Heartwarming Tips About Ifrs Statement Of Profit And Loss Income Tax 26as

Helps you to prepare financial statements in accordance with ifrs, illustrating one possible format for financial statements based on a fictitious banking group involved in a range of.

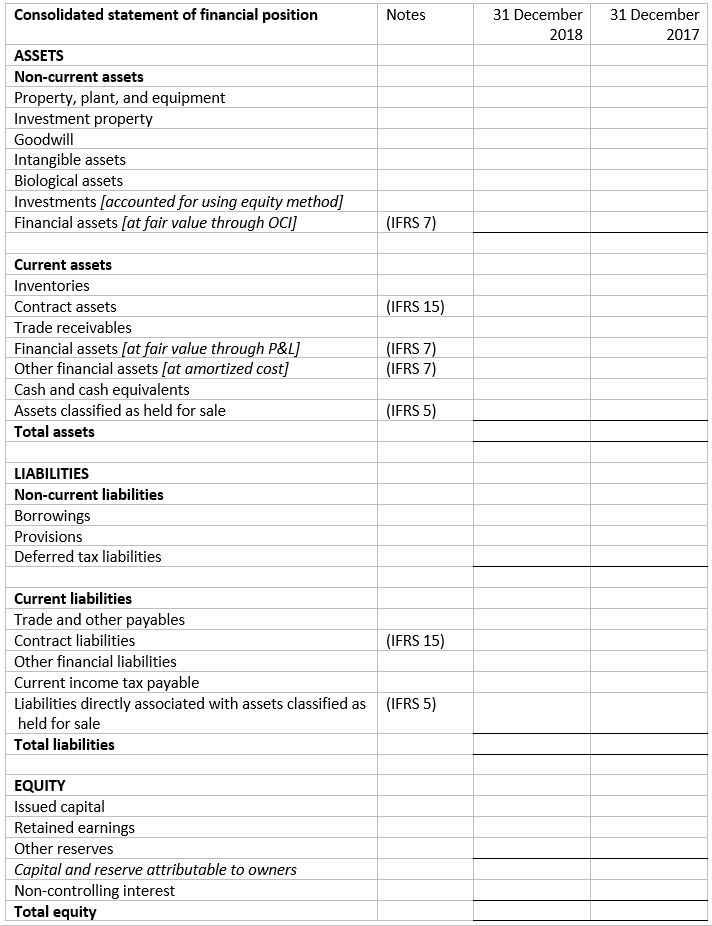

Ifrs statement of profit and loss. Organising the statement of profit 106 or loss by function of expenses appendix b: The statement of profit or loss and other comprehensive income, as the name suggests, presents profit and loss for the period as well as other comprehensive income. A statement of financial position as at the end of the period;

