Unbelievable Tips About 1120s Balance Sheet Out Of Indirect Method Operating Cash Flow

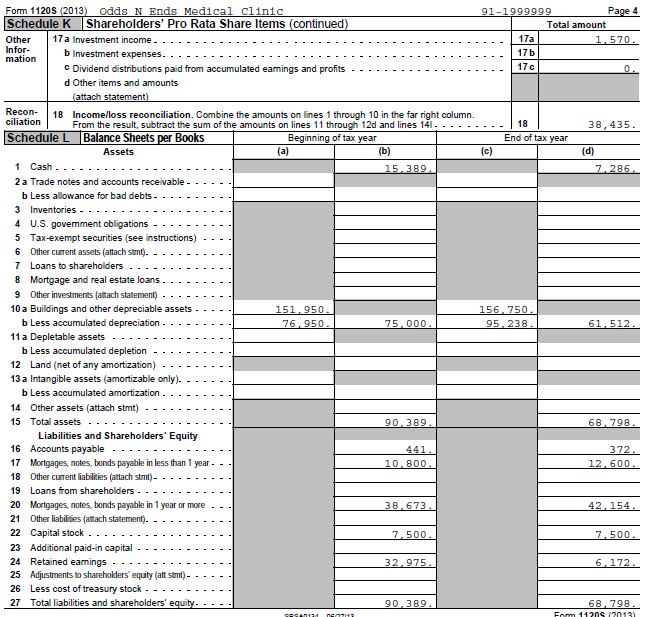

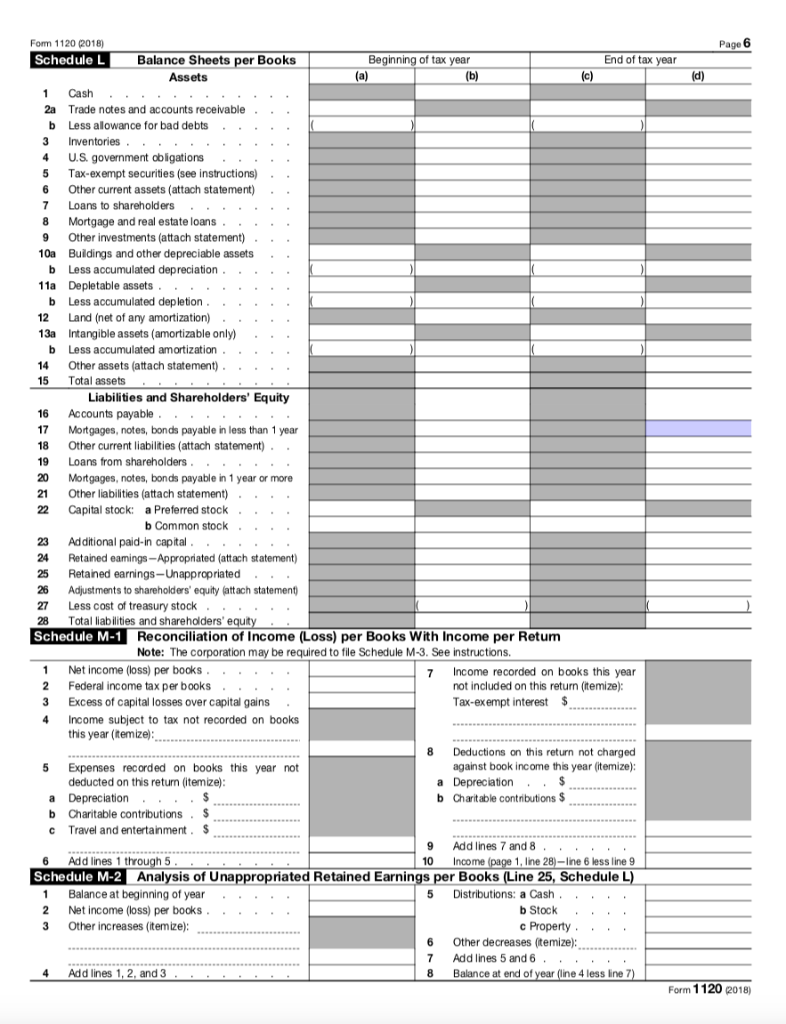

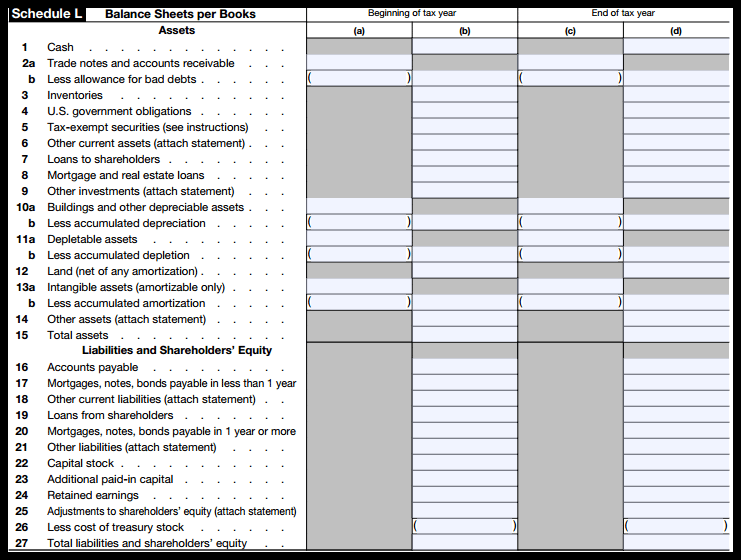

Check if the item is included, doubled, or excluded from the schedule l.

