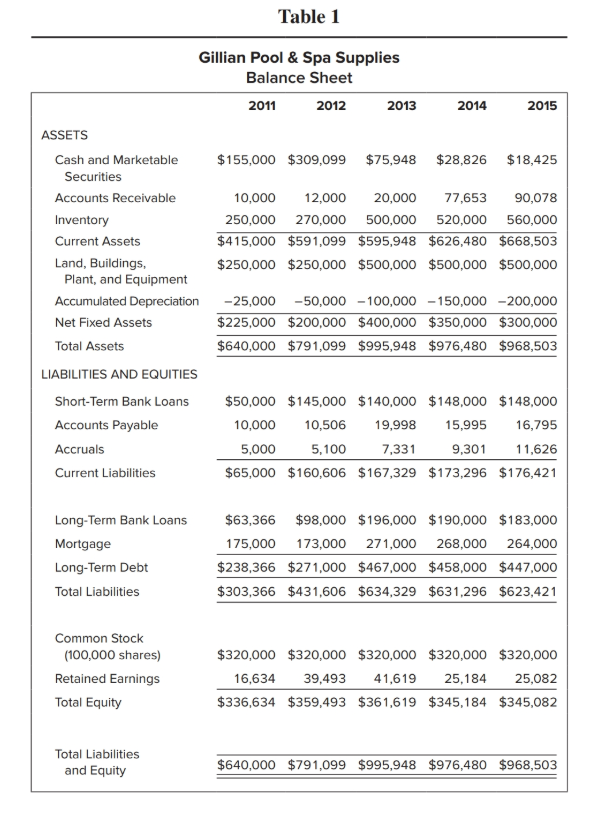

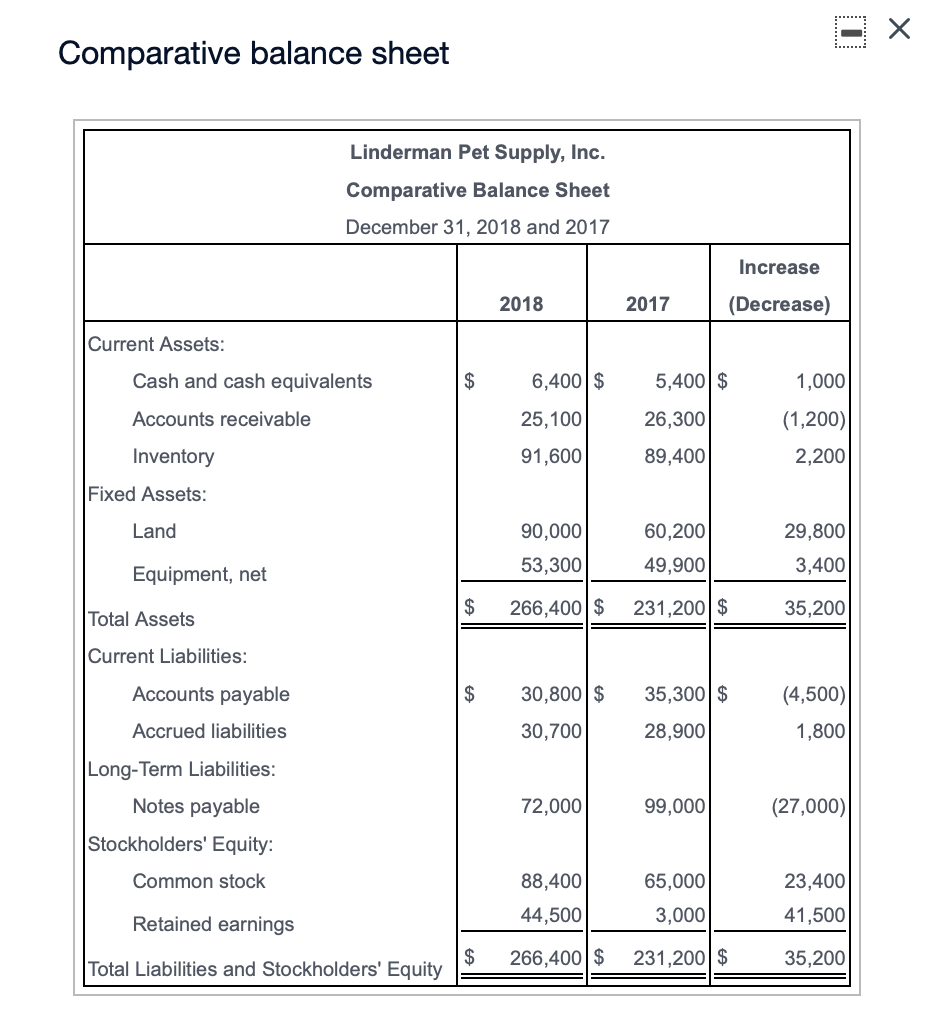

The balance sheet is based on the fundamental equation: Add total liabilities to total shareholders’ equity and compare to assets. The losses are estimated to include more than 3,000 armoured fighting vehicles in the past year alone and close to 8,800 since february 2022.

A related account is supplies expense, which appears on the income statement. Staff members may use these items regularly to complete their daily tasks. Bookkeeping guidebook if the cost of the supplies that you have purchased and not yet consumed is significant, then you can instead record them as an asset, using the following entry:

Difference between office supplies and inventory What happens if a company has unused supplies at the end of an accounting period? For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

How are supplies categorized on the balance sheet? Balance sheets provide the basis for. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

The iiss will publish its assessment of russian equipment losses on 13 february with the release of the military balance 2024. Current assets / current liabilities. If the cost is significant, small businesses can record the amount of unused supplies on their balance sheet in the asset account under supplies.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)