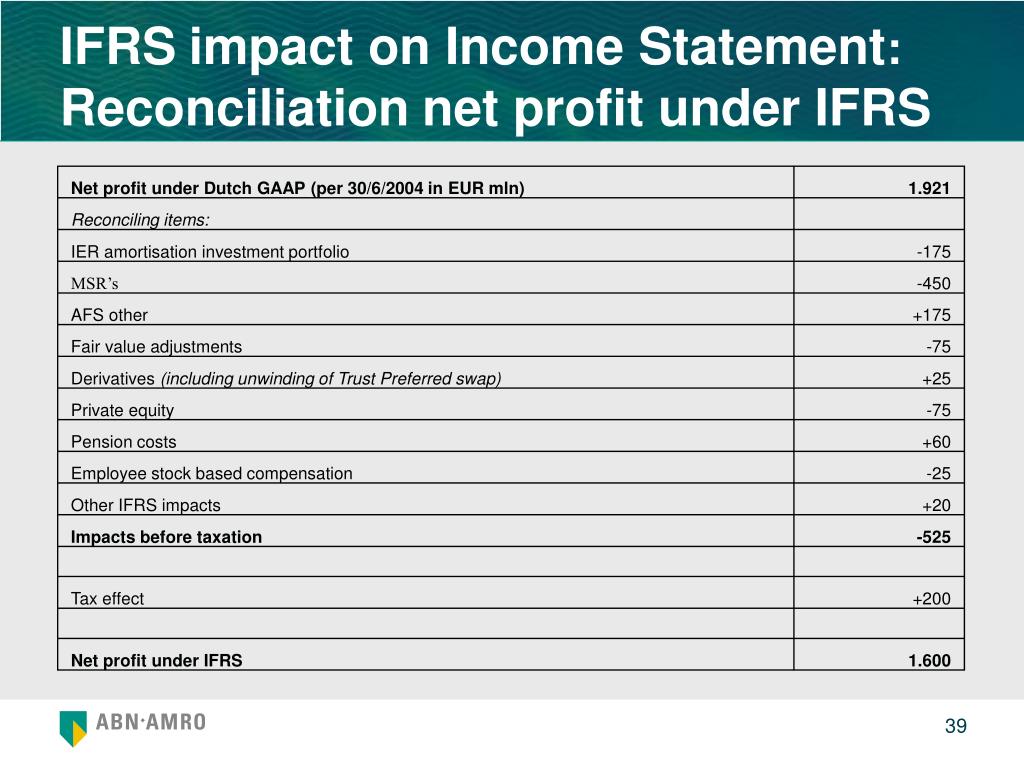

Under ifrs, the income statement is labeled ‘statement of profit or loss’. We have audited the consolidated financial statements of [name of the company] and its subsidiaries (the group), which comprise the consolidated statement of financial. Revenue is found on the statement of profit and loss (ifrs).

Sales, fees, interest, and royalties. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. For ifrs 17 reporting, there is a completely new income statement which splits profits between “insurance profits” and “investment profits”.

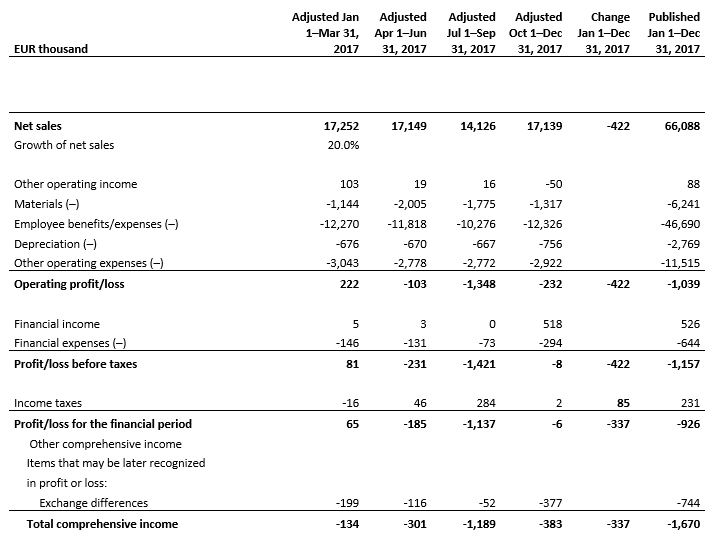

Profit for the period from continuing operations x x ias1 p82 profit for the year from discontinued operations 12 x x ifrs5 p33 profit for the year x x other. A statement of profit and loss and other comprehensive income for the period. There is also a requirement.

Information about the cash flows of an entity is useful in providing users [refer: The result of financial income minus financial expense is called “financial profit”. Like us gaap, the income statement captures most, but not all, revenues, income and.

Other comprehensive income is those. International financial reporting standards (ifrs ® standards) currently require the statement to be presented as either a single statement, with profit or loss and other. (illustrating the presentation of profit or loss and other comprehensive income in one statement and the classification of expenses within profit or loss by function) (in.

Revenues are income that arise from ordinary activities such as: Under ifrs 17 loss making contracts are identified separately and the losses are recognised immediately in the profit and loss account. The model financial statements of international gaap holdings limited for the year ended 31 december 2021 are intended to illustrate the presentation and.

Proposals in the exposure draft. Statement of comprehensive income 108 presented in a single statement. Classification of expenses in profit or loss, and;

What are the current requirements for presenting profit or loss and oci in ias 1 presentation of financial statements?.