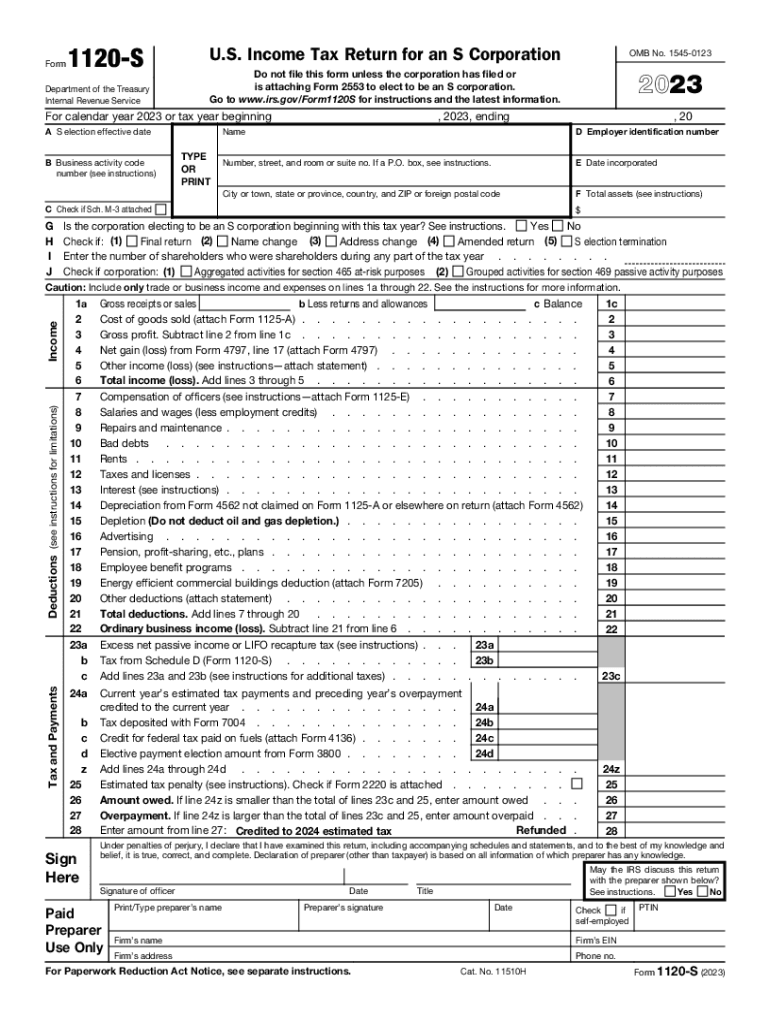

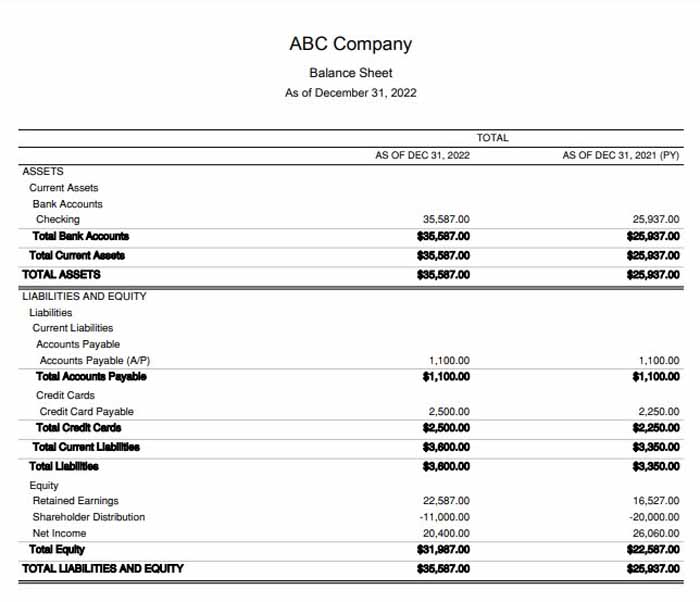

1120s balance sheet out of balance. When it comes time to file taxes, you’ll be able to refer to this sheet. Income tax return for an s corporation where the corporation reports to the irs their.

