Build A Info About Ifrs 16 Leasing Standard Income Statement Magyarul

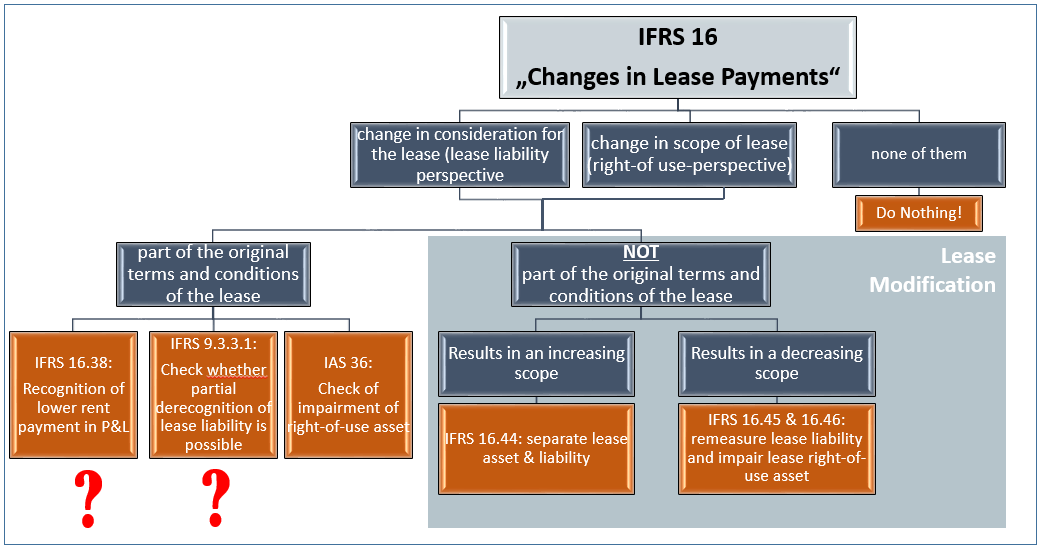

Ifrs 16 leases, effective for annual reporting periods beginning on or after 1 january 2019, brought significant changes in accounting requirements for lease accounting,.