Near the end of the post, i briefly mentioned schedule. So, using the bank funds to buy the truck outright simply is asset = asset, or no change to the balance sheet. If it is a balance sheet debit and a balance sheet credit (for instance cash is understated and officer loan payable is as well) then no.

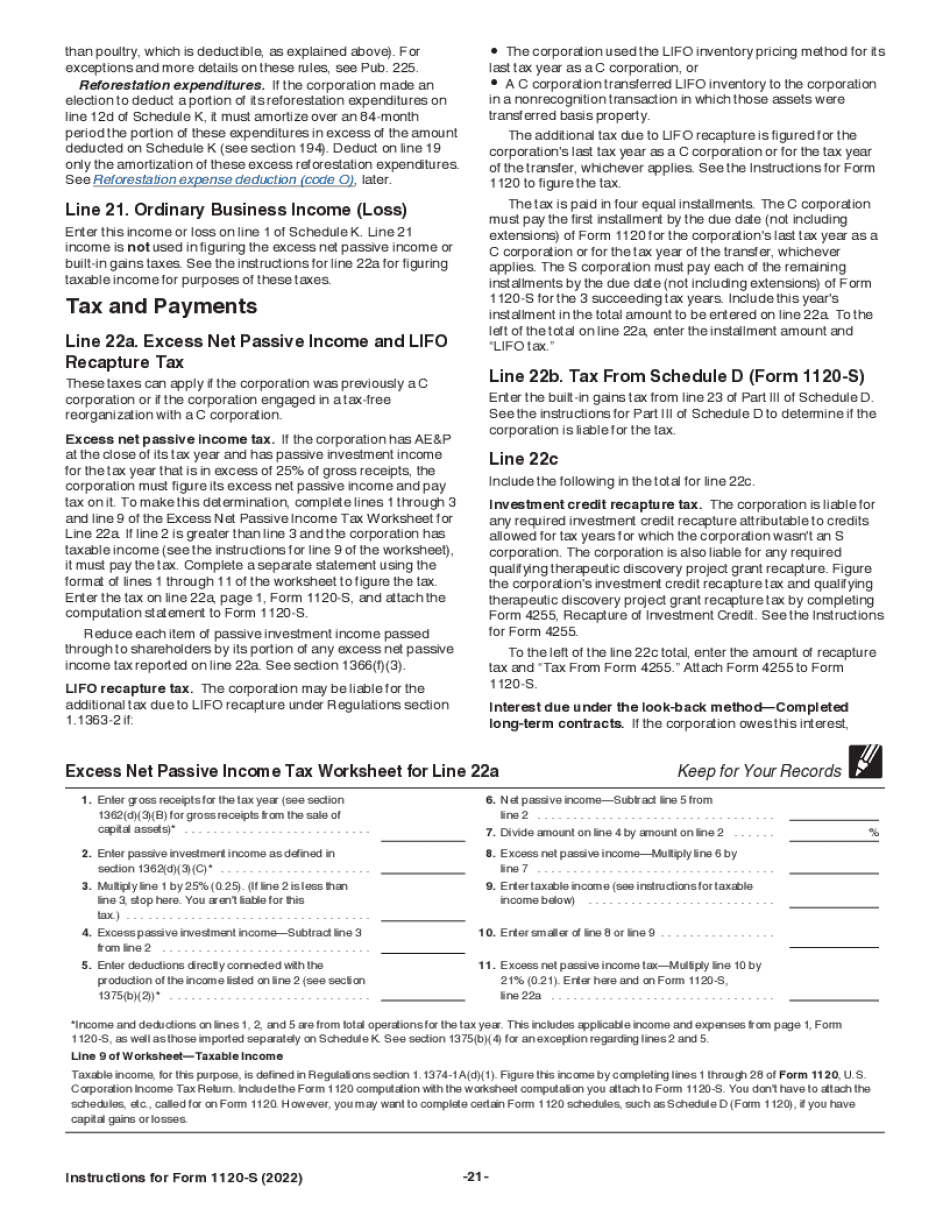

The statute of limitation for 2020 income tax returns (such as forms 1120,. If my balance sheet (schedule l) form 1120s is out of balance on the total assets vs the total liabilities and shareholders' equity, where should i look first to get it in balance?. For additional form 1120 tutorials, check here:

As an s corporation, you should use form 1120s, part of the schedule k document, to report the income, losses and dividends of shareholders. When entering a distribution in excess of retained earnings in intuit. Check the out of balance amount.

Income tax return for an s corporation where the corporation reports to the irs their balance. Entering distributions in excess of retained earnings for form 1120s in proseries. Taking the funds as distribution is reduction in asset.

16k views 2 years ago irs forms & schedules.