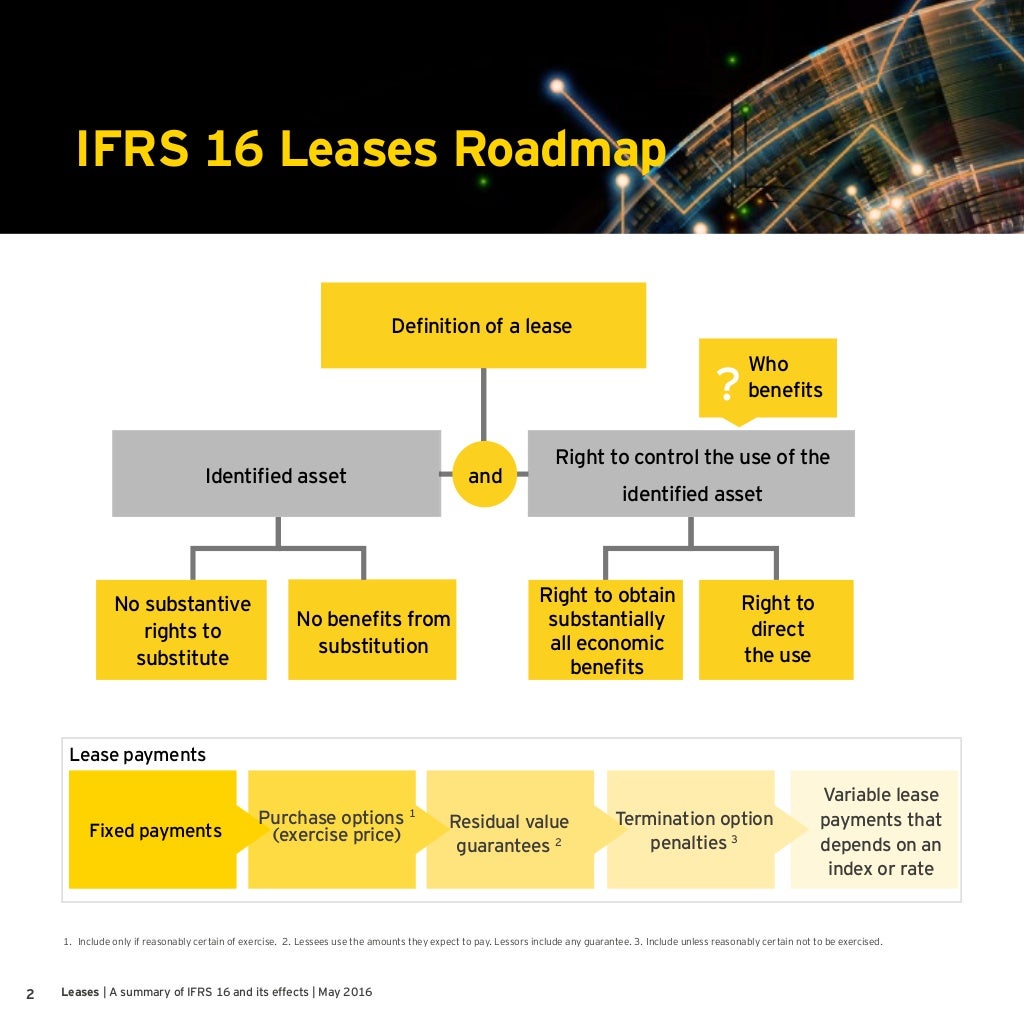

Ifrs 16 leasing standard. Reference to standard: In january 2016 the board issued ifrs 16 leases. Ifrs 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the.

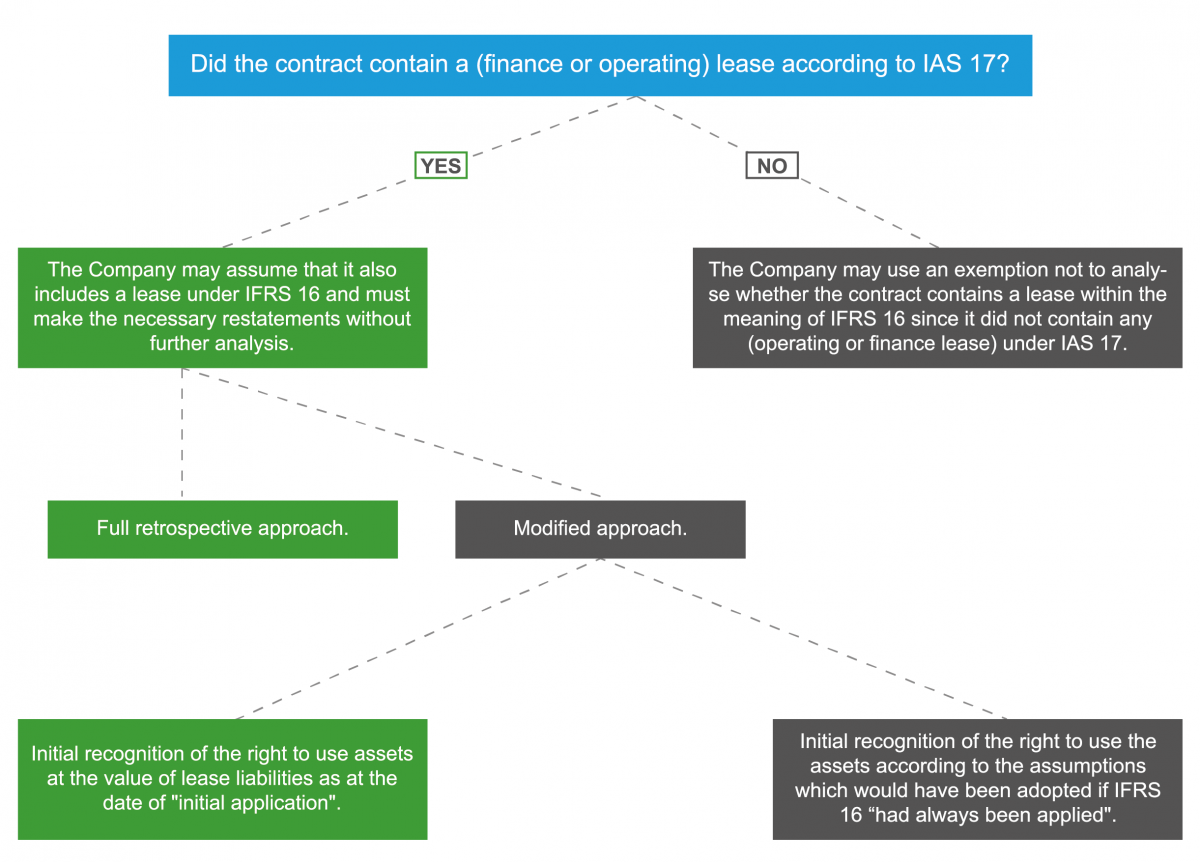

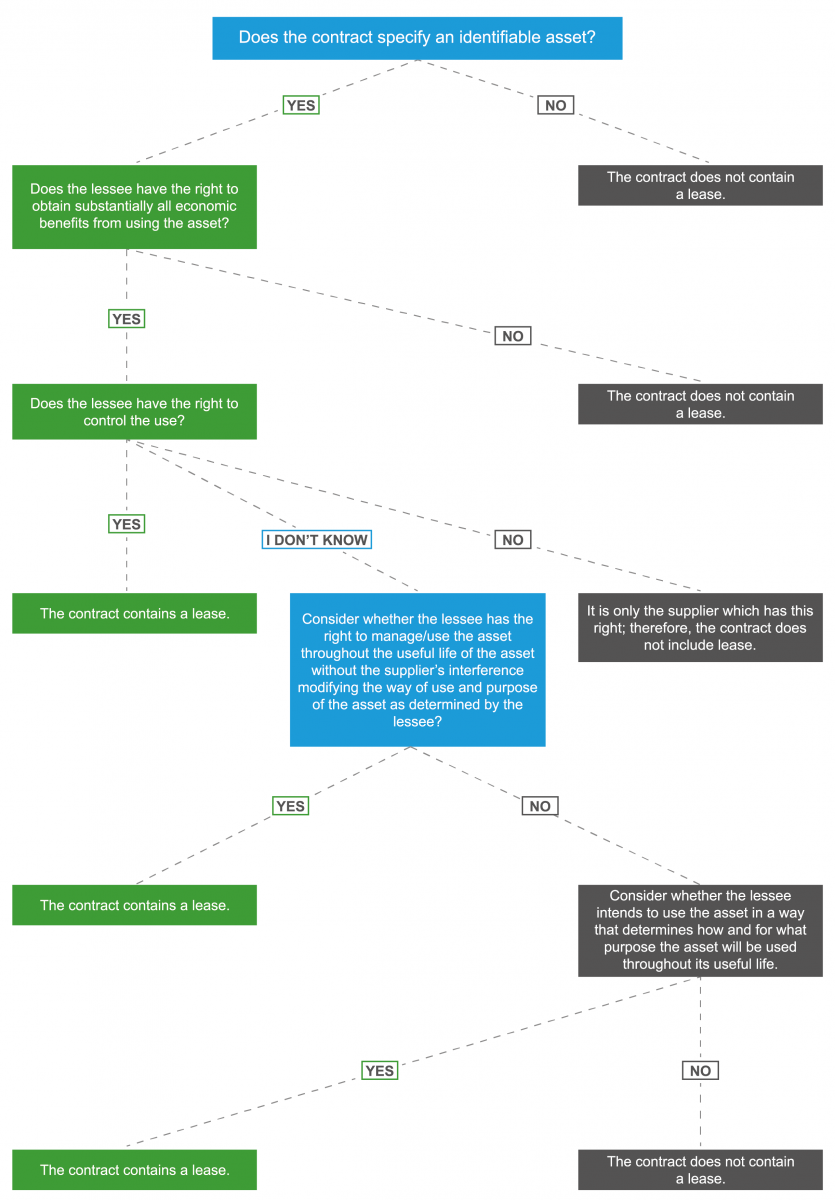

Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019. Ifrs 16 para 9, ifrs 16 app b para b13, ifrs 16 app b para b14, ifrs 16 app b para b9 reference to standing text: Ifrs 16 regards all leases as finance leases (with a couple of exceptions) and hence they are capitalised by recognising the present value of the lease payments.

It comes into effect on 1 january 2019. Ifrs 16 sets out the principles for the recognition, measurement,. To meet that objective, a lessee should recognise assets and liabilities arising from a lease.

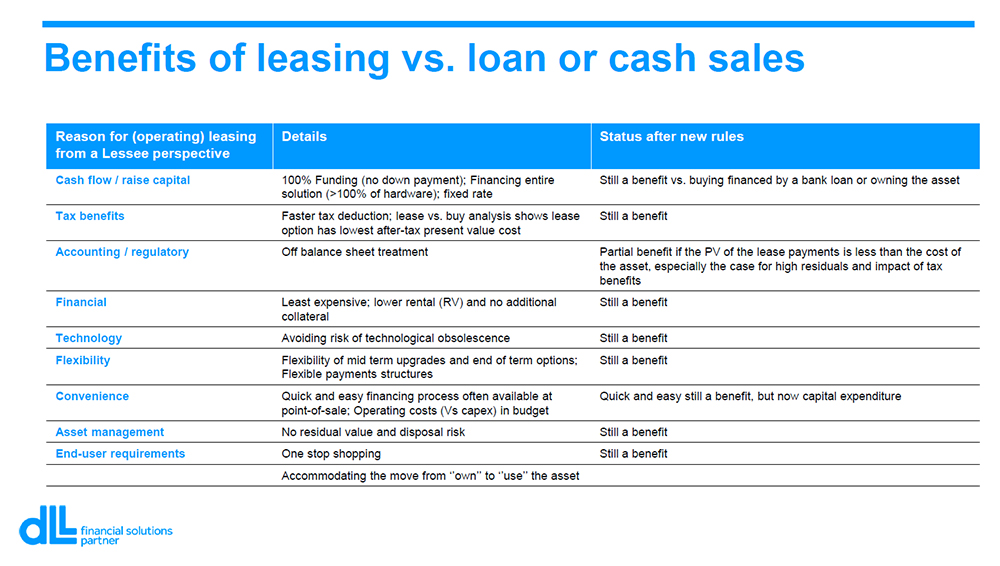

Efrag survey on ifrs 16 — user perspective. It is the new normal for lease accounting around the world. Ifrs 16 replaces the existing suite of standards.

Ifrs 16 leases brings significant changes in accounting requirements for lease accounting, primarily for lessees. In january 2016 the board issued ifrs 16 leases. Virtually every company uses rentals or leasing as a means to obtain.

Ifrs 16 replaces ias 17, ifric 4, sic‑15 and sic‑27. The international accounting standards board (iasb) has issued 'lease liability in a sale and leaseback (amendments to ifrs 16)' with amendments that. The european financial reporting advisory group (efrag) has launched the second part of its survey.

Ifrs 16 leases continues to be a significant project for many local authorities. Ifrs 16 sets out the principles for the recognition, measurement,. In january 2016, the iasb issued ifrs 16.